Rebalancing Canadian Ownership: Reducing U.S. Dominance

Table of Contents

The Current State of Foreign Ownership in Canada

U.S. Influence Across Key Sectors

U.S. companies hold a significant presence in numerous key Canadian sectors, impacting the nation's economic independence. This foreign investment, while sometimes beneficial, presents challenges to maintaining Canadian control over crucial industries. The extent of U.S. ownership varies considerably across sectors but is particularly pronounced in areas such as:

- Energy: Major U.S. oil and gas companies control a substantial portion of Canada's energy production and export capacity, influencing energy policy and pricing. For example, [Insert example of a U.S. company and its market share in the Canadian energy sector]. This level of control raises concerns about potential exploitation of Canadian resources and energy security.

- Technology: The Canadian tech sector sees considerable U.S. investment and acquisition, often resulting in the transfer of intellectual property and the potential loss of Canadian innovation. [Insert example of a U.S. company's acquisition of a Canadian tech firm]. This can stifle the growth of homegrown technology companies.

- Finance: U.S. financial institutions play a significant role in the Canadian financial landscape, impacting lending practices, investment strategies, and overall financial stability. [Insert example of a major U.S. bank's presence in Canada]. This influence can potentially limit the scope of Canadian financial policy.

The consequences of this dominance are multifaceted:

- Loss of control over key resources and industries.

- Reduced Canadian innovation and technological advancement.

- Potential for exploitation of Canadian resources and labor.

The Impact on Canadian Jobs and Innovation

U.S. dominance significantly impacts Canadian job creation, wages, and technological advancement. The concentration of economic power in the hands of foreign entities can lead to:

- Job displacement: Acquisitions by U.S. companies can lead to job losses in Canada as operations are consolidated or moved elsewhere. [Insert statistic or example showcasing job displacement due to foreign acquisition].

- Lower wages: Increased competition from foreign companies can suppress wages for Canadian workers, especially in sectors with significant U.S. presence.

- Reduced investment in R&D: Foreign companies may prioritize research and development in their home countries, limiting investment in Canadian innovation and technological advancement. This hinders the growth of a vibrant domestic tech sector.

- Loss of intellectual property: Acquisitions can lead to the transfer of valuable Canadian intellectual property to U.S. entities, diminishing the country's long-term competitive advantage.

Strategies for Rebalancing Canadian Ownership

Government Policies and Regulations

The Canadian government can play a crucial role in rebalancing Canadian ownership through strategic policies and regulations. This includes:

- Strengthening Investment Canada Act: The Act needs to be more robust in assessing the national interest implications of foreign acquisitions, especially in strategic sectors. This involves stricter scrutiny of deals and potentially introducing stricter thresholds for foreign ownership.

- Tax incentives for domestic investment: Providing tax breaks or other incentives for Canadian companies to expand and compete with foreign entities. This encourages domestic investment and strengthens Canadian businesses.

- Targeted support for Canadian businesses: Government grants and subsidies to support Canadian businesses, particularly startups and SMEs, in competing with larger foreign corporations.

- Reviewing trade agreements: Analyzing existing trade agreements to identify potential loopholes that negatively impact Canadian companies and adjusting them to better protect national interests.

Encouraging Domestic Investment

Stimulating investment from Canadian pension funds, individual investors, and corporations is crucial for rebalancing Canadian ownership. This can be achieved through:

- Tax incentives for Canadian investors: Offering tax advantages for investing in Canadian companies, particularly those in strategic sectors.

- Public awareness campaigns: Educating Canadians on the importance of investing in domestic companies and the benefits of supporting the national economy.

- Government-backed investment funds: Establishing government-backed investment funds specifically designed to support Canadian businesses and reduce reliance on foreign capital. These funds could target high-growth sectors or provide crucial funding during challenging economic periods.

Promoting Canadian Innovation and Entrepreneurship

A robust domestic innovation ecosystem is vital for competing with U.S. firms. The government can support this through:

- Support for Canadian startups and small businesses: Providing grants, mentorship programs, and access to funding for promising Canadian entrepreneurs and innovative businesses.

- Increased investment in research and development: Boosting funding for universities and research institutions to foster technological breakthroughs and support the commercialization of new technologies.

- Education and training programs: Investing in education and skills development to create a highly skilled workforce capable of competing in a globalized economy. This will ensure Canada has the talent pool to support innovative enterprises.

The Role of Canadian Investors and Consumers

The Power of Consumer Choice

Canadian consumers play a vital role in supporting domestic businesses. Consciously choosing Canadian products and services can significantly impact the success of domestic companies. This includes:

- Supporting Canadian brands: Actively seeking out and purchasing goods and services from Canadian companies.

- Researching product origins: Taking the time to investigate where products are manufactured and prioritizing Canadian-made products whenever possible.

Ethical Investing and Canadian Ownership

The rise of ethical investing offers a powerful mechanism to drive Canadian ownership. Canadians can actively contribute to rebalancing the economic landscape by:

- Investing in Canadian companies: Directing investments towards Canadian businesses that align with national interests and promote economic growth. This includes considering both publicly traded companies and privately held ventures.

- Promoting responsible investing: Supporting investment strategies that consider environmental, social, and governance (ESG) factors, aligning investments with long-term national interests.

