Net Asset Value (NAV) Explained: Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. It's essentially the market value of all the assets the ETF owns, minus its liabilities. This calculation provides a snapshot of the ETF's intrinsic worth. For the Amundi MSCI World Catholic Principles UCITS ETF Acc, the NAV is calculated daily.

The fundamental formula is simple:

Assets - Liabilities = Net Asset Value (NAV)

Let's break down the components:

Assets: These include:

- Holdings: The market value of all the stocks, bonds, or other securities held within the ETF. This is the largest component of the ETF's assets and is directly affected by market fluctuations. For the Amundi MSCI World Catholic Principles UCITS ETF Acc, these holdings are chosen based on the MSCI World Index but screened according to Catholic principles.

- Cash: Any cash or cash equivalents held by the ETF.

- Receivables: Amounts owed to the ETF.

Liabilities: These include:

- Expenses Payable: Outstanding fees and expenses incurred by the ETF.

- Accrued Interest: Interest earned but not yet received.

- Other outstanding obligations.

The daily calculation process for the Amundi MSCI World Catholic Principles UCITS ETF Acc involves valuing all assets at their closing market prices, summing these values, deducting liabilities, and then dividing by the number of outstanding shares. This provides the NAV per share. Market fluctuations throughout the day directly impact the daily NAV calculation, leading to variations in the NAV figure.

NAV vs. Market Price of Amundi MSCI World Catholic Principles UCITS ETF Acc

While the Net Asset Value (NAV) represents the intrinsic value of the ETF, the market price is the price at which the ETF is actually trading on the exchange. These two figures aren't always identical. Several factors contribute to the difference:

- Supply and Demand: If there's high demand for the ETF, the market price might temporarily exceed the NAV (a premium). Conversely, low demand might lead to a market price below the NAV (a discount).

- Trading Volume: High trading volume generally results in a market price closer to the NAV, while low volume can cause larger discrepancies.

Example:

Let's say the calculated NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is €10.00 per share. However, due to high demand, the market price might be €10.10 (a premium of €0.10), or due to low trading volume and selling pressure, it could be €9.90 (a discount of €0.10). Understanding these differences is crucial for making informed decisions.

Importance of NAV for Amundi MSCI World Catholic Principles UCITS ETF Acc Investors

Understanding the Net Asset Value (NAV) is paramount for several reasons:

- Performance Assessment: Tracking the NAV over time allows investors to gauge the ETF's performance, independent of short-term market price fluctuations. A consistent increase in NAV suggests positive performance.

- Benchmarking: Comparing the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc to the NAVs of similar ethically-screened ETFs allows for a more objective comparison of fund performance.

- Investment Decisions: Investors often use NAV as a key factor when deciding whether to buy or sell. A significant discount to NAV might present a buying opportunity, while a significant premium might suggest considering selling.

- Return Calculation: NAV is essential for calculating your overall return on investment, providing a clear picture of your gains or losses.

Where to Find the NAV of Amundi MSCI World Catholic Principles UCITS ETF Acc

Reliable NAV information is readily available from several sources:

- Amundi Website: The official website of Amundi, the ETF provider, is the most accurate source for the daily NAV.

- Financial News Websites: Reputable financial news sources often publish ETF NAV data, though always verify the source's reliability.

- Brokerage Platforms: Your brokerage account will display the NAV of your holdings.

Remember to pay attention to the currency and the date and time the NAV was calculated. Be aware that there might be slight delays in NAV updates, typically a few hours after market close. Always prioritize using reliable sources to ensure the accuracy of your NAV information.

Conclusion: Mastering Net Asset Value (NAV) for Informed ETF Investing

Understanding Net Asset Value (NAV) is vital for anyone investing in ETFs, particularly the Amundi MSCI World Catholic Principles UCITS ETF Acc. We've explored how NAV is calculated, its relationship to the market price, and its importance in assessing performance, comparing ETFs, and making informed investment decisions. Remember to monitor your Net Asset Value regularly. Understanding your ETF's NAV empowers you to make informed decisions based on your ETF's NAV, maximizing your investment potential. Start tracking your Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV today!

Featured Posts

-

M6 Traffic Chaos Van Overturn Causes Major Delays

May 24, 2025

M6 Traffic Chaos Van Overturn Causes Major Delays

May 24, 2025 -

Konchita Vurst Yiyi Prognoz Peremozhtsiv Yevrobachennya 2025

May 24, 2025

Konchita Vurst Yiyi Prognoz Peremozhtsiv Yevrobachennya 2025

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

M56 Motorway Incident Overturned Car Paramedic Treatment Of Casualty

May 24, 2025

M56 Motorway Incident Overturned Car Paramedic Treatment Of Casualty

May 24, 2025 -

Escape To The Country Building A Community In Your New Rural Home

May 24, 2025

Escape To The Country Building A Community In Your New Rural Home

May 24, 2025

Latest Posts

-

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025 -

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025 -

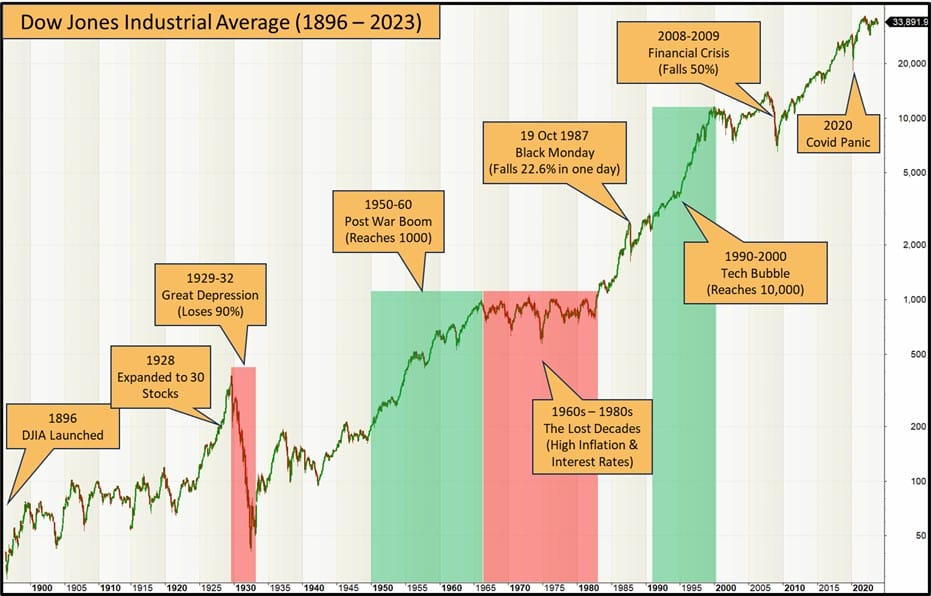

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Net Asset Value

May 24, 2025 -

Dreyfus Affair French Parliament Considers Posthumous Honor

May 24, 2025

Dreyfus Affair French Parliament Considers Posthumous Honor

May 24, 2025