MicroStrategy Stock Vs Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Business Model and its Bitcoin Holdings

MicroStrategy's core business revolves around providing business intelligence, analytics, and mobile software. However, its recent strategy has dramatically shifted its profile. The company has made a significant commitment to Bitcoin, accumulating a substantial amount of BTC as a treasury asset. This bold move has intertwined the company's financial performance inextricably with Bitcoin's price fluctuations.

- MSTR's revenue streams and profitability: While MicroStrategy's software business generates revenue, its profitability is significantly influenced by the value of its Bitcoin holdings. Any increase in BTC price boosts the company's overall value, but conversely, a price drop can severely impact its financial statements.

- The percentage of MicroStrategy's assets held in Bitcoin: A substantial portion of MicroStrategy's total assets is now represented by its Bitcoin holdings, making it highly leveraged to the cryptocurrency market.

- Impact of regulatory changes on MSTR's Bitcoin holdings: Changes in cryptocurrency regulations globally could drastically affect the value and liquidity of MicroStrategy's Bitcoin reserves.

- Potential for future Bitcoin acquisitions by MSTR: MicroStrategy's management has indicated a continued interest in acquiring more Bitcoin, further amplifying its exposure to the crypto market.

This heavy reliance on Bitcoin presents both significant opportunities and considerable risks for investors considering MicroStrategy stock.

Bitcoin's Price Volatility and Future Predictions for 2025

Bitcoin's price has historically been incredibly volatile, experiencing dramatic swings both upwards and downwards. Predicting its price in 2025 is inherently speculative, but analyzing several key factors can help us understand potential scenarios.

- Key technical indicators affecting Bitcoin's price: Technical analysis, including moving averages and chart patterns, offers insights into potential price trends, although it's not a foolproof prediction method.

- Impact of institutional adoption on Bitcoin's price: Increased adoption by institutional investors, such as large corporations and investment funds, can lead to significant price increases due to higher demand.

- Potential regulatory hurdles for Bitcoin adoption: Government regulations and potential bans on cryptocurrencies could negatively impact Bitcoin's price.

- Scenario planning for different Bitcoin price outcomes in 2025: Analysts offer varying predictions. Some predict significantly higher prices, while others foresee more modest growth or even potential declines depending on various macroeconomic conditions. It's crucial to consider a range of possibilities rather than relying on a single prediction. (Source: [Insert reputable source for Bitcoin price predictions, e.g., a research report from a financial institution]).

Understanding these influencing factors is essential for assessing the risks and rewards associated with a Bitcoin investment.

Comparative Analysis: MicroStrategy Stock vs. Direct Bitcoin Investment

Investing in MicroStrategy stock versus directly investing in Bitcoin presents distinct risk-reward profiles.

- Risk-reward profile of each investment: MicroStrategy offers diversification beyond Bitcoin, but its performance is highly correlated to BTC. Direct Bitcoin investment offers higher potential returns but also higher volatility.

- Correlation analysis between MSTR and BTC price movements: A strong positive correlation exists between MSTR stock price and Bitcoin’s price. This means that when Bitcoin's price rises, MicroStrategy's stock price generally follows suit, and vice-versa.

- Tax implications of each investment: Tax implications differ significantly between owning Bitcoin and MicroStrategy stock. Capital gains taxes will apply differently depending on the jurisdiction and holding period.

- Liquidity and accessibility of each investment: Both Bitcoin and MicroStrategy stock are relatively liquid, but the ease of access may vary based on the chosen exchange or brokerage.

Carefully considering these factors helps in determining which investment aligns better with your personal risk tolerance and financial goals.

Macroeconomic Factors and Their Influence on Both Investments

Broader macroeconomic factors significantly impact both Bitcoin and MicroStrategy stock.

- Impact of inflation on Bitcoin's value as a hedge: Some investors see Bitcoin as a hedge against inflation, believing its value will increase during inflationary periods.

- Influence of interest rates on investor sentiment towards both assets: Higher interest rates generally reduce investor appetite for riskier assets like Bitcoin and growth stocks like MicroStrategy.

- Potential effects of global recession on both investments: During economic downturns, both Bitcoin and MicroStrategy stock are likely to experience price declines, albeit potentially at different rates.

