Palantir's Competitors: 2 Stocks Projected For Higher Value In 3 Years

Table of Contents

Analyzing Potential Palantir Competitors: Key Selection Criteria

To identify promising Palantir competitors, we applied rigorous selection criteria focusing on long-term growth and sustainable competitive advantages. This involved a comprehensive assessment across several key areas:

Market Capitalization and Growth Trajectory

We prioritized companies demonstrating robust and consistent revenue growth, indicating strong market traction and a healthy expansion trajectory. This includes:

- Focus on companies with consistent revenue growth and expanding market share. A history of exceeding expectations and capturing increasing market share signifies a strong competitive position.

- Consider companies with strong potential for expansion into new markets or segments. Companies with adaptable business models and the ability to diversify into adjacent markets possess higher growth potential. This is crucial in the dynamic big data landscape.

Technological Differentiation and Competitive Advantage

A key differentiator is the presence of unique technologies or business models that provide a competitive edge against established players like Palantir. This includes evaluating:

- Assess the strength of their intellectual property and its defensibility. Strong patent portfolios and proprietary technologies provide a significant barrier to entry and protect against competition.

- Evaluate the scalability and adaptability of their technology. The ability to handle increasing data volumes and adapt to evolving market demands is crucial for long-term success in the big data analytics space.

