Norway's Sovereign Wealth Fund And The Trump Tariff Challenge

Table of Contents

The Structure and Investment Strategy of Norway's Sovereign Wealth Fund

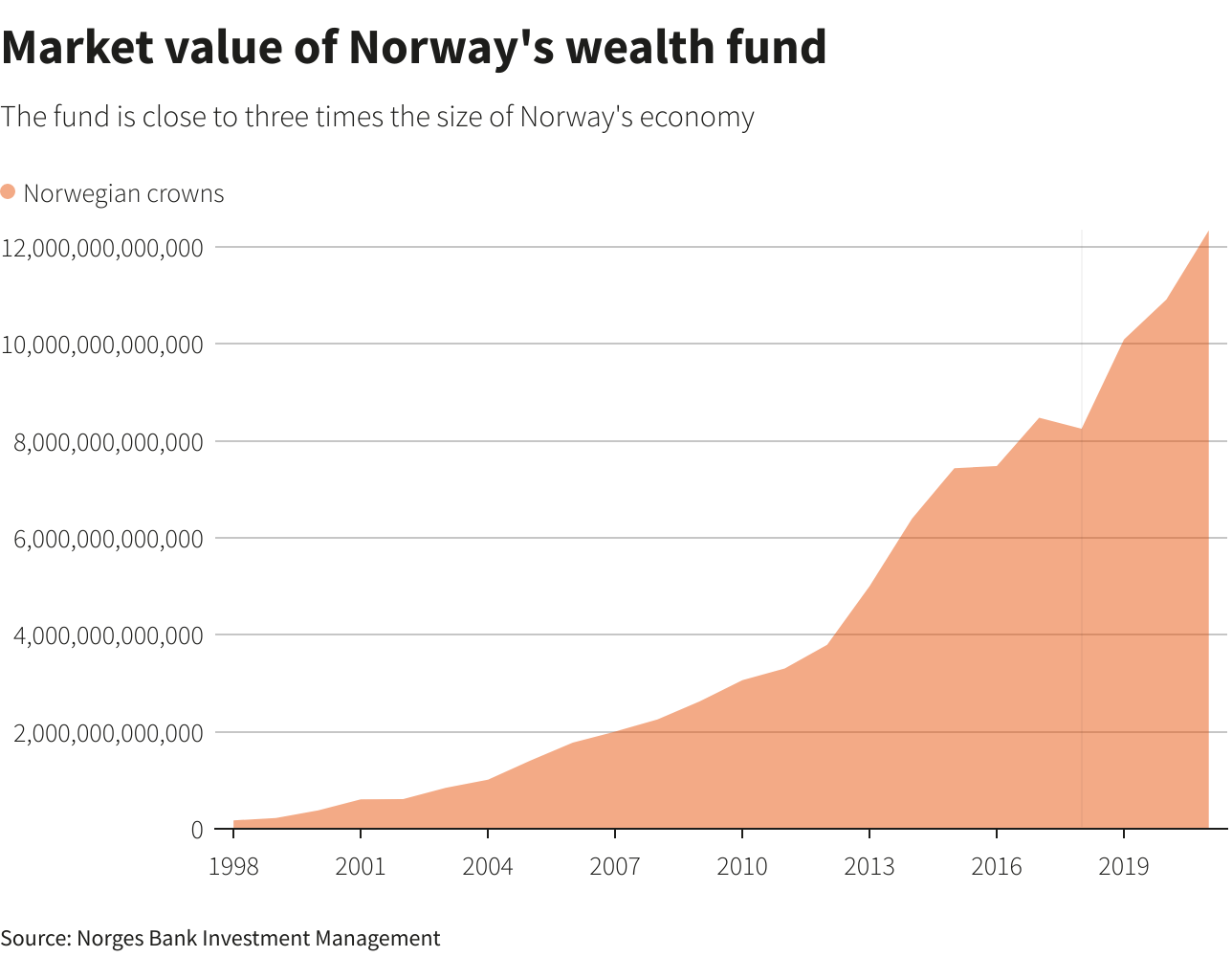

Norway's Sovereign Wealth Fund, officially known as the Government Pension Fund Global (GPFG), is a cornerstone of the Norwegian economy, primarily funded by oil and gas revenues. Its mandate is straightforward: to maximize long-term returns while ensuring a high level of diversification to minimize risk. This translates into a complex investment strategy spread across various asset classes.