Understanding these macroeconomic headwinds and tailwinds is crucial for informed decision-making.

Conclusion: Making Informed Investment Decisions: MicroStrategy Stock or Bitcoin in 2025?

Investing in either MicroStrategy stock or Bitcoin involves significant risk. MicroStrategy's business model is intrinsically linked to Bitcoin’s success, while direct Bitcoin investment exposes you to potentially massive volatility. While the potential rewards are substantial, the risks cannot be ignored. This analysis highlights the importance of conducting thorough research and carefully assessing your personal risk tolerance before making any investment decisions. Weigh the pros and cons of a MicroStrategy vs Bitcoin investment strategy before committing your capital. Before investing in either MicroStrategy stock or Bitcoin in 2025, take time to fully understand the nuances of each investment, the potential risks and rewards, and how they align with your overall financial goals. Make informed investment decisions in MicroStrategy stock or Bitcoin to manage your risk effectively.

Featured Posts

-

Expert Prediction Bitcoin Could Soar By 1 500 In Five Years

May 08, 2025

Expert Prediction Bitcoin Could Soar By 1 500 In Five Years

May 08, 2025 -

Inter Milan Midfielder Piotr Zielinski Faces Weeks Out With Calf Problem

May 08, 2025

Inter Milan Midfielder Piotr Zielinski Faces Weeks Out With Calf Problem

May 08, 2025 -

Exploring The Rare Double Performances Of Former Okc Thunder Players

May 08, 2025

Exploring The Rare Double Performances Of Former Okc Thunder Players

May 08, 2025 -

Analyzing Gta Vis Second Trailer Bonnie And Clyde Narrative Breakdown

May 08, 2025

Analyzing Gta Vis Second Trailer Bonnie And Clyde Narrative Breakdown

May 08, 2025 -

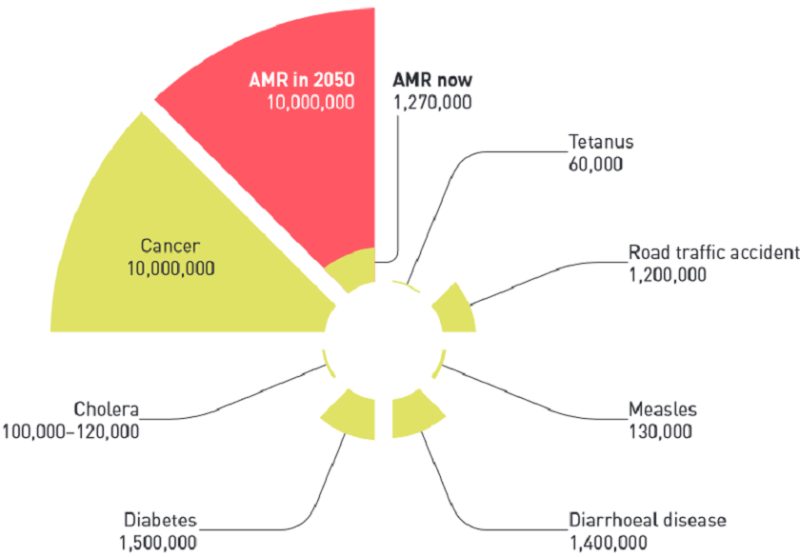

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Latest Posts

-

Sifrenizi Unuttunuz Mu Kripto Mirasiniz Tehlikede

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Mirasiniz Tehlikede

May 08, 2025 -

Kripto Para Piyasasinda Wall Street In Etkisi Degisen Tutumlar

May 08, 2025

Kripto Para Piyasasinda Wall Street In Etkisi Degisen Tutumlar

May 08, 2025 -

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Dikkat Edilmesi Gerekenler

May 08, 2025

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Dikkat Edilmesi Gerekenler

May 08, 2025 -

Spk Nin Aciklamasiyla Kripto Piyasalari Nasil Degisecek

May 08, 2025

Spk Nin Aciklamasiyla Kripto Piyasalari Nasil Degisecek

May 08, 2025 -

Kripto Varliklarda Miras Sorunu Sifre Kaybinin Yasal Sonuclari

May 08, 2025

Kripto Varliklarda Miras Sorunu Sifre Kaybinin Yasal Sonuclari

May 08, 2025