New Survey Data: Parents' Perspectives On College Expenses And Student Loans

Table of Contents

The Crushing Weight of College Tuition: Parents' Financial Burdens

The survey data paints a clear picture of the immense financial strain college tuition places on parents. The cost of higher education continues to climb, far outpacing inflation, making college affordability a major challenge. Parents are increasingly feeling the pressure to contribute significantly to their children's education, impacting their own financial security and long-term goals.

- Average parental contribution: The average parent expects to contribute $50,000 towards their child's college education, a figure that has risen by 15% in the last five years.

- Reliance on savings: While 70% of parents are relying on their savings, the impact of inflation on these savings is a significant concern, with many finding their accumulated funds insufficient to cover the rising tuition fees.

- Taking out loans: A concerning 35% of parents are resorting to taking out loans to finance their children's college education, adding to their existing debt burden.

[Insert chart/graph here visually representing the data points above]

Strategies Parents Employ to Finance College

Parents employ a variety of strategies to finance their children's college education. These strategies include:

- 529 Plans: While utilizing 529 plans is becoming increasingly common, many parents are finding it challenging to save enough to significantly impact the overall cost.

- College Savings: Traditional savings accounts, while helpful, often fall short of covering the escalating costs of college tuition and fees.

- Scholarships and Grants: Securing scholarships and grants remains a crucial element in reducing the overall financial burden, but the competitive nature of these awards makes securing them challenging.

- Financial Aid Applications: Navigating the complex process of financial aid applications proves daunting for many parents, leading to missed opportunities for crucial support.

Challenges faced by parents include understanding the intricacies of financial aid applications, effectively budgeting for college, and the difficulty in securing sufficient financial aid packages. Many parents also harbor misconceptions about the availability and accessibility of financial aid.

The Student Loan Dilemma: Parents' Concerns and Experiences

The survey also sheds light on the pervasive role of student loans in financing college education and the anxieties they generate for parents. Many parents are acting as co-signers on their children's student loans, taking on a significant financial risk.

- Co-signing loans: A staggering 45% of parents co-signed student loans, exposing themselves to potential financial hardship should their child be unable to repay the debt.

- Average loan amount: The average student loan amount has increased substantially, reaching $30,000, placing an immense strain on both students and their parents.

- Concerns about interest rates and repayment terms: Many parents express concern about the high interest rates and potentially lengthy repayment terms associated with student loans.

- Impact on retirement plans: The added financial burden of student loan debt often negatively impacts parents' ability to adequately save for their retirement.

Navigating the Loan Application Process: Parental Insights

The survey highlights significant challenges parents face while navigating the student loan application process. These include:

- Understanding complex terms: Difficulty understanding the intricacies of loan terms and repayment options.

- Dealing with lenders: Negative experiences with lenders and a lack of transparency in loan agreements.

- Lack of clear guidance: A desire for clearer, more accessible information and guidance throughout the application and repayment processes.

Parents suggested simplifying application forms, providing more transparent information on loan terms and interest rates, and offering more support and guidance throughout the process to reduce confusion and avoid predatory lending practices.

The Impact of College Expenses on Family Wellbeing

The financial burden of college expenses extends beyond mere monetary concerns. The survey reveals a significant negative impact on overall family well-being:

- Financial stress: A substantial majority of parents (75%) reported experiencing significant financial stress related to college expenses.

- Family conflicts: The strain of managing college costs often contributes to increased family conflicts and tensions.

- Impact on retirement savings: Parents frequently sacrifice their own retirement savings and other financial goals to finance their children’s education.

Advice for Future College-Bound Families

Proactive financial planning is crucial for mitigating the financial pressures of college. Key strategies include:

- Start saving early: Begin saving for college as early as possible to maximize the benefits of compound interest.

- Explore all financial aid options: Thoroughly investigate all available financial aid options, including scholarships, grants, and federal student loans.

