Novo Nordisk And Ozempic: Falling Behind In The Competitive Weight-Loss Market

Table of Contents

Increased Competition from Generic and Biosimilar Drugs

The rise of generic and biosimilar GLP-1 receptor agonists is significantly impacting Novo Nordisk's market share. These drugs offer similar efficacy to Ozempic but at significantly lower prices, making them attractive alternatives for patients and healthcare systems. This price difference is a crucial factor driving market share shifts.

-

Specific Competitors: Several competitors, including Mounjaro (tirzepatide), are gaining traction with their own GLP-1 receptor agonists and even dual agonists like Mounjaro offering improved weight loss outcomes compared to older GLP-1 receptor agonists like Ozempic. These newer drugs are not only effective but also aggressively marketed.

-

Pricing Strategies: Competitors are employing various pricing strategies, from direct price competition to value-based pricing, further eroding Ozempic's market position. The introduction of cheaper alternatives puts immense pressure on Novo Nordisk to maintain its market share.

-

Impact on Ozempic Sales: The influx of competitive GLP-1 receptor agonists and the lower prices associated with generics and biosimilars have already begun to noticeably impact Ozempic's sales figures, prompting Novo Nordisk to reassess its strategic positioning.

Supply Chain Issues and Production Challenges

Production delays and shortages of Ozempic have plagued Novo Nordisk, impacting market availability and patient access. These supply chain disruptions have created significant challenges for the company.

-

Bottlenecks: Increased demand coupled with complexities in manufacturing these intricate biological drugs has led to bottlenecks in the production process.

-

Regulatory Hurdles: Regulatory hurdles and approvals can also delay production and contribute to supply shortages. Meeting stringent regulatory requirements for quality control adds to the complexity.

-

Reputational Damage: These shortages have impacted Novo Nordisk's reputation and customer trust, creating an opportunity for competitors to capitalize on unmet needs within the weight-loss market. Patients frustrated by the lack of access might switch to alternative treatments.

Growing Concerns Regarding Side Effects and Long-Term Safety

While Ozempic and other GLP-1 receptor agonists have shown remarkable effectiveness in weight loss, concerns regarding side effects and long-term safety are emerging.

-

Known Side Effects: Nausea, vomiting, constipation, and diarrhea are commonly reported side effects associated with GLP-1 receptor agonists, including Ozempic. More serious side effects, though less common, also exist.

-

Long-Term Studies: Ongoing research is necessary to fully understand the long-term effects and potential risks associated with these drugs. The absence of definitive long-term data fuels patient anxieties.

-

Regulatory Actions: Health authorities are closely monitoring the safety profile of these medications, issuing warnings and guidelines as needed. Negative publicity surrounding side effects can significantly influence patient perception and market demand.

Marketing and Strategic Challenges

Novo Nordisk's marketing strategies, while initially successful, face increasing scrutiny in the face of aggressive competition.

-

Competitive Marketing: Competitors are employing innovative marketing approaches, including digital marketing campaigns and targeted outreach to specific patient populations. Novo Nordisk needs to adapt to remain competitive.

-

Addressing Side Effects: Novo Nordisk's communication strategy regarding Ozempic's side effects needs to be more transparent and proactive. Addressing patient concerns effectively is critical to maintaining confidence.

-

Managing Expectations: Effectively managing patient expectations concerning weight loss outcomes is crucial. Overpromising can lead to disappointment and negative reviews.

Conclusion: The Future of Novo Nordisk and Ozempic in the Weight-Loss Market

Novo Nordisk and Ozempic face significant headwinds in the weight-loss market. Increased competition from generic and biosimilar drugs, supply chain issues, growing safety concerns, and evolving marketing dynamics create considerable uncertainty about Ozempic's continued dominance. Novo Nordisk must address these challenges proactively through new drug development, improved supply chain management, transparent communication about safety, and innovative marketing strategies. The future of the weight-loss market is undeniably competitive, with the long-term success of Ozempic and Novo Nordisk's continued leadership still to be determined. Continue to monitor the Novo Nordisk and Ozempic market closely for updates on competition, new developments, and regulatory changes impacting the weight-loss landscape. Stay informed about the latest in GLP-1 receptor agonist developments and their influence on the future of weight-management treatments.

