Musk's X Debt Sale: New Financials Reveal A Transforming Company

Table of Contents

H2: The Details of X's Debt Sale

H3: The Amount and Type of Debt

Reports suggest X sold a significant amount of debt to bolster its financial position. While precise figures remain partially undisclosed, estimations point to billions of dollars raised through a combination of high-yield bonds and term loans. These debt instruments likely come with varying interest rates and maturity dates, reflecting the current market conditions and investor appetite for risk.

- Specific figures on debt sold: While precise numbers are not yet publicly available, sources suggest the total amount raised through the X debt sale is in the multi-billion dollar range.

- Explanation of the debt instruments involved: The debt sale likely comprised a mix of high-yield bonds and term loans, offering different risk profiles and return expectations to investors.

- Mention of any potential investors or lenders: The identity of the investors and lenders involved may not be fully disclosed due to confidentiality agreements, but it's likely a diverse range of institutional investors and private equity firms.

- Analysis of the interest rates compared to market benchmarks: The interest rates charged on this debt will reflect X's creditworthiness and prevailing market interest rates. Higher risk typically translates to higher interest rates, potentially impacting X's profitability.

H3: Rationale Behind the Debt Sale

The rationale behind X's debt sale is multifaceted. The massive acquisition cost of Twitter itself created a significant debt burden. Furthermore, X's ongoing operational expenses and ambitious expansion plans, which include significant investments in AI development and platform enhancements, require substantial funding. The debt sale provides the necessary capital to support these initiatives.

- Discussion of the original Twitter acquisition debt: The initial acquisition of Twitter by Elon Musk incurred substantial debt, a significant portion of which the recent debt sale likely addresses.

- Explanation of X's current financial needs: X requires substantial funding for ongoing operations, ongoing platform maintenance, content moderation, server costs and technological advancements.

- Potential future investments the debt sale will support: The funds raised will likely be used to finance further development of X's AI capabilities, expand its user base, and improve platform features and functionality.

H2: Impact on X's Financial Health

H3: Short-Term Implications

The immediate impact of the debt sale on X's financial health is complex. While it provides much-needed liquidity, it also increases the company's debt-to-equity ratio and potentially its interest coverage ratio (the ability to cover interest payments with earnings). This could lead to a downgrade in X's credit rating, making future borrowing more expensive.

- Analysis of key financial ratios before and after the debt sale: A detailed analysis of X's financial statements is needed to fully assess the changes in its key financial ratios following the debt sale.

- Mention of any credit rating agency actions: Credit rating agencies like Moody's and S&P will likely review X's financial position and adjust its credit rating accordingly.

- Discussion of the potential impact on X's borrowing costs in the future: Increased debt levels will likely increase X's borrowing costs if it needs additional financing in the future.

H3: Long-Term Outlook

The long-term consequences depend heavily on X's ability to generate sufficient revenue to service its debt and achieve sustainable profitability. Increased leverage, while providing opportunities for expansion, also carries significant risks. Failure to generate sufficient revenue could lead to financial distress.

- Discussion of the potential benefits and drawbacks of increased leverage: Leverage can accelerate growth, but it also magnifies both profits and losses.

- Analysis of X's projected revenue streams and profitability: X needs a clear path towards increased profitability to manage its elevated debt levels.

- Assessment of the long-term viability of X's business model: The success of X's business model and its ability to adapt to the evolving tech landscape will be crucial factors in determining the long-term impact of the debt sale.

H2: The Broader Market Implications

H3: Impact on Investors

The market's reaction to X's debt sale has been mixed. While some investors may see it as a sign of financial distress, others might view it as a strategic move to fuel growth. Changes in X's stock price (if applicable) will reflect investor sentiment and confidence in the company's future prospects.

- Analysis of stock price changes (if applicable): If X is publicly traded, the impact of the debt sale on its stock price would provide a clear indicator of investor confidence.

