Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Analysis And Insights

Table of Contents

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several key factors influence the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these factors is critical for interpreting NAV movements and making informed investment decisions.

Currency Fluctuations

The "USD Hedged" aspect of this ETF is significant. This means the fund employs strategies to mitigate the impact of currency fluctuations between the US dollar (USD) and other currencies represented in the underlying MSCI World Index. This hedging typically involves using currency forwards or other derivative instruments to offset potential losses from exchange rate movements. While this reduces risk associated with currency volatility, it doesn't eliminate it completely. Significant shifts in exchange rates can still subtly affect the NAV.

- Impact: A strengthening US dollar generally leads to a slightly lower NAV (for USD-based investors), as the value of non-USD assets in the portfolio decreases when converted to USD. Conversely, a weakening US dollar can result in a slightly higher NAV.

- Hedging Mechanics: The effectiveness of the hedging strategy depends on various factors, including the complexity of the hedging instruments employed and the accuracy of the exchange rate forecasts. This complexity means that a perfect hedge is unlikely.

Market Performance of the MSCI World Index

The primary driver of the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV is the performance of the MSCI World Index, its underlying benchmark. This index tracks the performance of large and mid-cap equities across developed markets globally.

- Index Correlation: The ETF's NAV closely tracks the MSCI World Index's performance. Positive returns in the index translate to a higher NAV, and vice versa.

- Sectoral Influence: Performance variations within specific sectors (e.g., technology, energy, financials) significantly influence the overall index and therefore the ETF's NAV. Strong performance in one sector can offset weakness in another.

- Geographic Impact: Regional economic developments also play a crucial role. Strong growth in certain regions represented in the MSCI World Index positively impacts the NAV, while economic downturns in others can negatively affect it.

Dividend Distributions

The "Dist" in the ETF name signifies that it distributes dividends to its shareholders. These dividend payouts, derived from the underlying companies' dividend distributions, impact the NAV.

- Impact on NAV: On the ex-dividend date, the NAV usually decreases by the amount of the dividend paid per share. This is because the fund's assets have been reduced by the dividend distribution.

- Distribution Frequency: The frequency of dividend distributions varies but is usually announced by the fund manager. Investors should consult the ETF's fact sheet for the most up-to-date information.

Expense Ratio

The expense ratio represents the annual cost of managing the ETF. This fee is deducted from the fund's assets and, therefore, indirectly influences the NAV.

- Impact: A higher expense ratio means a slightly lower NAV growth over time compared to an ETF with a lower expense ratio, all else being equal.

Trading Volume and Liquidity

While the NAV reflects the intrinsic value of the ETF's holdings, the market price at which the ETF trades can sometimes deviate slightly. This deviation is often influenced by trading volume and liquidity.

- Impact: High trading volume generally ensures the market price closely tracks the NAV. Low trading volume, however, can lead to temporary discrepancies between market price and NAV.

Analyzing Historical NAV Data of Amundi MSCI World II UCITS ETF USD Hedged Dist

Analyzing historical NAV data is crucial for understanding the ETF's performance and risk profile. Reliable NAV data can be found on the Amundi website and through various financial data providers such as Bloomberg or Refinitiv.

Data Source

Access reliable NAV data from official sources to ensure accuracy. Comparing data from multiple sources can help identify potential discrepancies and increase confidence in the analysis.

Trend Analysis

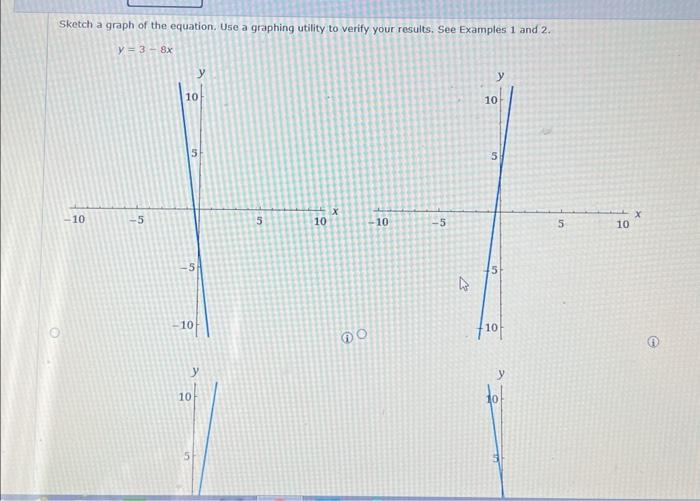

Examine long-term NAV trends to identify periods of growth and decline. This long-term perspective helps assess the ETF's overall performance over time.

Volatility Analysis

Analyze the volatility of NAV fluctuations using statistical measures like standard deviation. This helps understand the risk associated with investing in this ETF. Charts and graphs visually represent this volatility.

Comparison with Benchmark

Compare the ETF's NAV performance against the MSCI World Index to assess the ETF's tracking effectiveness. A close correlation indicates efficient tracking.

Key Dates & Events

Identify specific dates with significant NAV changes and correlate them with relevant market events (e.g., economic announcements, geopolitical events).

Interpreting NAV for Investment Decisions

Understanding NAV is crucial for making informed investment decisions.

NAV as an Indicator of Value

The NAV provides a snapshot of the underlying asset value of the ETF. It's a crucial indicator of the fund's worth.

NAV vs. Market Price

The market price of an ETF might temporarily deviate from its NAV due to supply and demand. However, over the long term, the market price tends to converge with the NAV.

Risk Assessment

Analyzing NAV fluctuations helps assess the investment's risk. Higher volatility indicates higher risk.

