One-Year Ban: Saudi Public Investment Fund Restricts PwC Advisory Services

Table of Contents

The Saudi Public Investment Fund's Decision and its Rationale

The PIF's announcement of the one-year ban on PwC's advisory services came as a surprise to many within the financial and consulting sectors. While the exact reasons haven't been fully disclosed publicly, the PIF cited concerns regarding unspecified failures in PwC's advisory work. The lack of specific details surrounding the reasons behind the ban has fueled speculation and increased scrutiny of both the PIF's decision-making process and PwC's operations in Saudi Arabia.

Key aspects of the ban include:

- Duration: A one-year restriction on providing advisory services.

- Services Affected: The ban encompasses a broad range of advisory services, although the precise scope remains unclear. This ambiguity adds to the uncertainty surrounding the PIF's actions and their potential long-term impact.

- Geographical Scope: The ban specifically targets PwC's operations within Saudi Arabia, impacting its local workforce and projects.

- Financial Implications: The potential financial impact on PwC is substantial, considering the significant number of projects the firm likely had underway with the PIF and other Saudi entities. This loss of revenue could trigger significant adjustments within PwC's regional strategy.

Impact on PwC's Operations and Reputation

The repercussions for PwC are multifaceted and extend beyond immediate financial losses. The short-term effects include a significant disruption of ongoing projects, the potential loss of key personnel, and a scramble to mitigate reputational damage. Long-term consequences might involve difficulty in regaining the PIF's trust and a potential loss of future contracts within the Saudi market, affecting PwC's competitive positioning and growth strategy.

The impact on PwC can be further broken down as follows:

- Loss of Revenue and Contracts: The immediate loss of revenue from suspended PIF projects is substantial, potentially affecting profitability and shareholder value.

- Employee Impact: The ban may lead to layoffs or reassignments within PwC's Saudi Arabian operations, impacting employee morale and talent retention.

- Reputational Damage: The ban undoubtedly tarnishes PwC's reputation, raising concerns about its due diligence practices and potentially impacting its ability to secure future contracts in other regions.

- Legal Ramifications: Depending on the specifics of the PIF's concerns, PwC might face legal repercussions, either from the PIF or from other stakeholders involved in the affected projects.

Broader Implications for the Saudi Arabian Business Landscape

The PIF's decision has significant implications for the broader Saudi Arabian business landscape and its attractiveness to foreign investors. It signals a stricter regulatory environment and a more rigorous evaluation of consulting firms working on projects related to the Kingdom's ambitious Vision 2030 goals. The enhanced scrutiny might deter some international firms, while encouraging others to strengthen their compliance procedures and risk management strategies when operating within Saudi Arabia.

Consider the following broader implications:

- Signal to Other Firms: The ban sends a clear message to other international consulting firms operating in Saudi Arabia, emphasizing the need for rigorous adherence to regulations and high ethical standards.

- Increased Scrutiny: Expect greater government oversight and stricter auditing processes for advisory firms working on large-scale projects within the Kingdom.

- Impact on Public-Private Partnerships: The ban could influence future public-private partnerships, requiring enhanced due diligence and potentially delaying some key projects under Vision 2030.

- Vision 2030 Impact: While potentially disruptive in the short term, the PIF's actions could ultimately contribute to a more robust and transparent business environment, aligning with Vision 2030's objectives for sustainable economic growth.

Potential Future Developments and PwC's Response

The coming months will be crucial in determining how this situation unfolds. PwC's response to the ban will be closely watched, including any potential appeals, legal challenges, or internal reforms to improve compliance and prevent similar incidents in the future. The PIF's future actions will also shape the overall business climate, including its approach to other international consulting firms and its commitment to transparent regulatory processes.

Potential future developments include:

- PwC's Strategy: PwC will likely focus on regaining the PIF's trust through a combination of transparency, remedial actions, and strengthened internal controls.

- Legal Challenges: The possibility of legal challenges by PwC, seeking clarification or contesting the ban, remains open.

- Impact on Other Firms: The ban could spur similar investigations or actions against other consulting firms operating in Saudi Arabia.

- Long-Term Relationship: The long-term relationship between the PIF and international consulting firms will depend heavily on the outcome of this situation and future regulatory clarity.

Conclusion

The one-year ban imposed by the Saudi Public Investment Fund on PwC's advisory services marks a significant event in the Saudi Arabian business landscape. The consequences for PwC are substantial, encompassing financial losses, reputational damage, and potential legal repercussions. For Saudi Arabia, the ban highlights the increased scrutiny on international firms and a strengthened commitment to regulatory oversight. The long-term impact remains to be seen, but it underscores the importance of transparency, accountability, and robust risk management in the Kingdom's evolving business environment. Stay informed on this evolving situation by following reputable news sources and industry publications covering Saudi Arabian finance and business. Learn more about the implications of the PwC advisory services ban and its potential impact on the Saudi Arabian economy and global business.