Featured Posts

-

Kawasaki Meluncurkan Tiga Jet Ski Premium Baru Di Indonesia

May 30, 2025

Kawasaki Meluncurkan Tiga Jet Ski Premium Baru Di Indonesia

May 30, 2025 -

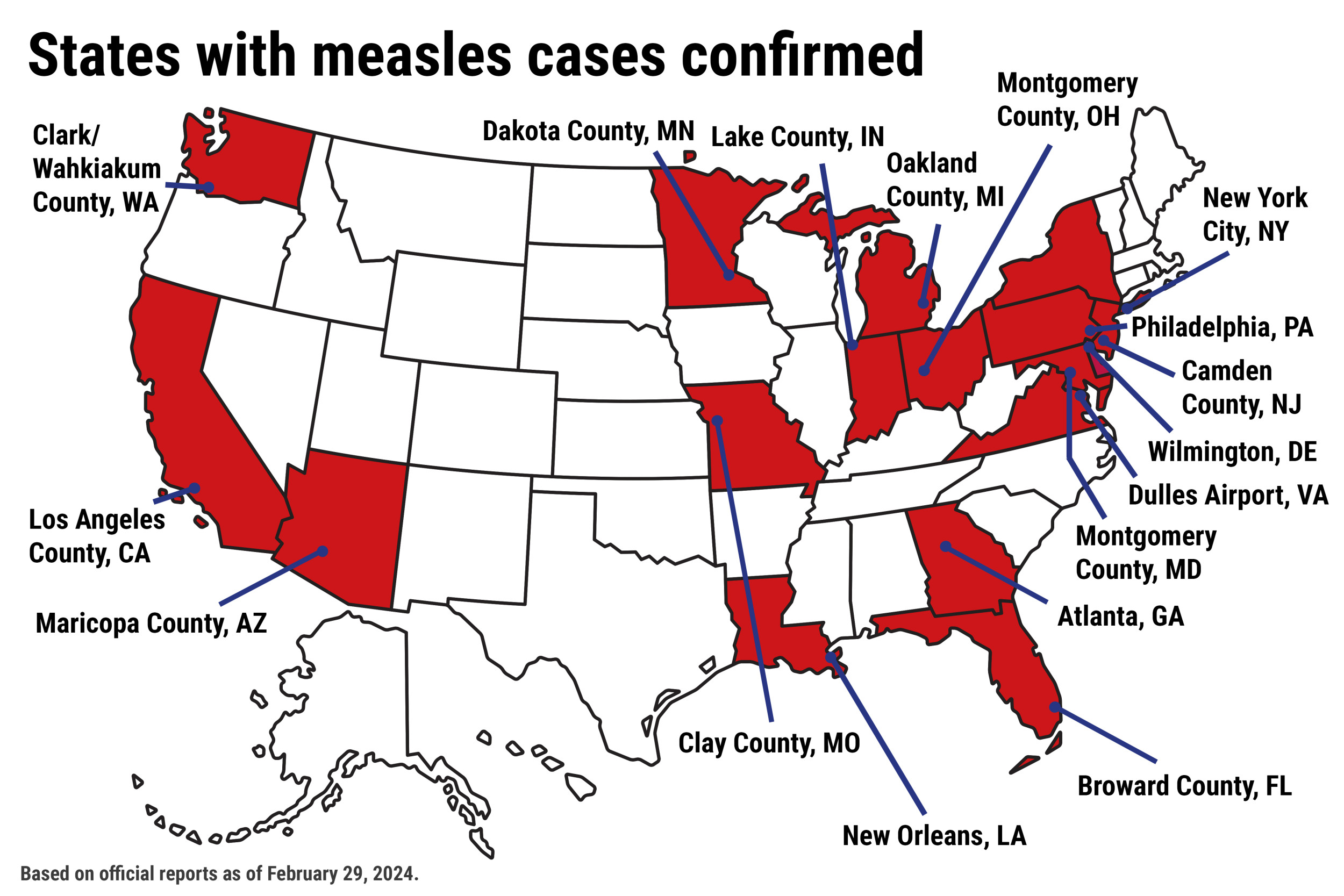

Tracking The Measles Outbreak Latest Case Locations In The United States

May 30, 2025

Tracking The Measles Outbreak Latest Case Locations In The United States

May 30, 2025 -

Orden Ejecutiva De Trump El Fin De La Reventa De Boletos En Ticketmaster

May 30, 2025

Orden Ejecutiva De Trump El Fin De La Reventa De Boletos En Ticketmaster

May 30, 2025 -

Reembolso De Boletos Axe Ceremonia 2025 Guia Completa Ticketmaster

May 30, 2025

Reembolso De Boletos Axe Ceremonia 2025 Guia Completa Ticketmaster

May 30, 2025 -

Novo Nordisk And Ozempic Falling Behind In The Competitive Weight Loss Market

May 30, 2025

Novo Nordisk And Ozempic Falling Behind In The Competitive Weight Loss Market

May 30, 2025

Latest Posts

-

Covid 19 Jn 1 Variant In India Staying Safe Amidst The Outbreak

May 31, 2025

Covid 19 Jn 1 Variant In India Staying Safe Amidst The Outbreak

May 31, 2025 -

Alcarazs Rome Masters Triumph Italian International Success

May 31, 2025

Alcarazs Rome Masters Triumph Italian International Success

May 31, 2025 -

Zverevs Semifinal Run At The Bmw Open In Munich

May 31, 2025

Zverevs Semifinal Run At The Bmw Open In Munich

May 31, 2025 -

Slight Uptick In Covid 19 Cases In India Global Xbb 1 5 Variant Impact

May 31, 2025

Slight Uptick In Covid 19 Cases In India Global Xbb 1 5 Variant Impact

May 31, 2025 -

Important Information Covid 19 Jn 1 Variant Outbreak In India And Its Symptoms

May 31, 2025

Important Information Covid 19 Jn 1 Variant Outbreak In India And Its Symptoms

May 31, 2025