New ECB Initiative Aims To Simplify Complex Banking Regulations

Table of Contents

Key Features of the New ECB Initiative

The ECB's initiative to simplify banking regulations is multifaceted, focusing on several key areas to create a more efficient and transparent regulatory environment. The core components are designed to reduce the administrative burden on banks while maintaining the integrity and stability of the financial system.

- Streamlined Reporting Requirements: The initiative aims to significantly reduce the amount of data banks are required to submit, focusing on the most critical information for supervisory purposes. This involves consolidating various reporting templates and utilizing more efficient data submission methods.

- Clarified Definitions and Interpretations of Existing Rules: Ambiguity in existing regulations often leads to confusion and inconsistent application. This initiative tackles this by providing clearer definitions and interpretations, reducing the risk of misinterpretations and legal disputes.

- Improved Digital Tools and Platforms for Compliance: The ECB is investing in the development of advanced digital tools and platforms to facilitate compliance. These tools will automate many reporting processes, making them faster, more efficient, and less prone to errors.

- Increased Transparency and Communication from the ECB: Improved communication and transparency from the ECB will help banks better understand the regulatory landscape and proactively address potential compliance issues. This includes enhanced guidance, more frequent consultations, and easily accessible information.

- Focus on Proportionality – Tailoring Regulations to Bank Size and Complexity: Recognizing that a "one-size-fits-all" approach is inefficient, the initiative emphasizes proportionality. Smaller banks will face less stringent requirements compared to larger, more complex institutions, ensuring a more balanced and fair regulatory environment.

Benefits for Banks of Simplified Regulations

The simplification of ECB banking regulations offers numerous advantages for banks of all sizes, ultimately contributing to a healthier and more competitive financial landscape.

- Reduced Administrative Burden: Streamlined reporting requirements and improved digital tools free up valuable time and resources for staff, allowing them to focus on core business activities rather than compliance tasks.

- Improved Operational Efficiency: Reduced complexity and ambiguity in regulations translates to improved operational efficiency, optimizing processes and reducing delays.

- Lower Legal and Consulting Fees: Clearer rules and simplified processes reduce the need for expensive legal and consulting services to ensure compliance.

- Freed-up Resources for Core Business Activities: By reducing the administrative burden, banks can redirect resources towards innovation, customer service, and strategic initiatives, ultimately boosting profitability and competitiveness.

- Enhanced Competitiveness: Reduced compliance costs and increased efficiency allow banks to compete more effectively in the market, offering better services and products to customers.

Impact on Financial Stability and Economic Growth

The positive effects of this ECB initiative extend beyond individual banks, impacting the wider financial system and contributing to overall economic growth.

- Increased Lending to Businesses and Consumers: Reduced regulatory burdens and improved efficiency allow banks to lend more readily to businesses and consumers, fueling investment and stimulating economic activity.

- Stimulated Economic Activity: Increased lending translates to increased investment, job creation, and overall economic growth, benefiting the Eurozone as a whole.

- Enhanced Financial Stability: Clearer and more consistently applied regulations contribute to a more stable and resilient financial system, reducing the risk of systemic crises.

- Improved Investor Confidence: A simplified regulatory environment fosters investor confidence, encouraging investment in the Eurozone financial market.

- Strengthened EU Financial Market Competitiveness: By improving efficiency and reducing compliance costs, the initiative enhances the competitiveness of the EU financial market on a global scale.

Challenges and Potential Drawbacks of the Initiative

While the ECB's initiative holds immense promise, it's essential to acknowledge potential challenges and drawbacks.

- Implementation Complexities: Implementing significant regulatory changes is a complex undertaking, requiring careful planning and coordination across multiple stakeholders.

- Potential Unintended Consequences: Any significant regulatory change carries the risk of unintended consequences, which require careful monitoring and adjustment.

- Resistance from Certain Stakeholders: Some stakeholders may resist changes to the existing regulatory framework, requiring effective communication and engagement to address concerns.

- Need for Ongoing Monitoring and Evaluation: The effectiveness of the initiative needs to be continuously monitored and evaluated to ensure it achieves its intended goals and adapt to changing circumstances.

- Ensuring Consistent Application Across the EU: Maintaining consistent application of simplified regulations across all EU member states is crucial for avoiding regulatory arbitrage and maintaining a level playing field.

Future Outlook and Next Steps for ECB Banking Regulation Simplification

The implementation of this initiative is an ongoing process, with several key steps planned for the future.

- Ongoing Consultation with Stakeholders: The ECB will continue consulting with various stakeholders, including banks, supervisors, and other relevant parties, to ensure the initiative remains effective and addresses their concerns.

- Phased Implementation of New Rules: The new regulations will be implemented in phases to allow banks sufficient time to adapt and minimize disruption.

- Regular Reviews and Adjustments: The ECB will conduct regular reviews of the initiative's effectiveness and make adjustments as needed to ensure it remains fit for purpose.

- Development of Additional Support Tools and Resources: The ECB will continue to develop and provide additional tools and resources to support banks in complying with the simplified regulations.

