Stocks Surge 8% On Euronext Amsterdam: Trump's Tariff Pause Fuels Rally

Table of Contents

The Impact of Trump's Tariff Pause on Global Markets

The pause in planned US tariffs on Chinese goods has had a profound impact on global markets, significantly reducing uncertainty and boosting investor confidence. This unexpected move has dramatically altered the landscape of the ongoing trade war, offering a glimmer of hope for a potential resolution and a more stable global economic future.

Reduced Trade Uncertainty

The prolonged trade war between the US and China has created considerable uncertainty for businesses and investors worldwide. This uncertainty, characterized by high risk aversion, has stifled investment and dampened economic growth. The tariff pause, however, has alleviated these concerns to a significant degree.

- Decreased risk aversion: Investors are now less hesitant to commit capital, perceiving a lower risk of significant trade disruptions.

- Increased willingness to invest: The positive sentiment generated by the pause has unlocked previously hesitant investment, leading to increased capital flow into various markets.

- Positive sentiment in global markets: The news has spread optimism, creating a more positive overall sentiment that is driving market growth.

The impact of uncertainty on investment decisions cannot be overstated. Before the announcement, many companies delayed expansion plans and investment decisions due to the unpredictable nature of the trade war. The tariff pause has lessened this apprehension, allowing businesses to plan with more confidence and facilitating a surge in investment activity.

Specific Benefits for European Companies

European companies, especially those heavily reliant on trade with both the US and China, are among the biggest beneficiaries of this development. The interconnected nature of global supply chains means that any resolution – or even a pause – in trade tensions can have a ripple effect across continents.

- Automotive Sector: Companies in the automotive industry, which relies heavily on international trade and component sourcing, experienced significant gains.

- Technology Sector: Technology companies, also heavily reliant on global supply chains and trade, saw substantial increases in stock prices.

For example, [insert example of a specific European company in the automotive or technology sector that saw significant gains and the percentage increase]. This surge highlights the interconnectedness of the global economy and how even a temporary respite from trade tensions can dramatically impact specific sectors. The reduction in tariffs and the ensuing decrease in input costs provide a direct boost to these companies’ profitability and investor confidence.

Euronext Amsterdam's Performance: A Detailed Look at the Surge

The Euronext Amsterdam stock exchange was particularly responsive to the news of the tariff pause, experiencing a dramatic 8% surge in stock prices. This performance reflects both the broader global market reaction and the specific sensitivities of European companies listed on the exchange.

Sector-Specific Analysis

The rally on Euronext Amsterdam wasn't uniform across all sectors. Some sectors saw significantly larger gains than others, reflecting their varying degrees of exposure to US-China trade relations.

- Top Performing Sectors: [List the top 3-5 performing sectors and their percentage increases].

- Specific Company Examples: [Provide 1-2 specific examples of companies within those sectors that experienced significant growth and the percentage increase]. For example, [company name] in the [sector] sector saw an impressive [percentage]% increase.

The reasons behind the outsized performance of certain sectors are directly linked to their reliance on trade with the US and China. Sectors with extensive supply chains that involve both countries benefitted most from the reduced uncertainty.

Trading Volume and Volatility

The announcement of the tariff pause led to a significant increase in trading activity and market volatility on Euronext Amsterdam. This heightened activity reflects the market's reaction to the unexpected news and the subsequent reassessment of investment strategies.

- Trading Volume: [Insert data on trading volume, e.g., "Trading volume increased by X% compared to the previous day"].

- Price Fluctuations: [Insert data on price fluctuations, e.g., "The index experienced a [range]% fluctuation throughout the day"].

- Overall Market Activity: [Describe the overall market activity, e.g., "The market experienced a period of high volatility followed by a more stable period as investors digested the news."]

The increased volatility is a natural consequence of the unexpected nature of the news. Investors reacted swiftly, leading to rapid price adjustments as they reevaluated their positions based on the changed risk landscape.

Future Implications and Investor Outlook

While the 8% surge on Euronext Amsterdam is encouraging, it's crucial to assess the sustainability of this rally and its implications for investors.

