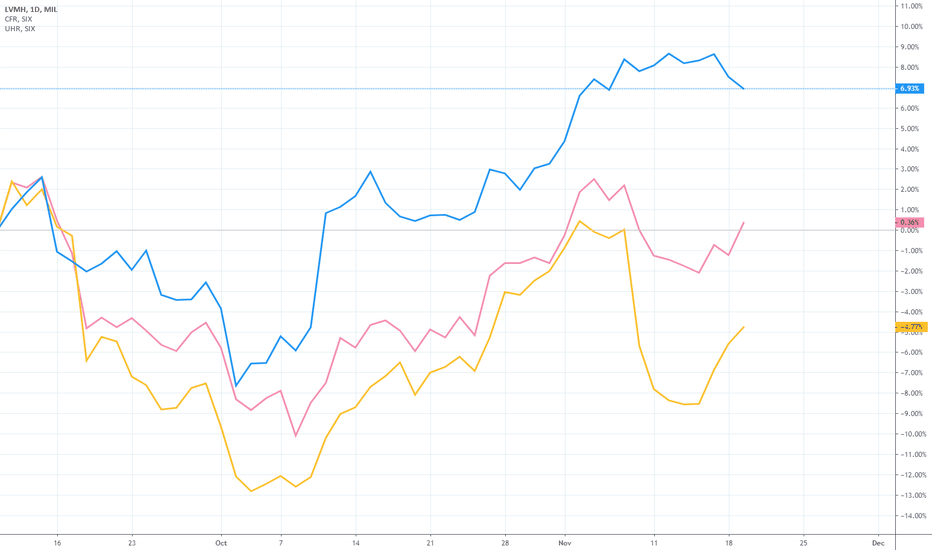

LVMH Stock Takes A Hit: 8.2% Decline After Weak Q1 Sales

Table of Contents

Weak Q1 Sales Figures: A Detailed Breakdown

LVMH's Q1 2024 sales figures revealed a concerning trend. Overall revenue declined by [Insert Specific Percentage Decline Here] compared to the same period last year, falling significantly short of analyst expectations. This underperformance wasn't uniform across the board. Let's break down the key aspects:

- Brand Performance: While some brands within the LVMH portfolio may have shown resilience, key revenue drivers like Louis Vuitton and Dior experienced [Insert Specific Percentage Decline or Growth for Each Brand, if available]. Sephora, the beauty retailer, also faced [Insert Performance Data for Sephora]. This uneven performance across different brands suggests a complex interplay of factors influencing LVMH's overall sales.

- Geographical Breakdown: The decline in sales wasn't geographically uniform. [Insert Specific Regions and their performance – e.g., "The Asian market, particularly China, witnessed a more pronounced slowdown compared to Europe and the US."]. This geographical variation emphasizes the importance of understanding specific market dynamics and consumer behaviors in different regions.

- Product Category Underperformance: [Mention specific product categories that underperformed, e.g., "Certain leather goods lines showed weaker-than-expected performance, suggesting potential shifts in consumer preferences"]. This points to the need for LVMH to adapt its product offerings to meet evolving consumer demands.

- Comparison to Expectations: The Q1 results fell considerably short of the consensus estimates provided by analysts, who were expecting [Insert Analyst Expectations]. This significant miss fueled investor concerns about the company's short-term prospects.

Impact of Macroeconomic Factors on LVMH Performance

The significant decline in LVMH's Q1 sales isn't solely attributable to internal factors. Several macroeconomic headwinds played a substantial role:

- Global Inflation and Consumer Spending: Rising inflation rates worldwide have eroded consumer purchasing power, particularly impacting discretionary spending on luxury goods. Consumers are becoming more price-sensitive, leading them to reconsider high-end purchases.

- Slowdown in Key Markets: Economic slowdowns in major markets like China, Europe, and the US have directly impacted demand for luxury goods. Concerns about recessionary pressures have further dampened consumer confidence, leading to reduced spending.

- Geopolitical Instability and Supply Chain Disruptions: Ongoing geopolitical tensions and lingering supply chain issues continue to create uncertainty within the global economy, impacting the luxury goods sector. These factors add to the overall complexity of the market.

- Shifting Consumer Preferences: The economic climate may be driving some consumers to shift their spending habits away from luxury brands towards more value-oriented options. This trend requires LVMH to adapt its strategies.

LVMH's Response and Future Outlook

In response to the weak Q1 results, LVMH [Insert LVMH's Official Statement or Actions]. The company is likely to implement various strategies to navigate these challenges:

- Pricing Strategies: While maintaining brand prestige is crucial, LVMH might adjust pricing strategies to better align with changing consumer behavior and purchasing power.

- Cost-Cutting Measures: The company might explore cost-optimization measures to improve profit margins in the face of reduced revenue.

- New Product Launches: Introducing innovative products and tapping into emerging trends could help revitalize sales and attract new customers.

- Long-Term Growth Strategy: LVMH’s long-term growth strategy will need to incorporate flexibility and responsiveness to the evolving macroeconomic landscape.

