News Corp's Business Units: Undervalued Assets Or Fair Market Price?

Table of Contents

News Corp's Core Business Units: A Deep Dive

News Corp's sprawling portfolio encompasses several distinct yet interconnected business units. Understanding each unit's performance is crucial to assessing the overall valuation of the company.

News & Information Services (e.g., The Wall Street Journal, The Sun)

This segment remains a cornerstone of News Corp, encompassing iconic brands with substantial global reach. Revenue streams are diverse, including print circulation, digital subscriptions, and advertising. The ongoing digital transformation is key, with a focus on attracting and retaining subscribers through high-quality journalism and user-friendly digital platforms.

- Key Performance Indicators (KPIs): Digital subscriber growth is paramount, along with improvements in average revenue per user (ARPU) and engagement metrics.

- Market Share: The Wall Street Journal maintains a strong position in the financial news market, while The Sun holds significant market share in the UK tabloid sector.

- Growth Potential: Continued expansion of digital subscriptions and targeted advertising strategies are key avenues for growth. Exploring new digital formats and international expansion remain potential avenues for the future. The successful transition to a predominantly digital model is key to mitigating the challenges of declining print advertising revenue.

Keywords: news media, digital subscriptions, print circulation, journalism, financial news, tabloid, digital transformation.

Book Publishing (e.g., HarperCollins)

HarperCollins, a major player in the global book publishing industry, contributes significantly to News Corp's revenue and profitability. The company benefits from a strong portfolio of bestselling authors and a diversified range of genres. However, the publishing industry faces ongoing challenges related to changing consumer preferences and digital disruption.

- Profitability: HarperCollins generally maintains healthy profit margins, though these can fluctuate based on the success of specific titles and overall market conditions.

- Market Share: HarperCollins holds a significant share within the global book publishing market, particularly in certain genres.

- Growth Potential: Expansion into new markets, particularly in education and digital publishing, presents significant opportunities. Further penetration of the rapidly growing audiobook market offers compelling avenues for growth.

Keywords: publishing industry, bestsellers, ebook sales, audiobooks, educational publishing, digital publishing.

Digital Real Estate Services (e.g., realtor.com)

News Corp's foray into the proptech sector, with realtor.com, is showing increasing promise. This segment benefits from the large and growing online real estate market. Revenue is generated through subscription models for realtors and targeted advertising.

- Market Share: realtor.com holds a substantial market share within the US online real estate sector.

- User Growth and Engagement: Consistent growth in user numbers and engagement metrics points towards healthy market penetration.

- Future Innovation: The integration of AI-powered search functions and data analytics promises to enhance the user experience and further strengthen realtor.com's competitive position.

Keywords: real estate market, online real estate, digital property listings, proptech, AI-powered property search.

Valuation Analysis: Are News Corp's Business Units Undervalued?

Determining whether News Corp's business units are undervalued requires a robust valuation analysis. Several methodologies can be employed, including discounted cash flow (DCF) analysis and comparable company analysis.

- Discounted Cash Flow (DCF): This method projects future cash flows for each business unit and discounts them back to their present value, providing an estimate of intrinsic value.

- Comparable Company Analysis: This involves comparing News Corp's business units to similar publicly traded companies to derive valuation multiples (e.g., Price-to-Earnings ratio).

By applying these and other methods, and comparing the estimated intrinsic value to the current market capitalization, a more informed judgement regarding the potential undervaluation of News Corp's assets can be made. Specific financial ratios and metrics, such as revenue growth, profit margins, and return on equity, will be crucial in this assessment.

Keywords: market capitalization, intrinsic value, discounted cash flow, valuation multiples, price-to-earnings ratio, financial ratios.

Potential Risks and Opportunities for News Corp

News Corp faces various challenges and opportunities across its business units.

Risks:

- Declining print advertising revenue remains a significant risk, particularly for the News & Information Services segment.

- Intense competition from other digital platforms presents an ongoing challenge across all segments.

- Regulatory changes and economic downturns can negatively impact performance.

Opportunities:

- Expanding into new markets (both geographically and by product offering) presents significant growth potential.

- Strategic acquisitions can bolster market share and diversify the portfolio.

- Leveraging data analytics can enhance efficiency and inform future business strategies.

- Further developing digital subscription models remains a core strategy for mitigating the decline in print advertising revenue and sustaining growth.

Keywords: market risks, growth opportunities, digital transformation, strategic acquisitions, regulatory compliance.

