Next Key Price Levels For Apple Stock (AAPL): A Technical Analysis

Table of Contents

Identifying Key Support Levels for AAPL

What are Support Levels?

Support levels represent price points where buying pressure is strong enough to prevent a further price decline. Think of them as a safety net for the stock price. These levels are formed by the interaction of buyers and sellers; when the price approaches a support level, buyers often step in, preventing a significant drop. Conversely, if the price breaks below a support level, it signals a potential weakening of buying interest and may lead to further price declines.

- Formation: Support levels often form around previous lows, psychological price points (e.g., round numbers like $150), or significant trendline support.

- Indicators: Technical indicators such as moving averages (e.g., 20-day, 50-day, 200-day moving averages) and trendlines can help pinpoint potential support areas.

Analyzing Recent AAPL Performance to Determine Support

Analyzing recent AAPL price action reveals potential support levels. For instance, the $150 price point has historically acted as a strong support level, coinciding with previous price bottoms. Similarly, the $140 level could provide additional support, although a break below this level could signal a more significant downward trend.

- Potential Support Levels: $150, $140.

- Implications of a Drop: A break below $140 could trigger further selling pressure, potentially leading to a more pronounced decline. However, a bounce off of these levels would reinforce their significance as support.

[Insert chart showing AAPL price action with highlighted support levels at $150 and $140]

Pinpointing Key Resistance Levels for AAPL

Understanding Resistance Levels

Resistance levels are price points where selling pressure overwhelms buying pressure, preventing further price increases. They act as ceilings, temporarily halting upward momentum. These levels often form around previous highs, psychological price points, or significant trendline resistance.

- Formation: Resistance levels are created when sellers enter the market en masse, preventing the price from exceeding a certain level.

- Indicators: Technical indicators like trendlines, moving averages, and previous price highs are valuable tools in identifying potential resistance levels.