- International Collaboration to Harmonize Regulations: The ECB will work with international organizations and other jurisdictions to harmonize banking regulations and reduce unnecessary complexities.

Conclusion:

The ECB's initiative to simplify banking regulations represents a significant step towards creating a more efficient, competitive, and resilient financial system within the Eurozone. By reducing compliance costs, improving operational efficiency, and promoting transparency, this initiative promises to unlock significant economic benefits, boosting lending, investment, and overall growth. The potential positive impacts on financial stability and the EU's global competitiveness are considerable. Stay informed about the latest developments in ECB banking regulation simplification by visiting the ECB website and engaging with our future updates.

Featured Posts

-

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025 -

Forgotten Star Patrick Schwarzenegger In Ariana Grandes White Lotus Music Video

Apr 27, 2025

Forgotten Star Patrick Schwarzenegger In Ariana Grandes White Lotus Music Video

Apr 27, 2025 -

Con Alberto Ardila Olivares La Garantia De Un Gol Seguro

Apr 27, 2025

Con Alberto Ardila Olivares La Garantia De Un Gol Seguro

Apr 27, 2025 -

Getting My Nintendo Switch 2 The Game Stop Experience

Apr 27, 2025

Getting My Nintendo Switch 2 The Game Stop Experience

Apr 27, 2025 -

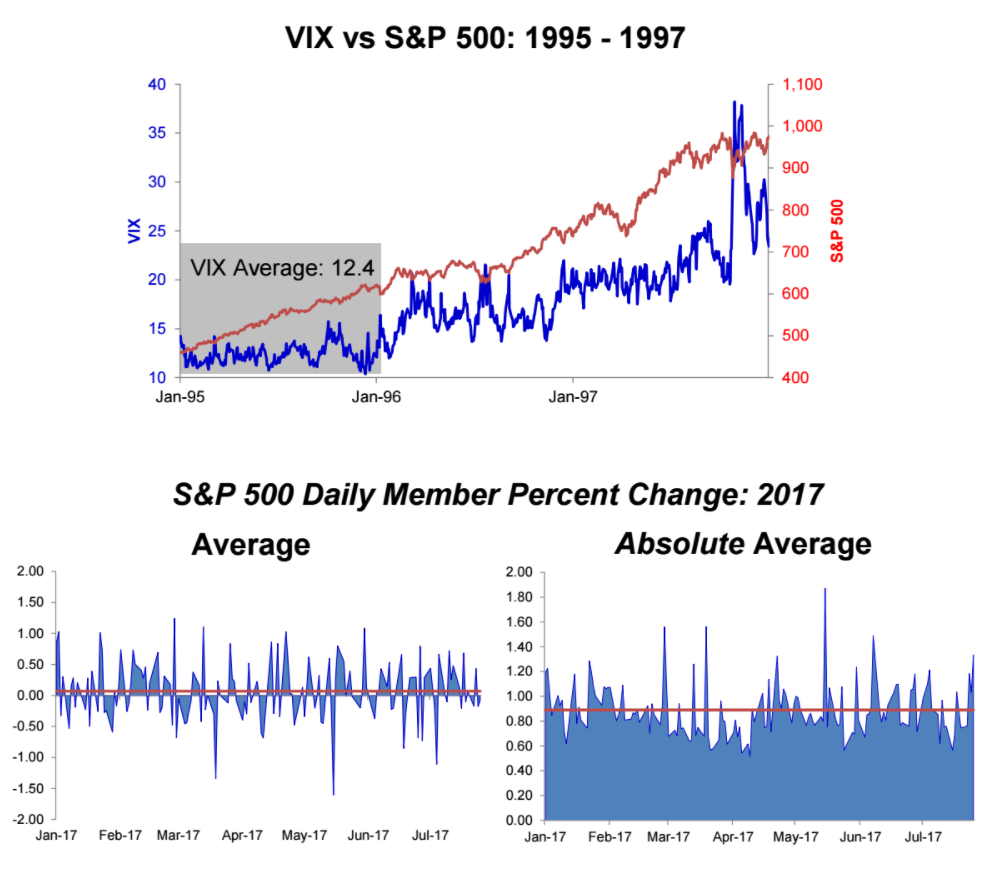

The Fragile State Of Private Credit A Weekly Review Of Market Cracks

Apr 27, 2025

The Fragile State Of Private Credit A Weekly Review Of Market Cracks

Apr 27, 2025

Latest Posts

-

Lingering Effects Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 28, 2025

Lingering Effects Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 28, 2025 -

Ohio Train Derailment Prolonged Exposure To Toxic Chemicals In Buildings

Apr 28, 2025

Ohio Train Derailment Prolonged Exposure To Toxic Chemicals In Buildings

Apr 28, 2025 -

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 28, 2025

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 28, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 28, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 28, 2025 -

Understanding The Volatility Of Gpu Prices

Apr 28, 2025

Understanding The Volatility Of Gpu Prices

Apr 28, 2025