Norwegian Cruise Line (NCLH): A Hedge Fund Perspective On Investment

Table of Contents

NCLH's Financial Health and Performance

Analyzing the financial health of Norwegian Cruise Line Holdings Ltd. (NCLH) is crucial for any potential investor. This involves a deep dive into several key areas.

Analyzing NCLH's Revenue Streams

NCLH's revenue isn't solely dependent on cruise ticket sales. Diversification is key to understanding its financial stability. Revenue streams include:

- Cruise ticket sales: This remains the core business, but pricing strategies and demand significantly impact this area. Factors like destination popularity, time of year, and cabin type all play a role.

- Onboard spending: Revenue from onboard purchases (drinks, excursions, spa treatments, etc.) contributes significantly. Improving onboard experiences and offering attractive packages can boost this revenue stream.

- Other revenue sources: This includes things like gratuities, internet access, and shore excursions. These smaller revenue streams collectively contribute to the overall financial health of the company.

Analyzing historical revenue growth shows a pattern of strong growth followed by significant dips, notably during the pandemic. Understanding this seasonality, with its peaks during summer months and holiday periods, is essential for accurate forecasting and risk assessment.

- Strong growth in premium offerings: NCLH has seen success in its higher-priced cabin categories and premium experiences.

- Potential for ancillary revenue growth: Further diversification into new onboard offerings can improve profit margins.

- Susceptibility to economic downturns: Luxury travel is often the first to be affected during economic instability.

Evaluating NCLH's Debt and Liquidity

High levels of debt are a significant concern for NCLH. Hedge funds will meticulously analyze:

-

Debt-to-equity ratio: This shows the proportion of financing from debt versus equity. A high ratio indicates higher financial risk.

-

Interest coverage ratio: This measures NCLH's ability to pay interest on its debt. A low ratio indicates difficulty servicing debt.

-

Cash flow generation: Strong cash flow generation is crucial for debt repayment and operational flexibility.

-

Liquidity position: This measures NCLH's ability to meet its short-term obligations.

-

High debt levels a potential risk: This is a major factor impacting the company's credit rating and overall risk profile for Norwegian Cruise Line (NCLH) investment.

-

Strong cash flow generation following recovery from pandemic: The post-pandemic recovery demonstrated the company’s ability to generate cash, but sustainability needs further observation.

-

Impact of refinancing strategies: NCLH's success in refinancing its debt will influence its future financial stability.

Profitability and Valuation Metrics

Assessing profitability and valuation is vital for informed investment decisions. Key metrics include:

-

Profit margins: Analyzing operating and net profit margins reveals the efficiency of NCLH's operations.

-

Return on equity (ROE): This metric demonstrates how effectively NCLH uses shareholder investments to generate profit.

-

Price-to-earnings (P/E) ratio: Comparing NCLH's P/E ratio to industry averages provides insight into its relative valuation. A high P/E might indicate future growth potential, while a low P/E might suggest undervaluation or lower expected growth.

-

Compare P/E ratio to industry averages: Benchmarking against Carnival and Royal Caribbean is essential.

-

Discuss potential for future earnings growth: Factors like expansion plans and market share gains impact future earnings.

-

Analyze impact of fuel prices on profitability: Fluctuating fuel costs significantly impact the cruise industry's profit margins.

Industry-Specific Risks and Opportunities

The cruise industry presents unique risks and opportunities. Understanding these factors is essential for a comprehensive NCLH investment analysis.

Competition and Market Share

The cruise industry is highly competitive, with major players like Carnival and Royal Caribbean. Analyzing NCLH's competitive landscape requires considering:

-

Market share: NCLH's market share and its trajectory are vital indicators of its success.

-

Competitive advantages: NCLH's "Freestyle Cruising" concept is a key differentiator. This needs to be assessed in terms of its effectiveness and long-term viability.

-

Potential for mergers and acquisitions: Consolidation in the industry is always a possibility.

-

Competition from Carnival and Royal Caribbean: These are major players with significant resources.

-

NCLH's unique selling propositions: The effectiveness of “Freestyle Cruising” in attracting customers is crucial.

-

Potential for mergers and acquisitions: This could significantly alter the competitive landscape and impact NCLH’s position.

Regulatory and Geopolitical Risks

External factors can significantly impact NCLH's performance. Key risks include:

-

Environmental regulations: Stringent environmental regulations regarding emissions and waste disposal can increase operational costs.

-

Geopolitical events: Pandemics, political instability in key regions, and travel restrictions significantly affect passenger numbers and profitability.

-

Safety regulations: Stringent safety requirements impact operational costs and require significant investment in safety measures.

-

Impact of environmental regulations: Compliance with increasingly strict environmental regulations is crucial.

-

Potential for travel restrictions due to political instability: Geopolitical events pose a significant threat to the cruise industry.

