Norwegian Cruise Line (NCLH) Stock Jumps On Positive Earnings Report

Table of Contents

Key Highlights from the NCLH Earnings Report

The NCLH earnings report revealed several key factors contributing to the company's strong performance and the subsequent NCLH stock price increase.

Strong Revenue Growth

NCLH reported a remarkable [insert percentage]% increase in revenue compared to the previous quarter and a [insert percentage]% increase year-over-year. This robust growth can be attributed to several factors:

- Higher Average Fares: Increased demand allowed NCLH to command higher average fares, boosting overall revenue.

- Increased Onboard Spending: Passengers spent more on onboard amenities and activities, contributing significantly to the revenue growth. This indicates a healthy consumer confidence and willingness to spend during their cruises.

- Strong Booking Growth: The number of bookings significantly increased compared to the same period last year, indicating a robust demand for NCLH cruises. This positive trend is a key indicator of the recovery in the cruise sector. The NCLH revenue growth showcases the company's ability to capitalize on the improving market conditions.

Improved Occupancy Rates

NCLH achieved an occupancy rate of [insert percentage]%, a substantial improvement compared to the [insert previous period's occupancy rate]%. This signifies a strong return to pre-pandemic levels of demand and demonstrates the company's effective capacity utilization. The implications are significant:

- Enhanced Profitability: Higher occupancy rates directly translate to increased profitability, as fixed costs are spread across more passengers.

- Positive Market Sentiment: High occupancy rates reinforce positive market sentiment towards the cruise industry's recovery.

- Future Growth Potential: The improved occupancy rate sets the stage for further growth and expansion in the coming quarters. The NCLH occupancy figures are a testament to the company's successful strategies.

Cost-Cutting Measures and Efficiency Improvements

NCLH implemented several strategic cost-cutting measures, which played a crucial role in improving profitability. These initiatives included:

- Streamlining Operations: NCLH optimized its operational processes to reduce unnecessary expenses.

- Negotiating Better Deals with Suppliers: The company secured more favorable contracts with its suppliers, resulting in lower costs.

- Investing in Technology: The adoption of technology improved efficiency and reduced operational costs. The NCLH cost reduction strategies showcase the company's commitment to financial prudence and long-term sustainability.

Future Outlook and Guidance

NCLH provided a positive outlook for the coming quarters, projecting continued revenue growth and improved profitability. However, the company acknowledged potential challenges:

- Fuel Prices: Fluctuations in fuel prices pose a potential risk to profitability.

- Global Economic Conditions: The global economic climate could influence consumer spending and demand for cruises. Nevertheless, the NCLH forecast remains optimistic, reflecting the company's confidence in its strategies and the cruise market's recovery. The company anticipates robust demand for NCLH cruises in the near future.

Investor Reaction and Market Analysis

The NCLH earnings report generated a strong positive response from investors.

