Malaysian Ringgit (MYR) Exchange Rate: Front-Loading Benefits For Exporters

Table of Contents

Understanding the MYR Exchange Rate and its Volatility

The Malaysian Ringgit (MYR) exchange rate is influenced by a multitude of interconnected factors, making it inherently volatile. Understanding these factors is the first step towards effective currency risk management. Key influencers include:

- Global economic conditions: Global recessions or economic slowdowns often weaken the MYR as demand for Malaysian exports decreases. Conversely, periods of robust global growth tend to strengthen the currency.

- Political stability: Political uncertainty or instability within Malaysia can negatively impact investor confidence, leading to a weakening of the MYR.

- Commodity prices: Malaysia is a significant exporter of commodities like palm oil and rubber. Stronger global demand and higher prices for these commodities typically strengthen the MYR.

- Interest rates: Bank Negara Malaysia's (BNM) monetary policy decisions regarding interest rates influence the MYR. Higher interest rates generally attract foreign investment, boosting the currency's value.

- Foreign investment: Increased foreign direct investment (FDI) flows into Malaysia strengthen the MYR, while capital flight weakens it.

What is Front-Loading in Export Transactions?

Front-loading, in the context of MYR exchange rate management, refers to a proactive strategy where exporters accelerate invoicing and payments to take advantage of a favorable exchange rate. This involves strategically timing transactions to capitalize on periods when the MYR is strong against the buyer's currency. Key aspects of front-loading include:

- Accelerating invoicing and payments: Exporters proactively invoice customers earlier than usual and encourage faster payments when the MYR is strong, securing higher MYR returns.

- Negotiating contracts with MYR-denominated payments: Where possible, negotiate contracts where payments are made in MYR, eliminating exchange rate risk for the exporter.

- Utilizing hedging strategies: Employing financial instruments like forward contracts or currency options to lock in a favorable exchange rate for future transactions. This mitigates the risk of the MYR weakening before payment is received.

- Examples of successful front-loading strategies: A Malaysian palm oil exporter, anticipating a weakening MYR, might negotiate advance payments or accelerate invoicing when the currency is strong.

Benefits of Front-Loading for Malaysian Exporters

Implementing a front-loading strategy offers several significant advantages for Malaysian exporters:

- Increased revenue in Malaysian Ringgit (MYR): By securing payments when the MYR is strong, exporters receive a higher amount in MYR, boosting their overall revenue.

- Improved profit margins due to favorable exchange rates: Higher MYR revenue directly translates to improved profit margins, enhancing business profitability.

- Reduced financial risk associated with exchange rate volatility: Front-loading minimizes the impact of MYR fluctuations, providing greater financial stability.

- Enhanced competitiveness in the global market: By effectively managing currency risk, Malaysian exporters can offer more competitive prices, strengthening their position in the international marketplace.

Case Studies: Successful Front-Loading Examples

Several Malaysian businesses have successfully leveraged front-loading strategies. For instance, a rubber glove manufacturer negotiated advance payments from its European buyers, securing a favorable MYR exchange rate before the currency weakened due to global economic uncertainty. Similarly, a technology firm proactively invoiced clients when the MYR strengthened against the US dollar, maximizing its revenue in MYR.

Risks and Considerations of Front-Loading

While front-loading offers significant benefits, it's crucial to acknowledge potential drawbacks:

- Potential for lost opportunities if the MYR strengthens unexpectedly: If the MYR strengthens unexpectedly after payments have been received, the exporter might miss out on even higher returns.

- Need for accurate forecasting of exchange rate movements: Effective front-loading relies on accurate forecasting of MYR exchange rate movements. Inaccurate predictions can lead to losses.

- Importance of expert financial advice: Seeking professional guidance from financial experts experienced in foreign exchange markets is crucial to make informed decisions.

- Considerations related to cash flow management: Front-loading requires careful planning and management of cash flow to ensure sufficient funds are available when payments are received.

Tools and Strategies for Effective MYR Exchange Rate Management

Several tools and techniques can assist Malaysian exporters in managing their MYR exposure:

- Utilizing forward contracts and currency options: These hedging instruments allow exporters to lock in a specific exchange rate for future transactions, mitigating risk.

- Employing currency hedging strategies: Various hedging strategies, such as natural hedging (matching currency flows) and netting (offsetting payments in different currencies), can reduce exposure to exchange rate risk.

- Working with financial institutions specializing in foreign exchange: Banks and specialized financial institutions offer expert advice and a range of products to help manage currency risk.

- Regular monitoring of market trends and economic indicators: Staying informed about global and domestic economic developments is crucial for making well-informed decisions.

Conclusion

Proactive management of the Malaysian Ringgit (MYR) exchange rate is vital for Malaysian exporters. Front-loading offers a strategic approach to capitalize on favorable exchange rates, boosting revenue, improving profit margins, and reducing financial risk. While it necessitates careful planning and potentially expert advice, the potential benefits significantly outweigh the risks for businesses willing to adopt this strategy. Learn more about managing your MYR exchange rate risk and adopt effective strategies like front-loading to optimize your export business. Seeking professional advice on managing the Malaysian Ringgit (MYR) exchange rate for your specific needs is highly recommended. Contact your bank or a financial advisor specializing in foreign exchange for personalized guidance.