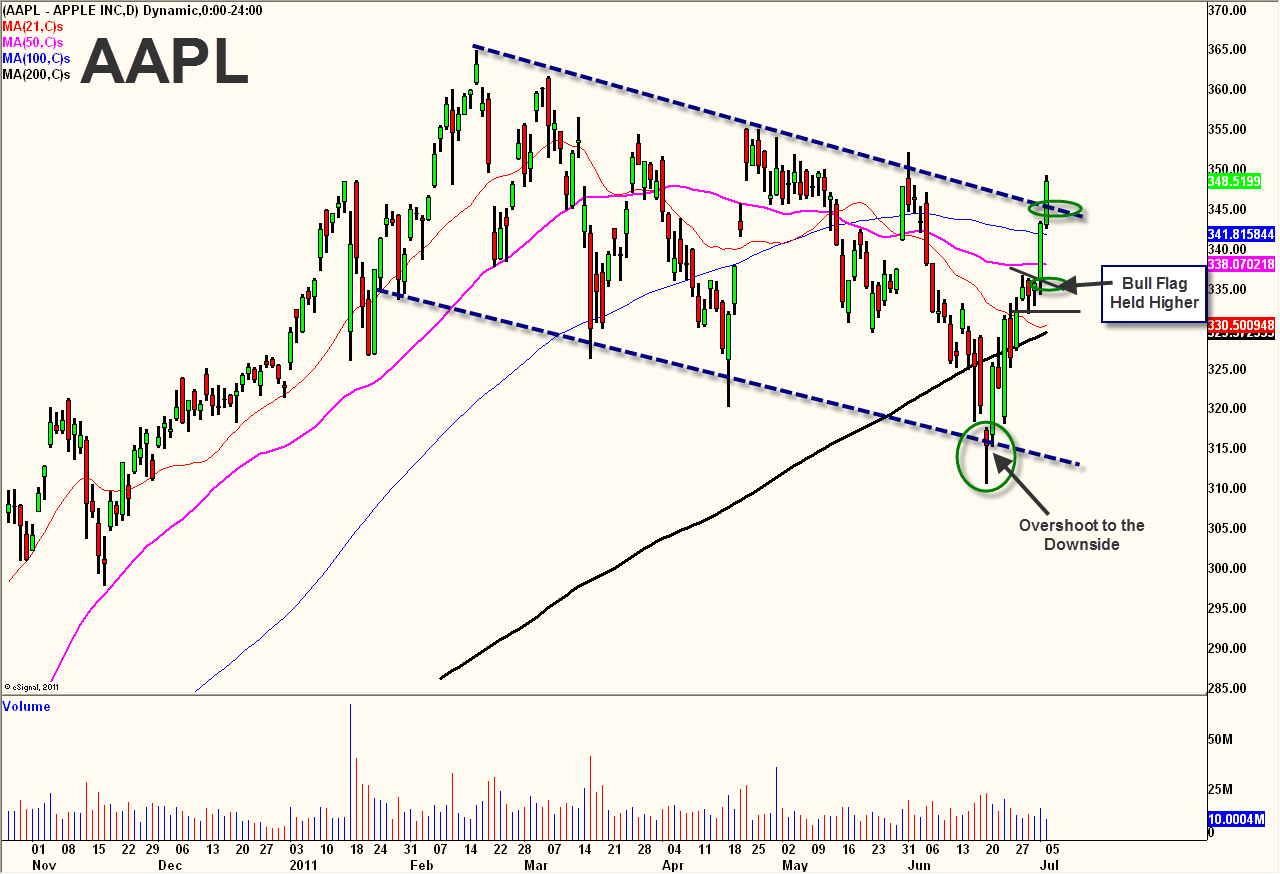

Projecting Potential Resistance for Apple Stock

Based on recent price action and chart patterns, several potential resistance levels emerge for AAPL. The $170 mark represents a significant psychological barrier and a previous high, while the $180 level could present even stronger resistance, potentially representing a longer-term price ceiling.

- Potential Resistance Levels: $170, $180.

- Implications of Reaching Resistance: If AAPL's price approaches and struggles to break through these resistance levels, it could signal a potential period of consolidation or even a price reversal. A successful breakout above these levels, however, could suggest stronger bullish momentum.

[Insert chart showing AAPL price action with highlighted resistance levels at $170 and $180]