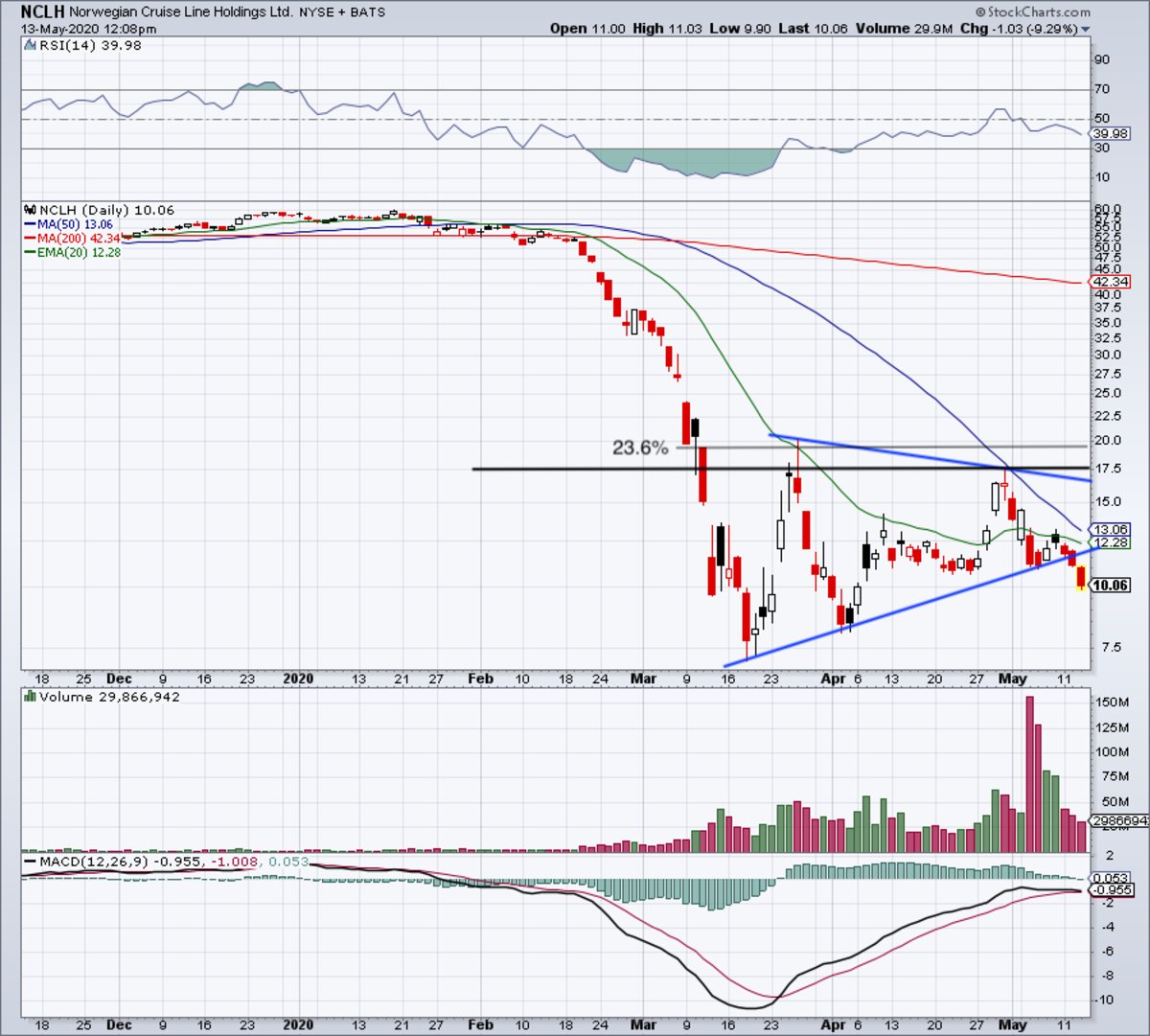

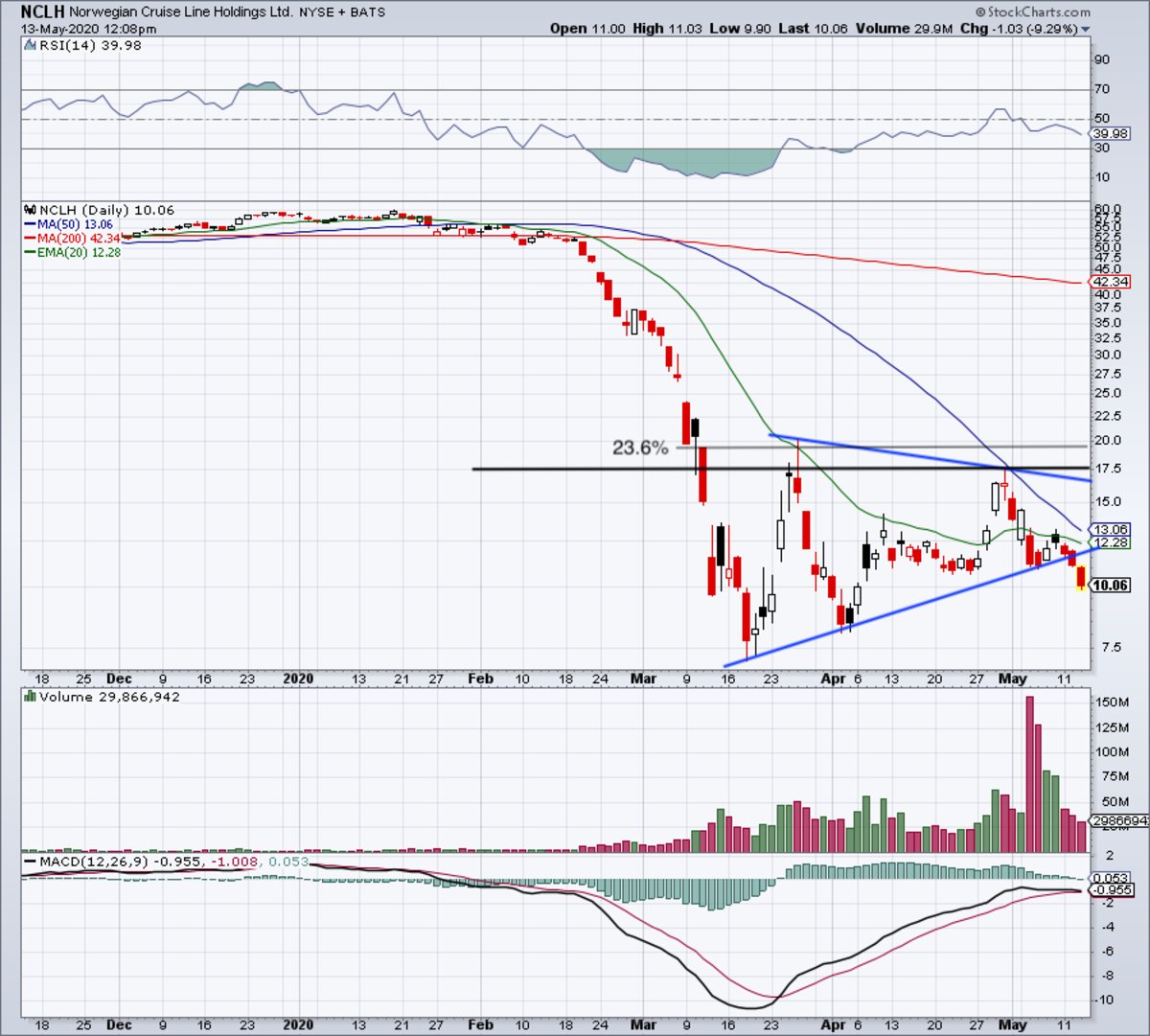

Stock Price Performance

Following the release of the report, the NCLH stock price surged [insert percentage]%, showcasing investor confidence in the company's future prospects. This increase also reflects:

- Increased Trading Volume: A higher than average trading volume suggests strong investor interest.

- Positive Analyst Ratings: Several analysts upgraded their ratings on NCLH stock, further fueling the price increase. The NCLH stock price increase highlights the market's positive assessment of the company's financial performance.

Impact on the Cruise Industry

NCLH's positive earnings report has significant implications for the broader cruise industry:

- Industry Recovery: The strong performance signals a positive trend in the cruise industry's recovery from the pandemic.

- Competitive Landscape: While competitors also experienced growth, NCLH's results indicate its competitive strength and market leadership.

- Investor Sentiment: The positive news surrounding NCLH boosts investor confidence in other cruise stocks. The cruise industry recovery is gaining momentum, and NCLH's performance is a key indicator of this trend.

Conclusion: NCLH Stock: A Strong Signal for the Cruise Industry's Revival