Featured Posts

-

Rihannas Third Child Updates And Details On Her Pregnancy

May 07, 2025

Rihannas Third Child Updates And Details On Her Pregnancy

May 07, 2025 -

20 Ai

May 07, 2025

20 Ai

May 07, 2025 -

Nba Game Preview Knicks Vs Cavaliers Can New York Secure A Victory

May 07, 2025

Nba Game Preview Knicks Vs Cavaliers Can New York Secure A Victory

May 07, 2025 -

El Regreso De Lewis Capaldi A Wwe Smack Down Tras Su Pausa Por Salud

May 07, 2025

El Regreso De Lewis Capaldi A Wwe Smack Down Tras Su Pausa Por Salud

May 07, 2025 -

The Last Of Us Season 2 Episode 4 A Week Long Filming Process

May 07, 2025

The Last Of Us Season 2 Episode 4 A Week Long Filming Process

May 07, 2025

Latest Posts

-

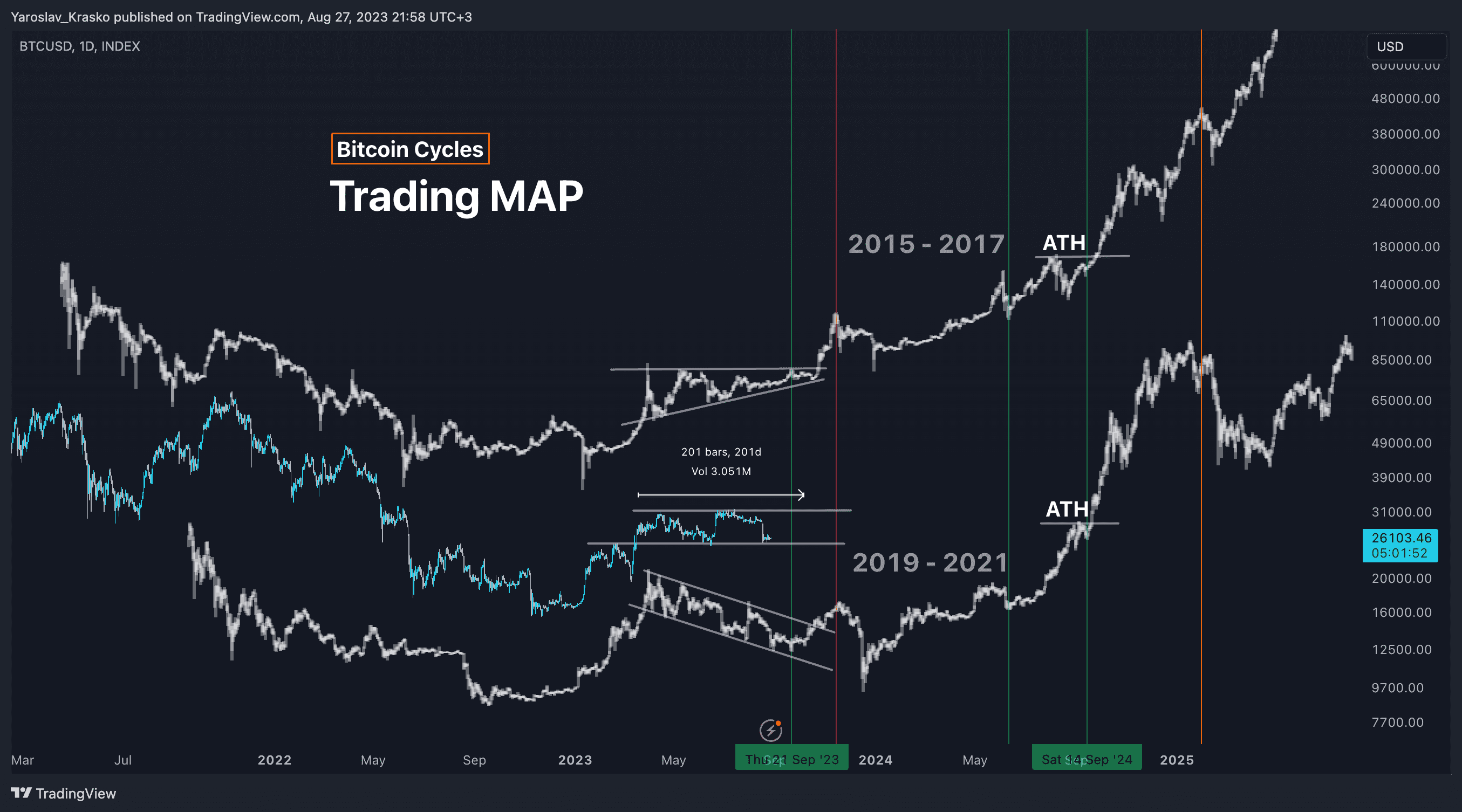

Expert Prediction Bitcoin Could Soar By 1 500 In Five Years

May 08, 2025

Expert Prediction Bitcoin Could Soar By 1 500 In Five Years

May 08, 2025 -

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025 -

Bitcoins Future Exploring The Possibility Of A 1 500 Rise

May 08, 2025

Bitcoins Future Exploring The Possibility Of A 1 500 Rise

May 08, 2025 -

Five Year Bitcoin Forecast Potential For 1 500 Growth

May 08, 2025

Five Year Bitcoin Forecast Potential For 1 500 Growth

May 08, 2025 -

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025