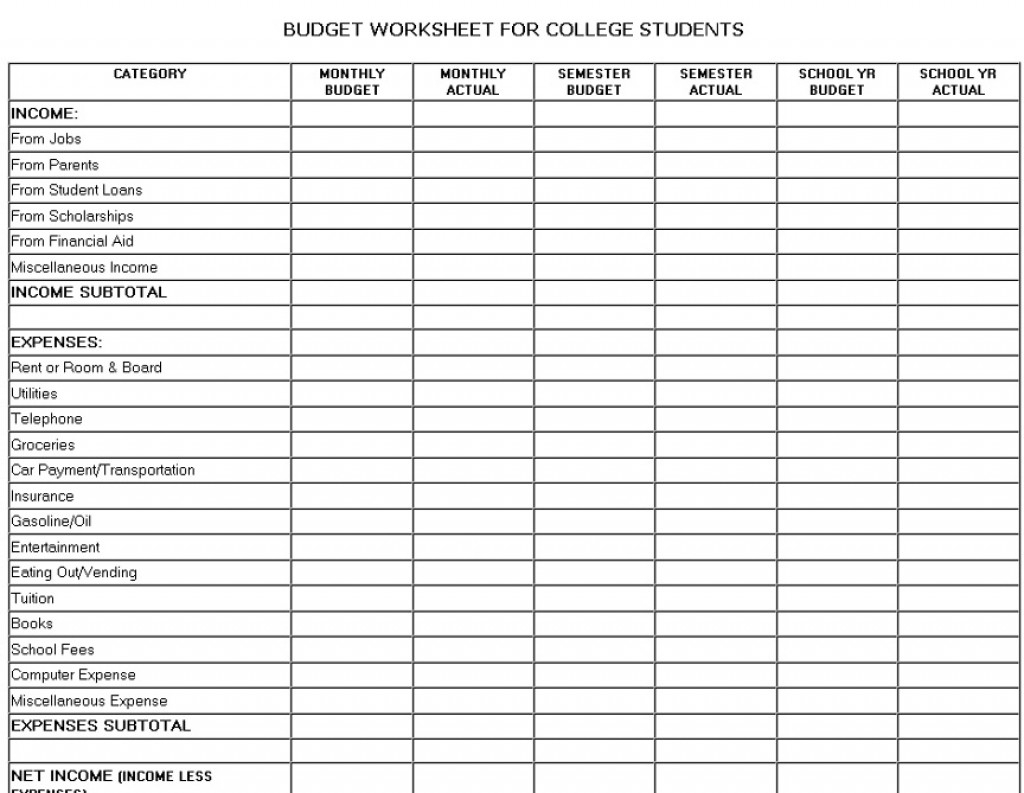

- Create a realistic budget: Develop a comprehensive budget that accounts for all college-related expenses, including tuition, fees, room and board, books, and other costs.

- Prioritize financial literacy: Improve your understanding of financial planning principles and available resources for managing college expenses.

Conclusion

This survey data underscores the significant financial burden college expenses place on parents and the pervasive challenges associated with student loans. The impact extends far beyond finances, affecting family well-being and long-term financial stability. Proactive financial planning, coupled with a thorough understanding of available resources and support, is paramount in navigating this complex landscape. Don't let college expenses overwhelm you – learn more about effective financial strategies for college by visiting [insert link to relevant resources here] and take control of your family's college planning today!

