MicroStrategy Vs. Bitcoin In 2025: Which Is The Better Investment?

Table of Contents

Bitcoin's Potential in 2025: A Decentralized Future

Bitcoin's Price Volatility and Long-Term Growth Potential

Bitcoin's price history is a rollercoaster. Dramatic price swings are the norm, making it a high-risk, high-reward investment. Predicting the Bitcoin price prediction 2025 is challenging, but several factors could influence its trajectory:

- Wider Adoption: Increasing mainstream acceptance and institutional investment could drive price appreciation.

- Regulatory Changes: Clearer regulatory frameworks in major economies could boost confidence and attract more investors. Conversely, overly restrictive regulations could stifle growth.

- Technological Advancements: Upgrades to the Bitcoin network, such as the Lightning Network, could improve scalability and transaction speeds, impacting its usability and value.

- Inflation Hedging: Many see Bitcoin as a hedge against inflation, potentially boosting demand during periods of economic uncertainty. The impact of Bitcoin ETFs on price stability is also a key factor to consider.

Analysts offer diverse Bitcoin price predictions 2025, ranging from conservative estimates to extremely bullish forecasts. The potential impact of Bitcoin ETFs, which would allow for easier institutional investment, remains a significant unknown. A well-defined Bitcoin investment strategy is crucial to mitigate the inherent volatility.

Bitcoin's Role as a Store of Value and Hedge Against Inflation

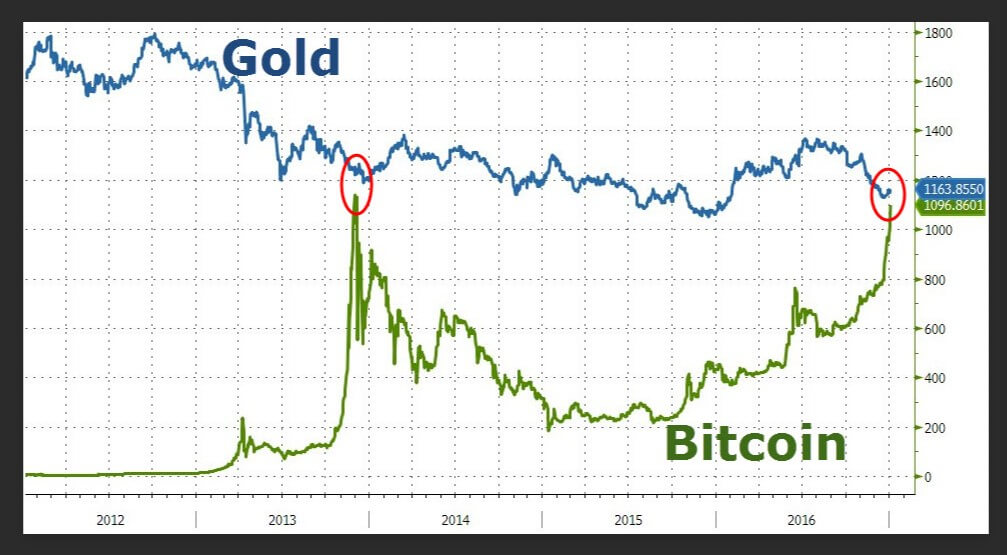

Bitcoin's limited supply of 21 million coins is a key argument for its potential as a store of value, similar to gold. Its decentralized nature and resistance to government control further enhance this appeal. The comparison with traditional assets like gold is frequently made, with Bitcoin proponents highlighting its superior portability and divisibility.

- Comparison with Traditional Assets: Bitcoin's performance compared to gold, stocks, and bonds during inflationary periods will be crucial.

- Impact of Macroeconomic Factors: Global economic events, interest rate changes, and geopolitical instability will all influence Bitcoin's value.

- Scarcity and Limited Supply: The inherent scarcity of Bitcoin is a significant factor contributing to its perceived value and potential as a deflationary asset.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks:

- Regulatory Uncertainty: Government regulations vary widely across the globe and remain a significant source of uncertainty.

