Major Losses Continue: Amsterdam Stock Exchange Down 11%

Table of Contents

Causes of the AEX's 11% Decline

The sharp 11% decline in the AEX index is a multifaceted issue stemming from both global and domestic factors. Understanding these underlying causes is crucial for assessing the situation and its potential trajectory.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, significantly impacting investor confidence and contributing to the AEX's decline.

- Increased Inflation and Interest Rates: Globally rising inflation rates and subsequent interest rate hikes by central banks are dampening economic growth and reducing investor appetite for riskier assets. This has triggered a sell-off in many markets, including the AEX.

- Geopolitical Instability: The ongoing war in Ukraine continues to create significant geopolitical uncertainty, disrupting supply chains, increasing energy prices, and fueling inflation. This instability directly impacts investor sentiment and fuels market volatility.

- Energy Crisis and Supply Chain Disruptions: The energy crisis, exacerbated by the war in Ukraine, is causing significant disruptions to global supply chains and impacting the profitability of many businesses, leading to decreased investor confidence.

- Specific Global Events: Examples of specific global events influencing the market include the ongoing tensions between the US and China, the energy crisis in Europe and the subsequent impact on various sectors, and the persistent challenges within the global supply chain.

Performance of Key Dutch Companies

The performance of individual companies listed on the AEX has significantly contributed to the overall market decline. Several key sectors have been particularly hard hit.

- Energy Sector Losses: Energy companies listed on the AEX have experienced substantial share price drops due to volatile energy prices and regulatory uncertainty.

- Technology Sector Slowdown: The technology sector, globally facing challenges, has seen a slowdown in growth, impacting the performance of Dutch tech companies listed on the AEX.

- Examples of Significant Drops: [Insert examples of specific companies and the percentage drop in their share price, along with the reason for the drop]. For example, Company X, a major player in the energy sector, saw a 15% drop due to decreased demand and increased production costs.

Impact on the Dutch Economy

The 11% drop in the AEX has significant implications for the Dutch economy, affecting investor confidence, pension funds, and government policy.

Investor Sentiment and Confidence

The sharp decline has eroded investor confidence in the Dutch market.

- Capital Flight: Concerns about the stability of the AEX could lead to capital flight, with investors moving their money to perceived safer markets. This capital outflow could further weaken the Dutch economy.

- Impact on Pension Funds: Many Dutch pension funds hold significant investments in the AEX. The 11% drop directly impacts their asset values and could necessitate adjustments to pension payouts.

- Reduced Consumer Spending: Decreased investor confidence can lead to reduced consumer spending, potentially causing further economic slowdown.

Government Response and Potential Measures

The Dutch government is likely to respond to the market downturn with measures aimed at mitigating the damage.

- Stimulus Packages: The government might introduce stimulus packages to boost economic activity and support businesses affected by the decline.

- Regulatory Measures: Regulatory measures could be implemented to stabilize the market and increase investor confidence.

- Long-Term Economic Consequences: The long-term consequences of this decline will depend on the effectiveness of government interventions and the overall recovery of the global economy.

Future Outlook for the Amsterdam Stock Exchange

Predicting the future of the AEX is challenging, but analyzing expert opinions and market forecasts provides some insight.

Analyst Predictions and Market Forecasts

- Recovery Scenarios: Some analysts predict a gradual recovery as global economic uncertainty eases and key Dutch companies regain their footing. Others foresee a more prolonged period of volatility.

- Factors Affecting Recovery: Key factors influencing a potential rebound or further decline include global inflation rates, interest rate decisions by central banks, the resolution of the geopolitical situation in Ukraine, and the overall health of the global economy.

Advice for Investors

Navigating this volatile market requires careful planning and informed decision-making.

- Risk Management: Investors should carefully assess their risk tolerance and diversify their portfolios to mitigate potential losses.

- Long-Term Strategies: Maintaining a long-term investment perspective is crucial, avoiding panic selling based on short-term market fluctuations.

- Professional Advice: Seeking professional advice from a financial advisor is highly recommended during periods of market volatility.

Conclusion

The 11% drop in the Amsterdam Stock Exchange represents a significant challenge for the Dutch economy. Global economic uncertainty, coupled with underperformance of key Dutch companies, has led to a substantial loss of investor confidence. The government's response and the future outlook remain crucial factors in determining the long-term impact of this downturn. The interconnectedness of the global market and the specific vulnerabilities of the Dutch economy underscore the need for vigilance and adaptable investment strategies.

Call to Action: Stay informed about the evolving situation of the Amsterdam Stock Exchange. Monitor market trends, consult financial advisors, and make informed decisions to protect your investments during this period of market volatility. Understanding the intricacies of the Amsterdam Stock Exchange and its fluctuations is vital for effective investment strategies.

Featured Posts

-

I Miliardari Piu Influenti Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

I Miliardari Piu Influenti Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025 -

Proposed Changes To Juvenile Sentencing In France

May 24, 2025

Proposed Changes To Juvenile Sentencing In France

May 24, 2025 -

Escape To The Country Choosing The Right Rural Property

May 24, 2025

Escape To The Country Choosing The Right Rural Property

May 24, 2025 -

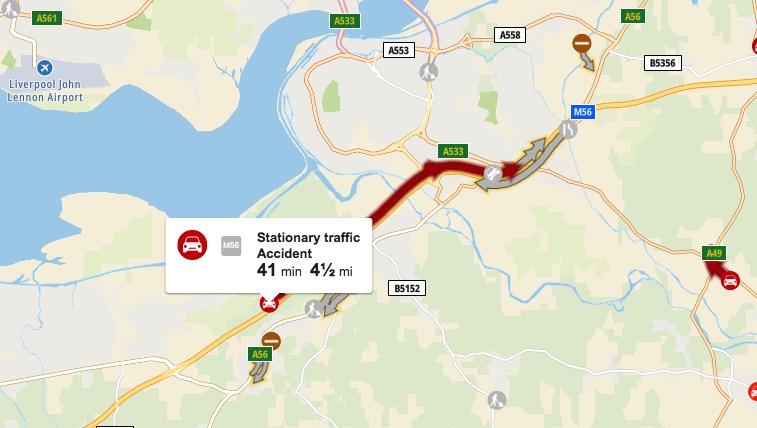

M56 Traffic Disruption Cheshire And Deeside Delays

May 24, 2025

M56 Traffic Disruption Cheshire And Deeside Delays

May 24, 2025 -

A Successful Escape To The Country Tips For A Smooth Transition

May 24, 2025

A Successful Escape To The Country Tips For A Smooth Transition

May 24, 2025

Latest Posts

-

Horoscopo 4 Al 10 De Marzo De 2025 Pronosticos Para Todos Los Signos Zodiacales

May 24, 2025

Horoscopo 4 Al 10 De Marzo De 2025 Pronosticos Para Todos Los Signos Zodiacales

May 24, 2025 -

Financial Strain Leads To Increased Auto Theft In Canada A Growing Concern

May 24, 2025

Financial Strain Leads To Increased Auto Theft In Canada A Growing Concern

May 24, 2025 -

Descubre Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025

Descubre Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025

May 24, 2025 -

Tutumlulukta Oende Gelen 3 Burc

May 24, 2025

Tutumlulukta Oende Gelen 3 Burc

May 24, 2025 -

Predicciones Astrologicas Horoscopo Del 4 Al 10 De Marzo De 2025

May 24, 2025

Predicciones Astrologicas Horoscopo Del 4 Al 10 De Marzo De 2025

May 24, 2025