Will The Wall Street Recovery Undermine The DAX's Recent Gains?

Table of Contents

The DAX's Recent Performance and Contributing Factors

The DAX, Germany's leading stock market index, has seen significant gains recently. This positive trend can be attributed to several key factors. Strong corporate earnings, particularly from export-oriented sectors, have boosted investor confidence. Easing inflation concerns in Europe, coupled with government stimulus measures aimed at supporting economic growth, have further contributed to the DAX's rise.

- Strong-performing DAX companies: Companies like Siemens, BASF, and Allianz have reported robust financial results, driving up the overall index.

- Quantitative data: The DAX has shown X% growth in the past Y months, exceeding initial market expectations.

- Relevant economic indicators: Improved German manufacturing PMI and a decrease in unemployment figures point towards a strengthening German economy, supporting the DAX's upward trend.

Wall Street's Recovery and its Underlying Drivers

The recovery on Wall Street is equally noteworthy. Positive economic data, such as improved employment figures and a cooling inflation rate, has fueled investor optimism. The Federal Reserve's monetary policy, while still focused on managing inflation, has also played a role in bolstering investor confidence.

- Key economic indicators: Stronger-than-expected GDP growth, declining unemployment rates, and moderating inflation in the US have all contributed to the Wall Street recovery.

- Significant US corporate performances: Tech giants and other large US corporations have reported positive earnings, further driving up the stock market.

- Federal Reserve's impact: While interest rate hikes aim to curb inflation, the perceived stabilization of monetary policy has provided a sense of predictability, encouraging investment.

Potential Interdependence and Spillover Effects

The US and German economies are deeply intertwined. A strong US economy can positively impact Germany through increased demand for German exports and higher foreign investment. Conversely, a weakening US economy can negatively affect German businesses reliant on the US market.

- German companies reliant on US markets: Many German automotive and manufacturing companies have significant operations and sales in the US, making them vulnerable to shifts in the US economy.

- Impact of US interest rate hikes: Higher US interest rates can lead to increased borrowing costs for German companies, potentially hindering investment and economic growth.