Conclusion

Rebalancing Canadian ownership requires a multifaceted approach involving government policies, private sector initiatives, and conscious consumer choices. Addressing U.S. dominance is critical for securing Canada's economic future and maintaining national sovereignty. Strengthening the Canadian economy through increased domestic investment and supporting Canadian innovation is crucial for long-term prosperity.

Let's work together to prioritize Canadian ownership and strengthen our national economy. Learn more about investing in Canadian companies and supporting Canadian businesses to help us achieve rebalancing and reduce U.S. dominance in key sectors. Support initiatives promoting Canadian ownership and participate in building a stronger, more independent Canadian economy.

Featured Posts

-

Ecdc Vaccino Covid E Long Covid Un Legame Fondamentale

May 29, 2025

Ecdc Vaccino Covid E Long Covid Un Legame Fondamentale

May 29, 2025 -

Daltons Alliance With Murakami Linked Fund Reshaping Fuji Media

May 29, 2025

Daltons Alliance With Murakami Linked Fund Reshaping Fuji Media

May 29, 2025 -

Eyd Astqlal Alardn Thnyt Khast Mn Alshykh Fysl Alhmwd Ebr Jw 24

May 29, 2025

Eyd Astqlal Alardn Thnyt Khast Mn Alshykh Fysl Alhmwd Ebr Jw 24

May 29, 2025 -

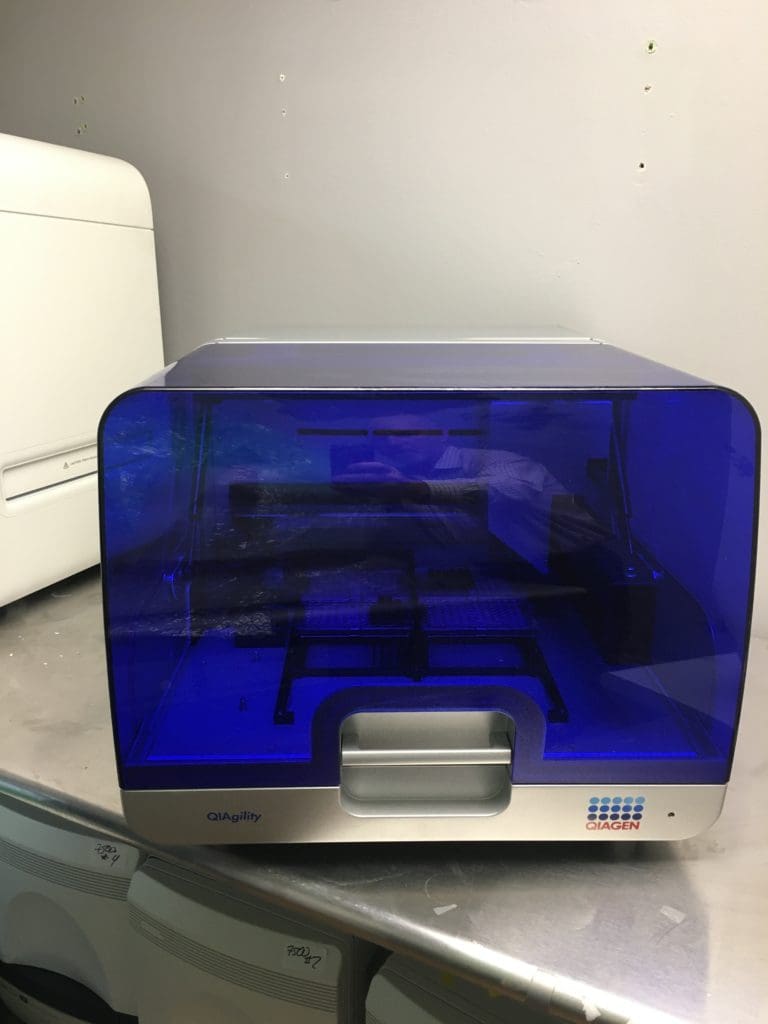

Qiagens Strong Q1 2025 Performance Drives Upward Revision Of Full Year Eps Guidance

May 29, 2025

Qiagens Strong Q1 2025 Performance Drives Upward Revision Of Full Year Eps Guidance

May 29, 2025 -

El Significado De Los Arcanos Menores En La Lectura Del Tarot

May 29, 2025

El Significado De Los Arcanos Menores En La Lectura Del Tarot

May 29, 2025

Latest Posts

-

Incentive Program German City Offers Free Two Week Stay For Potential Residents

May 31, 2025

Incentive Program German City Offers Free Two Week Stay For Potential Residents

May 31, 2025 -

Two Weeks Free Accommodation German Citys Incentive For New Residents

May 31, 2025

Two Weeks Free Accommodation German Citys Incentive For New Residents

May 31, 2025 -

German City Offers Free Two Week Stay To Attract New Residents

May 31, 2025

German City Offers Free Two Week Stay To Attract New Residents

May 31, 2025 -

Update Former Nypd Commissioner Keriks Hospitalization And Expected Recovery

May 31, 2025

Update Former Nypd Commissioner Keriks Hospitalization And Expected Recovery

May 31, 2025 -

Neue Einwohner Gesucht Deutsche Stadt Bietet Kostenlose Unterbringung

May 31, 2025

Neue Einwohner Gesucht Deutsche Stadt Bietet Kostenlose Unterbringung

May 31, 2025