- Primary Investment Goals: Long-term value growth, risk diversification, and ethical considerations.

- Asset Allocation: The GPFG holds a significant portion in equities (around 70%), followed by fixed income, real estate, and renewable energy infrastructure.

- Geographical Distribution: A substantial portion of its equity holdings are in North American and European markets, making it significantly exposed to fluctuations in these regions, including the effects of US trade policies.

- Significant exposure to the US market made it particularly vulnerable to the Trump tariffs.

- Investments in other regions provide crucial diversification, mitigating some of the risks associated with US-centric policies.

- ESG Investing: The fund actively incorporates Environmental, Social, and Governance (ESG) factors into its investment decisions, reflecting Norway's commitment to sustainable development.

Trump's Tariff Policies and Their Global Impact

The Trump administration implemented sweeping tariffs on various goods, citing the need to protect domestic industries and address perceived trade imbalances. These protectionist measures, however, sent ripples through the global economy.

- Rationale: The stated rationale was to bolster American manufacturing and reduce trade deficits with specific countries.

- Targeted Sectors and Countries: Tariffs targeted goods from China, the European Union, and other countries, impacting sectors like steel, aluminum, and agricultural products.

- Economic Consequences: The tariffs led to increased prices for consumers, trade disputes, and uncertainty in global markets. Specific sectors, particularly manufacturing and energy, felt the brunt of the impact.

- Increased costs for businesses using imported materials.

- Retaliatory tariffs imposed by other countries, creating a tit-for-tat trade war.

- Examples: Tariffs on steel imports led to higher prices for construction projects globally, while tariffs on agricultural products disrupted supply chains.

The Direct Impact of Trump's Tariffs on Norway's Sovereign Wealth Fund

The Trump tariffs directly affected Norway's Sovereign Wealth Fund due to its substantial exposure to US and globally-affected markets.

- Exposure to Affected Sectors: The GPFG's investments in companies within the targeted sectors experienced decreased valuations.

- Potential Losses: While precise figures are difficult to pinpoint, the market volatility caused by the tariffs likely resulted in decreased returns for the fund.

- Response Strategies: The fund likely employed various strategies to mitigate losses, including diversification across asset classes and geographical regions, as well as hedging strategies to protect against further market declines.

- Examples of Affected Investments: Specific companies in the manufacturing and energy sectors, whose stock prices were negatively impacted by tariffs, represent direct hits to the fund's portfolio. The exact details are confidential, however the general impact was palpable.

Norway's Diplomatic Response to US Trade Policies

Norway, while not directly targeted by the most aggressive tariffs, engaged in diplomatic efforts to address concerns about the broader impact of US trade policies. However, the effectiveness of these responses remains a subject of ongoing debate. Bilateral agreements and participation in international collaborations were used to navigate these challenges. The nuanced nature of these diplomatic interactions highlights the complexities of international trade relations.

Long-Term Implications for Norway's Sovereign Wealth Fund and Investment Strategy

The experience of the Trump tariffs offered valuable lessons for the management of Norway's Sovereign Wealth Fund.

- Lessons Learned: The vulnerability of even a diversified portfolio to geopolitical risks was underscored.

- Investment Strategy Adjustments: The fund might consider further diversification, potentially reducing its reliance on US markets and increasing exposure to emerging markets or other asset classes.

- Long-Term Performance Implications: While the long-term impact remains to be seen, the tariffs served as a reminder of the importance of proactive risk management in a volatile global environment.

- Future Risks and Opportunities: Future risks could include further protectionist policies, climate change related disruptions, and technological advancements. Opportunities lie in exploring new investment areas, such as renewable energy and sustainable technologies.

Conclusion

The Trump tariffs highlighted the vulnerability of even the world's largest Sovereign Wealth Fund, Norway's Government Pension Fund Global, to global trade uncertainties. While the fund's diversified strategy and active risk management helped mitigate the impact, the experience underscored the need for continuous adaptation and strategic diversification. The fund’s response, and the wider implications for managing sovereign wealth in a volatile market, showcase the need for proactive risk management. To learn more about the complexities of global finance and the challenges facing sovereign wealth funds, further reading on Norway's Government Pension Fund Global, Norway's oil fund, and managing sovereign wealth in a volatile market is highly recommended.