Considering Key Indicators for AAPL Price Prediction

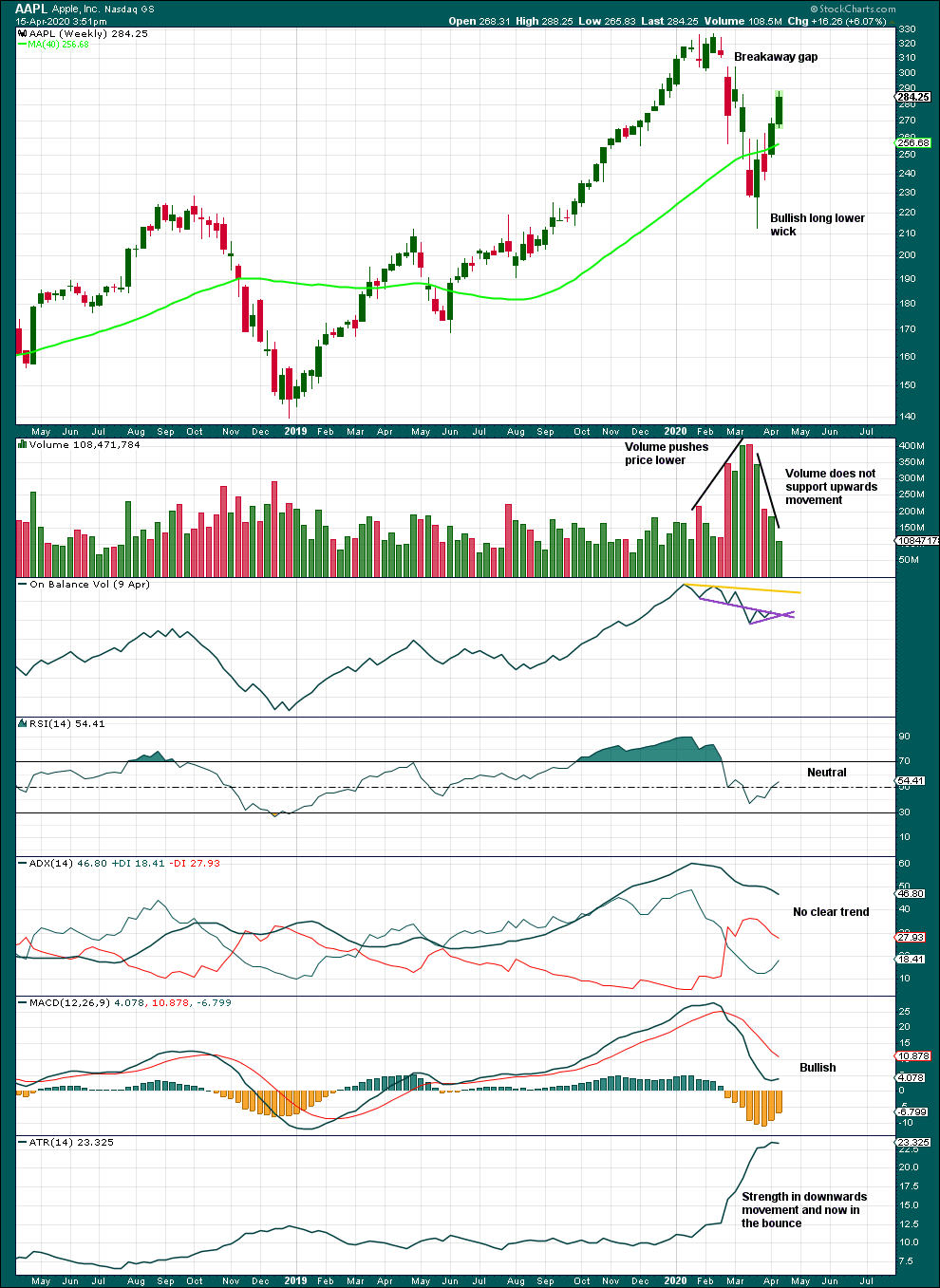

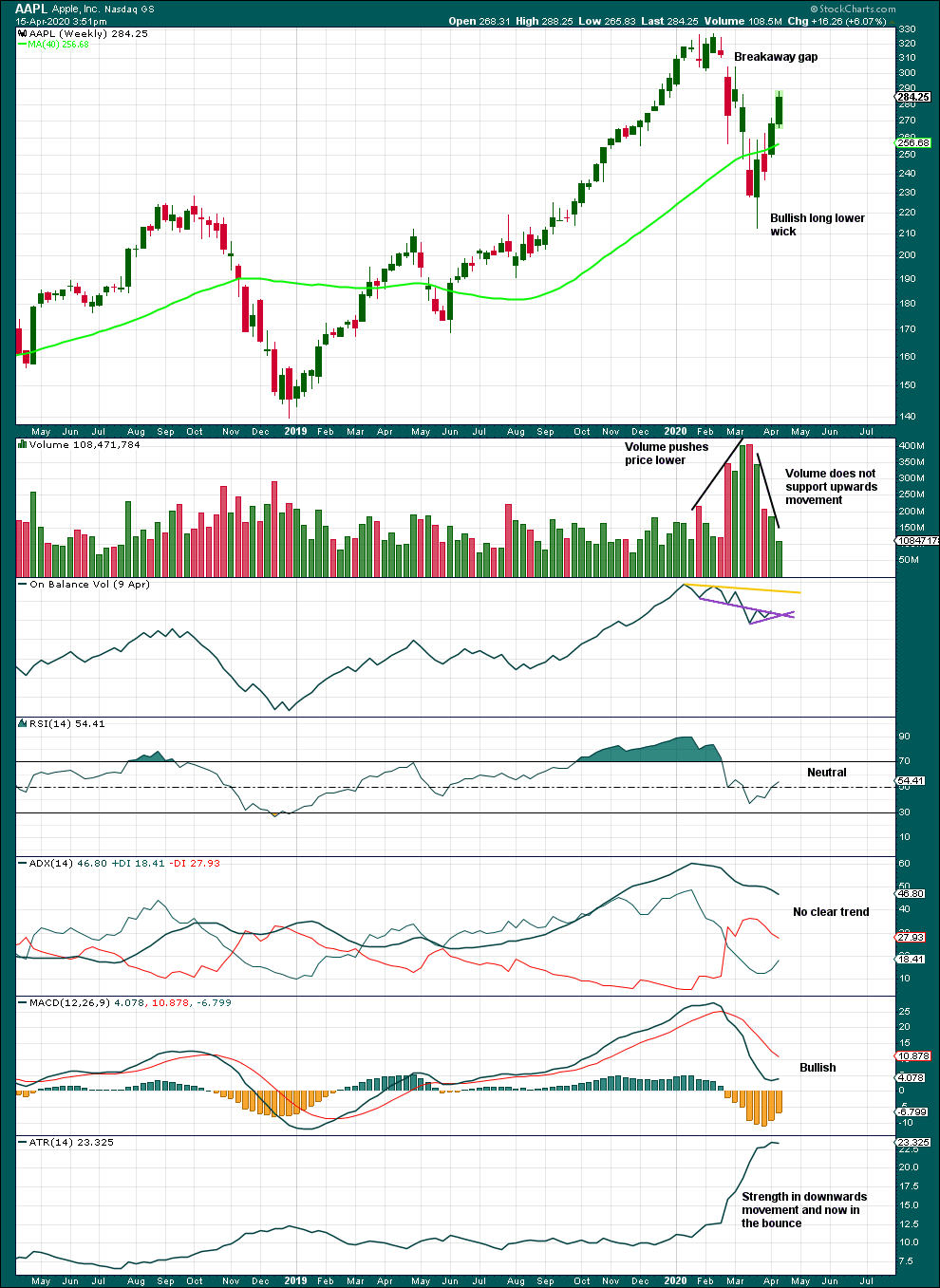

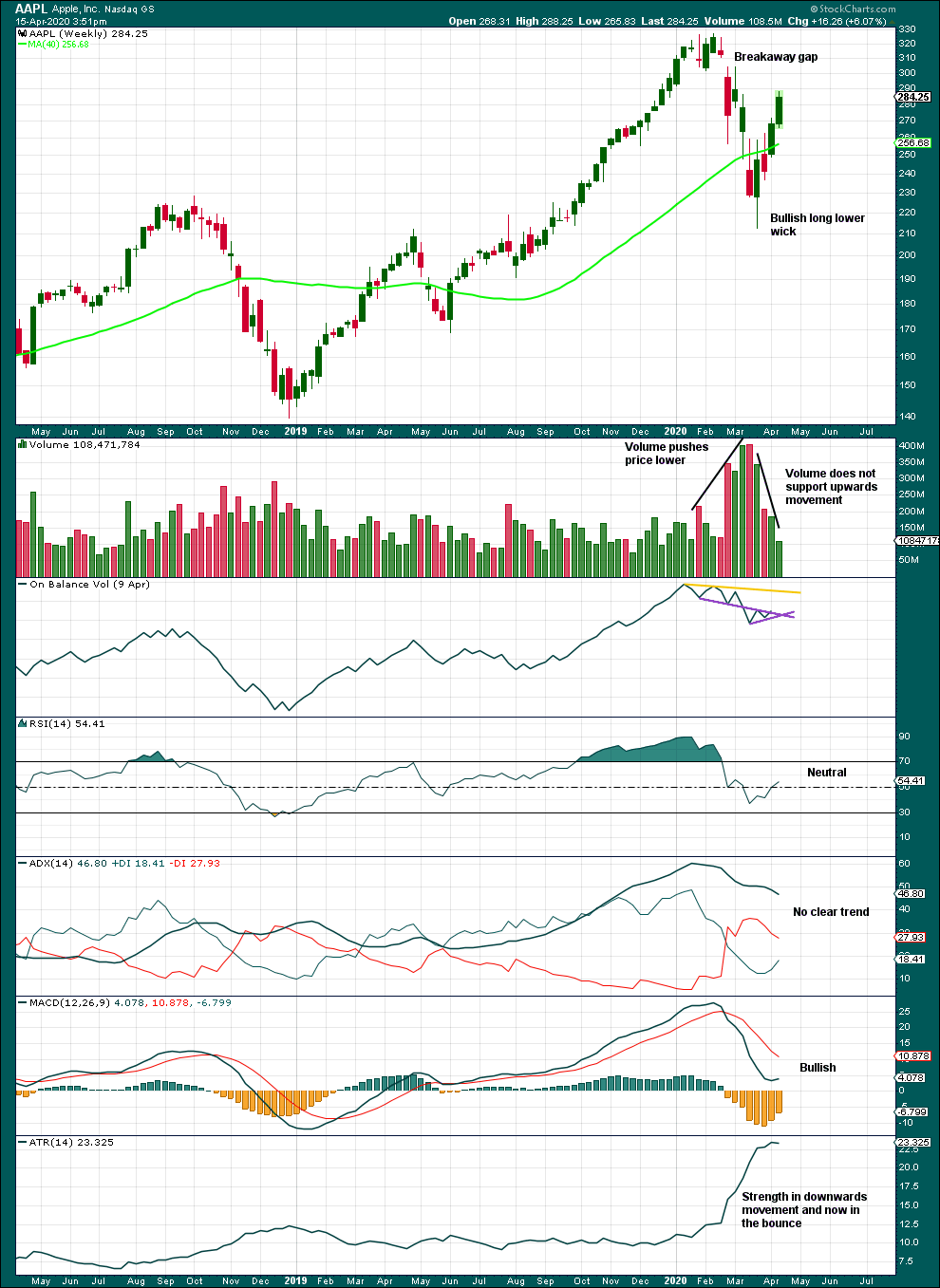

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 generally suggests an overbought market, indicating a potential pullback, while an RSI below 30 suggests an oversold market, hinting at a possible price rebound. Analyzing the RSI in conjunction with price action provides a more comprehensive view of AAPL's potential price movements.

Moving Averages

Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and identify trends. A price above both the 50-day and 200-day moving averages usually signifies an uptrend, while a price below both suggests a downtrend. Crossovers of these moving averages can also provide valuable signals.

Volume Analysis

Volume analysis examines the relationship between price changes and trading volume. High volume during price increases suggests strong buying pressure, confirming the uptrend. Conversely, high volume during price declines signals strong selling pressure. Analyzing volume helps validate price movements and identify potential breakouts or breakdowns.

Conclusion: Navigating the Future of AAPL: Key Price Levels and Investment Strategy

In summary, our technical analysis suggests potential support levels for AAPL around $150 and $140, and resistance levels near $170 and $180. However, it's crucial to remember that these are projections, and market conditions can shift rapidly. Using technical analysis tools, like those discussed above, alongside fundamental analysis, empowers you to make more informed investment decisions. Remember, reaching these price levels doesn't guarantee a specific outcome, but understanding these potential support and resistance areas allows you to anticipate potential shifts in market sentiment. Conduct thorough research, consider the next key price levels for Apple stock (AAPL), and develop a robust investment strategy tailored to your risk tolerance and financial goals. For deeper insights, explore resources such as financial news websites and reputable investment analysis platforms. Understanding the next key price levels for Apple stock (AAPL) is paramount for navigating the market successfully.

