Market Rally: Sensex And Nifty Surge; UltraTech's Decline

Table of Contents

Sensex and Nifty's Impressive Surge: A Detailed Analysis

The Indian stock market experienced a robust rally today, with both the Sensex and Nifty indices registering significant gains. This surge can be attributed to a confluence of factors, both global and domestic.

Factors Contributing to the Market Rally:

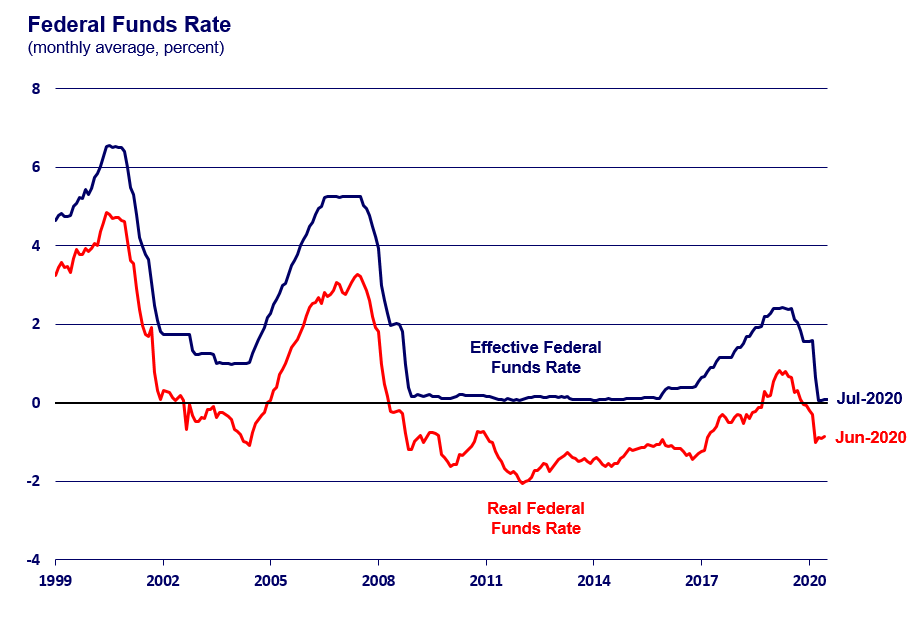

- Positive Global Cues: Easing inflation concerns in major economies like the US and Europe provided a positive global economic outlook, boosting investor confidence. Positive economic data releases from these regions further fueled the market rally.

- Strong Domestic Factors: Robust corporate earnings from several Indian companies, particularly in the IT and FMCG sectors, injected optimism into the market. Government policies supporting infrastructure development and economic growth also played a significant role.

- Improved Investor Sentiment: A shift in investor sentiment towards a more bullish outlook significantly impacted buying activity. This positive sentiment was reflected in increased trading volumes across various sectors.

- Data Points: The Sensex gained X%, reaching Y points, while the Nifty surged by Z%, closing at A points. Trading volumes were significantly higher than average, indicating strong participation from investors. Keywords: Sensex gains, Nifty surge, market sentiment, global economic outlook, Indian economy.

Sector-wise Performance:

While the overall market experienced a surge, the performance varied across sectors. The IT and FMCG sectors were among the top performers, driven by strong corporate earnings and positive investor sentiment. Conversely, some sectors, like real estate and energy, exhibited comparatively weaker performance. This sector-specific variation highlights the nuances within the broader market rally. Keywords: sectoral performance, stock market sectors, top performing stocks.

UltraTech Cement's Unexpected Dip: Understanding the Contradiction

While the Sensex and Nifty enjoyed a significant rally, UltraTech Cement's stock price experienced an unexpected decline. This divergence necessitates a closer examination of the factors influencing UltraTech's performance.

Reasons for UltraTech's Decline:

- Company-Specific Factors: While the overall market celebrated, potential factors influencing UltraTech's dip could include recent quarterly results (if released), internal management decisions, or a less optimistic outlook for future growth projected by analysts. A detailed analysis of these company-specific factors is necessary to fully understand the decline.

- Industry-Specific Factors: Fluctuations in cement prices, increased competition within the cement industry, and rising raw material costs could all contribute to the decline. An analysis of the broader cement industry landscape is critical in understanding the pressure on UltraTech's performance.

- Global Factors: Global economic uncertainties, potentially impacting demand for cement, could also play a role in UltraTech's performance. Keywords: UltraTech Cement stock, cement industry, stock price decline, company performance.

Technical Analysis of UltraTech's Stock:

A technical analysis of UltraTech's stock chart (if applicable) might reveal insights into the price movement. Examining support and resistance levels, trading volumes, and chart patterns could provide further understanding of the recent decline. Keywords: technical analysis, stock chart, support resistance levels.

Implications and Future Outlook for the Indian Stock Market

The sustainability of this market rally hinges on several factors. While positive global cues and strong domestic performance contributed to the surge, potential risks and challenges remain. Geopolitical events, inflation concerns, and changes in investor sentiment could all impact the market's trajectory.

Predicting the future performance of the Sensex, Nifty, and UltraTech Cement with certainty is impossible. However, continuous monitoring of these factors is crucial. Keywords: market outlook, future predictions, stock market analysis, investment strategies.

Conclusion: Navigating the Market Rally – Sensex, Nifty, and UltraTech's Story

Today's market presented a fascinating contrast: a significant surge in the Sensex and Nifty indices alongside an unexpected decline in UltraTech Cement's stock price. While the rally was driven by positive global cues and strong domestic factors, UltraTech's dip highlights the importance of understanding company-specific and industry-specific factors. The Indian stock market's future trajectory depends on the interplay of various internal and external forces. Therefore, staying informed about market movements and conducting thorough research before making investment decisions related to the Sensex, Nifty, or UltraTech Cement is paramount. Stay updated on market trends to make informed investment choices.

Featured Posts

-

Anomalnye Snegopady V Mae Problemy Meteoprognozov

May 09, 2025

Anomalnye Snegopady V Mae Problemy Meteoprognozov

May 09, 2025 -

Trump Appoints Jeanine Pirro As Dc Prosecutor A Fox News Connection

May 09, 2025

Trump Appoints Jeanine Pirro As Dc Prosecutor A Fox News Connection

May 09, 2025 -

U S Federal Reserve Rate Decision A Deep Dive Into Current Economic Conditions

May 09, 2025

U S Federal Reserve Rate Decision A Deep Dive Into Current Economic Conditions

May 09, 2025 -

Anchorage Opens Candle Studio New Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Anchorage Opens Candle Studio New Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

Bitcoin Madenciligi Karlilik Duesuesue Ve Gelecege Dair Tahminler

May 09, 2025

Bitcoin Madenciligi Karlilik Duesuesue Ve Gelecege Dair Tahminler

May 09, 2025