PwC's Withdrawal From Nine Sub-Saharan African Countries: Implications And Analysis

Table of Contents

PwC's recent announcement of its withdrawal from nine Sub-Saharan African countries has sent shockwaves through the business community. This unprecedented move raises significant questions about the future of auditing, financial services, and economic development across the region. This article analyzes the implications of PwC's withdrawal and explores its potential consequences for various stakeholders. The scale of this decision necessitates a thorough understanding of its underlying causes and potential ramifications for the African economy.

Reasons Behind PwC's Withdrawal

The decision by PwC to withdraw from nine Sub-Saharan African countries is likely multifaceted, driven by a complex interplay of factors. Understanding these reasons is crucial to assessing the long-term impact on the region.

Regulatory Scrutiny and Compliance Costs

Increasing regulatory scrutiny and the associated compliance costs undoubtedly played a significant role. Many Sub-Saharan African countries are strengthening their regulatory frameworks for financial services, aligning with international standards. This often translates into:

- Stricter regulations: New laws and regulations demanding greater transparency and accountability in financial reporting.

- Increased audit fees: Higher costs for PwC to comply with these stricter rules, impacting profitability.

- Challenges in meeting international standards: Difficulties in adapting to evolving global accounting standards (like IFRS) within the context of sometimes less developed infrastructure.

- Potential for penalties: The risk of significant financial penalties for non-compliance further increases operational costs and risk.

PwC's cost-benefit analysis likely weighed the substantial investments required to maintain compliance against the potential returns in these markets. The decision suggests that, for these specific countries, the costs outweighed the benefits.

Market Dynamics and Competition

The competitive landscape within Sub-Saharan Africa's accounting market is also a critical factor. The presence of other Big Four firms, coupled with the emergence of strong local competitors, creates a highly competitive environment.

- Presence of other Big Four firms: Intense competition from Deloitte, EY, and KPMG for a share of the market.

- Emergence of local competitors: Growth and increasing capabilities of indigenous accounting firms offering competitive services.

- Market saturation in certain regions: Potential for reduced profitability in already saturated markets.

This competitive pressure may have influenced PwC's strategic decision to consolidate its resources in more lucrative or strategically important markets.

Operational Challenges and Infrastructure

Operational challenges and infrastructural limitations within the affected countries present additional hurdles. These challenges can significantly impact operational efficiency and profitability:

- Political instability: Political risks and uncertainty in some regions pose considerable challenges.

- Lack of reliable communication networks: Limited access to reliable internet and communication technologies impacting operational efficiency.

- Difficulties in talent acquisition and retention: Challenges in attracting and retaining skilled professionals in competitive markets.

- Security concerns: Safety and security risks for personnel operating in certain regions can be substantial.

Impact on Sub-Saharan African Economies

PwC's withdrawal carries significant implications for the economies of the affected Sub-Saharan African countries. The consequences extend beyond the immediate loss of a major auditing firm.

Loss of Expertise and Capacity

The departure of PwC represents a loss of significant expertise and capacity in the region. Many local businesses and governments relied heavily on PwC's services. This loss could lead to:

- Reduced access to high-quality audit services: Local firms may lack the capacity or expertise to immediately fill the gap.

- Increased risk of financial mismanagement: A decrease in rigorous auditing practices can increase the risk of financial irregularities.

- Difficulty in attracting foreign investment: A perceived reduction in auditing standards could negatively impact investor confidence.

- Negative impact on investor confidence: Foreign investors might view the withdrawal as a sign of increased risk.

Ripple Effects on the Financial Sector

The ripple effects on the financial sector could be substantial. The remaining firms will experience an increased workload, potentially straining their resources and capabilities.

- Increased workload for remaining firms: Deloitte, EY, and KPMG will likely absorb a significant portion of PwC's former clients.

- Potential strain on local regulatory bodies: Regulatory bodies may face increased pressure to ensure adequate oversight.

- Increased risk of financial fraud: Reduced auditing capacity could inadvertently increase the risk of financial malpractice.

- Decreased transparency and accountability: A decline in the quality of auditing services can reduce overall transparency.

Implications for Foreign Direct Investment (FDI)

The reduced auditing capacity is likely to impact international investors’ perceptions of risk. This could have far-reaching consequences:

- Potential decline in FDI: Investors may be hesitant to invest in regions perceived as having weaker auditing standards.

- Increased investor uncertainty: The withdrawal may create uncertainty among potential investors.

- Challenges in attracting foreign capital: The lack of high-quality audit services could hinder the ability to attract foreign capital.

- Slower economic growth: Reduced investment can lead to slower economic growth in the affected countries.

Potential Future Scenarios and Strategies

The situation demands proactive responses from various stakeholders to mitigate the negative consequences of PwC's withdrawal.

Role of Local Accounting Firms

Local accounting firms have a significant opportunity to expand their services and fill the void left by PwC. This requires:

- Opportunities for growth and expansion for local firms: A chance to capture a larger market share.

