Predicting Future Stock Growth: Two Potential Investments To Beat Palantir

Table of Contents

Palantir Technologies has seen significant growth, but are there better opportunities out there? Predicting future stock growth is challenging, but by analyzing market trends and identifying undervalued companies with strong growth potential, investors can potentially outperform established players. This article explores two promising investment avenues that could potentially surpass Palantir's returns. We’ll delve into their fundamentals, growth potential, and risks involved.

Analyzing the Current Market Landscape for High-Growth Potential

Predicting future stock growth requires a keen understanding of the current market landscape. This involves identifying undervalued companies with robust growth trajectories and mitigating inherent risks.

Identifying Undervalued Companies:

Finding undervalued companies is crucial for predicting future stock growth. Several methods can help:

- Discounted Cash Flow (DCF) Analysis: This model projects future cash flows and discounts them back to their present value, providing an intrinsic valuation. A stock trading below its DCF valuation may be considered undervalued.

- Price-to-Earnings (P/E) Ratio: Comparing a company's P/E ratio to its industry peers and historical averages can reveal whether it's relatively overvalued or undervalued. A lower P/E ratio might suggest undervaluation, but it's crucial to consider the company's growth prospects.

- Industry Benchmarks: Comparing key financial metrics like revenue growth, profit margins, and debt-to-equity ratio against industry averages provides context and helps identify companies performing significantly better than their peers.

Other important financial metrics to consider include:

- Revenue growth rate: A consistently high revenue growth rate indicates strong market demand and potential for future expansion.

- Profit margins: High and improving profit margins suggest efficient operations and strong pricing power.

- Debt-to-equity ratio: A low debt-to-equity ratio indicates a healthy financial position and lower risk.

- Return on Equity (ROE): A high ROE signifies efficient use of shareholder investments.

Understanding the company's competitive landscape and market position is also paramount. A strong competitive advantage, such as a unique technology or strong brand loyalty, can significantly enhance growth potential.

Assessing Growth Potential and Future Earnings:

Predicting future stock growth involves evaluating a company's potential for future earnings. Key aspects to consider include:

- Business Model: A robust and scalable business model is essential for sustainable growth.

- Innovation Pipeline: A strong pipeline of new products or services indicates a company's commitment to innovation and staying ahead of the competition.

- Management Team: An experienced and capable management team is crucial for effective execution and navigating challenges.

Factors contributing to future growth include:

- Expanding Market Share: Capturing a larger share of the existing market is a key driver of growth.

- New Product Launches: Successful product launches can significantly boost revenue and market share.

- Strategic Partnerships: Collaborating with other companies can open up new markets and opportunities.

Forecasting models and comprehensive industry analysis can help predict future earnings. However, it's crucial to understand that these are just projections and not guarantees.

Managing Risk in High-Growth Investments:

High-growth stocks, while offering substantial returns, come with inherent risks:

- Volatility: High-growth stocks tend to be more volatile than established, large-cap companies.

- Market Corrections: During market downturns, high-growth stocks can experience significant price drops.

To mitigate these risks:

- Diversification: Spreading investments across multiple stocks and asset classes reduces overall portfolio risk.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals helps mitigate the risk of buying high and selling low.

- Stop-Loss Orders: Setting stop-loss orders can limit potential losses if a stock price falls below a certain level.

Factors that could negatively impact a company's future growth include:

- Increased Competition: New entrants or existing competitors could erode market share.

- Economic Downturns: Recessions or economic slowdowns can significantly impact consumer spending and business investment.

- Regulatory Changes: New regulations or changes in existing regulations could negatively affect a company's operations or profitability.

Investment Opportunity 1: [Company Name A] - A Deep Dive (Example: Company A = CrowdStrike Holdings, Inc.)

Company Overview and Business Model:

CrowdStrike Holdings, Inc. (CRWD) is a cybersecurity company offering cloud-based endpoint protection. Its subscription-based model provides recurring revenue and strong customer stickiness. Its target market includes businesses of all sizes seeking comprehensive cybersecurity solutions.

Growth Drivers and Competitive Advantages:

CrowdStrike's growth is driven by:

- Technological Innovation: Its Falcon platform leverages AI and machine learning for superior threat detection and response.

- Strong Brand Recognition: CrowdStrike has established itself as a leader in the cybersecurity space.

- First-Mover Advantage: Its early entry into the cloud-based endpoint protection market gave it a significant advantage.

Financial Performance and Future Projections:

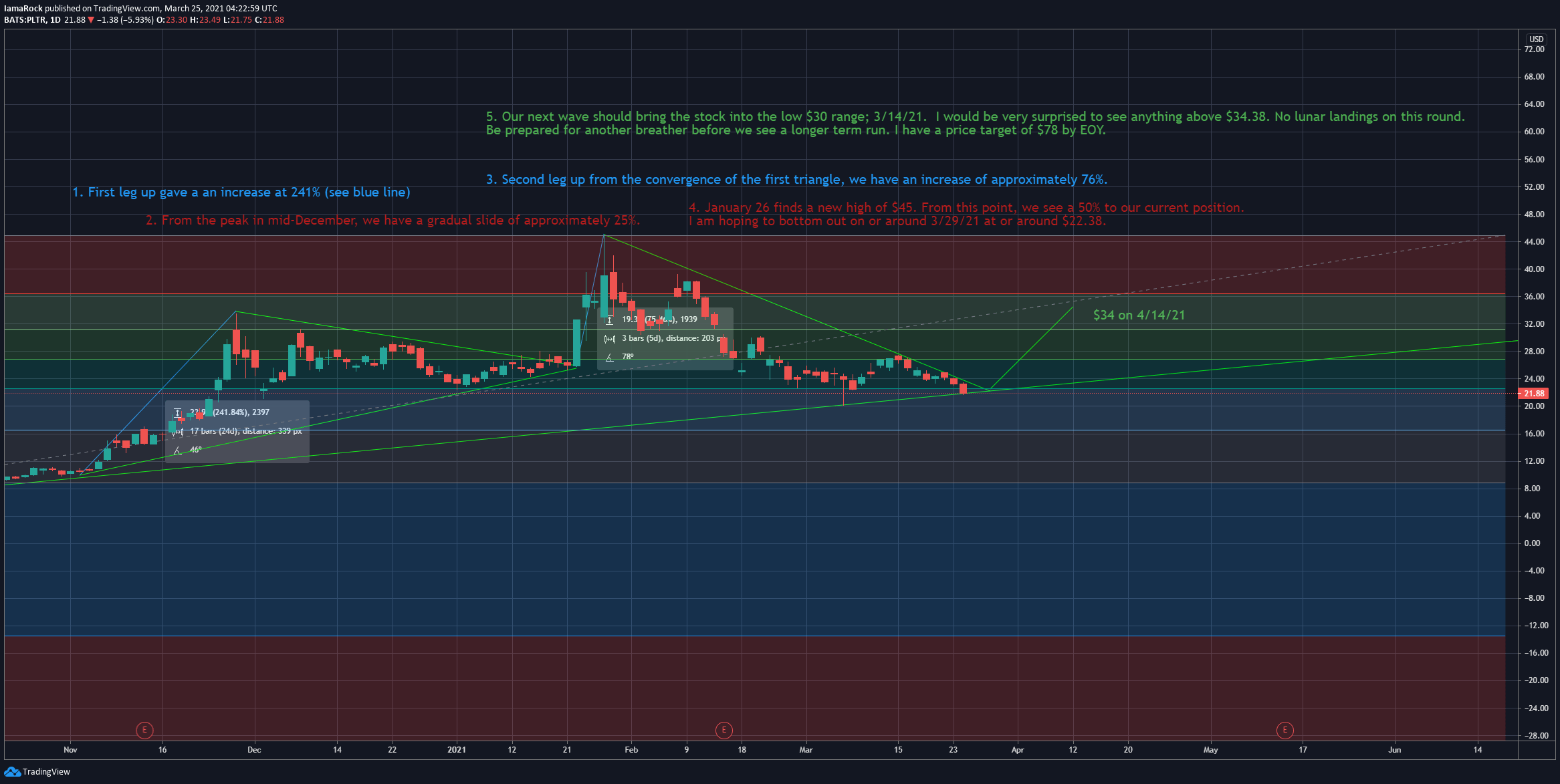

(Insert relevant financial data, charts, and graphs showing revenue growth, profit margins, and projected future earnings. Source the data appropriately.) CrowdStrike demonstrates consistent revenue growth and expanding profit margins, suggesting strong future potential.

Potential Risks and Challenges:

Potential risks include increased competition from established cybersecurity firms, dependence on subscription revenue, and potential security breaches affecting its reputation.

Investment Opportunity 2: [Company Name B] - A Detailed Analysis (Example: Company B = Datadog)

Company Overview and Business Model:

Datadog (DDOG) provides a monitoring and analytics platform for cloud-scale applications. Its SaaS-based model provides recurring revenue streams and allows for rapid scaling. Its target market includes businesses using cloud-based infrastructure and applications.

Growth Drivers and Competitive Advantages:

Datadog's growth is driven by:

- Technological Innovation: Its platform offers comprehensive monitoring and analytics capabilities.

- Strong Brand Recognition: Datadog is a well-regarded name in the cloud monitoring space.

- Network Effects: The platform's value increases as more users join, creating a network effect.

Financial Performance and Future Projections:

(Insert relevant financial data, charts, and graphs showing revenue growth, profit margins, and projected future earnings. Source the data appropriately.) Datadog also demonstrates robust revenue growth and improving profitability.

Potential Risks and Challenges:

Potential risks include increasing competition, dependence on the cloud computing market, and potential integration challenges for its customers.

Conclusion:

Predicting future stock growth requires careful analysis of market trends, company fundamentals, and potential risks. While Palantir represents a successful investment, CrowdStrike and Datadog, with their strong growth potential and robust business models, present compelling alternative investment opportunities. Remember that thorough due diligence is crucial before investing in any high-growth stock. Effective risk management strategies, such as diversification and dollar-cost averaging, are recommended.

Start predicting your future stock growth today by researching CrowdStrike Holdings, Inc. (CRWD) and Datadog (DDOG)—two compelling alternatives to Palantir that offer potentially higher returns. Remember to always conduct thorough due diligence before making any investment decisions. This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025 -

Planlegg Vinterreisen Sjekk Vaermeldingen For Du Kjorer I Sor Norges Fjell

May 09, 2025

Planlegg Vinterreisen Sjekk Vaermeldingen For Du Kjorer I Sor Norges Fjell

May 09, 2025 -

Is Palantir A Buy After A 30 Price Drop

May 09, 2025

Is Palantir A Buy After A 30 Price Drop

May 09, 2025 -

2025 Iditarod Ceremonial Start A Sea Of Spectators In Downtown Anchorage

May 09, 2025

2025 Iditarod Ceremonial Start A Sea Of Spectators In Downtown Anchorage

May 09, 2025 -

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025