-

Pandemic recovery strategies: The ability to quickly adapt to and recover from global crises like the COVID-19 pandemic is vital.

Fuel Prices and Operational Costs

Fluctuating fuel prices pose a significant risk to NCLH's profitability. Managing this risk involves:

-

Fuel hedging strategies: Using financial instruments to mitigate the risk of price volatility.

-

Technological advancements: Investing in fuel-efficient technologies can reduce operational costs.

-

Crew wages and maintenance costs: These contribute to the overall operational costs and impact profit margins.

-

Fuel hedging strategies: The effectiveness of these strategies in mitigating price fluctuations needs to be evaluated.

-

Potential for technological advancements reducing fuel consumption: Investing in newer, more efficient ships is vital for long-term profitability.

-

Impact of crew wages and maintenance costs: These costs need to be carefully managed to maintain profitability.

Hedge Fund Investment Strategies for NCLH

Hedge funds utilize various strategies for NCLH investments.

Long-Term vs. Short-Term Investment Horizons

The investment horizon significantly impacts the strategy:

- Long-term growth potential: NCLH's long-term growth potential, based on industry trends and its strategic plans, is a crucial factor for long-term investors.

- Short-term volatility: Short-term investors must consider the inherent volatility of the cruise industry and its susceptibility to external factors.

- Impact of macroeconomic factors: Economic downturns and global events can significantly influence short-term performance.

- Consideration of dividend payouts: Dividend payouts can provide a stream of income for long-term investors.

Derivatives and Hedging Strategies

Sophisticated investors use derivative instruments:

- Options for hedging against fuel price fluctuations: Options and futures contracts can help mitigate fuel price risk.

- Potential use of interest rate swaps: Managing interest rate risk is vital, especially given NCLH's debt levels.

- Consideration of currency risk: Fluctuations in exchange rates can impact profitability.

Conclusion

Investing in Norwegian Cruise Line (NCLH) requires a thorough understanding of its financial health, the competitive landscape, and inherent industry risks. While high debt levels and industry competition present challenges, NCLH's strong brand, innovative offerings, and potential for revenue growth make it a compelling investment opportunity for sophisticated investors. A well-defined investment strategy, potentially incorporating hedging techniques, is crucial. Remember to conduct thorough due diligence and seek professional financial advice before making any Norwegian Cruise Line (NCLH) investment decisions.

Featured Posts

-

March 6th Qnb Corp Investor Presentation At Virtual Banking Conference

Apr 30, 2025

March 6th Qnb Corp Investor Presentation At Virtual Banking Conference

Apr 30, 2025 -

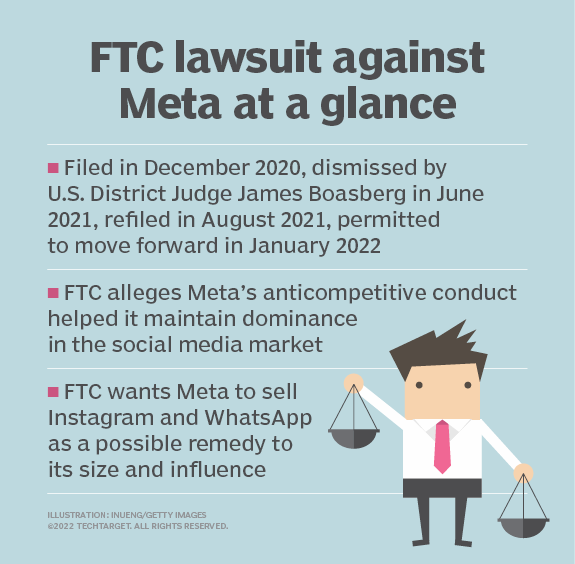

Meta Faces Ftc A Deep Dive Into The Instagram And Whats App Lawsuit

Apr 30, 2025

Meta Faces Ftc A Deep Dive Into The Instagram And Whats App Lawsuit

Apr 30, 2025 -

Akhbar Meashat Abryl 2025 Mwed Alsrf W Akhr Althdythat

Apr 30, 2025

Akhbar Meashat Abryl 2025 Mwed Alsrf W Akhr Althdythat

Apr 30, 2025 -

Iva I Siyana Podgotveni Za Predizvikatelstvata

Apr 30, 2025

Iva I Siyana Podgotveni Za Predizvikatelstvata

Apr 30, 2025 -

Olivia Wilde And Dane Di Liegro Spotted Again Looking Loved Up At Lakers Game

Apr 30, 2025

Olivia Wilde And Dane Di Liegro Spotted Again Looking Loved Up At Lakers Game

Apr 30, 2025

Latest Posts

-

Democratic Insiders Criticize Kamala Harris Post Election Absence

Apr 30, 2025

Democratic Insiders Criticize Kamala Harris Post Election Absence

Apr 30, 2025 -

Olivia Wilde 40 And Dane Di Liegro 36 Couples Pda At La Lakers Game

Apr 30, 2025

Olivia Wilde 40 And Dane Di Liegro 36 Couples Pda At La Lakers Game

Apr 30, 2025 -

Olivia Wilde And Dane Di Liegros Relationship A Look At Their Recent Public Appearance