- Discussion of investor confidence in X's future: The long-term success of X hinges on investor confidence in its ability to generate revenue and profits.

- Mention of any analyst comments or reports: Analyst reports provide valuable insights into the perceived risks and rewards associated with X's financial maneuvers.

H3: Implications for the Tech Industry

X's debt sale serves as a case study for other tech companies grappling with similar financial challenges. Its impact on debt markets and investor behavior could set a precedent for future financing strategies in the tech industry.

- Discussion of potential ripple effects on the tech industry's debt markets: The success or failure of X's strategy will have implications for how other tech companies approach debt financing.

- Comparison to other tech companies' financial strategies: X's financial maneuvers can be compared to the strategies of other tech companies to identify common themes and divergent approaches.

- Analysis of the overall impact on the tech landscape: The long-term implications of X's debt sale will influence the financial landscape of the tech industry as a whole.

3. Conclusion

X's recent debt sale is a significant event that reveals much about the company's financial position and its ambitious transformation under Elon Musk's leadership. While it provides crucial funding for ongoing operations and future expansion, it also increases X's financial risk. The long-term consequences hinge on X's ability to generate sufficient revenue and navigate the complexities of the tech industry. The market's reaction, coupled with the broader implications for the tech industry, will shape the narrative surrounding Musk's X for years to come.

Call to Action: Stay informed about the ongoing developments surrounding Musk's X and its financial strategies. Follow [link to relevant source/publication] for further updates on Musk's X debt, X financials, and the continuing transformation of this influential tech company.