Analyst Reactions and Market Predictions for LVMH Stock

Following the announcement of the Q1 results, financial analysts expressed [Insert Analyst Reactions - e.g., mixed reactions, with some downgrading their ratings and price targets for LVMH stock while others maintained a more optimistic outlook].

- Rating Changes and Price Targets: [Mention specific rating changes and updated price targets by major analysts]. This reflects the diversity of opinion regarding LVMH's future performance.

- Market Sentiment: The overall market sentiment towards LVMH and the luxury goods sector is currently [Describe market sentiment – e.g., cautious, with investors closely monitoring economic developments and LVMH's strategic responses].

- Stock Price Predictions: Predictions for the future trajectory of LVMH's stock price vary widely, depending on the analyst's assessment of macroeconomic conditions and LVMH's ability to adapt to the current market realities.

Conclusion

The 8.2% decline in LVMH stock price following weak Q1 sales underscores the challenges faced by luxury brands in a volatile global economic environment. Macroeconomic factors such as inflation and slowing growth in key markets have significantly impacted consumer spending on luxury goods. While LVMH's response strategies remain to be fully seen, the company's ability to adapt and innovate will be crucial in determining its future performance. The varied analyst reactions and predictions highlight the uncertainty surrounding LVMH's stock price in the short term.

Stay updated on the latest developments affecting LVMH stock and the luxury market by subscribing to our newsletter. Understanding the nuances of LVMH sales and its impact on the stock price is crucial for informed investment decisions.

Featured Posts

-

Escape To The Countryside Making The Move A Success

May 25, 2025

Escape To The Countryside Making The Move A Success

May 25, 2025 -

Porsche Cayenne 2025 A Complete Picture Gallery

May 25, 2025

Porsche Cayenne 2025 A Complete Picture Gallery

May 25, 2025 -

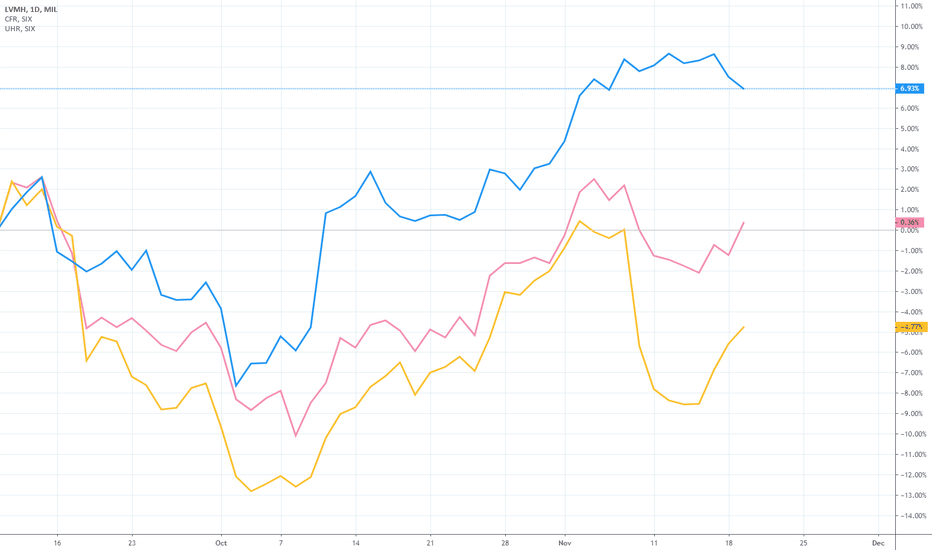

Glastonbury 2025 Headliner Announcement A Controversial Lineup

May 25, 2025

Glastonbury 2025 Headliner Announcement A Controversial Lineup

May 25, 2025 -

Glastonbury 2025 Lineup Complete List Of Artists And Ticket Availability

May 25, 2025

Glastonbury 2025 Lineup Complete List Of Artists And Ticket Availability

May 25, 2025 -

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Razbor

May 25, 2025

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Razbor

May 25, 2025

Latest Posts

-

7 Drop For Amsterdam Stocks As Trade War Fears Grip Markets

May 25, 2025

7 Drop For Amsterdam Stocks As Trade War Fears Grip Markets

May 25, 2025 -

2024 Philips Annual General Meeting A Recap Of Key Decisions

May 25, 2025

2024 Philips Annual General Meeting A Recap Of Key Decisions

May 25, 2025 -

Philips Shareholders Meeting Important Updates And Announcements

May 25, 2025

Philips Shareholders Meeting Important Updates And Announcements

May 25, 2025 -

Key Highlights From The Updated Philips 2025 Agm Shareholder Agenda

May 25, 2025

Key Highlights From The Updated Philips 2025 Agm Shareholder Agenda

May 25, 2025 -

Philips Shareholders 2025 Agm Agenda And Important Updates

May 25, 2025

Philips Shareholders 2025 Agm Agenda And Important Updates

May 25, 2025