Personal Loan Interest Rates Today: Find Your Lowest Rate

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into finding the best personal loan interest rates, it's crucial to grasp the fundamentals. This section will explain key concepts related to personal loan interest rates.

-

Annual Percentage Rate (APR): The APR represents the total annual cost of borrowing, including interest and any fees. It's a crucial figure for comparing loan offers, as it gives a comprehensive picture of the loan's true cost. A lower APR means lower overall borrowing costs.

-

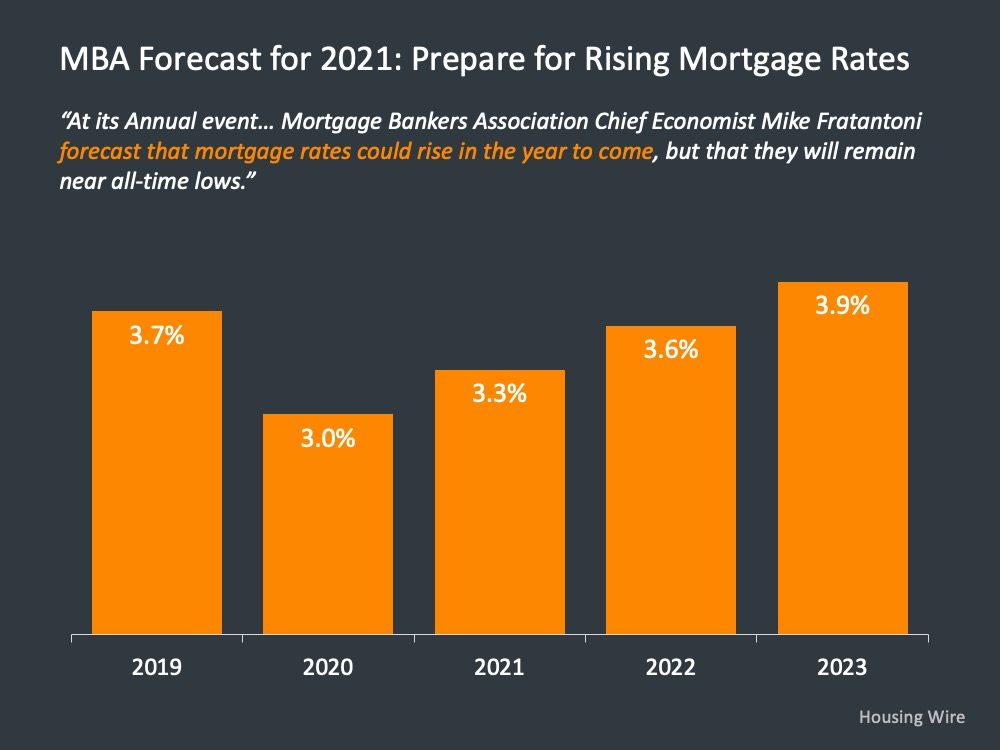

Fixed vs. Variable Interest Rates: A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments. A variable interest rate fluctuates based on market conditions, potentially leading to fluctuating monthly payments. While variable rates may start lower, they carry greater risk.

-

Compounding Interest: Interest is typically calculated on both the principal loan amount and accumulated interest. This compounding effect accelerates the growth of your debt over time, so understanding this is key to managing your loan effectively.

-

Factors Affecting Interest Rates: Several factors influence the interest rate you'll receive on a personal loan. These include your credit score, the loan amount, and the loan term. A longer loan term generally results in a lower monthly payment but higher overall interest paid.

Factors Affecting Your Personal Loan Interest Rate

Several key factors significantly impact the personal loan interest rate you'll qualify for. Let's delve into some of the most influential elements.

Your Credit Score's Impact

Your credit score is arguably the most critical factor determining your interest rate. A higher credit score signifies lower risk to lenders, resulting in more favorable interest rates.

-

Check Your Credit Report: Before applying for a loan, review your credit report for errors and work to improve your score if needed. Services like AnnualCreditReport.com allow you to access your reports for free.