Featured Posts

-

Over The Counter Birth Control A New Era Of Reproductive Freedom

Apr 28, 2025

Over The Counter Birth Control A New Era Of Reproductive Freedom

Apr 28, 2025 -

The Impact Of Professional Selling On Individual Investor Activity

Apr 28, 2025

The Impact Of Professional Selling On Individual Investor Activity

Apr 28, 2025 -

1 050 V Mware Price Increase At And Ts Concerns Over Broadcoms Acquisition

Apr 28, 2025

1 050 V Mware Price Increase At And Ts Concerns Over Broadcoms Acquisition

Apr 28, 2025 -

Market Downturns An Analysis Of Professional And Individual Investor Actions

Apr 28, 2025

Market Downturns An Analysis Of Professional And Individual Investor Actions

Apr 28, 2025 -

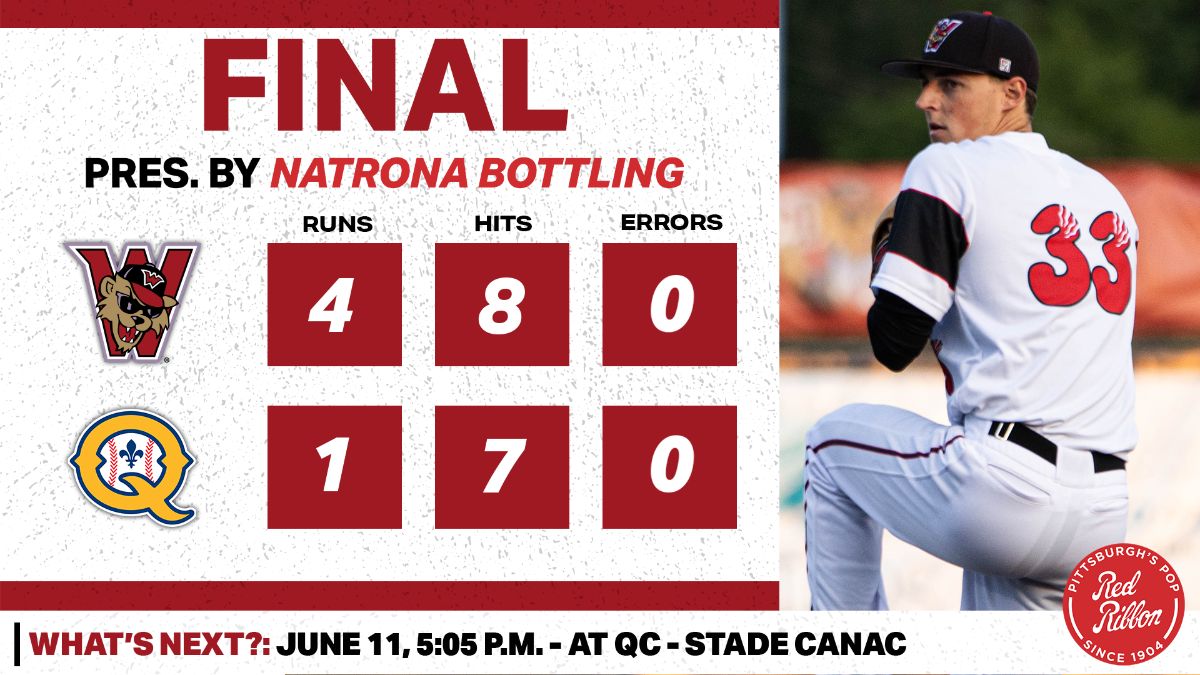

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

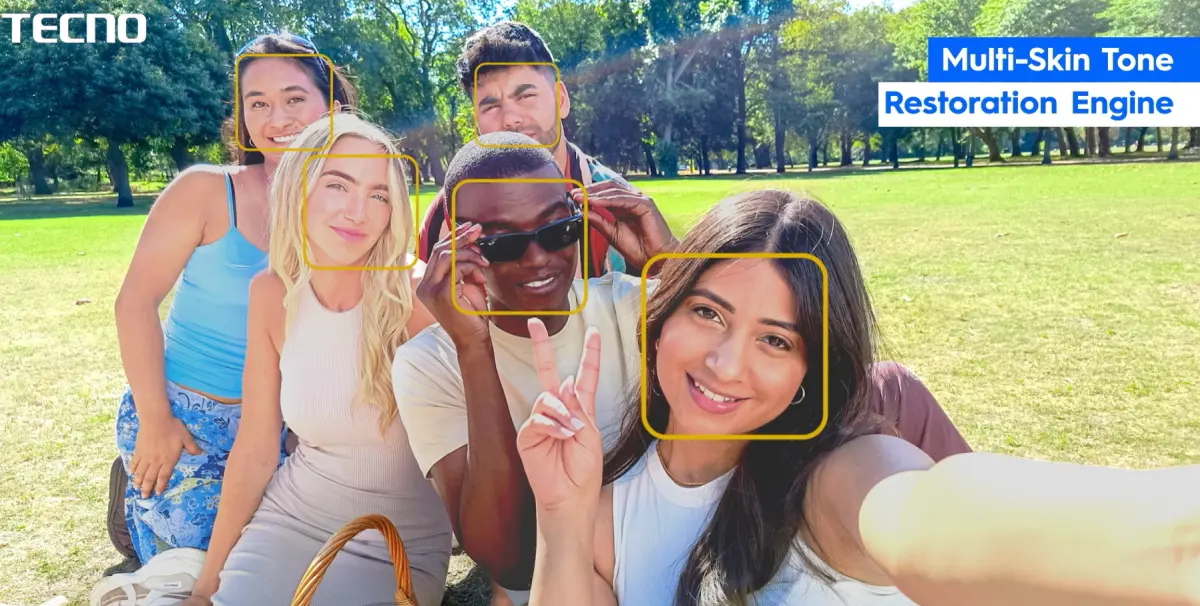

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Doubleheader Game 1 Alex Coras Red Sox Lineup Strategy

Apr 28, 2025

Doubleheader Game 1 Alex Coras Red Sox Lineup Strategy

Apr 28, 2025 -

Boston Red Sox Cora Alters Lineup Slightly For Doubleheader

Apr 28, 2025

Boston Red Sox Cora Alters Lineup Slightly For Doubleheader

Apr 28, 2025