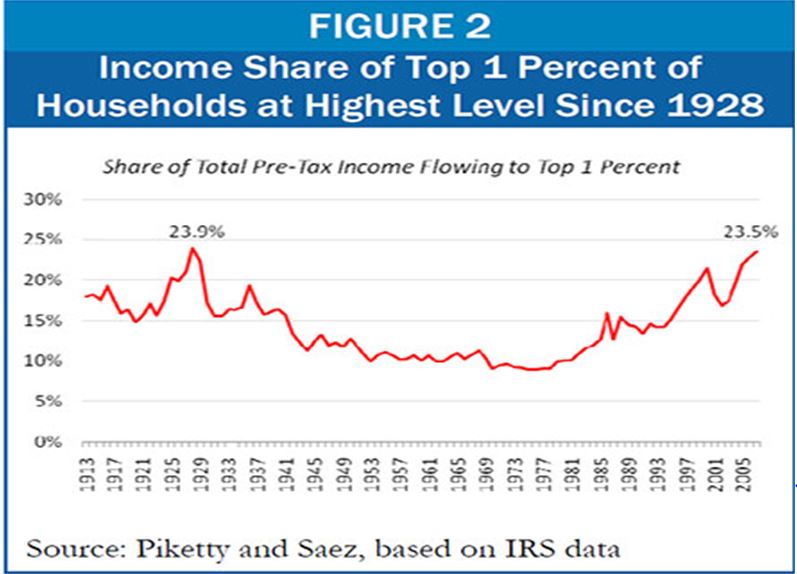

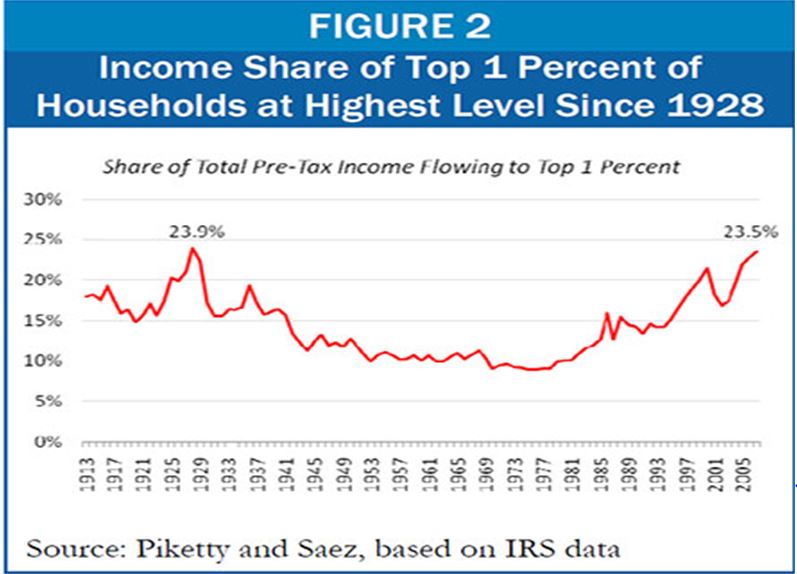

- Correlation between DAX and Dow Jones performance: Historically, there has been a degree of correlation between the DAX and the Dow Jones Industrial Average, suggesting a degree of interdependence between the two markets. However, this correlation isn't always perfect.

Assessing the Risks: Could Wall Street's Gains Undermine the DAX?

While a strong US economy generally benefits Germany, a rapid Wall Street recovery could potentially lead to a shift in investor sentiment, potentially drawing capital away from Europe.

- Potential for capital flight: Investors might reallocate funds from European markets, including the DAX, towards the seemingly more lucrative opportunities in the recovering US market.

- Impact of a stronger US dollar: A strengthening US dollar could negatively impact German exports, making German goods more expensive for international buyers and potentially slowing economic growth.

- Shifts in investor preferences: Investors might favor US stocks due to perceived higher growth potential, leading to decreased investment in the DAX.

Will the Wall Street Recovery Undermine the DAX's Recent Gains? – A Summary and Call to Action

This analysis highlights the complex relationship between the Wall Street recovery and the DAX's performance. While a strong US economy can positively influence Germany, the rapid recovery on Wall Street presents potential risks for the DAX, including capital flight and a stronger US dollar. The extent to which Wall Street's gains undermine the DAX's recent performance will depend on several factors, including the pace of the US recovery, the strength of the US dollar, and evolving investor sentiment. The interconnectedness of these markets underscores the need for ongoing monitoring.

To stay informed about the evolving relationship between Wall Street and the DAX, and to stay abreast of the impact of Wall Street Recovery on DAX Gains, subscribe to our newsletter, follow us on social media, or regularly check our website for updates. The future outlook for both markets remains dynamic and requires careful observation.

Featured Posts

-

Konchita Vurst Dnes Neynata Evolyutsiya Sled Spechelvaneto Na Evroviziya

May 25, 2025

Konchita Vurst Dnes Neynata Evolyutsiya Sled Spechelvaneto Na Evroviziya

May 25, 2025 -

Proposed Changes To Sentencing For Minors In France

May 25, 2025

Proposed Changes To Sentencing For Minors In France

May 25, 2025 -

Your Escape To The Country Financial Considerations And Planning

May 25, 2025

Your Escape To The Country Financial Considerations And Planning

May 25, 2025 -

Artfae Daks Alalmany Ila 24 Alf Nqtt Bfdl Atfaq Aljmark Byn Washntn Wbkyn

May 25, 2025

Artfae Daks Alalmany Ila 24 Alf Nqtt Bfdl Atfaq Aljmark Byn Washntn Wbkyn

May 25, 2025 -

Netherlands Hosts Major Bangladesh Investment Event 1 500 Attendees

May 25, 2025

Netherlands Hosts Major Bangladesh Investment Event 1 500 Attendees

May 25, 2025

Latest Posts

-

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025