LVMH Q1 Sales Miss Expectations, Shares Drop 8.2%

Table of Contents

Disappointing Q1 Sales Figures Detailed

LVMH reported a 2% decrease in sales compared to Q1 2023 and a 5% decrease compared to analyst expectations. This represents a considerable miss, sending shockwaves through the financial markets. The shortfall was particularly noticeable in the Fashion & Leather Goods sector, highlighting the impact of the slowing global economy and reduced consumer spending in key markets.

Key data points for LVMH Q1 2024:

- Total revenue: € [Insert Actual Revenue Figure] (This figure needs to be replaced with the actual data)

- Comparison to Q1 2023: -2% decrease

- Comparison to analyst consensus: -5% decrease

- Organic growth: -3% (This figure needs to be replaced with the actual data)

[Insert relevant chart or graph visualizing the sales data here. The chart should clearly show the comparison between actual sales, sales from Q1 2023, and analyst predictions.]

Underlying Factors Contributing to the Sales Miss

Several interconnected factors contributed to LVMH's disappointing Q1 sales performance.

-

Macroeconomic Factors: The global economic slowdown, particularly in Europe and China, significantly impacted consumer spending on luxury goods. High inflation and rising interest rates reduced disposable income, affecting demand for discretionary items like high-end fashion and accessories.

-

Geopolitical Influences: Geopolitical uncertainties, including the ongoing war in Ukraine and rising tensions in several regions, created market volatility and affected consumer confidence. This uncertainty led to a cautious approach to luxury purchases.

-

Supply Chain Disruptions: Persistent supply chain challenges, including raw material shortages and logistical bottlenecks, negatively affected production and delivery timelines. This led to delays and potential stock shortages, impacting sales.

-

Changing Consumer Behavior: Shifting consumer preferences towards sustainable luxury and experiential luxury might also have contributed to the sales miss. Consumers are increasingly demanding transparency and ethical sourcing, placing pressure on luxury brands to adapt their practices.

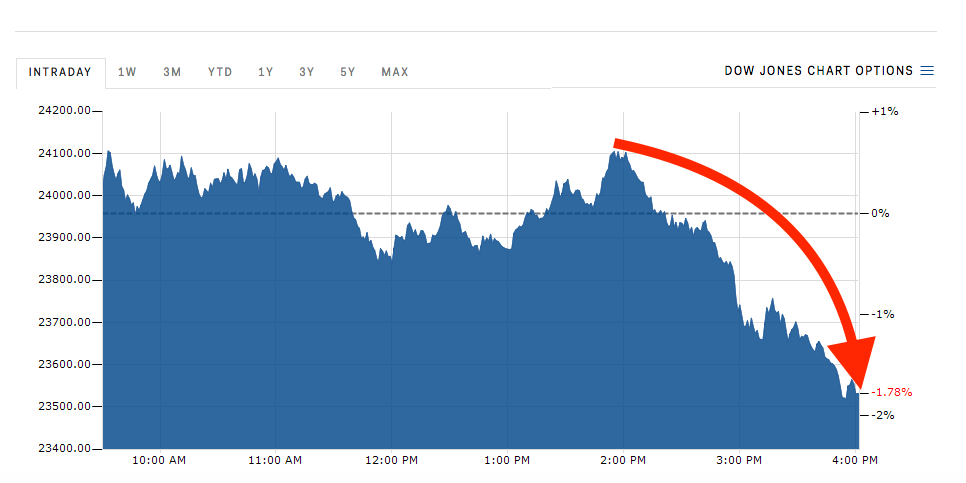

Market Reaction and Investor Sentiment

Following the announcement, LVMH shares experienced a sharp 8.2% decline, reflecting investor concern over the company's future performance. This significant drop underscores the market's sensitivity to any signs of weakness in the luxury sector.

-

Analyst Reactions: Analysts have downgraded their ratings and lowered price targets for LVMH, reflecting the negative impact of the Q1 sales miss. Many have revised their forecasts for the remainder of the year.

