Private Credit's Widening Cracks: Signs Of Distress Before The Market Turmoil

Table of Contents

Rising Defaults and Increased Delinquency Rates

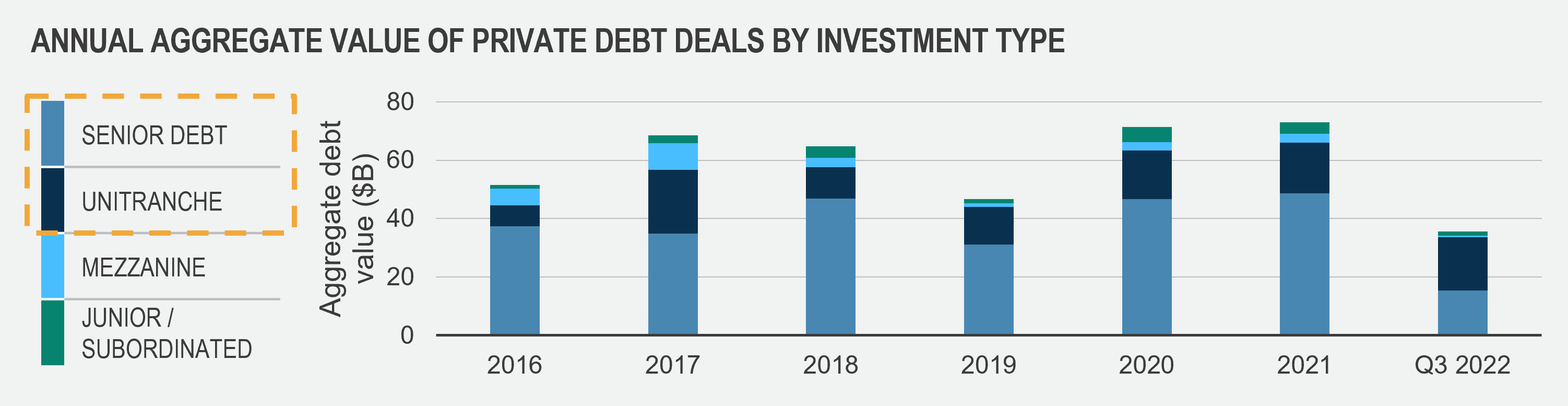

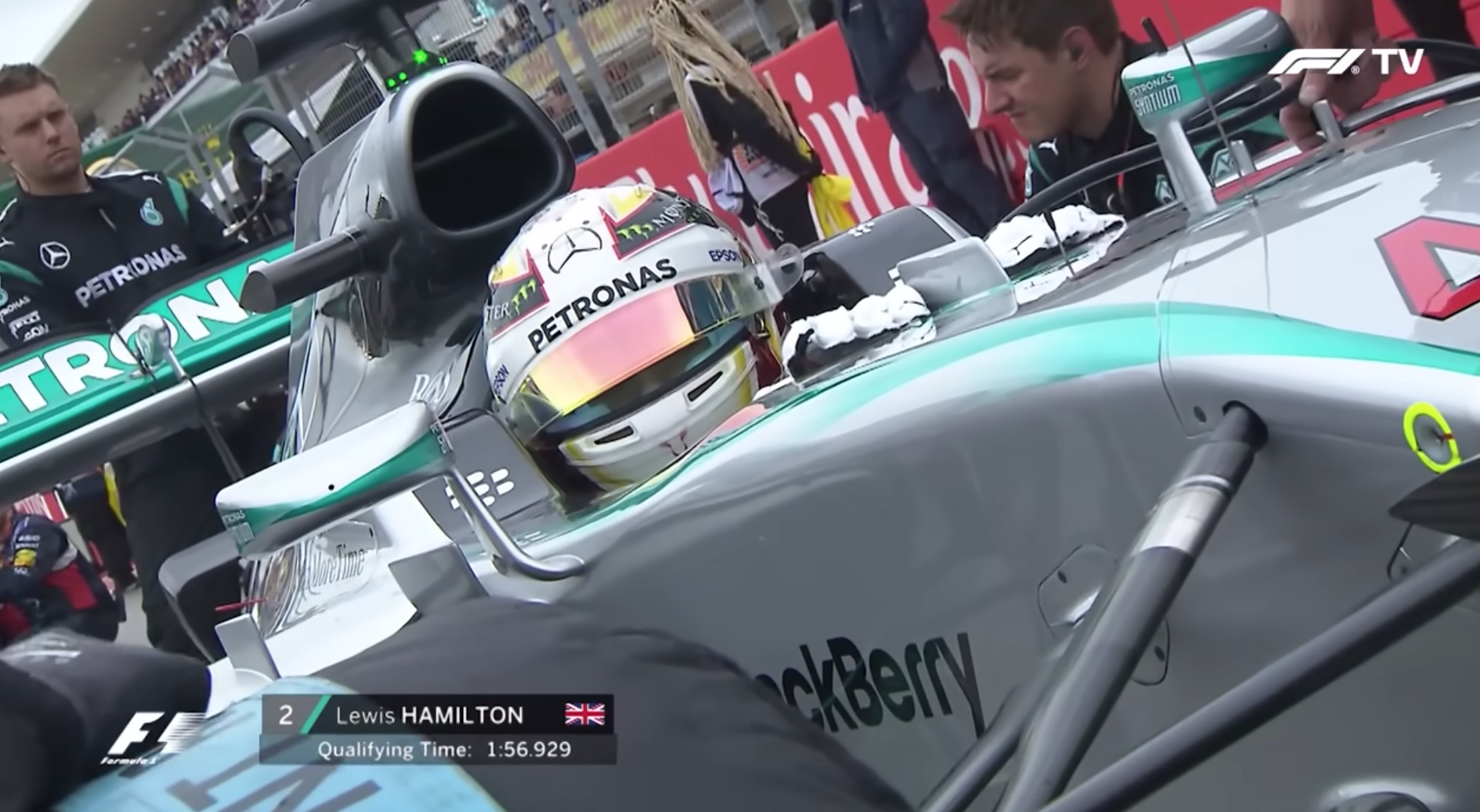

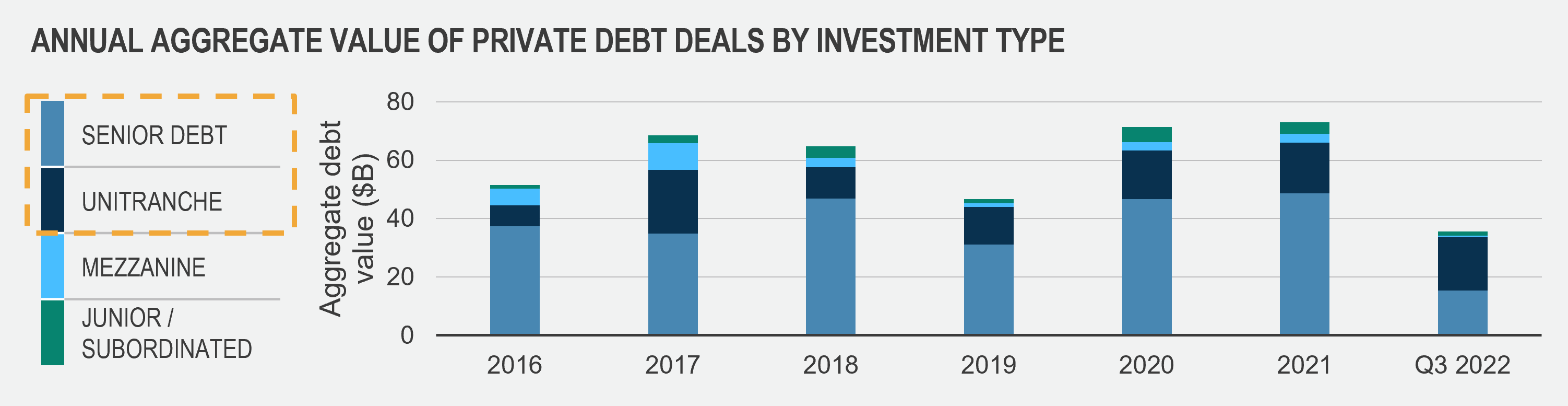

The private credit market, characterized by loans made outside of traditional banking channels, is experiencing a significant uptick in defaults and delinquencies. This represents a stark shift from the relatively stable performance seen in previous years. Several factors contribute to this worrying trend. Leveraged buyouts, once a staple of private credit strategies, have proven less profitable in a higher interest rate environment, leading to increased financial strain on borrowers.