The strong performance of NCLH stock, driven by its positive earnings report, signals a robust recovery for the cruise industry. The key takeaways include significant revenue growth, improved occupancy rates, and successful cost-cutting measures. NCLH's positive outlook further reinforces the optimism surrounding the company's future prospects. Consider researching NCLH stock further to see if it aligns with your investment strategy. The positive trajectory of NCLH offers a compelling investment opportunity within the recovering cruise sector. The NCLH stock outlook remains positive, making it a promising prospect for investors interested in the cruise industry.

Featured Posts

-

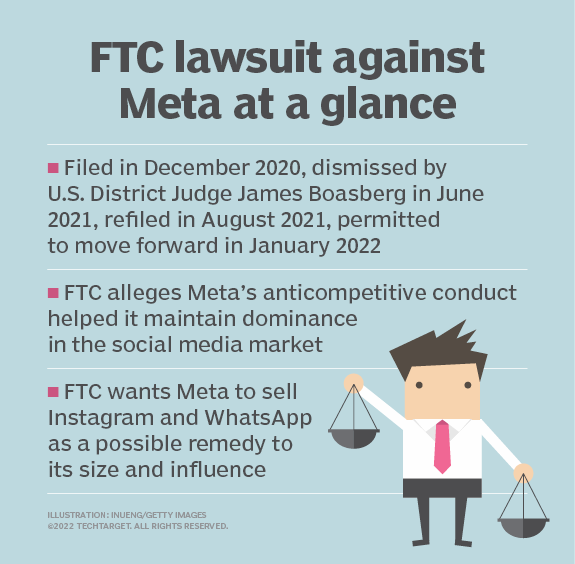

Meta Faces Ftc A Deep Dive Into The Instagram And Whats App Lawsuit

Apr 30, 2025

Meta Faces Ftc A Deep Dive Into The Instagram And Whats App Lawsuit

Apr 30, 2025 -

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii Co Hoi The Thao Va Tinh Than Doan Ket

Apr 30, 2025

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii Co Hoi The Thao Va Tinh Than Doan Ket

Apr 30, 2025 -

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 30, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 30, 2025 -