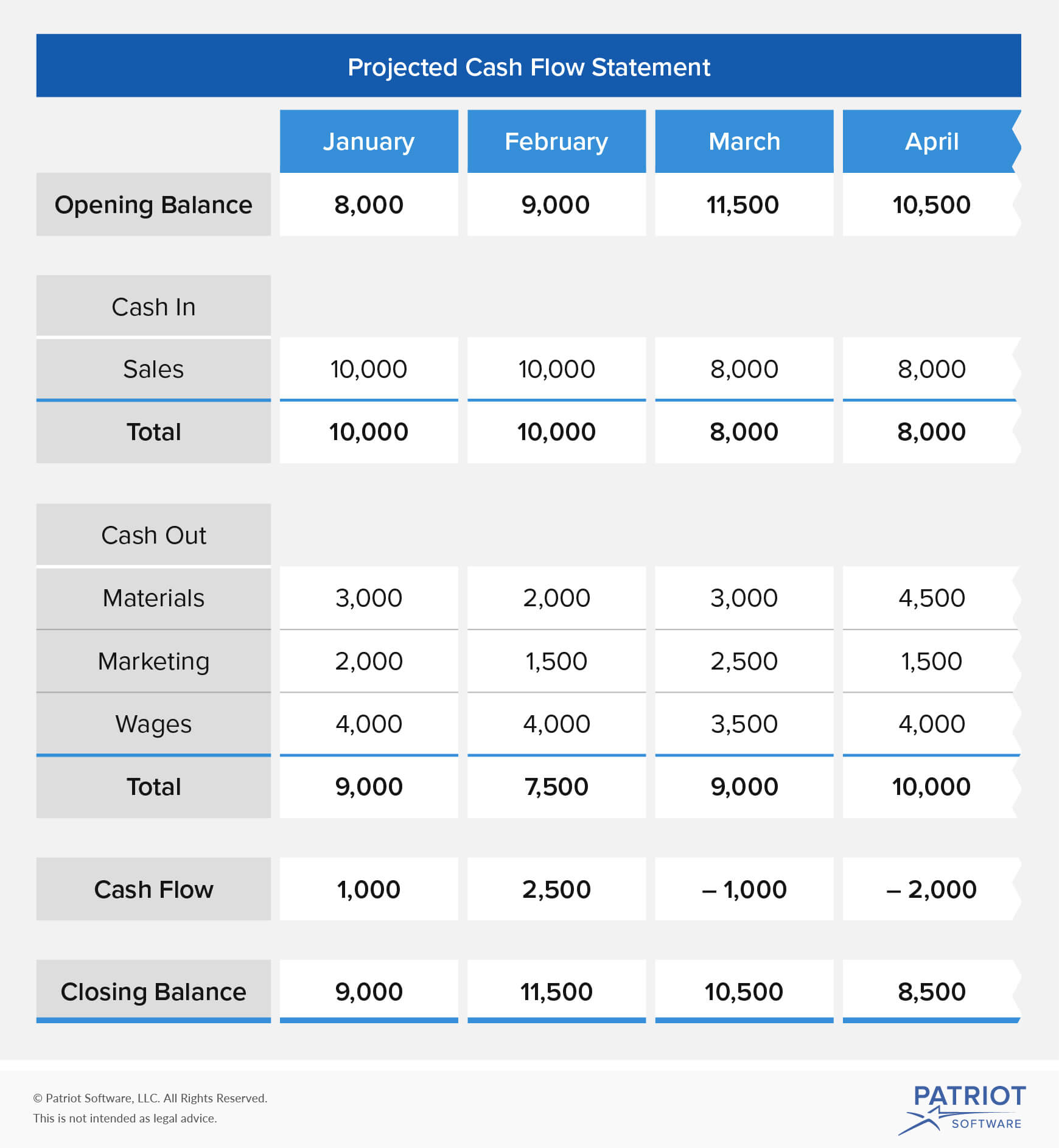

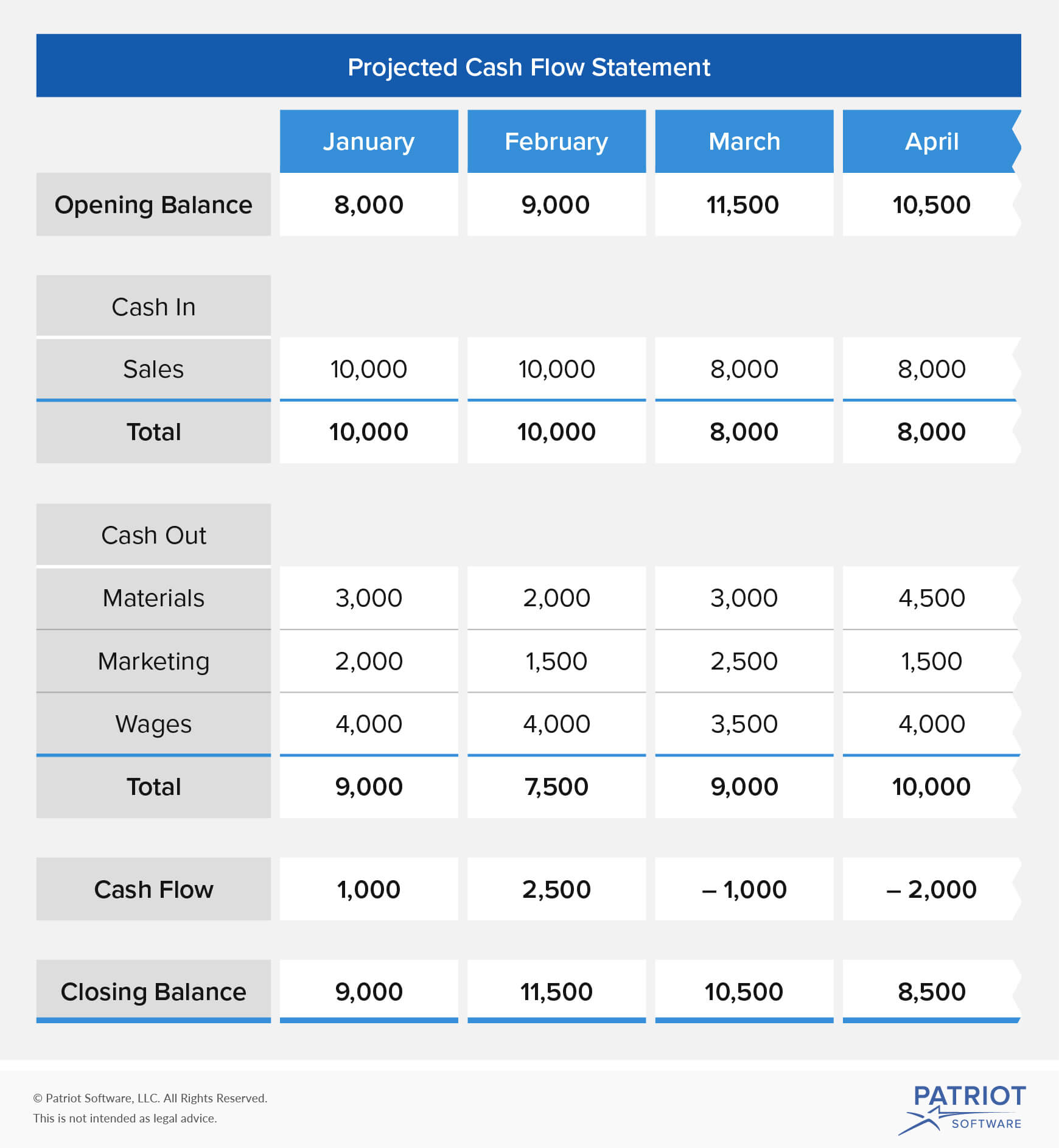

Financial Health and Stability

Sustainable growth requires robust financial foundations. We scrutinized the financial health of potential candidates, focusing on:

- Examine debt levels, profitability, and cash flow. Healthy cash flow, manageable debt, and consistent profitability demonstrate financial stability and the capacity for future investment and growth.

- Assess the overall financial health and stability of the business. A solid financial standing is crucial for weathering market fluctuations and ensuring long-term sustainability.

Stock #1: Snowflake – A Deep Dive

Snowflake is a cloud-based data warehousing and analytics company that offers a unique and scalable data platform. Its innovative approach to data management positions it as a strong Palantir competitor.

Company Overview and Business Model

