Posthaste: Risks And Implications Of The Global Bond Market's Instability

Table of Contents

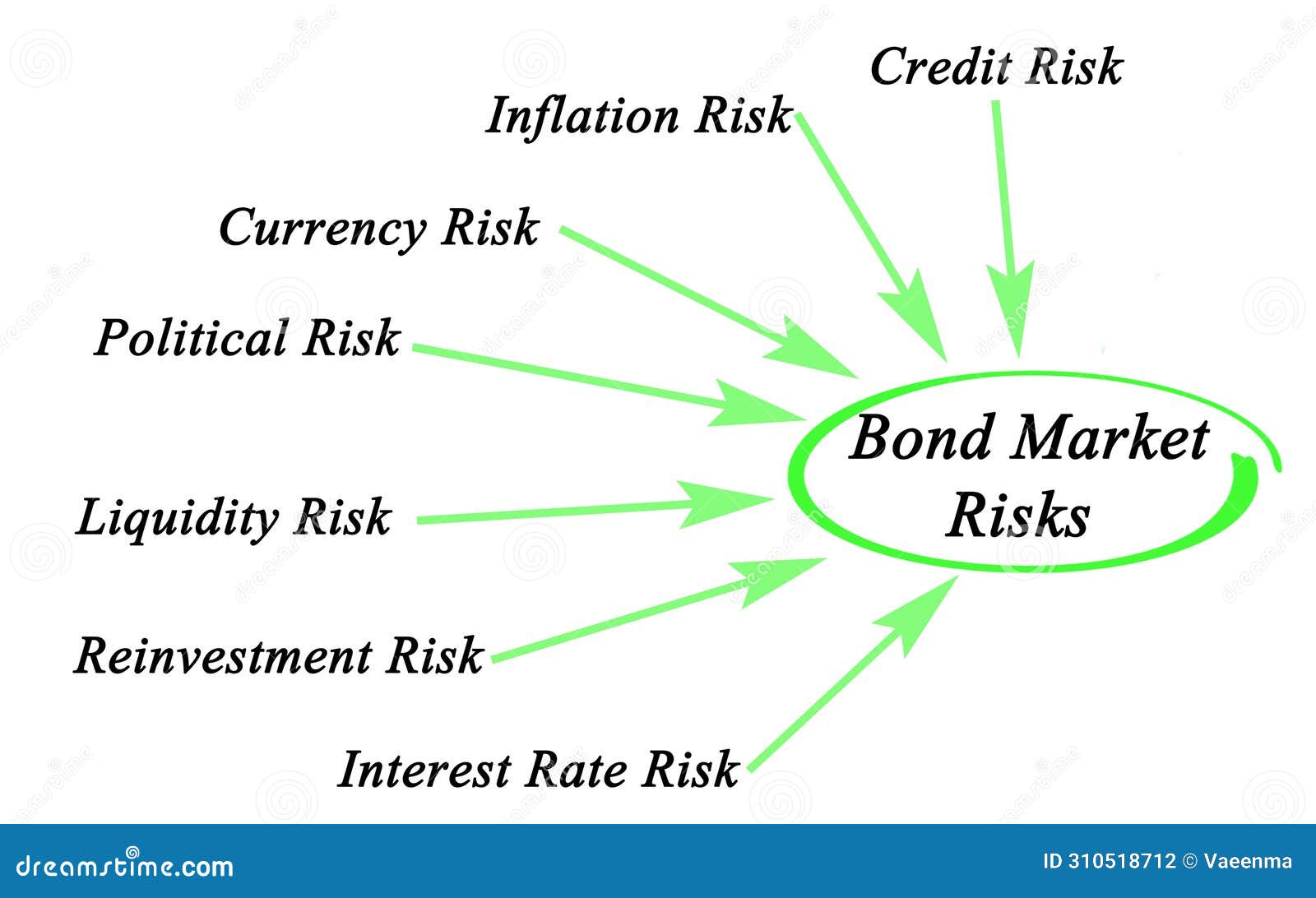

Rising Interest Rates and Their Impact

The aggressive interest rate hikes implemented by central banks globally to combat inflation have significantly impacted bond prices. Higher rates lead to lower bond prices, creating substantial losses for investors holding longer-term bonds. This is primarily due to the inverse relationship between interest rates and bond prices. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This phenomenon is known as interest rate risk, and it's a major concern for fixed-income investors.

