Pound Strengthens As Traders Reduce BOE Rate Cut Expectations Following UK Inflation Report

Table of Contents

UK Inflation Report Key Findings

Inflation Data

The July UK inflation report revealed a Consumer Price Index (CPI) of 6.8%, down from 7.9% in June and below the anticipated 7.1%. The Retail Price Index (RPI), a broader measure of inflation, also showed a decrease. This deceleration represents a significant shift from the persistent inflationary pressures observed earlier in the year.

- CPI: 6.8% (July), down from 7.9% (June) and below analyst forecasts of 7.1%.

- RPI: [Insert RPI figure and comparison to previous month and predictions].

- Key Contributing Factors: While energy prices remain elevated, their contribution to the overall inflation rate has lessened. A modest decline in food prices also contributed to the overall reduction. The easing of supply chain bottlenecks also played a role.

These figures are highly significant as they suggest that the peak of inflationary pressures in the UK may have passed. This directly impacts the Bank of England's monetary policy decisions.

Market Reaction to the Report

The market reacted swiftly to the lower-than-expected inflation figures. The Pound Sterling experienced an immediate surge against major currencies.

- GBP/USD: Rose from approximately 1.27 to 1.28 within hours of the report's release.

- GBP/EUR: Increased from roughly 1.16 to 1.17, demonstrating strengthening against the Euro as well.

- Market Volatility: While some initial volatility was observed, the overall market reaction was relatively stable, reflecting a positive response to the decreased inflation figures.

The strong market reaction signifies a shift in investor sentiment. Reduced inflation alleviates fears of aggressive interest rate hikes by other central banks, thereby improving the relative appeal of the Pound.

Impact on BOE Rate Cut Expectations

Reduced Probability of Rate Cuts

The inflation report has significantly diminished expectations for further BOE interest rate cuts in the near term. The market had previously priced in a substantial probability of a rate cut at the next monetary policy committee meeting.

- Before Report: Market analysts predicted a [Insert Percentage]% probability of a rate cut at the [Month] BOE meeting.

- After Report: This probability has dropped to approximately [Insert Percentage]%, indicating a reduced expectation of rate cuts.

Lower-than-anticipated inflation reduces the urgency for the BOE to stimulate economic growth through lower interest rates.

Implications for Monetary Policy

The UK inflation report has major implications for the BOE's monetary policy going forward. The central bank now has more leeway in its approach.

- Potential Future Actions: The BOE might now pause its rate-hiking cycle, maintain the current interest rate, or even consider a future rate hike depending on subsequent economic data.

- BOE Statements: [Insert any statements or hints from BOE officials regarding their future actions].

The BOE's primary mandate is price stability. This report reinforces their efforts to control inflation, potentially altering their future strategy.

Pound Sterling Outlook and Trading Implications

Short-Term GBP Forecast

Based on the current market conditions and expert analysis, the Pound Sterling is expected to maintain its strength in the short term. However, the forex market remains volatile.

- Short-Term Price Targets: Analysts predict GBP/USD could reach [Insert Price Target] in the coming weeks, while GBP/EUR may reach [Insert Price Target].

- Potential Catalysts: Future economic data releases, geopolitical events, and shifts in global risk appetite could influence the Pound's trajectory.

It's crucial to approach any forecast with caution, recognizing inherent market uncertainties.

Strategies for GBP Traders

The recent inflation report presents both opportunities and challenges for GBP traders. Risk management is paramount.

- Trading Strategies: Investors might consider long positions in GBP, benefiting from its potential appreciation. Hedging strategies could also be employed to mitigate potential losses.

- Responsible Trading: Traders should always conduct thorough research, diversify their portfolios, and adhere to responsible trading practices, including setting stop-loss orders and managing position sizes.

Remember that forex trading involves significant risk, and losses are possible.

Conclusion

The UK's July inflation report significantly impacted the Pound Sterling, leading to a strengthening of the currency as expectations for BOE rate cuts diminished. The lower-than-expected inflation figures reduce the pressure on the central bank to ease monetary policy, altering the outlook for the GBP and creating new considerations for forex traders. Stay informed about market developments through reputable sources and conduct thorough research before making any investment decisions. Carefully consider the implications of this inflation report and the shifting dynamics of the foreign exchange market when engaging in Pound Sterling trading or investment. Remember to always prioritize risk management in your GBP trading strategies.