-

Broader Implications: The LVMH sales miss raises concerns about the overall health of the luxury goods market and its susceptibility to macroeconomic headwinds. It suggests that even the most resilient brands are not immune to economic downturns.

LVMH's Response and Outlook

LVMH has acknowledged the challenges and stated their commitment to adapting to the changing market conditions. [Insert details of any official statements or press releases from LVMH here]. The company is likely to focus on strategies to boost sales, including targeted marketing campaigns, innovative product launches, and potential cost-cutting measures. The long-term outlook for LVMH remains largely positive, but the company faces significant hurdles in navigating the current economic climate.

Conclusion: Analyzing the LVMH Q1 Sales Miss and its Implications

The LVMH Q1 sales miss highlights the vulnerability of even the most established luxury brands to macroeconomic headwinds and evolving consumer preferences. The disappointing results led to a significant share price drop and raised concerns about the future performance of the luxury sector. While the Q1 figures are concerning, LVMH's long-term prospects remain largely positive, contingent upon its ability to navigate current challenges and adapt to changing market conditions. Stay tuned for further updates and analysis regarding LVMH's performance and the broader luxury goods market. Follow our coverage on LVMH Q1 sales and related news for the latest insights into the LVMH Q1 sales performance and its impact on the luxury sector.

Featured Posts

-

Nicki Chapmans Smart Property Investment 700 000 Profit Revealed

May 24, 2025

Nicki Chapmans Smart Property Investment 700 000 Profit Revealed

May 24, 2025 -

Trade War Fears Trigger 7 Drop In Amsterdam Stock Market

May 24, 2025

Trade War Fears Trigger 7 Drop In Amsterdam Stock Market

May 24, 2025 -

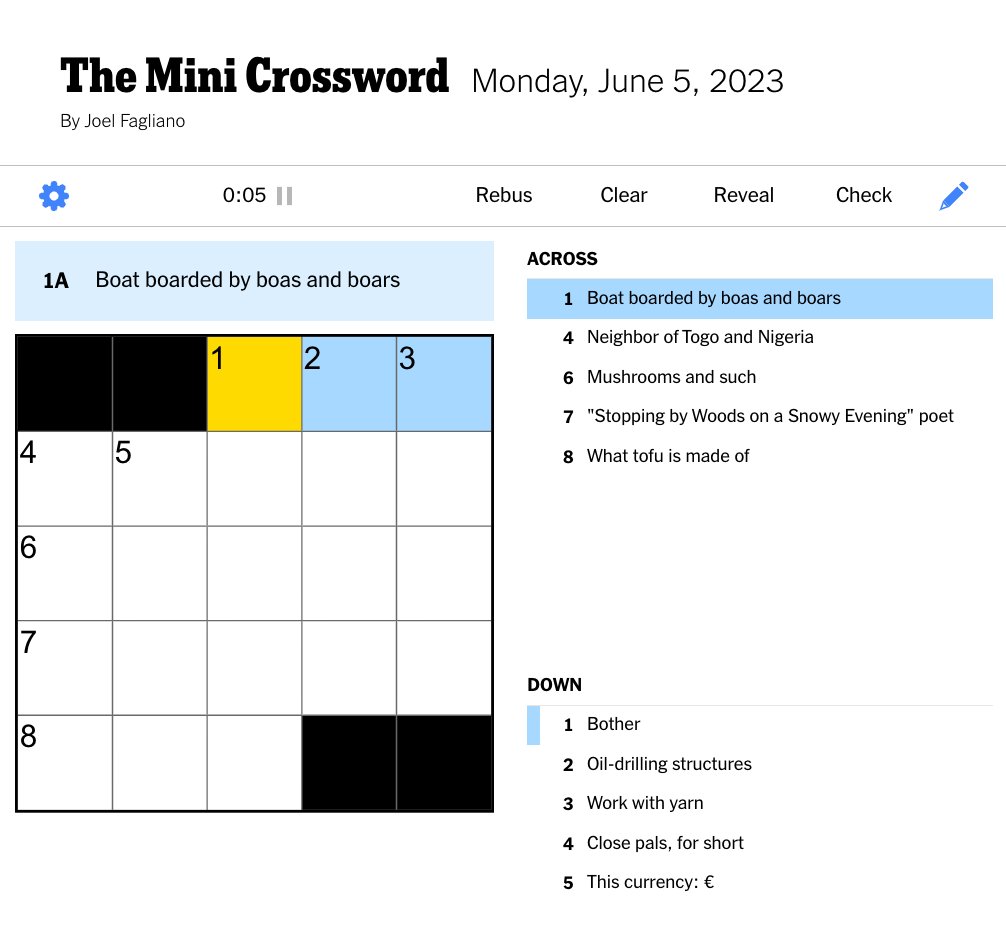

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 24, 2025

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 24, 2025 -

A Realistic Look At Escaping To The Country Challenges And Rewards

May 24, 2025

A Realistic Look At Escaping To The Country Challenges And Rewards

May 24, 2025 -

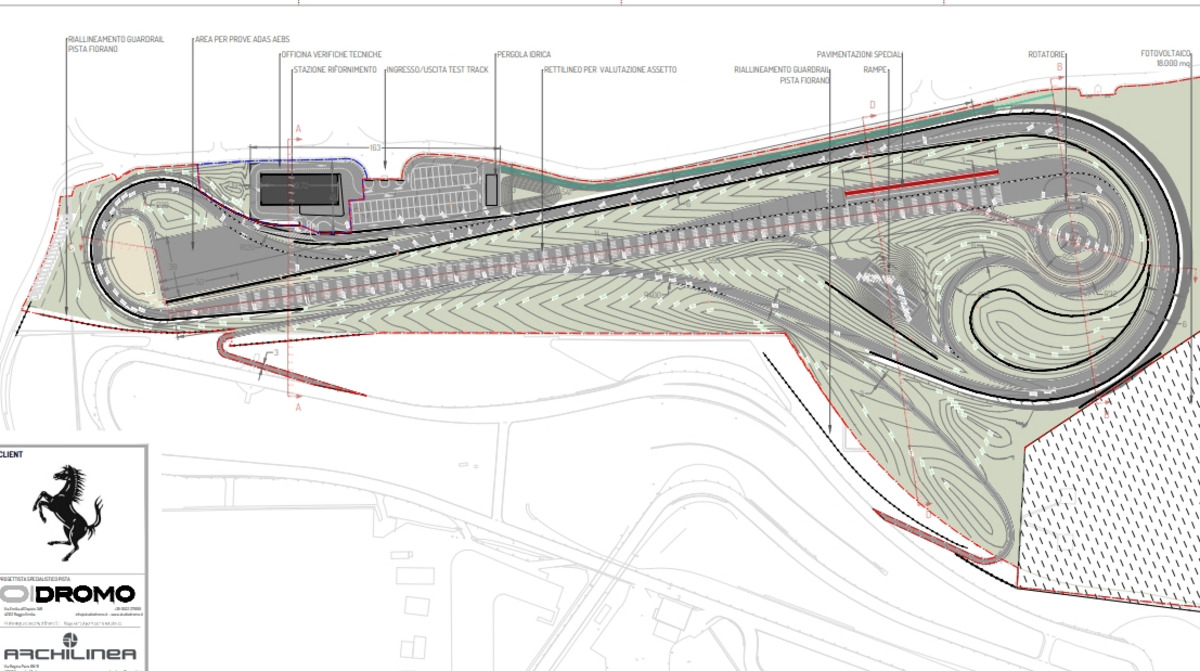

Fiorano Track Times Fastest 10 Standard Production Ferraris

May 24, 2025

Fiorano Track Times Fastest 10 Standard Production Ferraris

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025