Trade War Fears Trigger 7% Drop In Amsterdam Stock Market

Table of Contents

The Impact of Trade War Uncertainty on the Amsterdam Stock Market

Trade war uncertainty has directly impacted investor sentiment, leading to the significant decline in the Amsterdam Stock Market. The fear of escalating tariffs and unpredictable trade agreements creates considerable anxiety among businesses, particularly those heavily reliant on international trade. This uncertainty directly affects investment decisions, causing a ripple effect throughout the market.

-

Direct Correlation: As trade war anxieties increase, investor confidence plummets. This is clearly reflected in the sharp sell-off witnessed today. Investors are becoming increasingly risk-averse, opting to liquidate assets rather than hold them in a climate of such unpredictability.

-

Impact on Businesses: Businesses operating in or reliant upon international trade are particularly vulnerable. Uncertainty surrounding tariffs makes it difficult to plan for the future, hindering investment in expansion, innovation, and hiring. This uncertainty creates a chilling effect on economic activity.

-

Heavily Impacted Sectors: Export-oriented sectors within the Amsterdam Stock Market, such as agriculture, technology, and manufacturing, are experiencing the most significant drops. Companies involved in global supply chains are particularly vulnerable to disruptions caused by trade restrictions.

-

Specific Company Examples: [Insert examples of specific companies experiencing significant share price drops, linking to relevant news sources if possible. For example: "Company X, a major exporter of agricultural goods, saw its share price fall by 10%."]

-

Visual Representation: [Include a chart or graph visually depicting the market decline. Clearly label the axes and provide a concise caption explaining the data.]

-

Bullet Points Summarizing Key Impacts:

- Increased volatility leading to sharp price swings and significant losses for investors.

- Reduced investor confidence causing massive sell-offs and a decline in market capitalization.

- Negative impact on future investment and economic growth, potentially hindering long-term prosperity.

- Uncertainty delaying business decisions and investments, stifling innovation and expansion.

Global Factors Contributing to the Amsterdam Stock Market Decline

The decline in the Amsterdam Stock Market is not isolated; it reflects a broader global trend driven by several interconnected factors. The interconnectedness of global financial markets means that events in one region can trigger a domino effect, impacting markets worldwide.

-

Global Economic Context: Weakening global economic growth forecasts, coupled with rising inflation in several key economies, have contributed to a climate of increased economic uncertainty. This uncertainty fuels investor anxiety and prompts a flight to safety.

-

Interconnected Markets: The Amsterdam Stock Market is deeply integrated with other major global markets. Declines in the US, Asian, and other European markets have amplified the negative sentiment and contributed to the sell-off in Amsterdam.

-

Geopolitical Risks: [Discuss specific geopolitical events, such as heightened tensions between nations or unexpected political shifts, that may have exacerbated the situation. For example: Mention specific trade disputes or political instability affecting major trading partners.]

-

Market Sentiment: Negative market sentiment spreads rapidly in the interconnected global marketplace. Fear and uncertainty are contagious, leading to a self-reinforcing cycle of selling pressure.

-

Currency Fluctuations: Fluctuations in currency exchange rates can also impact investment returns, adding another layer of complexity and uncertainty for investors.

-

Bullet Points Summarizing Global Factors:

- Weakening global economic growth forecasts creating a pessimistic outlook for investors.

- Increased geopolitical instability worldwide fueling uncertainty and risk aversion.

- Negative sentiment spreading rapidly across international markets creating a snowball effect.

- Impact of currency fluctuations on investment returns leading to unpredictable losses.

Analyzing the Potential Long-Term Consequences for the Dutch Economy

The 7% drop in the Amsterdam Stock Market has significant implications for the broader Dutch economy. The ripple effects could impact employment, consumer spending, and overall economic growth for the foreseeable future.

-

Ripple Effects: The decline will likely lead to reduced business investment and a slowdown in economic activity. This could impact employment levels across various sectors, particularly those heavily reliant on international trade.

-

Impact on Employment: Job losses are a potential consequence, especially in export-oriented industries. Reduced business activity may force companies to cut costs, potentially leading to layoffs.

-

Consumer Spending: Decreased investor confidence and potential job losses could lead to reduced consumer spending, further dampening economic growth. Consumer sentiment is likely to decline as fear and uncertainty grip the market.

-

Government Interventions: The Dutch government may need to intervene through fiscal policies to stimulate the economy and mitigate the negative effects. This could involve measures such as tax cuts or increased government spending.

-

Foreign Investment: The market decline could negatively impact foreign investment in the Netherlands in the short term, as investors become hesitant to invest in a volatile market.

-

Bullet Points Summarizing Long-Term Consequences:

- Potential job losses in affected sectors leading to unemployment and social unrest.

- Reduced consumer confidence and spending impacting economic growth and market recovery.

- Slower economic growth in the short to medium term potentially hindering long-term prosperity.

- Need for government intervention to boost confidence and stimulate economic activity.

Conclusion

The 7% drop in the Amsterdam Stock Market is a stark reminder of the significant impact of trade war fears on even the most stable economies. The interconnectedness of global markets means that regional events have far-reaching consequences, affecting investor confidence and economic growth. Understanding the underlying factors behind this volatility is crucial for navigating these challenging times.