- Need for capacity building and training: Investment in training and development of local professionals is crucial.

- Potential for mergers and acquisitions: Larger local firms might consider acquiring smaller ones to expand their reach and capabilities.

- Need for government support: Government initiatives to support local firms are essential.

Government Response and Policy Changes

Governments in the affected countries need to implement supportive policies to address the situation:

- Investments in education and skills development: Enhancement of local accounting talent through education and training programs.

- Improvements in regulatory frameworks: Streamlining and improving the regulatory environment to encourage investor confidence.

- Creation of a more attractive business environment: Policies to attract and retain both local and international firms.

- Fostering competition among remaining accounting firms: Promoting a competitive yet fair landscape.

PwC's Future Strategy in Africa

PwC's future strategy in the remaining African markets will be closely watched. Potential actions include:

- Refocusing on key markets: Concentrating resources on more profitable and strategically important locations.

- Consolidation of resources: Streamlining operations and optimizing resource allocation.

- Adaptation to changing market conditions: Developing strategies to adapt to the evolving landscape.

- Review of risk assessment models: Re-evaluating risk assessment methodologies for future market entry and expansion decisions.

Conclusion

PwC's withdrawal from nine Sub-Saharan African countries represents a significant development with far-reaching implications. The loss of expertise, potential impact on financial stability, and implications for foreign direct investment are substantial concerns. The response from local firms, governments, and international organizations will shape the future of auditing and financial services in the region. This PwC withdrawal in Sub-Saharan Africa necessitates further research into the specific impacts on individual countries and the development of strategies to mitigate potential negative consequences. We urge readers to stay informed about developments related to PwC’s presence and future strategies in Sub-Saharan Africa. The long-term effects warrant continued observation and analysis. The future of Sub-Saharan Africa accounting depends on how stakeholders respond to this seismic shift.

Featured Posts

-

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025 -

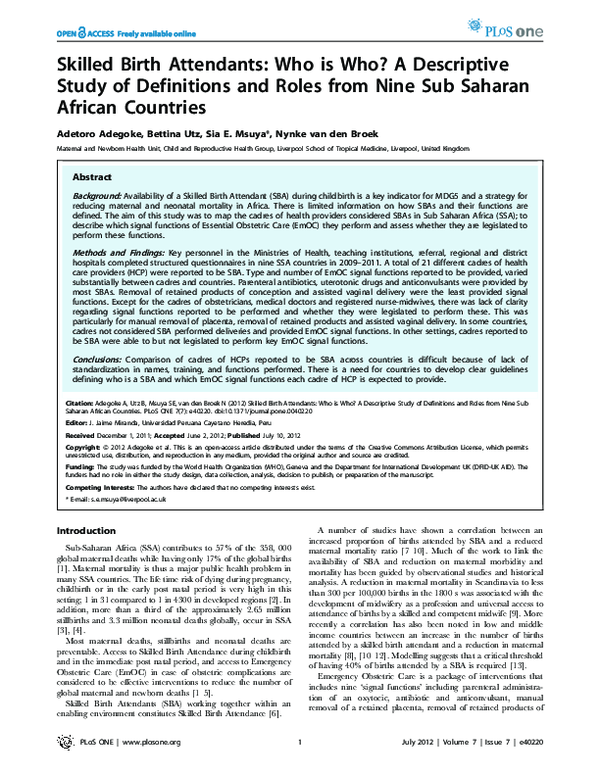

How U S Companies Are Responding To Tariff Uncertainty A Cost Cutting Focus

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty A Cost Cutting Focus

Apr 29, 2025 -

Fatal Boat Ferry Collision In Clearwater Florida Multiple Injuries Reported

Apr 29, 2025

Fatal Boat Ferry Collision In Clearwater Florida Multiple Injuries Reported

Apr 29, 2025 -

D C Helicopter Crash Investigation Reveals Pilot Error As Cause Of 67 Fatalities

Apr 29, 2025

D C Helicopter Crash Investigation Reveals Pilot Error As Cause Of 67 Fatalities

Apr 29, 2025 -

Djokovics Monte Carlo Masters 2025 Campaign Ends In Straight Sets Loss To Tabilo

Apr 29, 2025

Djokovics Monte Carlo Masters 2025 Campaign Ends In Straight Sets Loss To Tabilo

Apr 29, 2025

Latest Posts

-

Things Get Fishy A Guide To Ru Pauls Drag Race Season 17 Episode 6

Apr 30, 2025

Things Get Fishy A Guide To Ru Pauls Drag Race Season 17 Episode 6

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 Guide And Recap

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 Guide And Recap

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 Preview Things Get Fishy

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 Preview Things Get Fishy

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 What To Expect

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 What To Expect

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 A Preview And Guide

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 A Preview And Guide

Apr 30, 2025