- Market Manipulation: The relatively small market capitalization of Bitcoin compared to traditional assets makes it potentially susceptible to manipulation.

- Security Risks: While the Bitcoin network itself is secure, individual wallets and exchanges remain vulnerable to hacking and theft. Past market crashes have demonstrated the dramatic price drops Bitcoin can experience. Understanding these Bitcoin risks is paramount before investing.

MicroStrategy's Bitcoin Strategy and Stock Performance

MicroStrategy's Bitcoin Holdings and Investment Strategy

MicroStrategy's significant Bitcoin holdings have made it a prominent player in the cryptocurrency space. Their bold investment strategy, which involves using company reserves to acquire Bitcoin, has significantly impacted their balance sheet.

- Timeline of MicroStrategy's Bitcoin Purchases: Analyzing the timing and amounts of MicroStrategy's Bitcoin purchases offers insights into their strategy.

- Reasons Behind Their Strategy: Understanding the rationale behind MicroStrategy's decision to embrace Bitcoin as a long-term investment is crucial.

- Impact on the Company's Balance Sheet: The effect of Bitcoin's price fluctuations on MicroStrategy's financial health needs to be carefully considered.

MicroStrategy's Stock Price Performance and Correlation with Bitcoin

MicroStrategy's stock price is heavily correlated with the price of Bitcoin. This interdependence represents both a potential benefit and a significant risk for investors.

- Historical Data Comparing Stock and Bitcoin Performance: Analyzing historical data reveals the strength of this correlation.

- Analysis of Correlation: Understanding the extent of this correlation is crucial for risk assessment.

- Potential Future Scenarios: Predicting how the stock will perform under different Bitcoin price scenarios is essential. MicroStrategy stock price prediction models often reflect this dependence.

Risks Associated with Investing in MicroStrategy Stock

Investing in MicroStrategy stock exposes you to several risks:

- Dependence on Bitcoin's Price: The company's fortunes are intrinsically linked to Bitcoin's price performance.

- Company-Specific Risks: MicroStrategy's business model and financial health are subject to various risks independent of Bitcoin.

- Overall Market Conditions: Broader economic conditions and market downturns can negatively impact the stock price. Analyzing MicroStrategy's financial analysis and understanding their business model is crucial before investing.

Comparative Analysis: MicroStrategy vs. Bitcoin in 2025

Direct Comparison of Potential Returns

Comparing the potential returns of Bitcoin and MicroStrategy stock requires considering various scenarios. A high Bitcoin price could benefit both, but a drop would negatively impact both.

- Potential Upside and Downside for Each: Assessing potential gains and losses under different market conditions is vital.

- Consideration of Risk Tolerance: Investors with different risk tolerances will find one more appealing than the other.

- Diversification Strategies: Diversifying your portfolio to mitigate risks associated with both Bitcoin and MicroStrategy is advisable. MicroStrategy vs Bitcoin ROI comparisons need to incorporate risk-adjusted returns.

Risk Tolerance and Investment Goals

Choosing between Bitcoin and MicroStrategy depends significantly on your risk tolerance and investment goals.

- Different Investor Profiles and Suitable Investment Choices: Conservative investors may prefer lower-risk options.

- Long-Term vs. Short-Term Investment Strategies: Long-term horizons often better accommodate volatile assets.

Understanding your investment risk tolerance and investment goals helps determine the best fit for your portfolio.

Conclusion: Making the Right Investment Choice in 2025

This analysis of "MicroStrategy vs. Bitcoin" reveals that both offer significant potential returns but carry substantial risks. Bitcoin's decentralized nature and potential as an inflation hedge are compelling, but its volatility is a major concern. MicroStrategy's stock provides leveraged exposure to Bitcoin but is susceptible to company-specific risks.

