U.S.-China Trade Talks: De-escalation Efforts This Week

Table of Contents

Key Players and Their Objectives in the U.S.-China Trade Talks

The success of these U.S.-China trade talks hinges on the objectives and negotiating strategies of the key players involved. Understanding these differing perspectives is crucial to predicting the outcome.

The United States' Stance

The United States enters these negotiations with a clear set of demands focused on achieving a more balanced and reciprocal trade relationship. Their primary objectives include:

- Intellectual Property Protection: Strengthening protections for American intellectual property rights, combating forced technology transfer, and preventing theft of trade secrets.

- Fairer Market Access: Securing greater access to the Chinese market for American goods and services, reducing non-tariff barriers, and ensuring a level playing field for American companies.

- Addressing the Trade Deficit: Reducing the significant trade imbalance between the two countries through increased exports and decreased imports.

Specific demands include:

- Significant reductions in tariffs on agricultural products.

- Concrete commitments to end forced technology transfer practices.

- Addressing concerns about currency manipulation and its impact on trade.

High-level officials like U.S. Trade Representative Katherine Tai and Treasury Secretary Janet Yellen are central to shaping and executing U.S. strategy in these U.S.-China trade talks, and their public statements provide valuable insights into the administration's priorities.

China's Negotiating Position

China's negotiating position is complex, balancing the need for economic growth with the desire to avoid further escalation of the trade war. While China may offer concessions in certain areas, they will likely prioritize protecting their domestic industries and maintaining economic stability. Potential areas of flexibility include:

- Increased purchases of American agricultural products.

- Easing some restrictions on foreign investment in certain sectors.

- Addressing specific concerns regarding intellectual property protection, albeit potentially with caveats.

However, China is also expected to push back strongly on demands that are seen as infringing upon its sovereignty or undermining its long-term economic goals. The statements of Chinese officials, such as Vice Premier Liu He, offer vital counterpoints to the US perspective within the larger context of U.S.-China trade relations.

Potential Outcomes of the Current U.S.-China Trade Talks

The current U.S.-China trade talks could yield a range of outcomes, from a comprehensive agreement to a prolonged stalemate.

A Comprehensive Trade Deal

The ideal scenario would involve a comprehensive trade agreement addressing the core concerns of both nations. This would likely include:

- Significant reductions or eliminations of tariffs on a wide range of goods.

- Enhanced market access for American businesses in China.

- Stronger enforcement mechanisms for intellectual property rights.

Such a deal would offer substantial economic benefits for both countries, boosting global trade and investor confidence. However, achieving a comprehensive agreement requires significant concessions from both sides and navigating complex political realities. Analyzing the economic impact across various sectors – from manufacturing to agriculture – is vital to fully understanding this potential outcome's ripple effects.

A Partial Agreement or Stalemate

A less optimistic outcome could involve a partial agreement addressing only limited issues, or a complete stalemate where negotiations fail to produce any significant progress. Potential scenarios include:

- Continued high tariffs on certain goods.

- Limited concessions from either side, resulting in an unsatisfactory outcome.

- A prolonged period of trade tension, further damaging the global economy.

The economic and political repercussions of a partial agreement or stalemate would be significant, impacting global supply chains, investor confidence, and the broader geopolitical landscape.

Market Reactions and Global Implications of the U.S.-China Trade Talks

The outcome of these U.S.-China trade talks will have profound implications for global markets and geopolitical stability.

Impact on Global Markets

The uncertainty surrounding the talks has already created volatility in global stock markets. The outcome will significantly impact:

- Global stock market indices (e.g., Dow Jones, S&P 500, Shanghai Composite).

- Supply chains dependent on trade between the U.S. and China.

- Investor confidence in both countries and the global economy.

Experts predict increased market volatility in the short term, with potential for either substantial gains or losses depending on the agreement reached, or lack thereof.

Geopolitical Ramifications

The U.S.-China trade relationship has significant geopolitical implications, influencing:

- Alliances between nations and their trade agreements.

- Global trade dynamics and the stability of the multilateral trading system.

- The broader relationship between the U.S. and China across various global issues.

The outcome of these talks could significantly impact the global balance of power and reshape international relations for years to come.

Conclusion

The outcome of this week's U.S.-China trade talks will significantly impact global trade and economic stability. While hopes for de-escalation are high, the potential for both positive and negative resolutions exists. Close monitoring of the developments and understanding the diverse perspectives of key players are crucial. Staying informed on the progress of these critical U.S.-China trade talks is vital for businesses and investors alike. Continue to follow the latest updates to navigate the evolving landscape of U.S.-China trade relations and make informed decisions.