Sustainability of the Rally

The long-term impact of this tariff pause remains uncertain. The rally could be sustained or prove to be a short-lived phenomenon, depending on several factors:

- Factors that could sustain the rally: Continued progress in trade negotiations, positive economic indicators in Europe and globally, and a continued easing of trade tensions.

- Factors that could negatively impact the rally: Renewed threats of tariffs, geopolitical instability, and disappointing economic data.

The sustainability of the rally will depend on whether this pause translates into a more permanent de-escalation of trade tensions. Any renewed escalation could easily reverse the positive market sentiment and trigger another downturn.

Investment Strategies

The current market environment presents both risks and opportunities for investors. A cautious approach is warranted, considering the potential for further volatility.

- Diversification: Investors should maintain well-diversified portfolios across different asset classes and sectors to mitigate risk.

- Sector-Specific Focus: Depending on risk tolerance, investors might consider focusing on sectors that are expected to benefit from a resolution to trade tensions.

- Consult a Financial Advisor: Seeking professional advice is crucial for navigating this complex market landscape and developing an investment strategy that aligns with individual risk profiles and financial goals.

Conclusion:

The 8% surge on Euronext Amsterdam, triggered by Trump's unexpected tariff pause, represents a significant market event. This rally highlights the profound impact of trade policy on global markets and the specific vulnerabilities and opportunities for European companies. While the positive market reaction is encouraging, investors need to carefully consider the factors that could sustain or undermine this rally. The interconnected nature of global markets makes it imperative to monitor developments closely. The unexpected surge in stock prices on Euronext Amsterdam presents both opportunities and challenges for investors. Stay informed on market developments and consider consulting a financial advisor to make informed decisions regarding your investments in Euronext Amsterdam and related markets. Monitor the evolving trade situation for potential further impacts on Euronext Amsterdam stock prices.

Featured Posts

-

Avrupa Borsalarinda Karisik Seyir

May 24, 2025

Avrupa Borsalarinda Karisik Seyir

May 24, 2025 -

8 Stock Market Jump On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025 -

Vspominaya Sergeya Yurskogo 90 Let Legendarnomu Akteru I Intellektualu

May 24, 2025

Vspominaya Sergeya Yurskogo 90 Let Legendarnomu Akteru I Intellektualu

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Locations For A Tranquil Getaway

May 24, 2025 -

Evrovidenie Chto Delayut Pobediteli Poslednikh 10 Let

May 24, 2025

Evrovidenie Chto Delayut Pobediteli Poslednikh 10 Let

May 24, 2025

Latest Posts

-

Understanding The Debate Surrounding Thames Water Executive Bonuses

May 24, 2025

Understanding The Debate Surrounding Thames Water Executive Bonuses

May 24, 2025 -

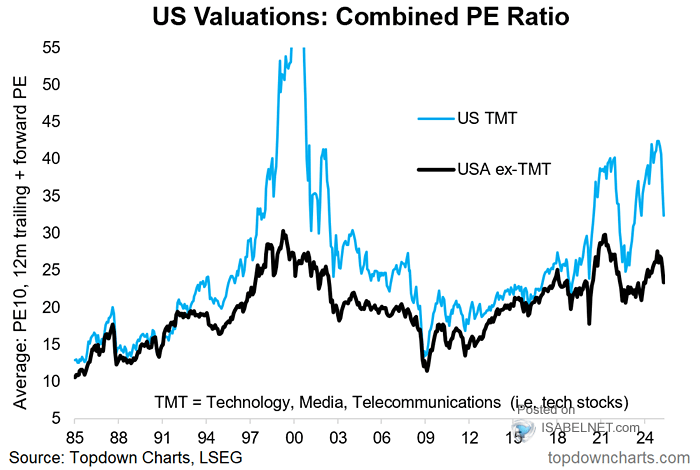

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

May 24, 2025

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

May 24, 2025 -

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025 -

The Thames Water Bonus Controversy Examining The Facts

May 24, 2025

The Thames Water Bonus Controversy Examining The Facts

May 24, 2025 -

Universals 7 Billion Investment Reigniting The Theme Park Arms Race

May 24, 2025

Universals 7 Billion Investment Reigniting The Theme Park Arms Race

May 24, 2025