- Specific data on default rates compared to previous years: While precise figures vary depending on the data source and methodology, industry reports suggest a substantial increase in private credit defaults in 2023 compared to the relatively low rates observed in 2021 and 2022. Some estimates place the increase at over 50% in certain high-risk sectors.

- Examples of sectors experiencing higher default rates (e.g., real estate, technology): The real estate sector, particularly commercial real estate, is experiencing a significant rise in defaults due to decreased property values and rising interest rates, impacting refinancing capabilities. Similarly, the technology sector, which saw significant private credit investment in recent years, is witnessing increased defaults as some companies struggle with reduced valuations and tighter funding conditions.

- Analysis of the reasons behind the increase (e.g., macroeconomic factors, over-leveraging): The current macroeconomic environment, characterized by rising interest rates, inflation, and geopolitical uncertainty, is a significant contributor. Many private credit borrowers, particularly those with high levels of leverage, are struggling to meet their debt obligations in this challenging climate. Over-leveraging during periods of cheap capital has left many companies vulnerable to even minor economic shifts.

Deteriorating Credit Quality and Increased Risk

The decline in credit quality within the private credit market is another significant warning sign. This deterioration is reflected in several key metrics. The increased reliance on covenant-lite loans—loans with fewer borrower protections—further exacerbates the risk profile. This trend increases the vulnerability of investors to borrower defaults.

- Explain the metrics used to assess credit quality (e.g., credit ratings, leverage ratios): Key metrics include credit ratings (where applicable), leverage ratios (debt-to-equity), interest coverage ratios, and debt service coverage ratios. A decline in these metrics indicates deteriorating credit quality.

- Highlight the increasing number of lower-rated loans: The market is seeing a surge in loans with lower credit ratings, reflecting increased risk. This signifies a shift towards riskier borrowers and less stringent underwriting standards.

- Discuss the impact of rising interest rates on borrowers' ability to repay: The sharp increase in interest rates has significantly impacted borrowers' ability to service their debt, leading to higher default probabilities. The rising cost of borrowing makes it more challenging for companies to manage their debt obligations, even those with previously healthy financial positions.

Reduced Investor Appetite and Liquidity Concerns

The recent decline in the private credit market is also evidenced by reduced investor appetite. Institutional investors are becoming increasingly cautious, leading to a decrease in new capital flowing into private credit funds. This reduced investor confidence is amplified by concerns about liquidity.

- Evidence of reduced fundraising for private credit funds: Several private credit fund managers are reporting difficulty raising capital for new funds, indicating a decline in investor interest and confidence.

- Analysis of the impact of decreased investor confidence: Decreased investor confidence contributes to a vicious cycle: lower demand drives down prices, further reducing investor appetite and increasing the likelihood of defaults.

- Discussion of the challenges of exiting private credit investments quickly: Private credit investments are typically illiquid, meaning it can be difficult to sell them quickly without significant price concessions. This illiquidity creates additional challenges for investors seeking to exit their positions in a stressed market.

Increased Scrutiny from Regulators

The increased regulatory scrutiny of the private credit market is another factor contributing to the current distress. Regulators are increasingly concerned about the lack of transparency, risk management practices, and potential systemic risks associated with this rapidly growing sector.

- Examples of recent regulatory actions or proposed changes: Regulatory bodies are implementing stricter capital requirements, enhancing reporting standards, and reviewing lending practices.

- Analysis of the potential consequences of increased regulation: Increased regulation could lead to higher compliance costs for private credit firms, reduced profitability, and potentially slower growth of the sector.

- Discussion of the impact on future investment strategies: The tightening regulatory environment will likely influence future investment strategies, potentially shifting the focus towards lower-risk borrowers and more conservative lending practices.

Conclusion

The warning signs are clear: rising defaults, deteriorating credit quality, reduced investor appetite, and increased regulatory scrutiny are all indicative of significant stress within the private credit market. This confluence of factors points towards a potential for substantial market turmoil. Understanding the widening cracks in the private credit market is crucial for investors. Take proactive steps to evaluate your exposure to private credit and diversify your portfolio to mitigate risk. Ignoring these warning signs could have significant consequences for your investment strategy. Careful consideration and proactive management of your private credit investments are essential in navigating this challenging market environment.