Featured Posts

-

Pakistan Stock Exchange Portal Down Volatility Amidst Rising Tensions

May 09, 2025

Pakistan Stock Exchange Portal Down Volatility Amidst Rising Tensions

May 09, 2025 -

Fiery Exchange Fox News Hosts Debate Trump Tariffs

May 09, 2025

Fiery Exchange Fox News Hosts Debate Trump Tariffs

May 09, 2025 -

Psychologists Controversial Claim Is Daycare Harmful To Children

May 09, 2025

Psychologists Controversial Claim Is Daycare Harmful To Children

May 09, 2025 -

5 Must Read Stephen King Books For True Fans

May 09, 2025

5 Must Read Stephen King Books For True Fans

May 09, 2025 -

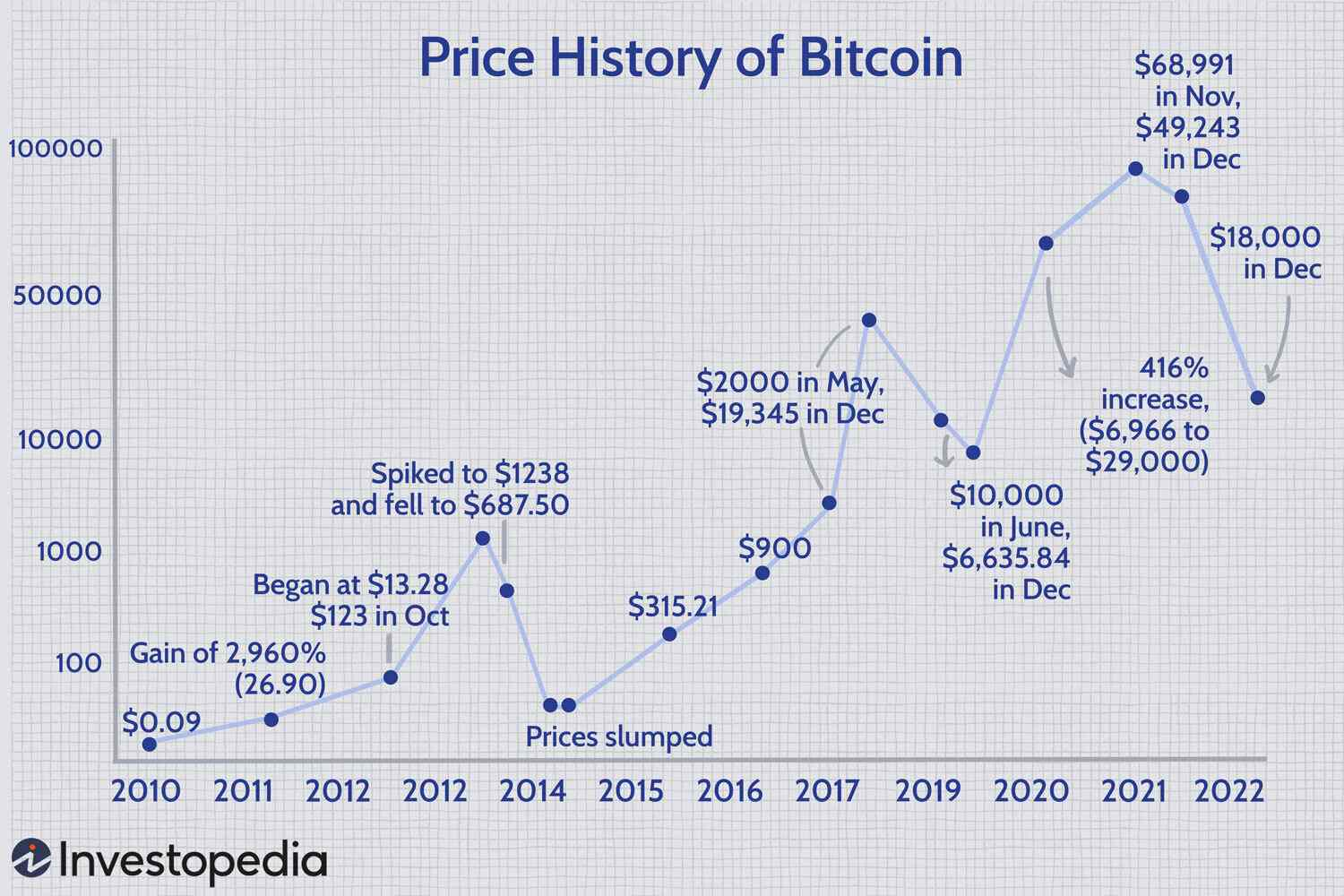

Bitcoin Price Prediction Evaluating The 100 000 Target After Trumps Speech

May 09, 2025

Bitcoin Price Prediction Evaluating The 100 000 Target After Trumps Speech

May 09, 2025