-

Improve Your Credit Score: Strategies to improve your credit score include paying bills on time, consistently, reducing high credit utilization (the amount of credit you use compared to your total available credit), and maintaining a diverse mix of credit accounts.

-

Debt-to-Income Ratio: Lenders assess your debt-to-income (DTI) ratio, comparing your monthly debt payments to your gross monthly income. A lower DTI ratio indicates better financial health and improves your chances of securing a lower interest rate.

-

Loan Amount and Term: Borrowing a larger amount or opting for a longer loan term can sometimes lead to higher interest rates. Lenders perceive these scenarios as riskier.

The Lender's Role

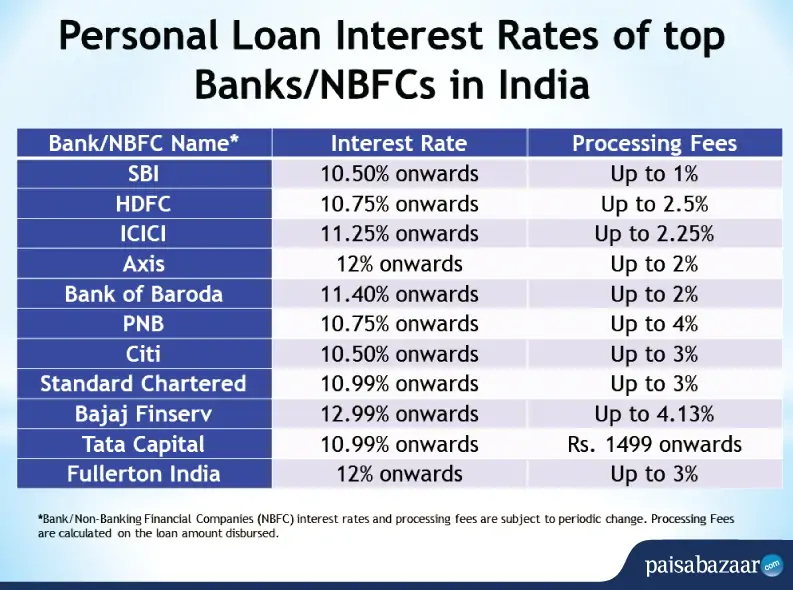

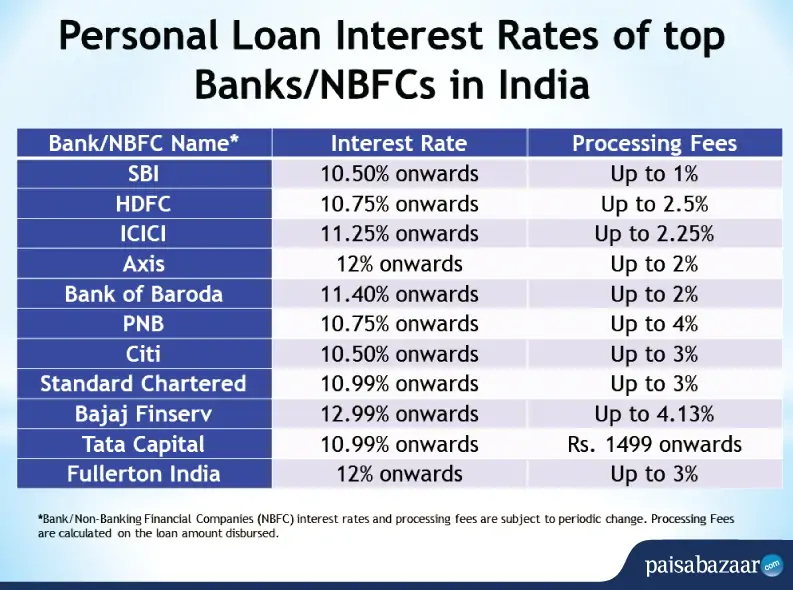

Different lenders have different lending criteria and interest rates. Understanding the nuances of various lenders is crucial.