Featured Posts

-

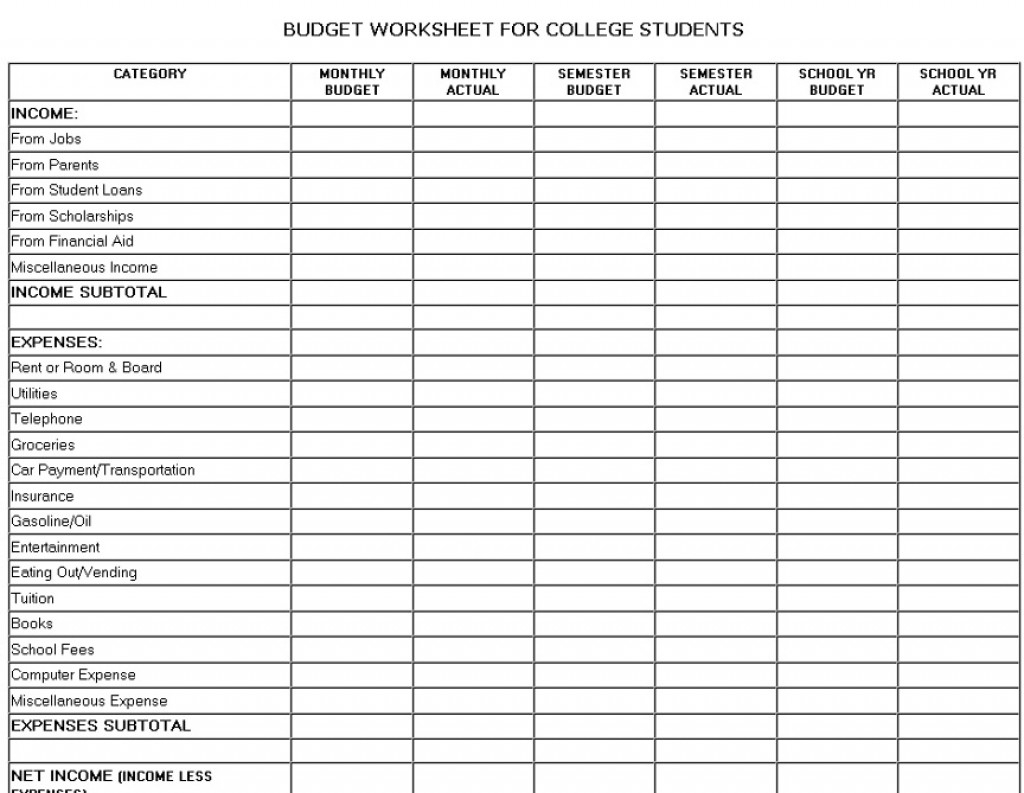

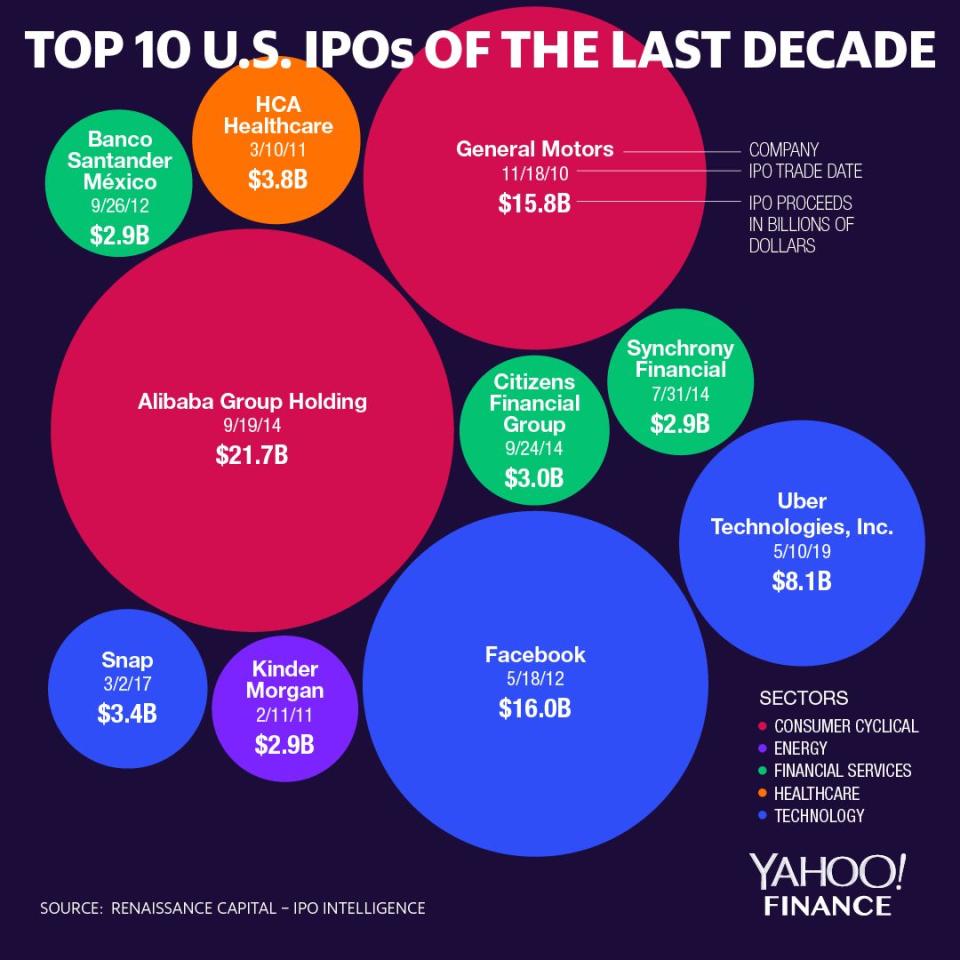

Understanding The Investment Potential Of Uber Uber

May 17, 2025

Understanding The Investment Potential Of Uber Uber

May 17, 2025 -

Industrialnye Parki Analiz Plotnosti I Effektivnosti Razmescheniya

May 17, 2025

Industrialnye Parki Analiz Plotnosti I Effektivnosti Razmescheniya

May 17, 2025 -

Descongelamiento De Cuentas Koriun Informacion Para Inversionistas

May 17, 2025

Descongelamiento De Cuentas Koriun Informacion Para Inversionistas

May 17, 2025 -

Jeffrey Dean Morgan On Negans Fortnite Role An Exclusive Interview

May 17, 2025

Jeffrey Dean Morgan On Negans Fortnite Role An Exclusive Interview

May 17, 2025 -

The Warner Bros Pictures Presentation At Cinema Con 2025 Film Trailers And More

May 17, 2025

The Warner Bros Pictures Presentation At Cinema Con 2025 Film Trailers And More

May 17, 2025