- Increased duration risk for long-term bond holders: Longer-term bonds are more sensitive to interest rate changes, experiencing larger price fluctuations than shorter-term bonds.

- Reduced returns on fixed-income investments: Higher interest rates directly reduce the returns on existing bond investments, especially those with fixed coupon payments.

- Difficulty in predicting future bond yields: The unpredictable nature of future interest rate movements makes it challenging to forecast future bond yields accurately.

- Potential for capital losses on existing bond portfolios: Investors holding bond portfolios might experience significant capital losses if interest rates rise unexpectedly.

- The need for a more diversified investment strategy: Diversification across different asset classes and maturities is crucial to mitigate interest rate risk.

Inflationary Pressures and Their Effects on Bond Yields

Persistently high inflation erodes the purchasing power of fixed-income investments. Investors demand higher yields to compensate for the loss of value, putting further pressure on bond prices. This means that even if a bond pays a seemingly attractive yield, inflation could eat away at those returns, resulting in a negative real yield. This is known as inflation risk, and it's a critical factor to consider in any bond investment strategy.

- Erosion of real returns due to inflation: High inflation can significantly reduce the real return on bond investments, potentially leading to losses in purchasing power.

- Increased demand for higher-yielding bonds: Investors seek higher-yielding bonds to offset inflation's impact on their investments.

- Difficulty in forecasting future inflation rates: Predicting future inflation rates is notoriously difficult, making it challenging to assess the true risk-adjusted return of bonds.

- The impact of inflation on investor confidence: High inflation can erode investor confidence, leading to increased volatility and potentially capital flight from bond markets.

- Strategies for hedging against inflation risk: Investors can consider inflation-linked bonds or other inflation-hedging strategies to mitigate inflation risk.

