Palantir Stock Investment: Weighing The Pros And Cons Before May 5th

Table of Contents

Palantir's Potential for Growth

Palantir Technologies (PLTR) operates in a rapidly expanding market, presenting significant opportunities for growth. Its success hinges on two key pillars: its strong foothold in government contracts and its accelerating expansion into the commercial sector.

Palantir Government Contracts and Revenue

Palantir's substantial presence in government contracts provides a relatively stable and predictable revenue stream. The company works with numerous agencies, including those within the defense, intelligence, and homeland security sectors. These contracts often involve long-term partnerships and substantial funding.

- Significant Government Contracts: Palantir has secured numerous multi-year contracts, contributing significantly to its recurring revenue. These contracts demonstrate a consistent demand for its data analytics and AI-powered platforms.

- Expansion into New Government Sectors: Palantir is actively pursuing opportunities beyond its existing client base, targeting new government agencies and exploring applications in areas like healthcare and public safety. This diversification strategy minimizes reliance on any single contract.

- Government Spending on Technology: Increased government spending on advanced technology, particularly in data analytics and artificial intelligence, positions Palantir favorably for continued growth. This trend is expected to sustain demand for Palantir's offerings.

The combination of existing contracts and the potential for expansion within the government sector makes Palantir's government revenue a significant driver of future growth, bolstering its Palantir government contracts and Palantir revenue growth.

Palantir Commercial Market Expansion

While government contracts form a crucial part of Palantir's revenue, its commercial expansion is equally critical for long-term success. The company has made significant strides in attracting clients across various sectors.

- Key Commercial Partnerships: Palantir has formed strategic partnerships with major players in finance, healthcare, and other industries, opening doors to a wider range of clients. These partnerships leverage existing infrastructure and expand Palantir's reach.

- Successful Commercial Implementations: Demonstrating successful deployments and tangible results for commercial clients strengthens Palantir's credibility and attracts further business. Case studies highlighting the value proposition are crucial in this space.

- Market Share Growth: Palantir is actively competing for market share in the commercial sector. Success here hinges on the company's ability to adapt its solutions to meet the specific needs of various industries while maintaining its technological advantage. This is a key element of Palantir commercial growth and Palantir market share.

Palantir Technological Innovation and Future Products

Palantir's commitment to research and development is a key factor driving its potential. The company continually innovates and develops new products and features to stay ahead of the competition.

- AI and Machine Learning: Palantir's integration of artificial intelligence and machine learning capabilities enhances the value and efficiency of its platforms. This provides a competitive edge and drives further adoption.

- New Product Development: The company consistently introduces new products and services catering to evolving market demands. This demonstrates adaptability and helps maintain a strong position in the data analytics landscape. Palantir technology, Palantir AI, and Palantir innovation are crucial aspects of this ongoing development.

Risks Associated with Palantir Stock

Despite its potential, investing in Palantir stock carries significant risks that potential investors must carefully consider.

High Valuation and Stock Price Volatility

Palantir's stock price has historically experienced significant volatility. This is partly due to its high valuation and sensitivity to market sentiment.

- Market Corrections: A downturn in the broader market can disproportionately impact high-growth stocks like Palantir, leading to substantial price drops.

- Valuation Concerns: Some investors express concerns about Palantir's valuation relative to its current earnings. This presents a risk if the company fails to meet growth expectations. Understanding Palantir stock price, Palantir valuation, and Palantir volatility is crucial before investing.

Competition and Market Saturation

The data analytics and AI market is becoming increasingly competitive. Palantir faces established players and numerous emerging companies vying for market share.

- Key Competitors: Palantir competes with companies like AWS, Google Cloud, and Microsoft Azure, all of which offer similar data analytics and AI services.

- Market Saturation Risk: As the market matures, the risk of saturation increases, potentially squeezing profit margins and hindering growth. Analyzing Palantir competitors and understanding the data analytics market is vital.

Dependence on a Few Key Clients

Palantir's revenue is somewhat concentrated among a few key clients, mainly government agencies. This creates dependence and vulnerability.

- Client Concentration Risk: The loss of a significant contract could have a substantial negative impact on Palantir's financial performance.

- Diversification Strategies: Palantir is actively working to diversify its client base to mitigate this risk, but this remains a factor to consider. This speaks to the risk of Palantir clients and client concentration risk.

Analyzing Palantir Before May 5th

Before making any investment decision, a thorough analysis is essential.

Reviewing Financial Statements

Carefully examine Palantir's financial statements, paying attention to key metrics such as revenue growth, profitability, debt levels, and cash flow.