-

Banks vs. Credit Unions vs. Online Lenders: Banks, credit unions, and online lenders all offer personal loans, but their rates and requirements vary. Credit unions often offer more competitive rates to their members. Online lenders may offer more convenience but could have higher rates.

-

Lender's Risk Assessment: Each lender has its own risk assessment process. They analyze your creditworthiness to determine the risk associated with lending to you. A lower perceived risk translates into a potentially lower interest rate.

-

Comparing Offers: Always compare offers from multiple lenders to find the most competitive interest rate. Don't settle for the first offer you receive.

How to Find the Lowest Personal Loan Interest Rate Today

Finding the lowest personal loan interest rate requires a strategic approach.

-

Use Online Comparison Tools: Leverage online comparison tools to quickly compare rates from various lenders without needing to apply multiple times. These tools save time and effort.

-

Pre-qualify for Loans: Many lenders offer pre-qualification options that allow you to check your potential interest rate without impacting your credit score. This helps you gauge your eligibility before applying formally.

-

Negotiate with Lenders: Don't be afraid to negotiate with lenders for a lower interest rate. Highlight your strong credit history and financial stability to strengthen your negotiating position.

-

Read the Fine Print: Before signing any loan agreement, meticulously review all the terms and conditions, including fees and interest rate calculations.

Tips for Securing a Low-Rate Loan

Here are some valuable tips for increasing your odds of securing a low personal loan interest rate:

- Maintain a good credit history: This is paramount. A high credit score significantly influences the interest rate offered.

- Shop around: Comparing offers from multiple lenders is essential to ensure you're getting the best deal.

- Consider a co-signer: If your credit history isn't ideal, a co-signer with excellent credit can improve your chances of approval and securing a lower interest rate.

- Have a solid repayment plan: Demonstrating a clear plan to repay the loan efficiently reassures lenders and can influence their decision.

Types of Personal Loans and Their Interest Rates

Understanding the different types of personal loans and their associated interest rates is also crucial for making an informed decision.

-

Secured Loans: Secured loans require collateral, meaning you put up an asset (like a car or home) to secure the loan. This lowers the risk for lenders, resulting in typically lower interest rates. Examples include home equity loans and auto title loans.

-

Unsecured Loans: Unsecured loans don't require collateral. This increased risk for lenders usually translates to higher interest rates. Traditional personal loans and credit card cash advances fall under this category.

-

Other Loan Options: Other loan options exist, such as payday loans (extremely high interest rates) and peer-to-peer lending, each with its own set of interest rate considerations.

Conclusion

Finding the best personal loan interest rates today requires careful research and planning. By understanding the factors that influence rates, and taking proactive steps to improve your creditworthiness, you can significantly increase your chances of securing a low-interest personal loan. Remember to compare offers from multiple lenders, negotiate effectively, and carefully review all terms and conditions before committing to a loan. Start your search for the lowest personal loan interest rates today! Don't hesitate to shop around and find the best deal for your individual financial needs. Remember, a lower interest rate can save you significant money in the long run.

Featured Posts

-

2025 Mlb Season Padres And Braves Face Off In Wild Card Rematch

May 28, 2025

2025 Mlb Season Padres And Braves Face Off In Wild Card Rematch

May 28, 2025 -

Secure A Personal Loan Today Low Interest Rates Available

May 28, 2025

Secure A Personal Loan Today Low Interest Rates Available

May 28, 2025 -

Sinner Announces Hamburg Tournament Following Doping Ban

May 28, 2025

Sinner Announces Hamburg Tournament Following Doping Ban

May 28, 2025 -

Analyzing Arsenals Performance In Their Last Five Games Against Psv Eindhoven

May 28, 2025

Analyzing Arsenals Performance In Their Last Five Games Against Psv Eindhoven

May 28, 2025 -

Check Euro Millions Results Irish Locations Of Winning Tickets Announced

May 28, 2025

Check Euro Millions Results Irish Locations Of Winning Tickets Announced

May 28, 2025