Montreal Guitarist Faces Import Tariff Headaches

Table of Contents

The Impact of Import Tariffs on a Montreal Guitarist's Business

The increased cost of importing musical instruments is directly impacting the livelihood of many musicians, particularly those who rely on importing specialized or high-quality equipment. For our Montreal guitarist, let's call him Jean-Pierre, the impact is substantial.

Increased Costs of Instruments and Equipment

Jean-Pierre's struggle is typical of many musicians. He's seen a dramatic increase in the cost of his instruments and equipment due to import tariffs. For example:

- Price Increase Percentages: Jean-Pierre notes a 20-30% increase in the cost of importing high-end guitars from the USA compared to prices just two years ago. Amplifier imports have seen similar price hikes.

- Examples of Specific Guitars: A custom-built Gibson Les Paul, previously costing him $4,000 USD, now costs nearly $5,200 USD after accounting for tariffs and exchange rates, making it a significant financial strain. Similarly, a Fender Stratocaster he regularly purchases for studio sessions has experienced a $500 USD increase.

- Impact on Profit Margins: These increased import costs significantly eat into Jean-Pierre's profit margins from live performances and recording sessions, making it increasingly difficult to maintain profitability.

Difficulty in Sourcing Instruments

The high import tariffs are forcing Jean-Pierre to explore alternative suppliers and sourcing strategies, which often prove problematic.

- Specific Suppliers Mentioned: He previously relied on established US suppliers known for quality and reliability, but the added costs are making these options unsustainable.

- Alternative Sourcing Difficulties: Trying to source guitars from other countries, such as Japan or Mexico, often presents logistical challenges, including higher shipping costs and longer lead times.

- Shipping Costs & Time Delays: Shipping costs are increasing, especially for bulky instruments, and customs delays further add to the financial burden and disrupt his workflow.

Effect on Live Performances and Income

The cumulative impact of these increased costs is affecting Jean-Pierre's ability to continue his musical career effectively.

- Reduced Gig Opportunities: The financial strain makes accepting lower-paying gigs more tempting, ultimately diminishing the quality and variety of his performances.

- Cancellation of Performances: On some occasions, he's had to cancel performances due to the unavailability or prohibitive cost of necessary equipment.

- Inability to Invest in New Equipment: The high costs prevent him from investing in new instruments or upgrading his existing equipment, hindering his artistic growth and competitiveness.

- Financial Strain: Overall, the increased costs related to import tariffs are creating significant financial strain, threatening the long-term sustainability of his musical career.

Navigating the Complexities of Canadian Customs and Import Regulations

Navigating the Canadian customs and import process is a complex undertaking fraught with potential pitfalls, adding further strain on musicians.

Understanding HS Codes and Tariffs

The Harmonized System (HS) codes used to classify goods for customs purposes are crucial in determining the applicable tariff rates. Musical instruments, depending on their construction and materials, fall under varying HS codes, leading to different tariff rates.

- Explanation of HS Codes: Understanding these codes and their implications for tariff rates is crucial but often challenging for musicians unfamiliar with import regulations.

- Differences in Tariff Rates: The origin of the instrument also influences the tariff rate. Instruments from certain countries may face higher tariffs than others.

- Examples of Relevant HS Codes: Navigating the intricacies of HS codes related to guitars, amplifiers, and other musical equipment is a significant hurdle for musicians.

The Process of Importing Musical Instruments into Canada

Importing instruments into Canada involves a multi-step process that requires specific documentation and often involves brokerage fees.

- Necessary Documentation: This includes commercial invoices, certificates of origin, and other documentation proving compliance with Canadian regulations.

- Brokerage Fees: Hiring a customs broker adds further cost to the import process.

- Customs Processing Time: Delays in customs processing can disrupt touring plans and musical projects.

- Potential Penalties for Errors: Errors in documentation or compliance can result in significant penalties and delays.

Seeking Support and Assistance

Musicians like Jean-Pierre need access to resources and support to navigate the complex world of import regulations.

- Relevant Government Agencies: The Canada Border Services Agency (CBSA) offers information and guidance, although navigating their website and regulations can be challenging.

- Musician Advocacy Groups: Advocacy groups can play a vital role in representing the interests of musicians facing these challenges.

- Industry Associations: Industry associations can provide valuable insights and support to their members dealing with import issues.

Potential Solutions and Policy Recommendations

Addressing the challenges faced by Montreal guitarists and musicians requires a multi-pronged approach, including policy changes and alternative sourcing strategies.

Advocacy for Lower Tariffs on Musical Instruments

Advocating for lower or eliminated tariffs on musical instruments is essential.