Considering News and Analyst Reports

Stay informed about recent news, developments, and analyst reports concerning Palantir. This will give you a better understanding of current market sentiment and future expectations.

Evaluating Your Risk Tolerance

Investing in Palantir involves significant risk. Ensure your investment aligns with your personal risk tolerance and overall investment strategy.

Conclusion

Investing in Palantir stock presents both exciting opportunities and significant risks. Thoroughly evaluating its growth potential, considering the competitive landscape, and analyzing its financial health before May 5th is crucial for informed decision-making. The company's strong government presence and growing commercial business create substantial upside potential, but its high valuation, competitive landscape, and client concentration pose significant challenges.

Call to Action: Before making any Palantir stock investment decisions, conduct thorough due diligence, consult with a financial advisor, and carefully weigh the pros and cons discussed in this article. Make an informed decision on your Palantir investment strategy. Remember to research Palantir stock thoroughly before investing.

Featured Posts

-

Sensex 600 Nifty

May 09, 2025

Sensex 600 Nifty

May 09, 2025 -

Sensex And Nifty Live Updates Market Performance And Analysis

May 09, 2025

Sensex And Nifty Live Updates Market Performance And Analysis

May 09, 2025 -

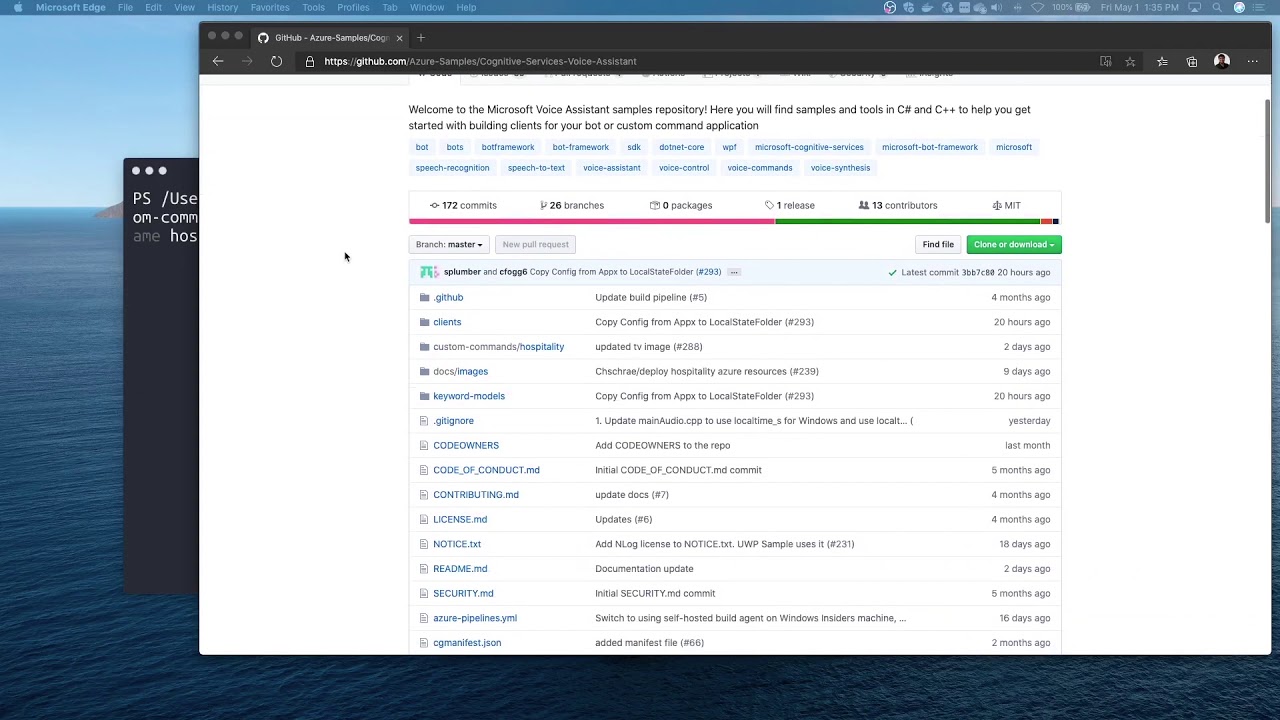

Building Voice Assistants Made Easy Open Ais Latest Developer Tools

May 09, 2025

Building Voice Assistants Made Easy Open Ais Latest Developer Tools

May 09, 2025 -

Harry Styles Response To A Critically Bad Snl Impression

May 09, 2025

Harry Styles Response To A Critically Bad Snl Impression

May 09, 2025 -

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025