Net Asset Value (NAV) Analysis: Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

Factors Influencing the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Net Asset Value of the Amundi MSCI World Catholic Principles UCITS ETF Acc, like any ETF, is dynamic and influenced by several key factors. Understanding these factors is crucial for interpreting NAV changes and making informed investment decisions.

Market Performance of Underlying Assets

The primary driver of the ETF's NAV is the performance of the underlying stocks it holds. These stocks are selected based on the MSCI World index but screened according to Catholic principles, resulting in a portfolio that aligns with specific ethical and social guidelines. This unique investment strategy, while potentially mitigating certain risks, also subjects the NAV to fluctuations stemming from various market forces.

- Global Economic Conditions: A global recession, for example, can negatively impact the performance of many underlying companies, leading to a decrease in the ETF's NAV.

- Sector-Specific Trends: Strong performance in certain sectors (e.g., technology) and underperformance in others (e.g., energy) directly influence the overall NAV.

- Individual Company Performance: The financial health and market success of individual companies within the ETF significantly contribute to NAV fluctuations. Positive earnings reports typically lead to NAV increases, while negative news can result in decreases.

The relationship between market fluctuations and NAV changes is direct. Positive market movements generally lead to NAV increases, while negative movements often lead to decreases. However, the specific impact depends on the weighting of each underlying asset within the ETF portfolio.

Currency Fluctuations

Given the ETF's global holdings, currency exchange rates play a significant role in influencing its NAV. The ETF likely holds assets denominated in various currencies (USD, EUR, GBP, etc.), and changes in these exchange rates relative to the ETF's base currency (likely EUR) directly impact the calculated NAV.

- Appreciation of the Euro: If the Euro strengthens against other major currencies, the NAV (calculated in EUR) will increase, even if the underlying assets haven't changed in value.

- Depreciation of the Euro: Conversely, a weakening Euro can lead to a decrease in the NAV, irrespective of the underlying asset performance.

Understanding and accounting for currency effects is essential when interpreting NAV changes. Investors should consider the overall currency environment when analyzing NAV trends and avoid drawing conclusions solely based on NAV movements without considering currency fluctuations.

ETF Expenses and Fees

Management fees, administrative expenses, and other charges associated with the ETF directly affect the NAV. These expenses are deducted from the fund's assets, resulting in a slightly lower NAV than it would otherwise be.

- Management Fees: These are the fees paid to the fund managers for managing the portfolio.

- Administrative Expenses: These cover costs associated with running the fund, such as record-keeping and compliance.

- Other Expenses: This category may include trading costs and other operational expenses.

It's important to consider these expenses when assessing the overall return on investment. While the NAV reflects the net asset value after deducting these fees, it's vital to factor them into your calculation of overall return to obtain a clearer picture of your investment's performance.

Analyzing Historical NAV Data for the Amundi MSCI World Catholic Principles UCITS ETF Acc

Analyzing historical NAV data is critical for understanding the ETF's performance and identifying potential trends. This section provides guidance on accessing and interpreting this crucial data.

Accessing NAV Information

Historical NAV data for the Amundi MSCI World Catholic Principles UCITS ETF Acc is readily available from several sources:

- Amundi's Website: The official website of Amundi, the ETF provider, is the primary source of information, often providing downloadable data.

- Financial News Websites: Major financial news websites (e.g., Bloomberg, Yahoo Finance) usually list ETF NAV data.

- Brokerage Platforms: If you hold the ETF through a brokerage account, your platform will typically display its historical NAV.

Finding and interpreting this data is straightforward. Most sources present NAV data in a tabular or graphical format, easily showing the NAV for each trading day.

Interpreting NAV Trends

Analyzing historical NAV data allows you to identify trends and patterns in the ETF's performance.

- Upward Trends: A consistent upward trend suggests strong underlying asset performance and positive investment returns.

- Downward Trends: A consistent downward trend signifies poor performance, potentially indicating underlying issues within the ETF's holdings or the broader market.

- High Volatility: Periods of significant NAV fluctuations indicate higher risk associated with the investment.

Using charts and graphs is highly recommended for a visual representation of NAV data. These visualizations make it easier to spot trends and understand volatility patterns.