Featured Posts

-

Anna Kendrick The Missing Piece For The Accountant 3

May 05, 2025

Anna Kendrick The Missing Piece For The Accountant 3

May 05, 2025 -

Stanley Cup Ratings Fall In Us But 4 Nation Face Off Provides A Boost

May 05, 2025

Stanley Cup Ratings Fall In Us But 4 Nation Face Off Provides A Boost

May 05, 2025 -

Rethinking The Middle Manager A Vital Link In The Organizational Chain

May 05, 2025

Rethinking The Middle Manager A Vital Link In The Organizational Chain

May 05, 2025 -

Jet Zeros Triangle Shaped Jet A 2027 Flight Plan

May 05, 2025

Jet Zeros Triangle Shaped Jet A 2027 Flight Plan

May 05, 2025 -

Stanley Cup Playoffs Understanding The First Round Dynamics

May 05, 2025

Stanley Cup Playoffs Understanding The First Round Dynamics

May 05, 2025

Latest Posts

-

Anna Kendricks Iconic Blake Lively Response Fans Obsessed

May 05, 2025

Anna Kendricks Iconic Blake Lively Response Fans Obsessed

May 05, 2025 -

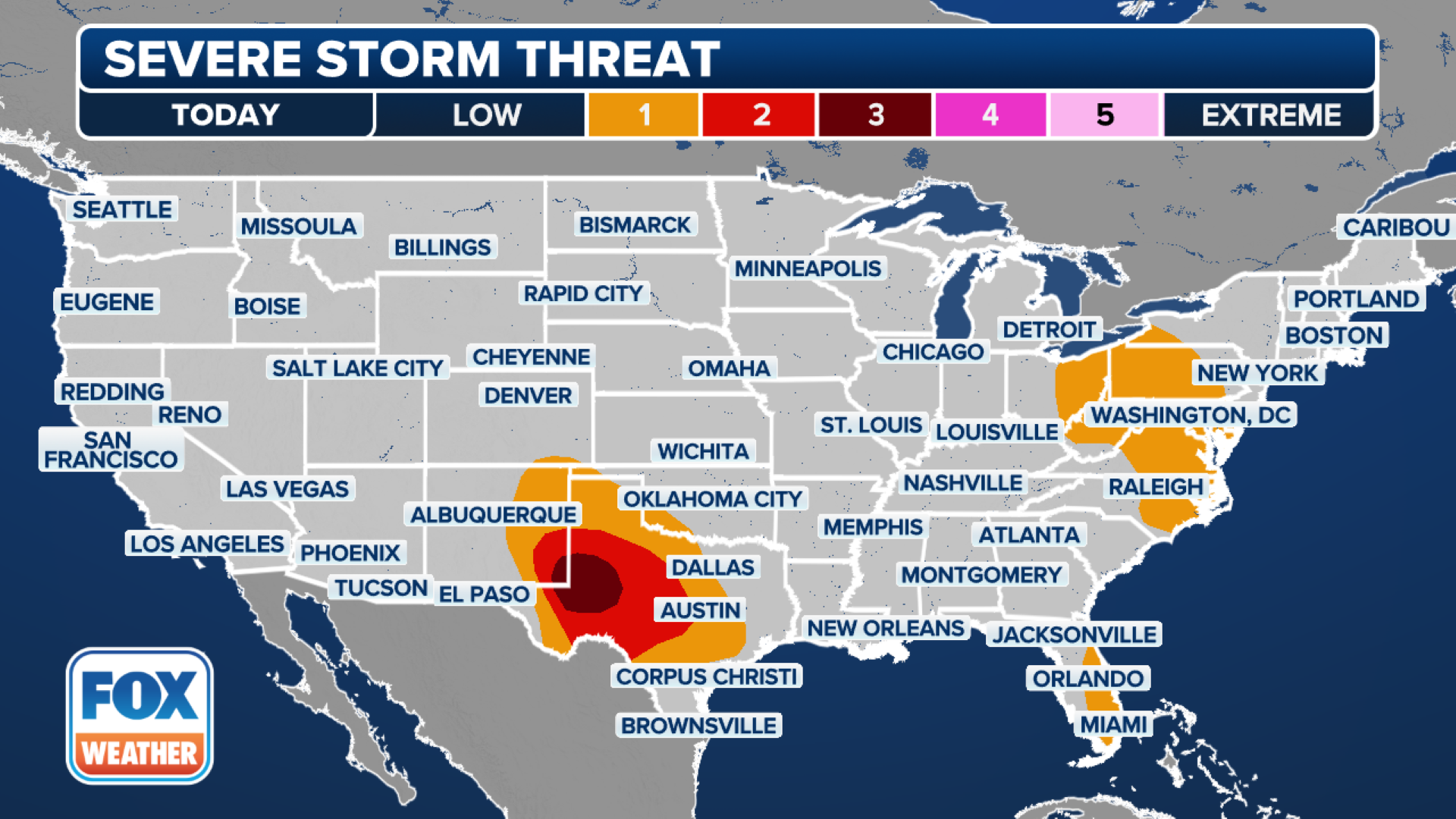

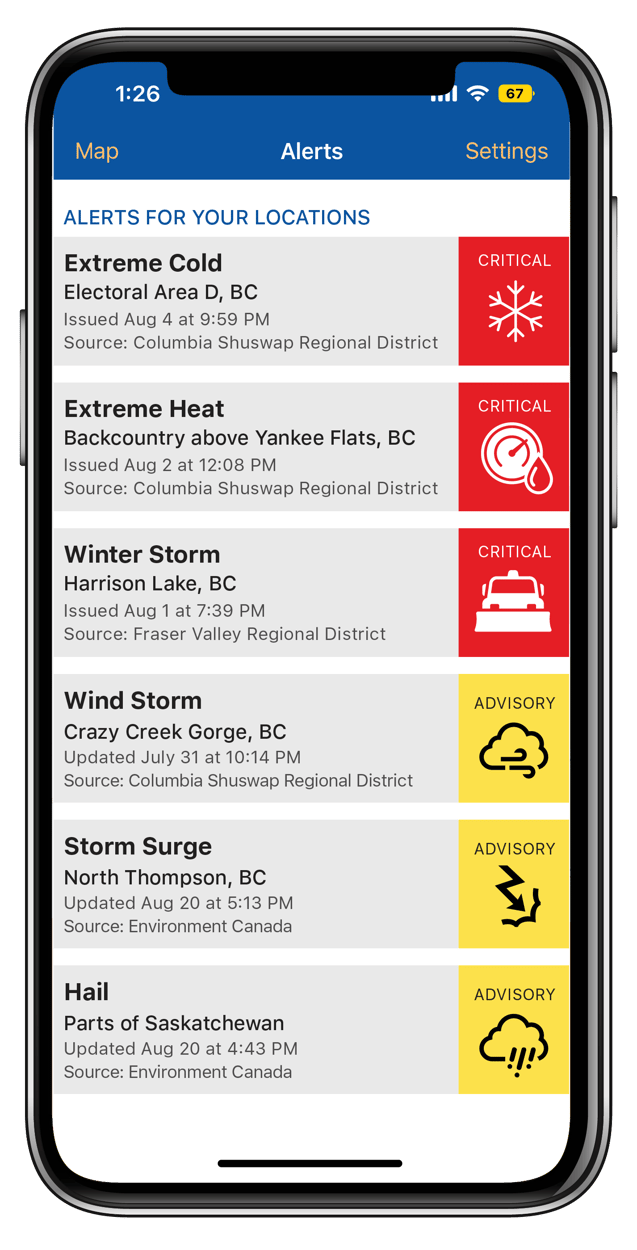

Mondays Severe Weather In Nyc A Detailed Forecast And Guide

May 05, 2025

Mondays Severe Weather In Nyc A Detailed Forecast And Guide

May 05, 2025 -

Severe Heat Warning South Bengal Temperatures Hit 38 C On Holi

May 05, 2025

Severe Heat Warning South Bengal Temperatures Hit 38 C On Holi

May 05, 2025 -

Severe Weather Alert Nyc Faces Potential Impacts Monday

May 05, 2025

Severe Weather Alert Nyc Faces Potential Impacts Monday

May 05, 2025 -

Rising Temperatures In South Bengal Holi Brings Extreme Heat

May 05, 2025

Rising Temperatures In South Bengal Holi Brings Extreme Heat

May 05, 2025