Featured Posts

-

A Deep Dive Into Ai Cognition Understanding Its Capabilities And Limitations

Apr 29, 2025

A Deep Dive Into Ai Cognition Understanding Its Capabilities And Limitations

Apr 29, 2025 -

Geary County Sheriffs Office Bookings April 24 28 Photo Gallery

Apr 29, 2025

Geary County Sheriffs Office Bookings April 24 28 Photo Gallery

Apr 29, 2025 -

Klarer Sieg Fuer Lask 6 0 Gegen Klagenfurt Bedeutet Gruppensieg

Apr 29, 2025

Klarer Sieg Fuer Lask 6 0 Gegen Klagenfurt Bedeutet Gruppensieg

Apr 29, 2025 -

Are La Landlords Price Gouging After Recent Fires A Celebrity Weighs In

Apr 29, 2025

Are La Landlords Price Gouging After Recent Fires A Celebrity Weighs In

Apr 29, 2025 -

Firefighters Investigate Gas Leak Downtown Louisville Buildings Evacuated

Apr 29, 2025

Firefighters Investigate Gas Leak Downtown Louisville Buildings Evacuated

Apr 29, 2025

Latest Posts

-

Trakiyski Khramove Kray Stara Zagora Kmett Na Khisarya Nastoyava Za Restavratsiya

Apr 30, 2025

Trakiyski Khramove Kray Stara Zagora Kmett Na Khisarya Nastoyava Za Restavratsiya

Apr 30, 2025 -

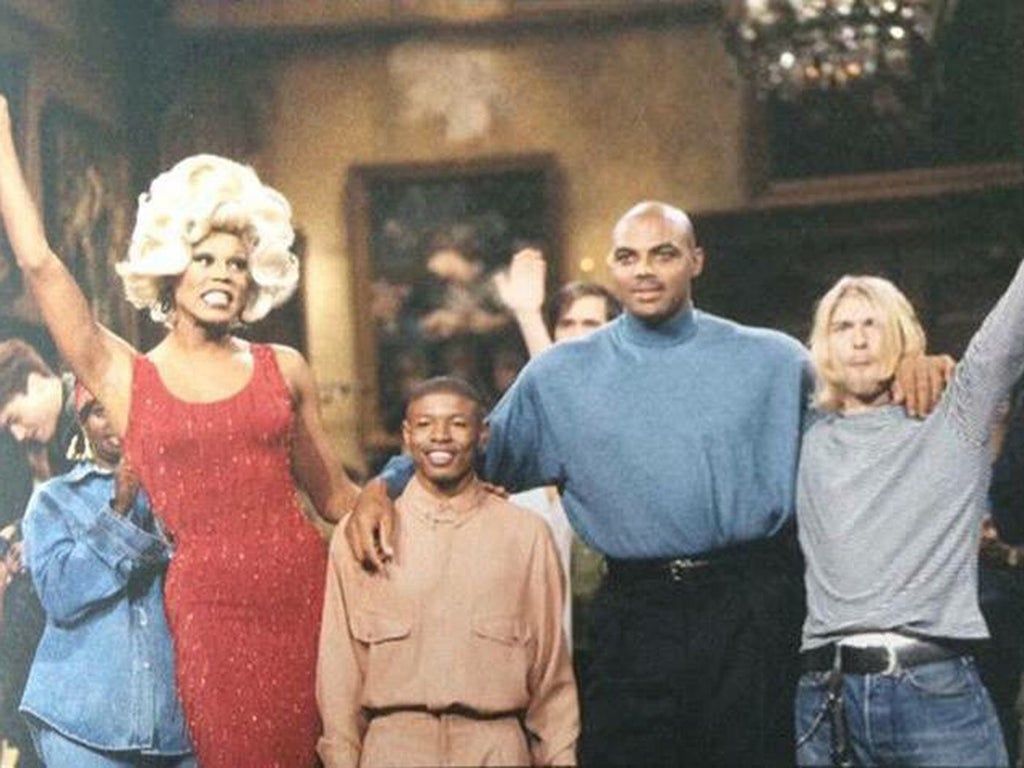

Charles Barkley And A Ru Pauls Drag Race Star A Connection You Wont Believe

Apr 30, 2025

Charles Barkley And A Ru Pauls Drag Race Star A Connection You Wont Believe

Apr 30, 2025 -

Obnovyavane Na Trakiyski Khramove Kmett Na Khisarya Otpravya Iskane

Apr 30, 2025

Obnovyavane Na Trakiyski Khramove Kmett Na Khisarya Otpravya Iskane

Apr 30, 2025 -

Unexpected Family Nba Legend And Ru Pauls Drag Race Star

Apr 30, 2025

Unexpected Family Nba Legend And Ru Pauls Drag Race Star

Apr 30, 2025 -

Zaschita Na Kulturnoto Nasledstvo Kmett Na Khisarya Trsi Sredstva Za Trakiyskite Khramove

Apr 30, 2025

Zaschita Na Kulturnoto Nasledstvo Kmett Na Khisarya Trsi Sredstva Za Trakiyskite Khramove

Apr 30, 2025