Conclusion: Reassessing the Value Proposition of News Corp's Assets

A comprehensive analysis of News Corp's diverse portfolio reveals a complex picture. While some business units, like the digital real estate segment, show considerable promise and strong growth trajectories, others face headwinds from a changing media landscape. Whether News Corp's assets are fairly priced or represent undervalued opportunities ultimately depends on the specific valuation methodology applied and the outlook for each individual business unit. The potential for significant growth in the digital sphere is undeniable, however, the transition needs careful management of the risks involved.

Continue your own analysis of News Corp's business units to determine if their current market price accurately reflects their underlying value. Dive deeper into the financials and explore the growth potential of each segment to assess whether these assets are indeed undervalued. The valuation of News Corp’s diverse portfolio is a complex issue requiring a nuanced understanding of individual business units and their potential for future success.

Featured Posts

-

Mia Farrow Visits Sadie Sink Backstage A Broadway Encounter

May 25, 2025

Mia Farrow Visits Sadie Sink Backstage A Broadway Encounter

May 25, 2025 -

Avrupa Borsalari Ecb Faiz Kararinin Ardindan Piyasalardaki Dalgalanma

May 25, 2025

Avrupa Borsalari Ecb Faiz Kararinin Ardindan Piyasalardaki Dalgalanma

May 25, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 25, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 25, 2025 -

French Presidential Election Assessing Jordan Bardellas Electoral Prospects

May 25, 2025

French Presidential Election Assessing Jordan Bardellas Electoral Prospects

May 25, 2025

Latest Posts

-

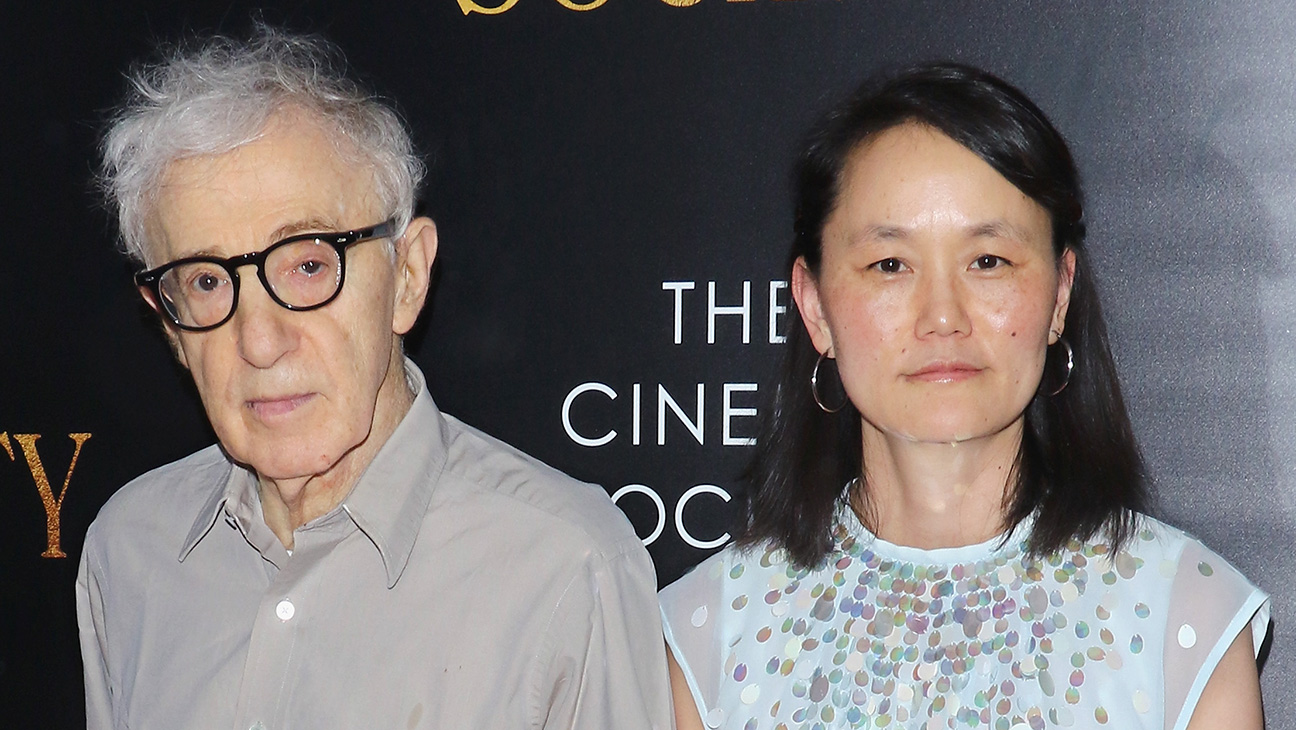

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025