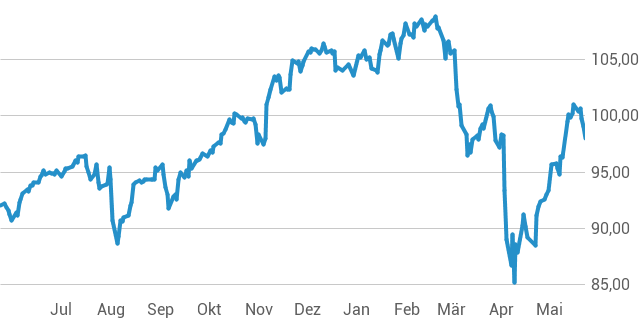

7% Drop For Amsterdam Stocks As Trade War Fears Grip Markets

Table of Contents

Understanding the Trade War's Impact on Amsterdam Stocks

The ongoing global trade war, characterized by escalating tariffs and protectionist policies, has created a ripple effect across international markets. The Netherlands, being a significant player in global trade, is particularly vulnerable. Specific trade policies directly impact Dutch businesses and the AEX, leading to several negative consequences:

- Impact on export-oriented Dutch companies: Many Dutch companies rely heavily on exports. Increased tariffs on Dutch goods in key markets reduce their competitiveness and profitability, directly impacting their stock prices on the Amsterdam stock market.

- Increased import costs and reduced consumer spending: Tariffs on imported goods increase prices for consumers, reducing purchasing power and potentially slowing economic growth. This decreased consumer confidence further impacts the performance of companies listed on the AEX.

- Uncertainty impacting investor confidence in the Amsterdam stock market: The unpredictability of trade policies creates uncertainty, causing investors to become hesitant and potentially withdraw investments from the Amsterdam stock market, leading to market volatility.

- Specific sectors heavily affected: Sectors like technology (dependent on global supply chains) and agriculture (reliant on international trade) are particularly vulnerable to trade war disruptions, leading to significant drops in stock prices within the Amsterdam stock market.

Analysis of the 7% Drop: Key Contributing Factors

The 7% drop in Amsterdam stock prices wasn't solely due to trade war anxieties. The speed and severity of the decline highlight a confluence of factors contributing to this market downturn. While trade war fears played a dominant role, other elements exacerbated the situation:

- Technical analysis of the market's decline: (Note: In a full article, this section would include charts and graphs illustrating the market's trajectory, showing the sharp decline and its relationship to specific events and announcements.) A technical analysis would reveal specific trading patterns and volume changes.

- Impact of investor sentiment and market psychology: Fear and uncertainty spread rapidly, creating a self-fulfilling prophecy where negative sentiment drives further selling and price declines. This "herd mentality" significantly contributes to the severity of the drop in the Amsterdam stock market.

- Role of currency fluctuations (Euro vs. US Dollar): Fluctuations in the Euro against the US Dollar can influence the performance of companies with significant international operations, further impacting the overall performance of the Amsterdam stock market.

The Amsterdam Stock Exchange (AEX) and its Vulnerability

The AEX, like many stock exchanges, is sensitive to global economic shifts. Its composition, with a strong representation of multinational corporations heavily involved in international trade and investment, makes it particularly vulnerable to trade war disruptions.

- Key sectors represented in the AEX and their susceptibility to trade wars: The AEX includes companies from various sectors, many of which are directly impacted by global trade, increasing the AEX's susceptibility to trade war volatility.

- Comparison to other European stock markets (e.g., London, Frankfurt) and their relative performance: A comparative analysis shows the AEX’s performance against other major European exchanges, providing context and highlighting its specific vulnerabilities. (Note: In a full article, this section would include a comparative analysis of stock market performance).

- The role of government intervention and potential stimulus measures: The Dutch government's response and potential measures to mitigate the economic impact of the trade war on the Amsterdam stock market and the overall economy are crucial factors to consider.

Future Outlook and Investor Strategies

Predicting the future trajectory of the Amsterdam stock market is challenging, hinging largely on the resolution (or escalation) of the trade war. Experts offer varying opinions: some anticipate a prolonged period of uncertainty, while others expect a rebound once trade tensions ease.

- Short-term vs. long-term investment strategies: Short-term investors might seek to capitalize on market volatility through tactical trading strategies, while long-term investors may consider this a buying opportunity if they believe in the underlying fundamentals of the Dutch economy.

- Diversification as a risk-mitigation tactic: Diversifying investment portfolios across different asset classes and geographic regions is crucial to mitigating risk in this uncertain market environment.

- Advice on specific stocks or sectors to watch: (Note: In a full article, specific stock recommendations and sector analyses would be provided, but such advice requires extensive research and disclaimers.)

Conclusion: Navigating the Uncertainty in the Amsterdam Stock Market

The 7% drop in Amsterdam stocks underscores the significant impact of trade war fears on global markets. The interconnected nature of the global economy means that events impacting one region quickly spread, causing ripple effects on stock markets worldwide. Understanding market volatility and making informed investment decisions is crucial for navigating this uncertainty. Stay informed about developments in the Amsterdam stock market and trade war negotiations to make sound investment choices and mitigate potential risks. Further research into stock market analysis, investment strategies, and economic forecasting will equip you with the knowledge to make better-informed decisions.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025 -

Apple Stock Dip Key Levels Before Q2 Earnings

May 25, 2025

Apple Stock Dip Key Levels Before Q2 Earnings

May 25, 2025 -

Escape To The Country Building Your Dream Rural Home

May 25, 2025

Escape To The Country Building Your Dream Rural Home

May 25, 2025 -

Former French Pm Critiques Macrons Decisions

May 25, 2025

Former French Pm Critiques Macrons Decisions

May 25, 2025 -

Find Bbc Radio 1 Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 25, 2025

Find Bbc Radio 1 Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 25, 2025

Latest Posts

-

Trump Administration Greenlights Nippon U S Steel Merger

May 25, 2025

Trump Administration Greenlights Nippon U S Steel Merger

May 25, 2025 -

Buy And Hold Investing Understanding The Gut Wrenching Waits

May 25, 2025

Buy And Hold Investing Understanding The Gut Wrenching Waits

May 25, 2025 -

Trump Approves Nippon U S Steel Deal Implications For The Industry

May 25, 2025

Trump Approves Nippon U S Steel Deal Implications For The Industry

May 25, 2025 -

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025 -

How 10 New Orleans Inmates Escaped Jail Undetected

May 25, 2025

How 10 New Orleans Inmates Escaped Jail Undetected

May 25, 2025