Comparing NAV to Other Similar ETFs

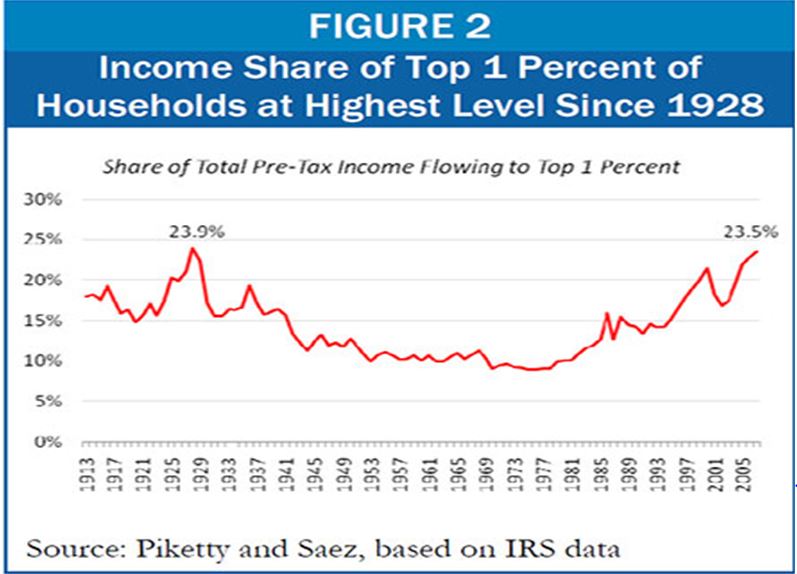

Comparing the NAV performance of the Amundi MSCI World Catholic Principles UCITS ETF Acc to similar ETFs within the same sector (ESG, Socially Responsible Investing) provides valuable context.

- Comparable ETFs: Consider comparing it to other MSCI World ETFs with similar investment strategies but without the Catholic principles filter, or to ETFs focusing on similar ethical considerations but with different underlying indices.

This comparison helps investors evaluate the effectiveness of the Catholic principles filter on investment performance. Are the ethical screens resulting in better or worse returns compared to comparable ETFs? This comparison provides valuable insights into the risk-return profile of the Amundi ETF.

Using NAV for Investment Decision-Making with the Amundi MSCI World Catholic Principles UCITS ETF Acc

Understanding the NAV is crucial for making informed investment decisions.

NAV as an Indicator of Value

NAV can help determine whether the ETF is currently undervalued or overvalued.

- NAV vs. Market Price: The market price of an ETF can deviate from its NAV, particularly in times of high volatility. If the market price is significantly below the NAV, it might indicate an undervaluation.

Investors can potentially utilize this information to time their purchases (buying when undervalued) or sales (selling when overvalued). However, this strategy requires careful analysis and an understanding of market dynamics.

NAV and Risk Assessment

Understanding NAV fluctuations is essential for risk assessment.

- NAV Volatility and Risk: High NAV volatility suggests higher risk. The more the NAV fluctuates, the greater the potential for both gains and losses.

Investors can manage risk by understanding the historical volatility of the ETF's NAV and making investment decisions that align with their risk tolerance. Diversification across various asset classes is also a key risk management strategy.

Conclusion: The Importance of NAV Analysis for the Amundi MSCI World Catholic Principles UCITS ETF Acc

Understanding the Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF Acc is crucial for making informed investment decisions. This article explored the key factors influencing its NAV, techniques for analyzing historical data, and how NAV can inform both valuation and risk assessment. Remember that NAV is just one piece of the puzzle; thorough due diligence, including considering the ETF's investment strategy and alignment with your personal financial goals, is always recommended before investing. By understanding the Net Asset Value and its fluctuations, you can make more informed decisions regarding the Amundi MSCI World Catholic Principles UCITS ETF Acc. Start your own NAV analysis today!

Featured Posts

-

Mwshr Daks Alalmany Ytjawz Aela Mstwa Lh Fy Mars

May 25, 2025

Mwshr Daks Alalmany Ytjawz Aela Mstwa Lh Fy Mars

May 25, 2025 -

Artfae Qyasy Daks Alalmany Ytsdr Almwshrat Alawrwbyt

May 25, 2025

Artfae Qyasy Daks Alalmany Ytsdr Almwshrat Alawrwbyt

May 25, 2025 -

Will The Wall Street Recovery Undermine The Daxs Recent Gains

May 25, 2025

Will The Wall Street Recovery Undermine The Daxs Recent Gains

May 25, 2025 -

Avrupa Borsalari Karisik Seyir Ve Guenuen Sonuclari

May 25, 2025

Avrupa Borsalari Karisik Seyir Ve Guenuen Sonuclari

May 25, 2025 -

Aktienmarkt Frankfurt Dax Faellt Analyse Zum 21 Maerz 2025

May 25, 2025

Aktienmarkt Frankfurt Dax Faellt Analyse Zum 21 Maerz 2025

May 25, 2025

Latest Posts

-

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 25, 2025

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 25, 2025 -

Voorspelling Vervolg Snelle Markt Draai Europese Aandelen

May 25, 2025

Voorspelling Vervolg Snelle Markt Draai Europese Aandelen

May 25, 2025 -

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025 -

Brest Urban Trail Un Evenement Reuni Grace Aux Benevoles Artistes Et Partenaires

May 25, 2025

Brest Urban Trail Un Evenement Reuni Grace Aux Benevoles Artistes Et Partenaires

May 25, 2025 -

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025