Apr 30, 2025

Olivia Wilde And Dane Di Liegros Relationship A Look At Their Recent Public Appearance

Apr 30, 2025 -

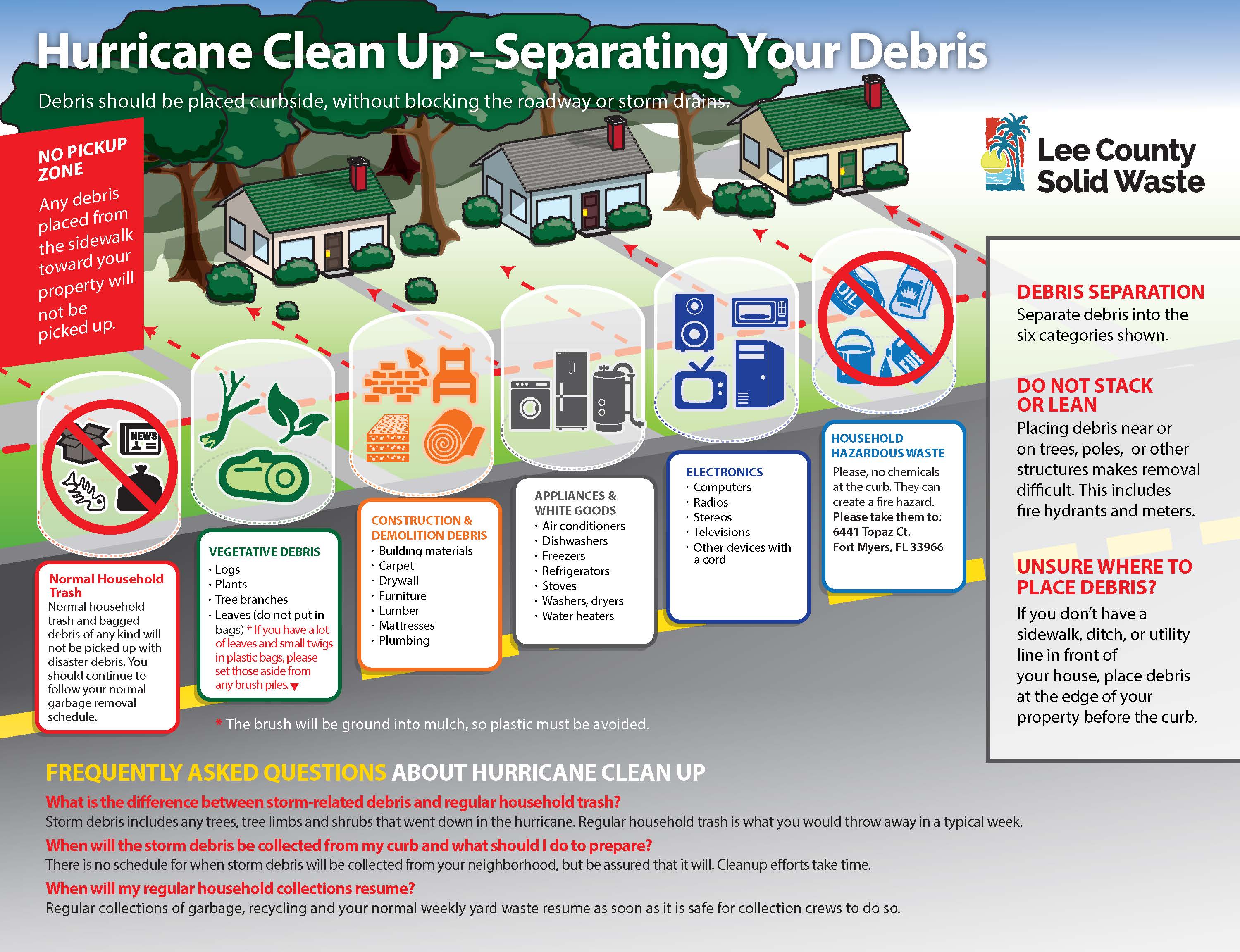

Louisville Launches Storm Debris Removal Program What You Need To Know

Apr 30, 2025

Louisville Launches Storm Debris Removal Program What You Need To Know

Apr 30, 2025 -

Olivia Wilde And Dane Di Liegro Spotted Again Looking Loved Up At Lakers Game

Apr 30, 2025

Olivia Wilde And Dane Di Liegro Spotted Again Looking Loved Up At Lakers Game

Apr 30, 2025