Nicki Chapman's Seven-Figure Country Home: Investment Strategy Revealed

Table of Contents

Location, Location, Location: The Power of Rural Property Investment

The adage "location, location, location" rings truer than ever when it comes to high-value property investment. Nicki Chapman's choice of a rural location likely played a significant role in her seven-figure home's value. Understanding the nuances of rural property investment is key to unlocking similar success.

- Analyzing the desirability of rural locations: Consider proximity to major cities (offering easy commutes), access to quality amenities (schools, hospitals, shops), and excellent transport links (train stations, major roads). The scenic beauty and tranquility of the countryside also significantly boost desirability.

- Understanding the demand for country homes: The UK has seen a surge in demand for country homes, driven by a desire to escape urban life, work remotely, and enjoy more space. This increased demand translates directly into higher property values.

- Identifying undervalued areas with high growth potential: Thorough market research is crucial. Look for areas with potential for future development, infrastructure improvements, or increased tourism, which can significantly impact property values.

- The impact of local schools and community on property value: Excellent schools and a thriving local community are major factors attracting families and increasing the demand (and price) for properties in a particular area. This is a key element to consider in location analysis.

Property Features and Value Drivers: Maximizing Return on Investment

While location forms the foundation of a successful property investment, the property's inherent features directly influence its value and potential ROI. Nicki Chapman's seven-figure home likely boasts a range of attractive features.

- Analyzing the features of a high-value property: Consider factors like size (square footage, number of bedrooms and bathrooms), land size (ample gardens, potential for extensions), unique architectural details (period features, modern design), and overall condition.

- Assessing the potential for renovations and upgrades to increase property value: Smart renovations can significantly increase a property's worth. Modernizing kitchens and bathrooms, improving energy efficiency, and creating stylish living spaces are all worthwhile investments.

- Understanding the impact of modernizations and energy efficiency improvements on ROI: Eco-friendly upgrades, like solar panels or improved insulation, not only increase value but also reduce running costs, enhancing the overall return on investment.

- The role of landscaping and outdoor spaces in enhancing property value: Well-maintained gardens, swimming pools, and other outdoor features greatly enhance the appeal and value of a country home, contributing to its overall luxury feel.

Financing Strategies for Seven-Figure Property Investments

Securing financing for a seven-figure property requires careful planning and potentially, unique strategies. While the specifics of Nicki Chapman's financing remain private, exploring potential routes is insightful.

- Exploring different mortgage options for high-value properties: High-net-worth individuals often access specialist mortgage products designed for large property investments. These may offer lower interest rates or more flexible repayment terms compared to standard mortgages.

- Utilizing investment loans and other financing strategies: Investment loans are a common route for acquiring multiple properties. Exploring bridging loans or other short-term financing solutions might also be relevant for purchasing and renovating a property simultaneously.

- Understanding the importance of financial planning and risk assessment: Before pursuing a high-value property purchase, thorough financial planning and risk assessment are essential. This includes evaluating your current financial situation and ensuring that the investment aligns with your overall financial goals.

- Seeking advice from financial professionals and mortgage brokers: Consult with financial advisors and experienced mortgage brokers who understand the intricacies of high-value property financing. Their expertise can be invaluable in navigating the complex financial landscape.

Long-Term Investment Strategies and Capital Growth

Investing in a seven-figure property is a long-term commitment. Maximizing capital appreciation and managing risks requires a strategic approach.

- Analyzing long-term trends in the rural property market: Understanding market trends is crucial. Research historical data, consider future infrastructure projects, and assess the predicted demand for properties in the chosen area.

- Understanding the potential for rental income as a supplementary investment strategy: Generating rental income can offset costs and further enhance the investment's overall return. Explore the feasibility of renting out part of the property or the entire property when not in use.

- Diversifying investment portfolios for risk mitigation: Don't put all your eggs in one basket. Diversifying investments across different asset classes can mitigate risks associated with the property market's volatility.

- The importance of regular property maintenance and upkeep: Maintaining the property's condition is crucial for preserving its value and ensuring smooth rental operations (if applicable). Establish a regular maintenance plan to address any issues promptly.

Conclusion

Nicki Chapman's seven-figure country home serves as a testament to the potential of strategic property investment. The key takeaways from this exploration emphasize the critical roles of prime location, desirable property features, effective financing strategies, and long-term investment planning in achieving substantial returns. By carefully analyzing market trends, understanding property value drivers, and securing suitable financing, investors can significantly improve their chances of success.

Inspired by Nicki Chapman's seven-figure country home, are you ready to explore your own high-value property investment opportunities? Start your research today and discover the potential for substantial returns in the UK property market. Learn more about effective strategies for investing in seven-figure homes and unlocking your own financial success.