Call to Action: Stay informed about the evolving trade war situation and its impact on the Amsterdam Stock Market. Monitor market trends, diversify your investments, and seek professional financial advice to manage your risk exposure during periods of heightened trade war uncertainty. Understanding the complexities of the Amsterdam Stock Market and global trade relations is vital for making sound investment decisions. Don't let trade war fears dictate your financial future; take proactive steps to protect your investments.

Featured Posts

-

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Needs

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Needs

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025 -

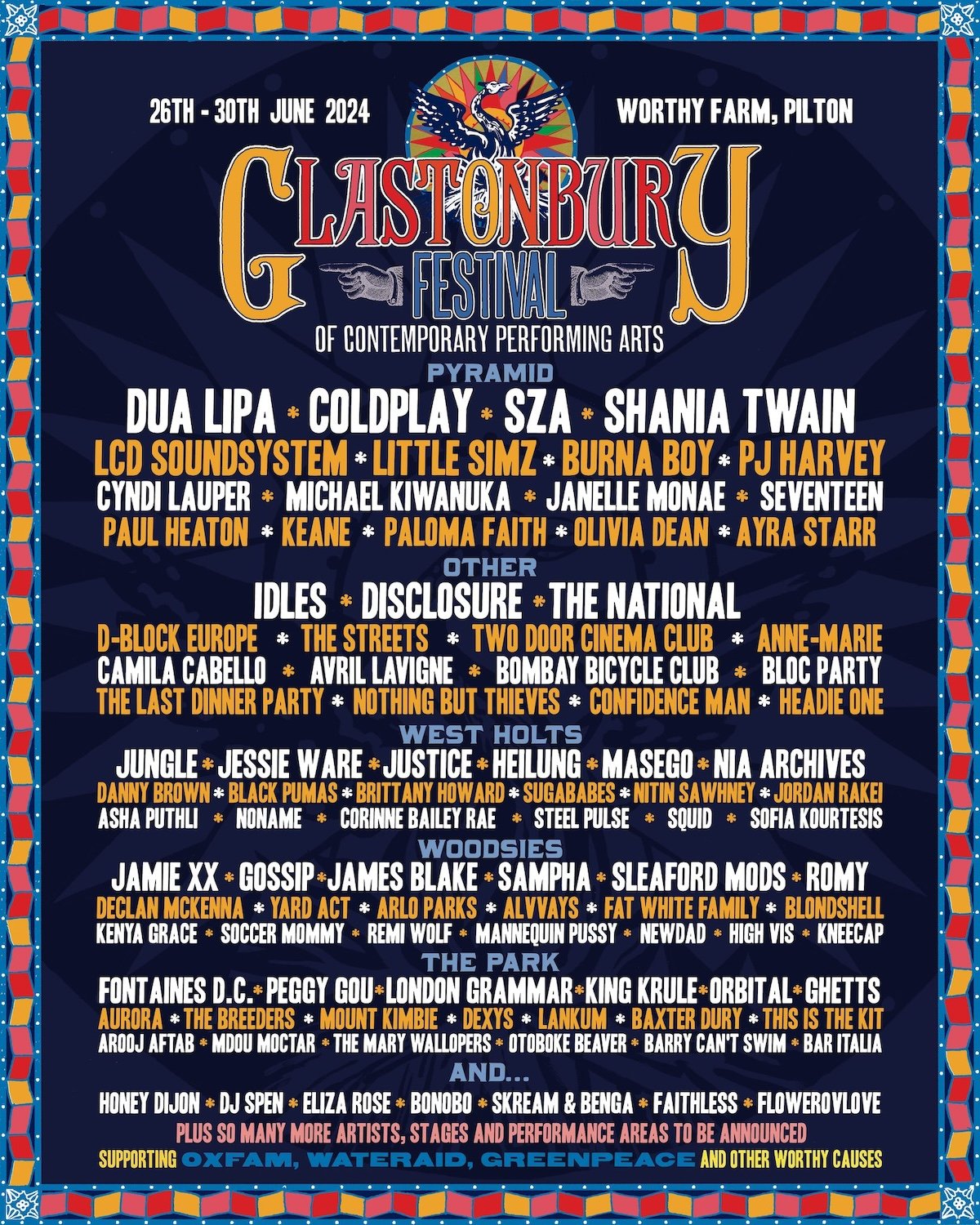

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025 -

Game Industry Cutbacks Accessibility Takes The Hit

May 24, 2025

Game Industry Cutbacks Accessibility Takes The Hit

May 24, 2025 -

Pobediteli Evrovideniya 2025 Smeloe Predskazanie Konchity Vurst

May 24, 2025

Pobediteli Evrovideniya 2025 Smeloe Predskazanie Konchity Vurst

May 24, 2025

Latest Posts

-

Mayis Ta Ask Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025

Mayis Ta Ask Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025 -

Ask Kapida Mayis Ayinda Askin En Yogun Yasanacagi 3 Burc

May 24, 2025

Ask Kapida Mayis Ayinda Askin En Yogun Yasanacagi 3 Burc

May 24, 2025 -

Mayis Ayinda Ask Yasamaya En Hazir 3 Burc

May 24, 2025

Mayis Ayinda Ask Yasamaya En Hazir 3 Burc

May 24, 2025 -

The 5 Luckiest Zodiac Signs On March 20 2025

May 24, 2025

The 5 Luckiest Zodiac Signs On March 20 2025

May 24, 2025 -

Zekanin Sirri Burclarda Mi En Akilli Burclar Listesi

May 24, 2025

Zekanin Sirri Burclarda Mi En Akilli Burclar Listesi

May 24, 2025