Pakistan Stock Market: Current Status And The Reasons Behind Recent Volatility

Table of Contents

Current Status of the Pakistan Stock Exchange (PSX)

The Pakistan Stock Exchange (PSX), as measured by the KSE-100 index, has shown mixed performance in recent times. While experiencing periods of growth, significant volatility has characterized the market, impacting investor confidence and overall market capitalization.

- Recent index movements: The KSE-100 index has shown a [Insert Percentage Change]% change over the last month and a [Insert Percentage Change]% change over the last year. This fluctuation reflects the interplay of various economic and political factors.

- Key sectors showing growth: The technology sector and select segments within the energy sector have demonstrated relative strength, driven by [mention specific reasons, e.g., government initiatives, technological advancements]. Consumer goods, particularly those catering to a growing middle class, have also shown some resilience.

- Sectors experiencing decline: The textile and cement sectors have faced challenges, largely attributed to [mention specific reasons, e.g., global economic slowdown, rising input costs, competition].

- Foreign investment inflow/outflow: Foreign investment has been [Insert whether inflow or outflow and quantify] in recent months, largely influenced by [mention specific reasons, e.g., global investor sentiment, political instability, economic uncertainty].

- Investor sentiment: Current investor sentiment can be described as [bullish/bearish/cautiously optimistic], reflecting the prevailing uncertainty and the need for a clear understanding of the underlying economic and political forces.

Macroeconomic Factors Influencing Volatility

Several macroeconomic indicators significantly influence the volatility of the PSX. Understanding these factors is critical for any investment strategy.

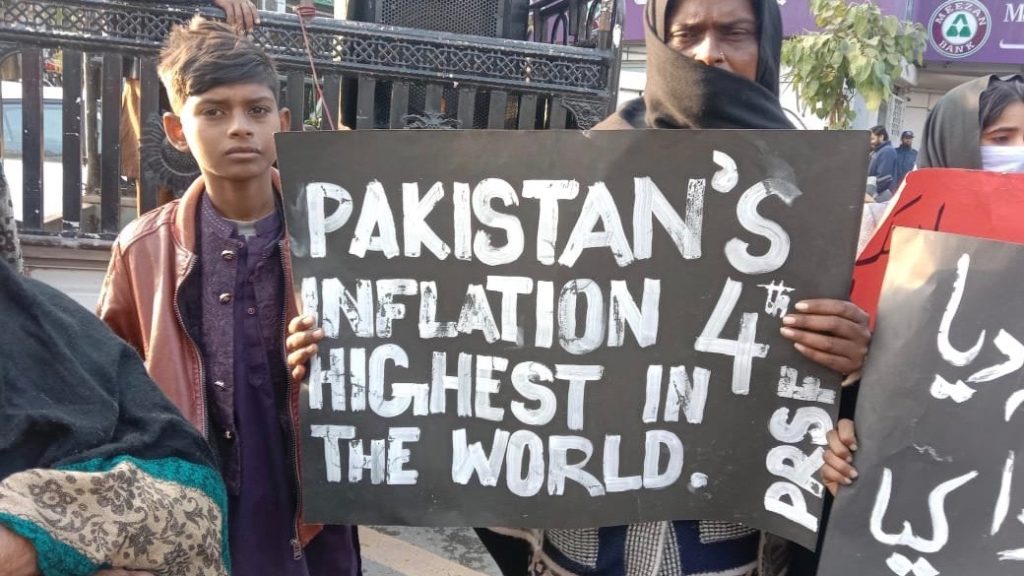

- Inflation rate and its effect on investor confidence: High inflation rates erode purchasing power and increase uncertainty, impacting investor confidence and potentially leading to capital flight. The current inflation rate in Pakistan is [Insert Current Inflation Rate] and its impact on the PSX is [Describe the impact].

- Interest rate hikes/cuts by the State Bank of Pakistan (SBP) and their consequences: The State Bank of Pakistan's monetary policy decisions, particularly interest rate adjustments, directly affect borrowing costs for businesses and investors. Recent interest rate [hikes/cuts] have [positively/negatively] impacted investor sentiment and market activity.