Featured Posts

-

Brazils Banking Power Shift Brbs Strategic Move To Rival Major Players

May 25, 2025

Brazils Banking Power Shift Brbs Strategic Move To Rival Major Players

May 25, 2025 -

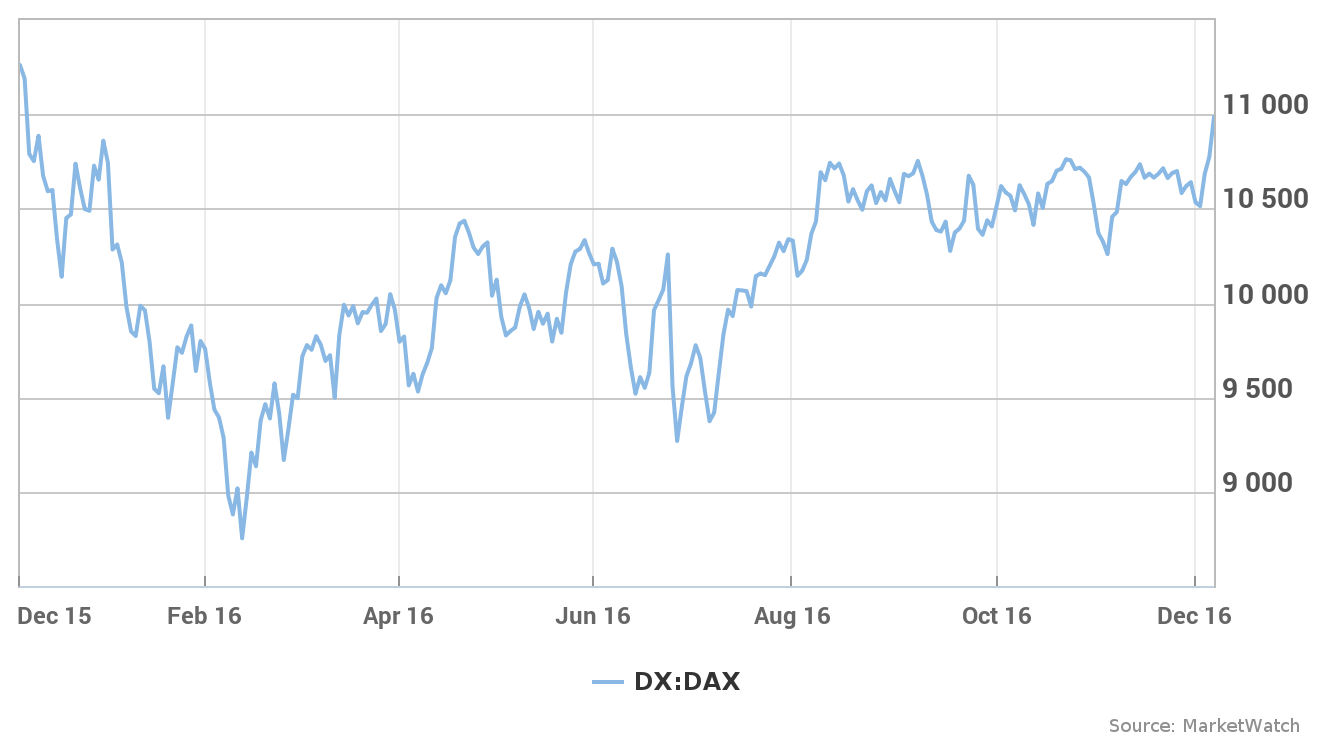

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 25, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 25, 2025 -

Cac 40 Index Weeks End Market Report Minor Decline Stable Overall March 7 2025

May 25, 2025

Cac 40 Index Weeks End Market Report Minor Decline Stable Overall March 7 2025

May 25, 2025 -

1 Million Escape To The Country Affordable Dream Homes Revealed

May 25, 2025

1 Million Escape To The Country Affordable Dream Homes Revealed

May 25, 2025 -

Experience Ferrari Excellence Bengalurus New Service Centre

May 25, 2025

Experience Ferrari Excellence Bengalurus New Service Centre

May 25, 2025

Latest Posts

-

La Guerra Dei Dazi Conseguenze Sulle Borse Europee E Reazioni Della Ue

May 25, 2025

La Guerra Dei Dazi Conseguenze Sulle Borse Europee E Reazioni Della Ue

May 25, 2025 -

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Decline

May 25, 2025

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Decline

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Gazete Trud Polniy Obzor

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Polniy Obzor

May 25, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 25, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 25, 2025 -

Dazi E Mercati Finanziari Analisi Dell Impatto Della Crisi Ue

May 25, 2025

Dazi E Mercati Finanziari Analisi Dell Impatto Della Crisi Ue

May 25, 2025