Snowflake's business model revolves around providing a cloud-based data warehouse as a service (DaaS). Its key differentiators include:

- Detail Company A's key services and offerings. Snowflake offers a comprehensive suite of services, including data storage, processing, and analysis, all delivered through a scalable cloud infrastructure.

- Highlight their target market and customer base. Snowflake caters to a broad range of customers, from large enterprises to smaller businesses, across diverse industries.

Growth Projections and Competitive Advantages

Snowflake's projected growth stems from several key factors:

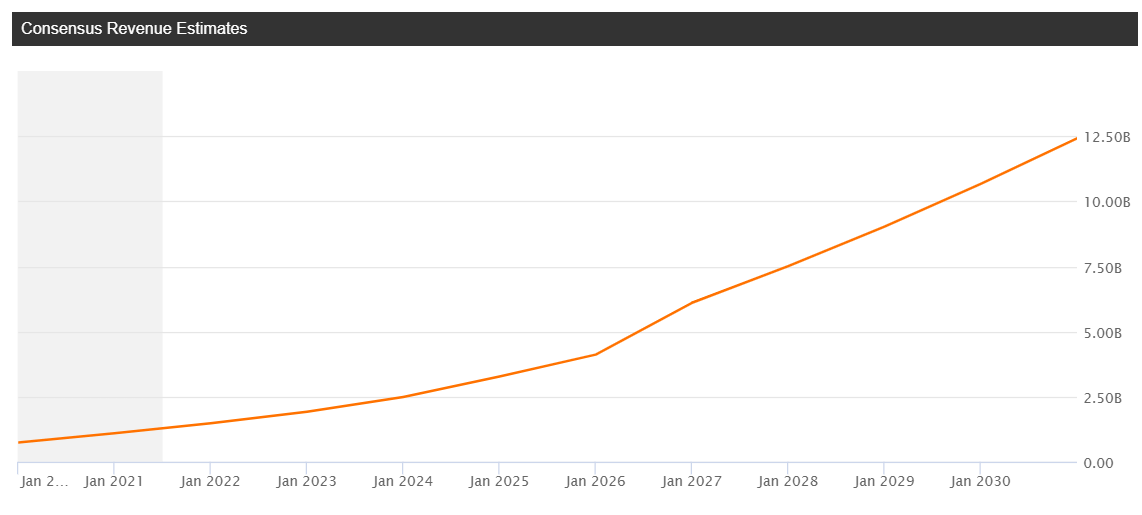

- Provide specific data points (if available) supporting growth projections. Analyst estimates predict substantial revenue growth for Snowflake over the next three years, driven by increased cloud adoption and growing demand for data analytics solutions.