- Currency exchange rate fluctuations (Pakistani Rupee against the US dollar): Fluctuations in the Pakistani Rupee's value against major currencies like the US dollar can significantly impact import costs, inflation, and overall economic stability, influencing investor behavior on the PSX. The current exchange rate is [Insert Current Exchange Rate] and its volatility is [Describe the volatility and impact].

- Government policies and their influence on specific sectors: Government policies, including fiscal and monetary policies, significantly influence the performance of different sectors within the PSX. [Provide specific examples of government policies and their impact].

- Impact of global economic events on the Pakistani market: Global economic events, such as changes in commodity prices, global interest rate adjustments, and geopolitical instability, can impact the Pakistani market indirectly but significantly. For example, [Mention a recent global event and its impact on the PSX].

Impact of Geopolitical Events

Geopolitical factors play a crucial role in shaping the Pakistan Stock Market's performance.

- Political stability within Pakistan and its effect on investor confidence: Political stability is paramount for investor confidence. Periods of political uncertainty tend to negatively affect the PSX. [Provide examples of how political events impact the PSX].

- Regional tensions and their influence on the market: Regional tensions and conflicts can significantly impact investor sentiment and lead to capital flight. [Give examples of regional conflicts and their impact].

- International relations and their impact on foreign investment: Pakistan's international relations and its standing in the global community influence foreign investment flows into the PSX. [Discuss the impact of international relations on foreign investments].

Sector-Specific Analysis

Analyzing individual sectors offers a nuanced understanding of the PSX’s performance.

- Banking sector: The banking sector's performance is closely tied to macroeconomic conditions, particularly interest rates and inflation. [Discuss the recent performance, challenges, and opportunities within the banking sector].

- Energy sector: The energy sector is vital for Pakistan's economy, but its performance is influenced by global energy prices and government policies. [Discuss the recent performance, challenges, and opportunities within the energy sector].

- Technology sector: The technology sector presents both opportunities and challenges, with growth potential dependent on technological advancements and digital adoption. [Discuss the recent performance, challenges, and opportunities within the technology sector].

Future Outlook and Investment Strategies

The future outlook for the PSX remains uncertain, requiring careful consideration of both risks and opportunities.

- Potential risks and opportunities in the coming months/years: Potential risks include ongoing macroeconomic challenges, geopolitical uncertainties, and sector-specific vulnerabilities. Opportunities exist in sectors poised for growth given the right conditions and supportive government policies.

- Suggested investment strategies for different risk tolerances: Investors with higher risk tolerance might consider investments in growth sectors, while those with lower risk tolerance might prefer more stable, established sectors. Diversification across sectors is crucial.

- Importance of diversification: Diversifying investments across multiple sectors and asset classes minimizes risk and maximizes potential returns.

Conclusion

The Pakistan Stock Market currently presents a complex investment landscape influenced by macroeconomic conditions, geopolitical factors, and sector-specific dynamics. Understanding the interplay of these factors is essential for navigating the volatility and making informed investment decisions. The KSE-100 index reflects the challenges and opportunities present. While certain sectors display growth potential, others face significant headwinds. Staying informed about the Pakistan Stock Market’s performance and the latest developments is crucial for making well-informed investment decisions. Conduct thorough research and consider consulting with a financial advisor before investing in the Pakistan Stock Market.

Featured Posts

-

Pakistan Economic Crisis Imf Review And Geopolitical Implications

May 09, 2025

Pakistan Economic Crisis Imf Review And Geopolitical Implications

May 09, 2025 -

Barbwza Yfqd Asnanh Tfasyl Merkt Marakana Almsyryt

May 09, 2025

Barbwza Yfqd Asnanh Tfasyl Merkt Marakana Almsyryt

May 09, 2025 -

Sensex Today Live Stock Market Updates Nifty Above 23 800

May 09, 2025

Sensex Today Live Stock Market Updates Nifty Above 23 800

May 09, 2025 -

High Down Payments And The Canadian Dream An Affordable Housing Crisis

May 09, 2025

High Down Payments And The Canadian Dream An Affordable Housing Crisis

May 09, 2025 -

Madeleine Mc Cann Imposter Apprehended At Uk Airport

May 09, 2025

Madeleine Mc Cann Imposter Apprehended At Uk Airport

May 09, 2025