Point72 Traders Exit Emerging Markets-Focused Fund

Table of Contents

Point72, the prominent hedge fund founded by billionaire Steve Cohen, has announced the closure of its emerging markets-focused fund. This significant move sends ripples through the investment world, raising crucial questions about the future of emerging market investments and the strategic decisions of major players like Point72. This article delves into the reasons behind this decision and its potential implications for investors and the broader financial landscape.

Reasons Behind Point72's Exit from Emerging Markets

Underperformance and Volatility

The decision to exit the emerging markets fund likely stems from a combination of factors, with underperformance and increased market volatility playing significant roles. Compared to established benchmarks, the fund may have struggled to deliver competitive returns. Emerging markets are inherently volatile, susceptible to rapid shifts in economic conditions and geopolitical events.

- Political instability: Many emerging markets grapple with political uncertainty, leading to unpredictable policy changes that impact investment returns. Recent examples include [cite specific examples of political instability impacting investments].

- Currency fluctuations: Sharp swings in exchange rates can significantly erode investment gains, especially for funds heavily invested in multiple emerging market currencies.

- Regulatory hurdles: Navigating complex and sometimes changing regulations in different emerging markets adds complexity and cost, impacting profitability.

While precise performance data from Point72's fund remains undisclosed, reports suggest [cite any available data or news reports on performance relative to benchmarks; if unavailable, remove this sentence and rephrase]. The heightened volatility in emerging markets in recent years likely exacerbated these challenges, prompting Point72 to reassess its strategy.

Strategic Portfolio Restructuring

Point72's exit from emerging markets aligns with a broader strategic shift in its overall investment portfolio. The firm is known for its active management approach and its willingness to adapt to changing market conditions. This move could signify a reallocation of resources toward sectors deemed more promising in the current investment climate.

- Focus on Technology and Healthcare: Point72 has been actively investing in the technology and healthcare sectors, which are perceived to offer higher growth potential in the long term.

- Capital Reallocation: The capital freed up from the closed emerging markets fund will likely be channeled into these and other high-growth areas where Point72 sees greater opportunities.

- Risk Management: This decision also reflects a proactive approach to risk management. By exiting a sector characterized by significant volatility, Point72 is potentially reducing its overall portfolio risk.