- Arguments for Tariff Reduction: Lower tariffs would directly benefit musicians, support the Canadian music industry, and enhance cultural vibrancy.

- Examples of Similar Policies: Other countries have implemented policies that favor the import of musical instruments, offering a model for Canada to follow.

- Potential Benefits for the Canadian Music Industry: Reduced tariffs could stimulate growth and innovation within the Canadian music sector.

Alternative Sourcing Strategies

Exploring alternative methods for obtaining instruments can help mitigate the impact of high tariffs.

- Benefits of Purchasing Used Equipment: Purchasing used instruments can offer significant cost savings.

- Community-Based Instrument Sharing Programs: Establishing or supporting community-based instrument sharing programs can increase access to equipment.

- Advantages of Collaboration: Musicians can collaborate and share resources to reduce the individual burden of purchasing and importing equipment.

Support for Small Music Businesses

Government support is vital to help small music businesses cope with the impact of import tariffs.

- Grant Programs: Targeted grant programs could provide financial assistance to small music businesses struggling with increased costs.

- Tax Incentives: Tax incentives can help offset some of the financial burden related to instrument imports.

- Loan Programs: Low-interest loan programs could facilitate investments in equipment and support business growth.

- Business Development Support: Providing business development support to help navigate the import process and develop sustainable business models is also crucial.

Conclusion

This article has highlighted the considerable challenges faced by a Montreal guitarist, Jean-Pierre, due to the increased import tariffs on musical instruments. The rising costs and complex import regulations are directly impacting musicians' livelihoods, threatening the vibrancy of the Montreal and Canadian music scene. The situation underscores the urgent need for greater support and policy changes regarding import tariffs on musical instruments in Canada. Let's work together to advocate for fairer policies and alleviate the "import tariff headaches" facing Montreal guitarists and musicians across the country. Contact your local representatives and demand action to protect the Canadian music community. Let your voice be heard to reduce import tariffs on musical instruments and support the artists who bring music to life.

Featured Posts

-

Market Reaction Gold Climbs On Trumps Less Aggressive Stance

Apr 25, 2025

Market Reaction Gold Climbs On Trumps Less Aggressive Stance

Apr 25, 2025 -

Veterans Warning Anzac Day Ignored Australias Future At Risk

Apr 25, 2025

Veterans Warning Anzac Day Ignored Australias Future At Risk

Apr 25, 2025 -

Meme Coin Millionaires Dine With President Trump A Look Inside

Apr 25, 2025

Meme Coin Millionaires Dine With President Trump A Look Inside

Apr 25, 2025 -

Fintech Giant Revolut Reports 72 Revenue Jump Driving International Growth

Apr 25, 2025

Fintech Giant Revolut Reports 72 Revenue Jump Driving International Growth

Apr 25, 2025 -

Linda Evangelistas Journey To Self Acceptance After Breast Cancer

Apr 25, 2025

Linda Evangelistas Journey To Self Acceptance After Breast Cancer

Apr 25, 2025

Latest Posts

-

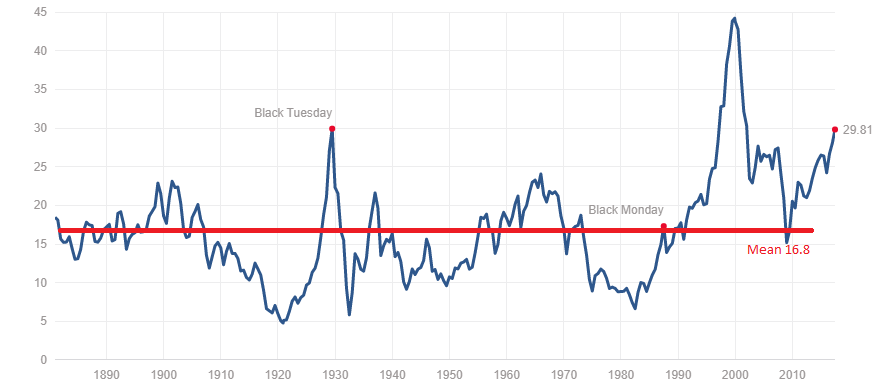

High Stock Market Valuations A Bof A Analysis For Investors

Apr 30, 2025

High Stock Market Valuations A Bof A Analysis For Investors

Apr 30, 2025 -

Stock Market Valuations Bof As Reassuring View For Investors

Apr 30, 2025

Stock Market Valuations Bof As Reassuring View For Investors

Apr 30, 2025 -

New Us Manufacturing Facility Merck Invests In Domestic Supply Of Key Drug

Apr 30, 2025

New Us Manufacturing Facility Merck Invests In Domestic Supply Of Key Drug

Apr 30, 2025 -

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025 -

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025