Proposed Changes To Bond Forward Regulations For Indian Insurers

Table of Contents

Increased Transparency and Disclosure Requirements

The proposed changes emphasize significantly increased transparency within the bond forward market. This enhanced transparency aims to bolster market stability and foster greater investor confidence. The regulatory authorities are pushing for more detailed reporting and rigorous disclosure practices to ensure accountability and prevent manipulative behavior.

- Detailed Reporting of Bond Forward Positions: Insurers will be required to provide comprehensive reports detailing the volume and value of their bond forward positions, categorized by maturity, counterparty, and underlying bond.

- Valuation Methodologies Disclosure: The proposed regulations mandate the disclosure of the specific valuation methodologies used for bond forwards, promoting consistency and comparability across insurers.

- Comprehensive Risk Management Practices Disclosure: Insurers must transparently detail their risk management frameworks, including stress testing procedures, internal controls, and contingency plans for managing potential losses from bond forward positions.

Increased transparency in regulatory compliance and financial reporting relating to bond forward positions will facilitate more effective risk mitigation strategies, allowing for better oversight and more informed decision-making by investors and regulators.

Strengthened Risk Management Frameworks

Strengthening risk management frameworks for bond forwards is a central theme of the proposed changes. The goal is to reduce systemic risk and safeguard policyholder interests by ensuring insurers have robust mechanisms in place to manage potential losses.

- Enhanced Capital Adequacy Requirements: The new regulations may introduce stricter capital adequacy requirements for insurers holding bond forward positions, ensuring they have sufficient capital buffers to absorb potential losses. This directly relates to solvency and risk-based capital calculations.

- Advanced Stress Testing Methodologies: Insurers will be expected to adopt more sophisticated stress testing methodologies to assess the potential impact of adverse market scenarios on their bond forward portfolios.

- Stringent Internal Controls: The proposed changes will likely involve strengthened internal controls and oversight mechanisms to monitor and manage bond forward-related risks effectively.

These changes directly improve the capital adequacy of the insurance sector, offering better protection against financial shocks and contributing to overall market stability.

Revised Valuation and Accounting Standards

The proposed amendments incorporate updated valuation and accounting standards for bond forward contracts, aligning them with international best practices. This harmonization aims to improve the accuracy and comparability of financial reporting among Indian insurers.

- Adoption of IFRS 9 and IND AS: The proposed changes may necessitate the adoption of IFRS 9 and relevant IND AS (Indian Accounting Standards) for the valuation and accounting of bond forwards, impacting fair value accounting principles.

- Impact on Financial Statements: The new standards will likely change how bond forward positions are reflected in insurers' financial statements, affecting key metrics like net income and asset values.

- Enhanced Transparency in Financial Reporting Standards: The updated standards aim to create a more transparent and comprehensive picture of an insurer's financial position, enhancing the quality of financial reporting standards.

The shift towards IFRS 9 and IND AS will necessitate significant adjustments in financial reporting processes, potentially requiring investment in new accounting systems and training for finance professionals.

Impact on Investment Strategies of Indian Insurers

The proposed changes in Bond Forward Regulations for Indian Insurers are likely to significantly influence the investment strategies of Indian insurance companies. Insurers will need to re-evaluate their risk appetite and asset allocation strategies in light of these new regulations.

- Shifts in Asset Allocation: Insurers may adjust their asset allocation to reduce exposure to bond forwards or diversify their holdings to mitigate risk. This will affect asset allocation and portfolio management strategies.

- Changes in Investment Choices: The new regulations might lead insurers to favor more liquid and less risky investments compared to previously held bond forward positions.

- Potential Effects on Returns and Risk Profiles: The impact on returns and risk profiles will depend on the specific strategies adopted by individual insurers. There is a potential for both increased compliance costs and decreased returns on certain strategies. This will affect their overall risk appetite.

Navigating this changing landscape requires careful portfolio management and a thorough understanding of the evolving regulatory environment.

Challenges and Opportunities for the Insurance Sector

The implementation of these new Bond Forward Regulations for Indian Insurers presents both challenges and opportunities for the insurance sector. Insurers need to proactively address the challenges to leverage the opportunities.

- Challenges: These include the substantial compliance costs associated with implementing the new regulations, and upgrading technological infrastructure to manage the increased reporting requirements. Technological adoption is critical here.

- Opportunities: Enhanced market credibility, improved risk management practices, and a stronger regulatory framework can improve the overall strength of the sector. This creates a competitive advantage for well-prepared firms.

Adapting to these changes effectively will ensure Indian insurers remain competitive and maintain the trust and confidence of policyholders and investors.

Conclusion: Preparing for the Future of Bond Forward Regulations for Indian Insurers

The proposed changes to Bond Forward Regulations for Indian Insurers represent a significant shift towards greater transparency, stronger risk management, and updated accounting standards. While implementation may present challenges, such as increased compliance costs and technological upgrades, the long-term benefits include improved market stability, enhanced investor confidence, and stronger protection for policyholders. Indian insurers must proactively adapt to these changes by investing in technology, enhancing their risk management capabilities, and staying informed about future updates. To stay abreast of further developments, we recommend regularly reviewing the regulatory announcements from IRDAI (Insurance Regulatory and Development Authority of India) and consulting with legal and financial experts specializing in insurance regulations. Proactive preparation for these changes in Bond Forward Regulations for Indian Insurers is crucial for the future success of the Indian insurance sector.

Featured Posts

-

Lidery Stran Proignoriruyut Parad V Kieve 9 Maya Starmer Makron Merts Tusk

May 09, 2025

Lidery Stran Proignoriruyut Parad V Kieve 9 Maya Starmer Makron Merts Tusk

May 09, 2025 -

Review Mariah The Scientists Burning Blue A Deep Dive

May 09, 2025

Review Mariah The Scientists Burning Blue A Deep Dive

May 09, 2025 -

Nhl Highlights Hertls Two Hat Tricks Lead Golden Knights To Victory

May 09, 2025

Nhl Highlights Hertls Two Hat Tricks Lead Golden Knights To Victory

May 09, 2025 -

8 Cagr Projected For Wireless Mesh Networks Market Size

May 09, 2025

8 Cagr Projected For Wireless Mesh Networks Market Size

May 09, 2025 -

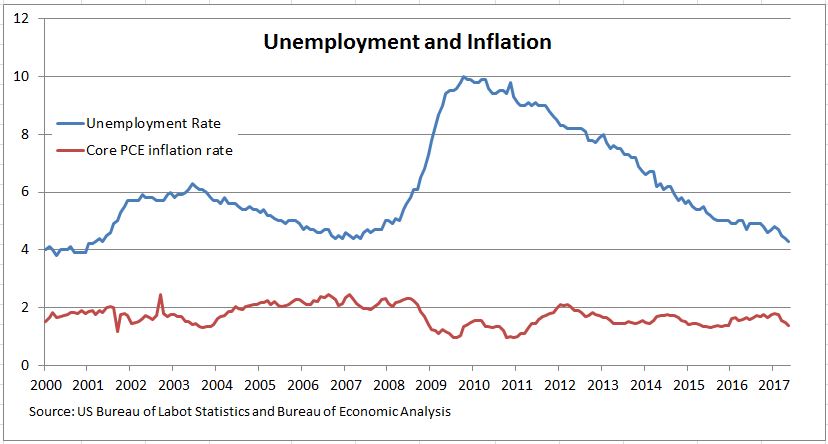

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025