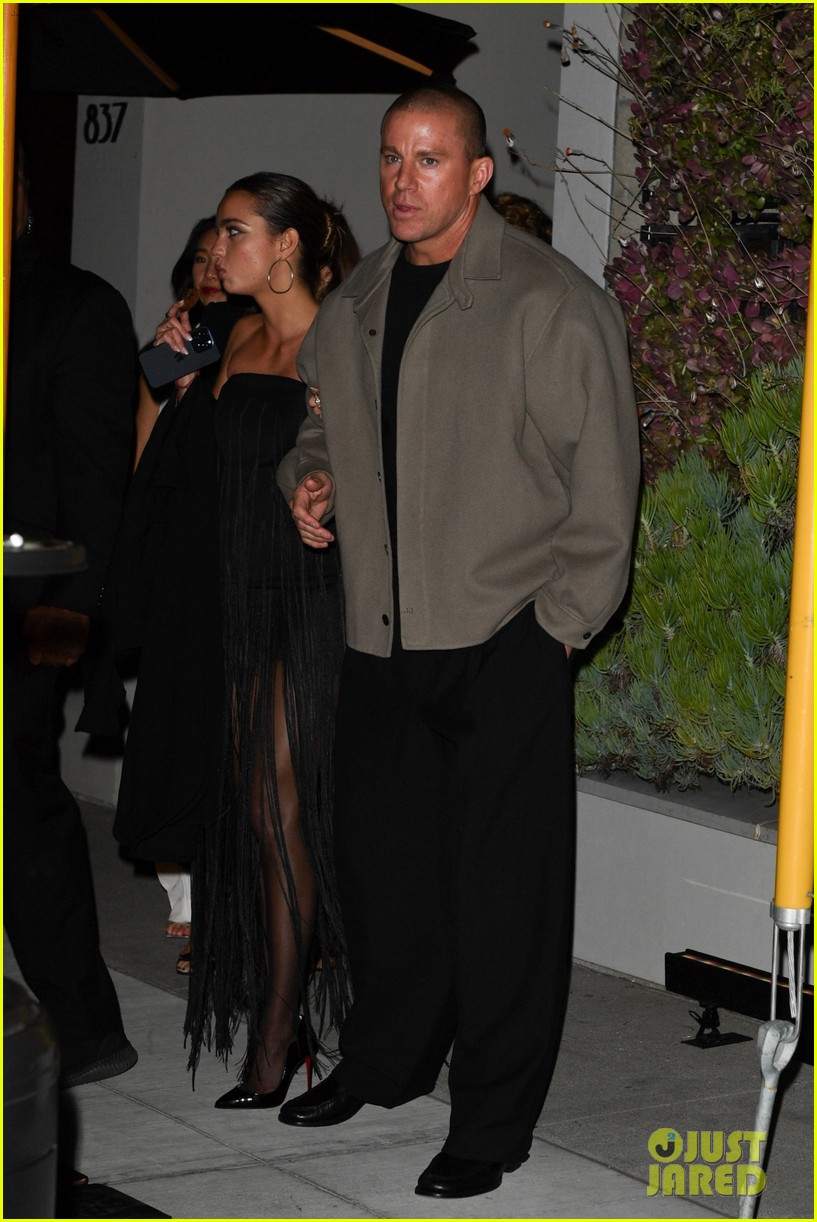

The Channing Tatum And Inka Williams Relationship Key Moments And Milestones

Apr 30, 2025

The Channing Tatum And Inka Williams Relationship Key Moments And Milestones

Apr 30, 2025 -

Da Li Blu Ajvi Zaista Lici Na Bijonse Analiza Izgleda

Apr 30, 2025

Da Li Blu Ajvi Zaista Lici Na Bijonse Analiza Izgleda

Apr 30, 2025

Latest Posts

-

Argamanis Urgent Call Secure Release Of Israeli Hostages

Apr 30, 2025

Argamanis Urgent Call Secure Release Of Israeli Hostages

Apr 30, 2025 -

Trump Legal Team Expands Fourth Firm Joins On Pro Bono Basis

Apr 30, 2025

Trump Legal Team Expands Fourth Firm Joins On Pro Bono Basis

Apr 30, 2025 -

Pro Bono Deal Fourth Firm Averts Sanctions Over Trump Representation

Apr 30, 2025

Pro Bono Deal Fourth Firm Averts Sanctions Over Trump Representation

Apr 30, 2025 -

Analysis Of Trumps Removal Of Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025

Analysis Of Trumps Removal Of Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025 -

Did Bowen Yang Try To Quit Playing Jd Vance On Snl

Apr 30, 2025

Did Bowen Yang Try To Quit Playing Jd Vance On Snl

Apr 30, 2025