Featured Posts

-

El Sistema Alberto Ardila Olivares Garantia De Logro En El Futbol

Apr 27, 2025

El Sistema Alberto Ardila Olivares Garantia De Logro En El Futbol

Apr 27, 2025 -

Albertas Oil Industry And The Anti Trump Divide In Canada

Apr 27, 2025

Albertas Oil Industry And The Anti Trump Divide In Canada

Apr 27, 2025 -

Is A Fifth Champions League Spot For The Premier League Inevitable

Apr 27, 2025

Is A Fifth Champions League Spot For The Premier League Inevitable

Apr 27, 2025 -

Nosferatu The Vampyre On Now Torontos Detour Film Analysis

Apr 27, 2025

Nosferatu The Vampyre On Now Torontos Detour Film Analysis

Apr 27, 2025 -

Private Credits Widening Cracks Signs Of Distress Before The Market Turmoil

Apr 27, 2025

Private Credits Widening Cracks Signs Of Distress Before The Market Turmoil

Apr 27, 2025

Latest Posts

-

Assessing The Economic Fallout The Canadian Travel Boycott And The Us

Apr 28, 2025

Assessing The Economic Fallout The Canadian Travel Boycott And The Us

Apr 28, 2025 -

The Us Economy Under Pressure Assessing The Impact Of The Canadian Travel Boycott

Apr 28, 2025

The Us Economy Under Pressure Assessing The Impact Of The Canadian Travel Boycott

Apr 28, 2025 -

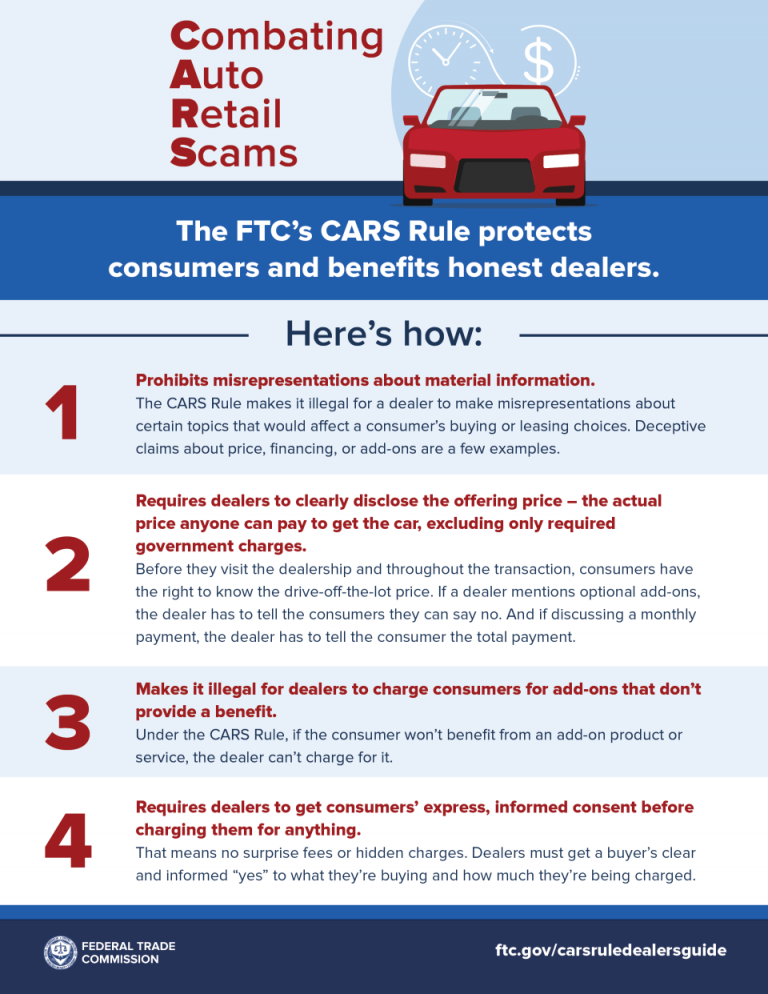

Auto Dealers Push Back Against Mandatory Ev Quotas

Apr 28, 2025

Auto Dealers Push Back Against Mandatory Ev Quotas

Apr 28, 2025 -

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 28, 2025

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025