Featured Posts

-

Understanding Key Price Levels For Apple Stock Aapl

May 24, 2025

Understanding Key Price Levels For Apple Stock Aapl

May 24, 2025 -

Next Key Price Levels For Apple Stock Aapl A Technical Analysis

May 24, 2025

Next Key Price Levels For Apple Stock Aapl A Technical Analysis

May 24, 2025 -

Navigating Bbc Radio 1 Big Weekend 2025 Ticket Applications Sefton Park

May 24, 2025

Navigating Bbc Radio 1 Big Weekend 2025 Ticket Applications Sefton Park

May 24, 2025 -

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025 -

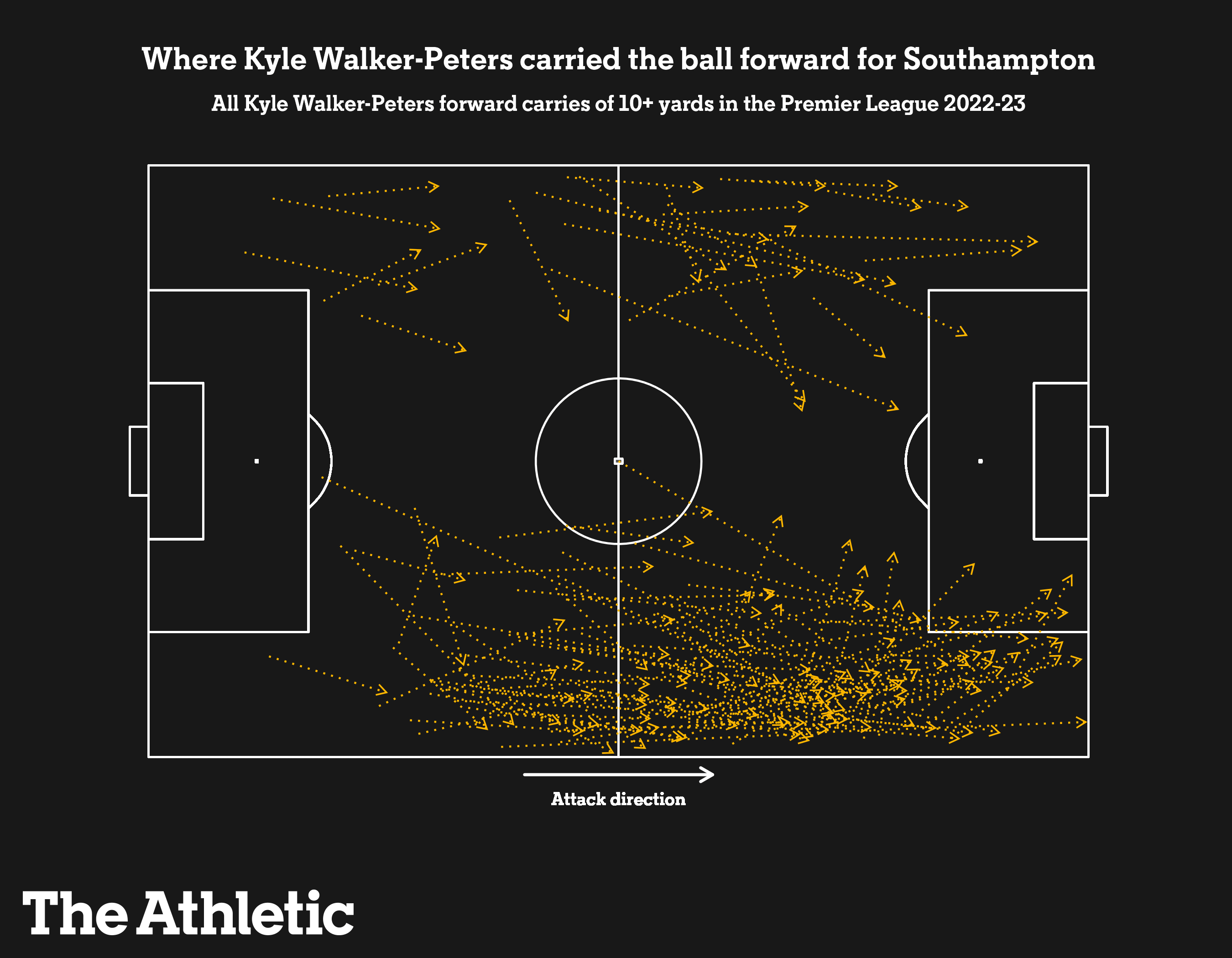

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025

Latest Posts

-

Changes To Italian Citizenship Law Claiming Rights Via Great Grandparents

May 24, 2025

Changes To Italian Citizenship Law Claiming Rights Via Great Grandparents

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Lineage

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Lineage

May 24, 2025 -

Italys New Citizenship Law Claiming Citizenship Through Great Grandparents

May 24, 2025

Italys New Citizenship Law Claiming Citizenship Through Great Grandparents

May 24, 2025 -

Best And Final Job Offer Your Guide To Successful Negotiation

May 24, 2025

Best And Final Job Offer Your Guide To Successful Negotiation

May 24, 2025 -

Job Offer Negotiation Overcoming The Best And Final Barrier

May 24, 2025

Job Offer Negotiation Overcoming The Best And Final Barrier

May 24, 2025