Considering individual risk tolerance and investment goals is crucial. A diversified approach, perhaps incorporating a small percentage of both Bitcoin and MicroStrategy stock within a broader portfolio, might be a suitable strategy for some investors. Remember, thorough research and a well-defined investment strategy are vital before investing in either Bitcoin or MicroStrategy stock. Conduct further research and make informed decisions about your MicroStrategy vs. Bitcoin investment strategy for 2025. Consider consulting with a qualified financial advisor before making any investment decisions.

Featured Posts

-

John Fettermans Health A Response To Ny Magazines Allegations

May 08, 2025

John Fettermans Health A Response To Ny Magazines Allegations

May 08, 2025 -

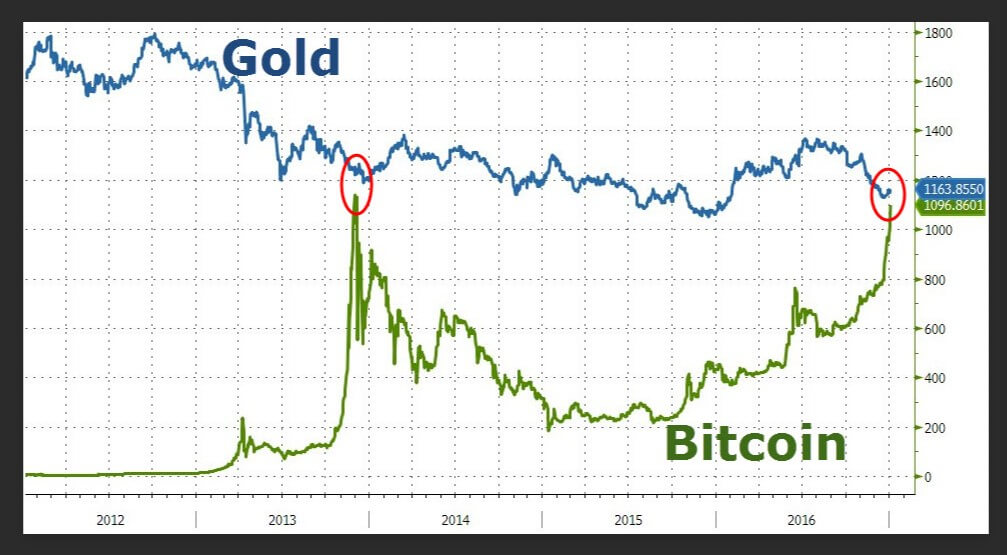

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025 -

Counting Crows 2025 Setlist Predictions What Songs Will They Play

May 08, 2025

Counting Crows 2025 Setlist Predictions What Songs Will They Play

May 08, 2025 -

Hong Kong Dollar Crisis Interest Rate Drop Sparks Concerns

May 08, 2025

Hong Kong Dollar Crisis Interest Rate Drop Sparks Concerns

May 08, 2025 -

Zdravstveno Stanje Papeza Zadnje Informacije In Analiza

May 08, 2025

Zdravstveno Stanje Papeza Zadnje Informacije In Analiza

May 08, 2025

Latest Posts

-

Dwp Overpayments And Underpayments Understanding Universal Credit

May 08, 2025

Dwp Overpayments And Underpayments Understanding Universal Credit

May 08, 2025 -

Celtics Coach On Tatums Wrist Latest Injury Update

May 08, 2025

Celtics Coach On Tatums Wrist Latest Injury Update

May 08, 2025 -

Could You Be Entitled To A Universal Credit Refund

May 08, 2025

Could You Be Entitled To A Universal Credit Refund

May 08, 2025 -

Check Your Universal Credit Entitlement Potential Back Payments

May 08, 2025

Check Your Universal Credit Entitlement Potential Back Payments

May 08, 2025 -

Dwp Overpayments How To Claim Back Universal Credit Money

May 08, 2025

Dwp Overpayments How To Claim Back Universal Credit Money

May 08, 2025