- Explain how Company A's competitive advantages will allow it to outperform Palantir. Snowflake's superior scalability, ease of use, and cost-effectiveness compared to traditional data warehousing solutions position it for significant market share gains. Unlike Palantir's more specialized approach, Snowflake offers a broader and more accessible platform.

Risks and Potential Challenges

Despite its strong position, Snowflake faces potential risks:

- Identify potential headwinds and market risks. Increased competition from other cloud providers and potential security breaches pose challenges.

- Discuss strategies for mitigating these risks. Snowflake is proactively investing in security enhancements and expanding its partnerships to mitigate these risks.

Stock #2: Databricks – A Detailed Look

Databricks is a prominent player in the big data and AI space, offering a unified analytics platform built on Apache Spark. Its capabilities present a compelling alternative to Palantir's offerings.

Company Overview and Business Model

Databricks provides a unified data analytics platform that combines data warehousing, data lake capabilities, and machine learning functionalities. Its key features include:

- Detail Company B's key services and offerings. Databricks offers a collaborative environment for data scientists and engineers, simplifying data analysis and AI model development.

- Highlight their target market and customer base. Its customer base spans various industries, encompassing enterprises and smaller businesses needing robust big data processing and AI capabilities.

Growth Projections and Competitive Advantages

Databricks's projected growth stems from:

- Provide specific data points (if available) supporting growth projections. Similar to Snowflake, analyst estimates suggest significant revenue growth for Databricks in the next three years, fueled by the growing demand for cloud-based big data and AI solutions.

- Explain how Company B's competitive advantages will allow it to outperform Palantir. Databricks's open-source foundation, scalability, and robust AI/ML capabilities provide a strong competitive edge, particularly for organizations needing extensive data processing and machine learning functionalities. This is a key differentiator from Palantir's more specialized focus.

Risks and Potential Challenges

Potential challenges for Databricks include:

- Identify potential headwinds and market risks. Intense competition in the big data analytics market and the complexity of its platform present some headwinds.

- Discuss strategies for mitigating these risks. Databricks continues to innovate, expanding its partnerships and improving its platform's usability to address these challenges.

Conclusion

While Palantir remains a force in the big data analytics market, Snowflake and Databricks present compelling alternative investment opportunities. Their projected growth, technological innovation, and strong financial positions indicate their potential to significantly outperform Palantir over the next three years. Remember to perform thorough due diligence before investing. Start researching these promising Palantir competitors today and discover the potential for substantial returns in the ever-evolving big data landscape. Remember to always consult a financial advisor before making any investment decisions.

Featured Posts

-

Luis Enriques Psg Transformation How The French Side Secured Victory

May 10, 2025

Luis Enriques Psg Transformation How The French Side Secured Victory

May 10, 2025 -

French Minister Calls For Stronger Eu Response To Us Tariffs

May 10, 2025

French Minister Calls For Stronger Eu Response To Us Tariffs

May 10, 2025 -

Return Of High Potential Season 2 Release Date And Episode Details

May 10, 2025

Return Of High Potential Season 2 Release Date And Episode Details

May 10, 2025 -

The He Morgan Brother Enigma 5 Key Theories About Davids Identity In High Potential

May 10, 2025

The He Morgan Brother Enigma 5 Key Theories About Davids Identity In High Potential

May 10, 2025 -

Should You Buy The Dip Palantir Stocks 30 Decline

May 10, 2025

Should You Buy The Dip Palantir Stocks 30 Decline

May 10, 2025