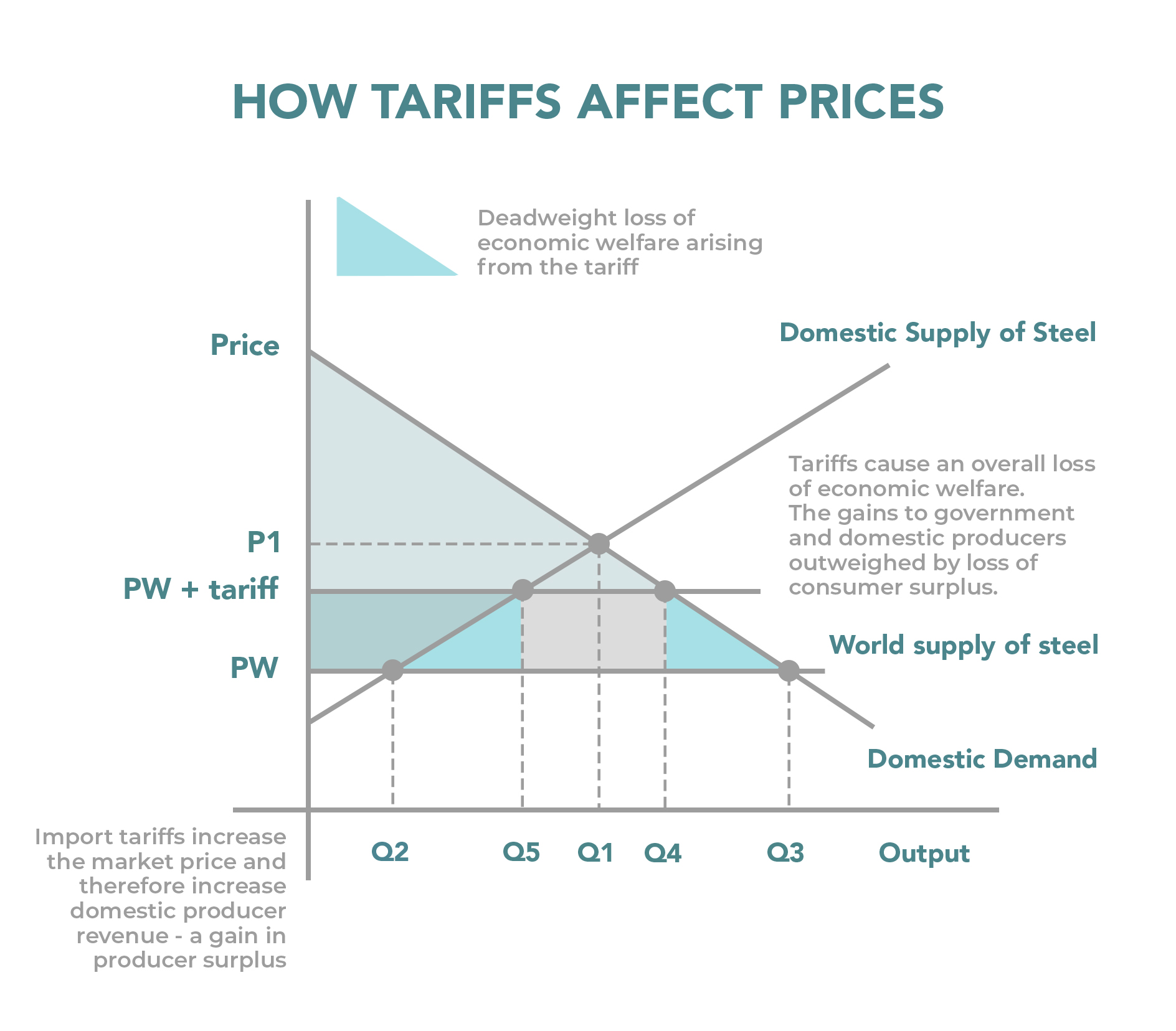

Macroeconomic Factors

Several macroeconomic headwinds impacting emerging markets likely influenced Point72's decision. These broader economic forces create an environment that makes emerging market investing more challenging.

- Rising Interest Rates: Global increases in interest rates have made borrowing more expensive, impacting economic growth in many emerging markets.

- Inflation Concerns: High inflation rates erode purchasing power and can lead to instability, making investment planning difficult.

- Geopolitical Risks: The ongoing war in Ukraine and other geopolitical tensions create uncertainty and negatively affect investor sentiment towards emerging markets. [Cite relevant economic data or expert opinions on these macroeconomic factors].

Implications for Investors and the Emerging Markets Landscape

Investor Sentiment and Market Reaction

Point72's announcement has sent a wave through the investment community. While the immediate market reaction may be nuanced, it signals a shift in investor sentiment.

- Impact on Emerging Market Indices: The news may have influenced the performance of various emerging market indices, potentially leading to short-term declines [cite data if available, otherwise rephrase].

- Investor Flows: Investors may reconsider their allocations to emerging markets, potentially leading to capital outflows in the short term.

- Analyst Commentary: Financial analysts are likely revising their outlooks for emerging markets, incorporating Point72's decision into their assessments [cite any available analyst commentary].

Future of Emerging Market Investments

Despite the challenges, emerging markets still present long-term growth opportunities. However, investors need to approach these markets with a nuanced understanding of the risks involved.

- Long-Term Growth Potential: Emerging markets are home to rapidly growing economies and large populations, offering long-term growth potential. However, this potential is accompanied by significant risk.

- Challenges Requiring Address: Addressing issues like infrastructure development, political stability, and regulatory frameworks is crucial for sustainable growth.

- The Role of Diversification: A well-diversified portfolio can mitigate some risks associated with emerging market investments.

Lessons for Investors

Point72's decision underscores the importance of careful due diligence, robust risk management, and diversified investment strategies. Investors should take heed of the following:

- Thoroughly research emerging market opportunities before investing.

- Implement a sound risk management strategy.

- Diversify investments across different asset classes and geographic regions.

Conclusion

Point72's exit from its emerging markets-focused fund highlights the challenges and risks inherent in these markets. Underperformance, volatility, strategic portfolio adjustments, and macroeconomic factors all played a role in this decision. This move impacts investor sentiment and underscores the need for careful consideration when investing in emerging markets. The future of emerging market investments remains complex, demanding a thorough understanding of both opportunities and risks. Therefore, carefully consider your investment strategy in emerging markets, research emerging markets thoroughly, and consult with a financial advisor before investing in emerging markets or similar high-risk ventures.

Featured Posts

-

Worlds Tallest Abandoned Skyscraper Construction To Restart After 10 Year Hiatus

Apr 26, 2025

Worlds Tallest Abandoned Skyscraper Construction To Restart After 10 Year Hiatus

Apr 26, 2025 -

200 Million Tariff Increase Impacts Colgate Cl Q Quarter Results Sales And Profits Down

Apr 26, 2025

200 Million Tariff Increase Impacts Colgate Cl Q Quarter Results Sales And Profits Down

Apr 26, 2025 -

Vehicle Subsystem Issue Leads To Blue Origin Launch Cancellation

Apr 26, 2025

Vehicle Subsystem Issue Leads To Blue Origin Launch Cancellation

Apr 26, 2025 -

Were In Nepo Hell Oscars After Party Highlights Nepotism Fury

Apr 26, 2025

Were In Nepo Hell Oscars After Party Highlights Nepotism Fury

Apr 26, 2025 -

Damen And Icdas Partner To Build Tugboat In Turkey

Apr 26, 2025

Damen And Icdas Partner To Build Tugboat In Turkey

Apr 26, 2025

Latest Posts

-

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025 -

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025 -

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025 -

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025 -

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025