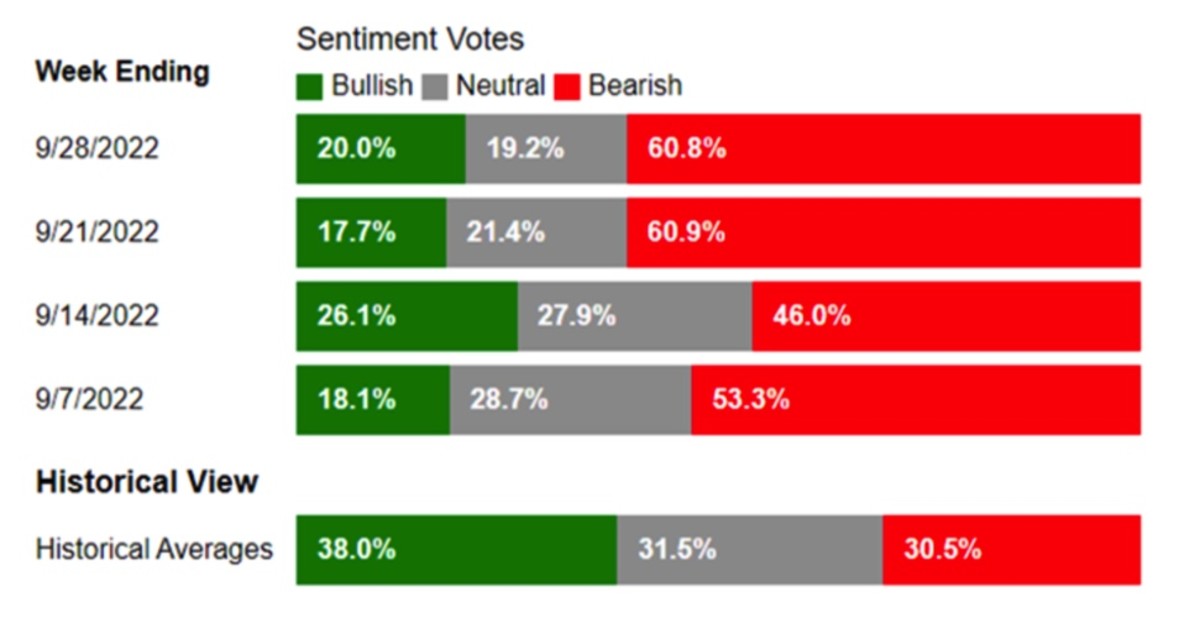

Geopolitical Risks and Their Influence on Bond Market Stability

Geopolitical events, such as wars, trade disputes, and political instability, can significantly impact investor sentiment and create volatility in the bond market. Uncertainty surrounding these events can lead to capital flight and increased risk aversion. Investors often seek safer havens during times of geopolitical turmoil, potentially causing a sell-off in the bond market. This is known as geopolitical risk, and its impact can be profound and unpredictable.

- Increased uncertainty and risk aversion among investors: Geopolitical events often lead to heightened uncertainty and risk aversion among investors, impacting their investment decisions.

- Flight to safety towards less risky assets: Investors may move their capital to perceived safer assets, such as government bonds of developed economies, during times of geopolitical uncertainty.

- Potential for sovereign debt crises in vulnerable economies: Geopolitical instability can exacerbate existing economic weaknesses, potentially leading to sovereign debt crises in vulnerable countries.

- The impact of sanctions and trade wars on bond markets: International sanctions and trade wars can negatively impact bond markets, particularly in the countries targeted by these actions.

- Importance of geopolitical risk assessment in investment decisions: A comprehensive geopolitical risk assessment is crucial for making informed investment decisions in today’s volatile environment.

Credit Risk and the Potential for Defaults

Rising interest rates and economic uncertainty can increase the risk of defaults, particularly for companies with high levels of debt. This poses significant risks to investors holding corporate bonds, especially high-yield bonds. Careful assessment of creditworthiness is therefore paramount, especially in a period of heightened bond market volatility.

- Increased risk of corporate bond defaults: Economic downturns often lead to an increased number of corporate bond defaults, impacting investors.

- Importance of credit rating analysis: Thorough credit rating analysis is critical for assessing the credit risk of individual corporate bonds.

- Diversification to mitigate credit risk: Diversifying across different issuers and sectors can help mitigate credit risk.

- Potential for contagion effects in the credit markets: Defaults by one issuer can trigger a cascade of defaults in the credit market, creating a domino effect.

- The role of credit default swaps in managing credit risk: Credit default swaps (CDS) can be used as a hedging tool to mitigate credit risk.

Conclusion

The instability in the global bond market presents significant challenges and risks for investors. Rising interest rates, inflationary pressures, geopolitical risks, and credit risk all contribute to a volatile environment. Careful analysis of these factors, diversification of investment portfolios, and a thorough understanding of interest rate risk, inflation risk, and credit risk are crucial for navigating this complex landscape. Understanding the implications of global bond market instability is essential for making informed investment decisions and protecting your portfolio. Don't delay – take proactive steps to assess your bond market investments today and develop a robust strategy to manage the inherent risks.

Featured Posts

-

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist What You Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist What You Need To Know

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025 -

Analyzing Apple Stocks Performance Ahead Of Q2 Report

May 24, 2025

Analyzing Apple Stocks Performance Ahead Of Q2 Report

May 24, 2025

Latest Posts

-

Kermit The Frog As Umd 2025 Commencement Speaker The Online Response

May 24, 2025

Kermit The Frog As Umd 2025 Commencement Speaker The Online Response

May 24, 2025 -

Umd Commencement 2025 Kermit The Frogs Surprise Announcement

May 24, 2025

Umd Commencement 2025 Kermit The Frogs Surprise Announcement

May 24, 2025 -

University Of Maryland Commencement A Famous Amphibian To Speak

May 24, 2025

University Of Maryland Commencement A Famous Amphibian To Speak

May 24, 2025 -

2025 Umd Graduation The Unexpected Choice Of Kermit The Frog

May 24, 2025

2025 Umd Graduation The Unexpected Choice Of Kermit The Frog

May 24, 2025 -

The Worlds Most Famous Amphibian To Deliver Commencement Speech At University Of Maryland

May 24, 2025

The Worlds Most Famous Amphibian To Deliver Commencement Speech At University Of Maryland

May 24, 2025