Operation Sindoor: Pakistan Stock Market Plunges Over 6%, KSE 100 Halted

Table of Contents

The Triggers Behind the Pakistan Stock Market Plunge

Several interconnected factors contributed to this sharp Pakistan Stock Market plunge. Let's examine the key triggers:

Impact of Operation Sindoor: A Catalyst for Uncertainty

The term "Operation Sindoor" (please replace this with the accurate and verifiable name of the operation if different and cite the source) refers to [Insert detailed and accurate description of Operation Sindoor and its policies, citing reliable sources]. This operation's immediate impact on investor confidence was severe, primarily due to:

- Increased Regulatory Scrutiny: The new policies introduced uncertainty regarding future regulations, causing apprehension among investors.

- Withdrawal of Foreign Investment: Concerns about the implications of Operation Sindoor led to a significant outflow of foreign investment, further destabilizing the market.

- Currency Devaluation: The operation's impact on the Pakistani Rupee contributed to currency devaluation, impacting investor sentiment and eroding the value of investments.

Geopolitical Instability: A Looming Shadow

Geopolitical instability in the region played a significant role in exacerbating the Pakistan Stock Market crash. The keywords "geopolitical risk," "regional tensions," and "global economic uncertainty" are all highly relevant here.

- [Cite specific geopolitical events and explain their influence on investor confidence. For example: Increased tensions with neighboring countries, global sanctions, etc.]

- [Explain how these events created uncertainty and discouraged investment.]

Economic Factors: Underlying Vulnerabilities Exposed

Pakistan's existing economic challenges were significantly amplified by Operation Sindoor, leading to the dramatic Pakistan Stock Market plunge. Keywords such as "inflation," "debt crisis," "currency devaluation," and "economic slowdown" are crucial in understanding this aspect.

- High Inflation: Soaring inflation eroded purchasing power and dampened consumer confidence, negatively impacting the market.

- High Debt Levels: Pakistan's already substantial debt burden became a significant concern for investors, further diminishing confidence.

- Depleting Foreign Exchange Reserves: Falling foreign exchange reserves signaled potential economic instability, triggering capital flight.

Consequences of the Pakistan Stock Market Crash

The consequences of this sharp Pakistan Stock Market crash are far-reaching and impact various aspects of the Pakistani economy.

Investor Losses: A Heavy Toll

The market plunge resulted in substantial financial losses for investors across the board.

- Retail Investors: Many retail investors experienced significant losses in their portfolios, potentially impacting their savings and financial stability. [Quantify the percentage loss if possible, citing sources].

- Institutional Investors: Institutional investors also suffered considerable losses, impacting their investment strategies and future investment plans. [Quantify the percentage loss if possible, citing sources].

- Overall Market Capitalization: The KSE 100 index's decline led to a substantial reduction in overall market capitalization, reflecting the severity of the crash.

Economic Impact: Ripple Effects Across Sectors

The Pakistan Stock Market crash has triggered a cascade of negative economic consequences.

- GDP Contraction: The downturn is likely to contribute to a contraction in GDP growth, slowing economic progress.

- Reduced Foreign Investment: The crash will likely deter foreign investment, hampering economic development and growth.

- Potential Job Losses: The economic slowdown could lead to job losses across various sectors, further exacerbating the crisis.

Government Response: Attempts at Stabilization

The Pakistani government has responded to the crash with [Describe the government's immediate response and any planned measures to stabilize the market and address the underlying economic issues, citing sources].

- [List specific policy changes or support measures announced by the government.]

- [Assess the effectiveness and potential impact of these measures.]

Future Outlook for the Pakistan Stock Market

The future of the Pakistan Stock Market remains uncertain, with both potential for recovery and significant risks.

Potential for Recovery: A Path to Stability?

Several factors could contribute to a market recovery:

- Successful Economic Reforms: Implementation of effective economic reforms could restore investor confidence and attract foreign investment.

- Improved Investor Sentiment: Positive developments in the economic and geopolitical landscape could boost investor sentiment.

- Resolution of Geopolitical Tensions: Easing of regional tensions could reduce uncertainty and improve the investment climate.

Risks and Uncertainties: Navigating the Challenges

Several challenges could hinder a swift recovery:

- Market Volatility: Continued market volatility could deter investors and prolong the recovery process.

- Economic Fragility: The underlying economic vulnerabilities could continue to pose significant risks.

- Political Risks: Political instability could further destabilize the market and hinder economic recovery.

Understanding and Navigating the Pakistan Stock Market Plunge

The significant Pakistan Stock Market plunge, driven by a confluence of factors including [mention key factors: Operation Sindoor, geopolitical instability, and economic vulnerabilities], has had severe consequences for investors and the broader Pakistani economy. While there's potential for recovery, significant uncertainties and risks remain. It is crucial to monitor the Pakistan Stock Market closely, stay updated on the KSE 100 performance, and consult with financial advisors before making any investment decisions. Make informed investment decisions regarding the Pakistan Stock Market. The situation warrants careful attention and a cautious approach to investing.

Featured Posts

-

West Hams Financial Predicament A 25m Funding Gap

May 10, 2025

West Hams Financial Predicament A 25m Funding Gap

May 10, 2025 -

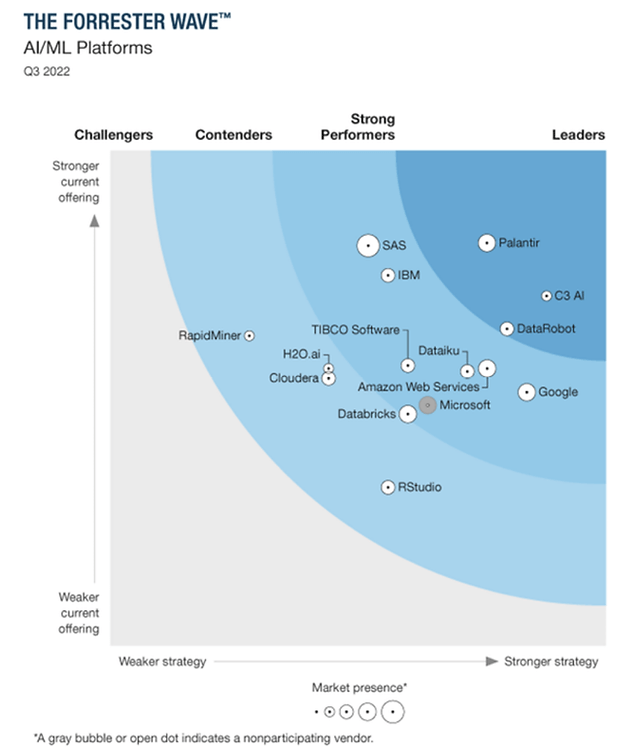

Will Palantir Be A Trillion Dollar Company By 2030 An In Depth Analysis

May 10, 2025

Will Palantir Be A Trillion Dollar Company By 2030 An In Depth Analysis

May 10, 2025 -

Nyt Strands April 10th Game 403 Complete Solution Guide

May 10, 2025

Nyt Strands April 10th Game 403 Complete Solution Guide

May 10, 2025 -

Harry Styles Debuts Retro Mustache In London

May 10, 2025

Harry Styles Debuts Retro Mustache In London

May 10, 2025 -

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 10, 2025

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 10, 2025