Investment Strategies

NAV data aids in strategic decision-making, informing strategies like dollar-cost averaging or rebalancing your portfolio.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Data

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is influenced by various factors, including currency fluctuations, the performance of the MSCI World Index, dividend distributions, expense ratios, and trading volume. Analyzing historical NAV data provides crucial insights into the ETF's performance and risk profile, allowing for informed investment decisions. Remember to consider your own investment objectives and risk tolerance before investing. Regularly monitoring the Net Asset Value (NAV) is essential for effective portfolio management. For deeper dives into Amundi MSCI World II UCITS ETF performance and NAV trends, further research into financial news sources and market analysis tools is recommended. Start making informed decisions about your investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist today!

Featured Posts

-

Avrupa Borsalari Ecb Faiz Kararinin Ardindan Piyasalardaki Dalgalanma

May 25, 2025

Avrupa Borsalari Ecb Faiz Kararinin Ardindan Piyasalardaki Dalgalanma

May 25, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 25, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 25, 2025 -

F1 Technologia A Koezuton Egyedi Porsche Modell Bemutatasa

May 25, 2025

F1 Technologia A Koezuton Egyedi Porsche Modell Bemutatasa

May 25, 2025 -

Long Delays On M6 Following Van Crash And Road Closure

May 25, 2025

Long Delays On M6 Following Van Crash And Road Closure

May 25, 2025 -

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025

Latest Posts

-

France To Honor Dreyfus Parliament Debates Posthumous Promotion

May 25, 2025

France To Honor Dreyfus Parliament Debates Posthumous Promotion

May 25, 2025 -

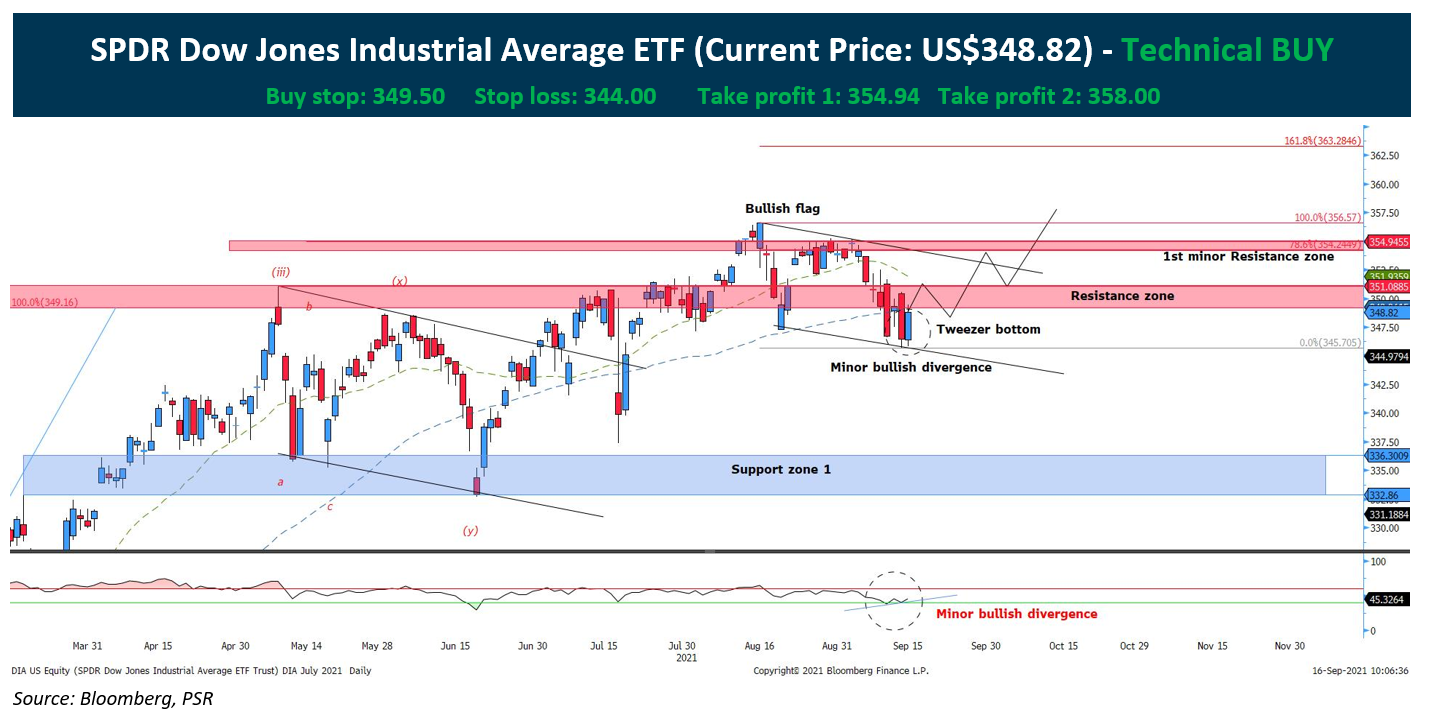

Investment In Amundi Dow Jones Industrial Average Ucits Etf Focus On Net Asset Value Nav

May 25, 2025

Investment In Amundi Dow Jones Industrial Average Ucits Etf Focus On Net Asset Value Nav

May 25, 2025 -

Understanding And Interpreting The Nav Of Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding And Interpreting The Nav Of Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Amundi Djia Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025

Amundi Djia Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025 -

French Lawmakers Push For Dreyfus Posthumous Promotion A Symbolic Gesture Of Justice

May 25, 2025

French Lawmakers Push For Dreyfus Posthumous Promotion A Symbolic Gesture Of Justice

May 25, 2025