Featured Posts

-

Hamiltons Words A New Headache For Mc Larens Team

May 23, 2025

Hamiltons Words A New Headache For Mc Larens Team

May 23, 2025 -

Big Rig Rock Report 3 12 Rock 101 Insights

May 23, 2025

Big Rig Rock Report 3 12 Rock 101 Insights

May 23, 2025 -

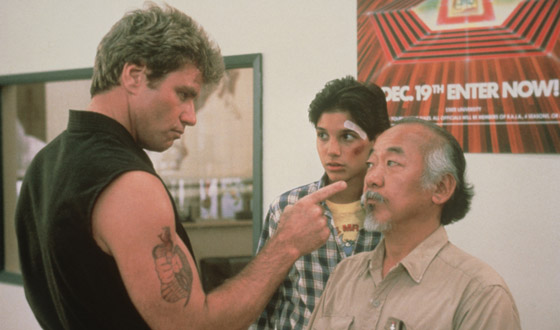

The Karate Kid And Its Impact On Martial Arts Popularity

May 23, 2025

The Karate Kid And Its Impact On Martial Arts Popularity

May 23, 2025 -

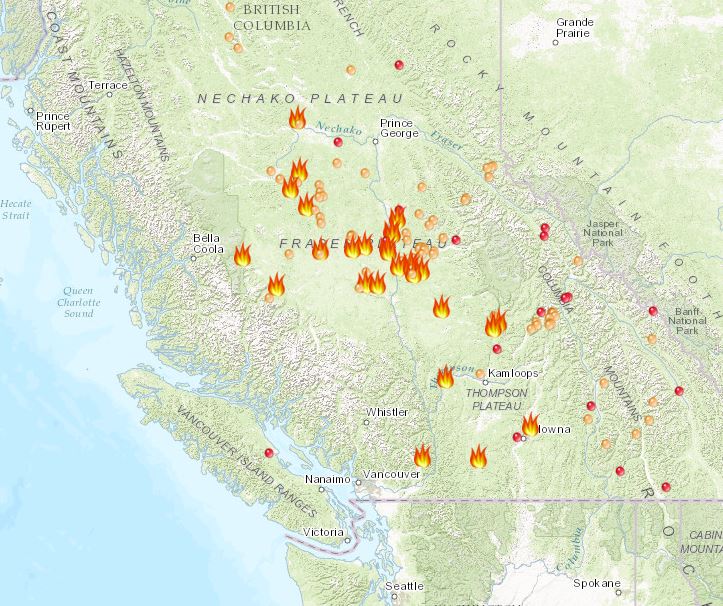

Global Forest Destruction Wildfires Contribute To Unprecedented Losses

May 23, 2025

Global Forest Destruction Wildfires Contribute To Unprecedented Losses

May 23, 2025 -

Top 7 Netflix Shows To Stream This Week May 18 24

May 23, 2025

Top 7 Netflix Shows To Stream This Week May 18 24

May 23, 2025

Latest Posts

-

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sales

May 23, 2025

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sales

May 23, 2025 -

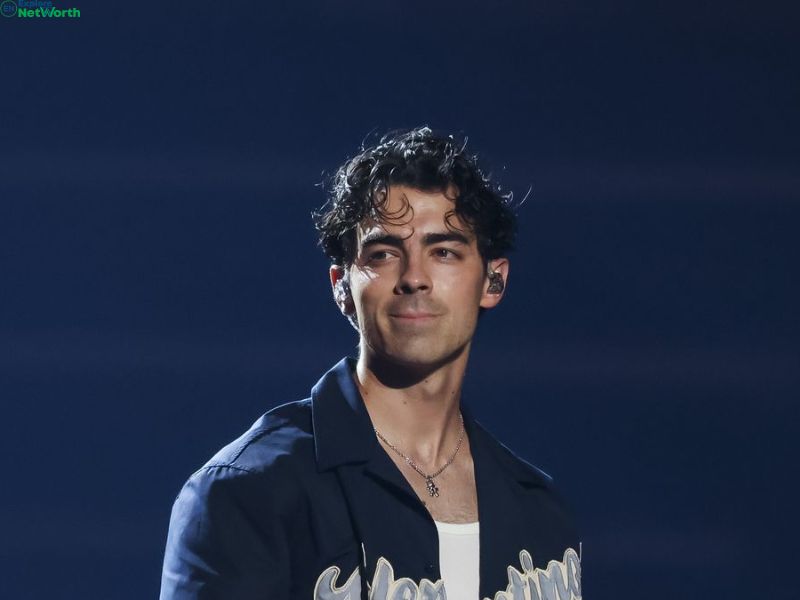

Unexpected Musical Treat Joe Jonas At The Fort Worth Stockyards

May 23, 2025

Unexpected Musical Treat Joe Jonas At The Fort Worth Stockyards

May 23, 2025 -

Is Publix Open On Memorial Day 2025 Florida Store Hours

May 23, 2025

Is Publix Open On Memorial Day 2025 Florida Store Hours

May 23, 2025 -

Fort Worth Stockyards Jonas Brothers Joe Jonas Delivers Impromptu Concert

May 23, 2025

Fort Worth Stockyards Jonas Brothers Joe Jonas Delivers Impromptu Concert

May 23, 2025 -

Get Your Wrestle Mania 41 Tickets Now Golden Belts And Memorial Day Weekend Deals

May 23, 2025

Get Your Wrestle Mania 41 Tickets Now Golden Belts And Memorial Day Weekend Deals

May 23, 2025