Recent Bitcoin Rebound: A Deeper Dive Into Market Trends

Table of Contents

Analyzing the Recent Bitcoin Price Surge

The recent Bitcoin price surge is a multifaceted event, influenced by both technical and macroeconomic factors. Let's break down the key elements contributing to this upward trend.

Technical Factors Fueling the Rebound:

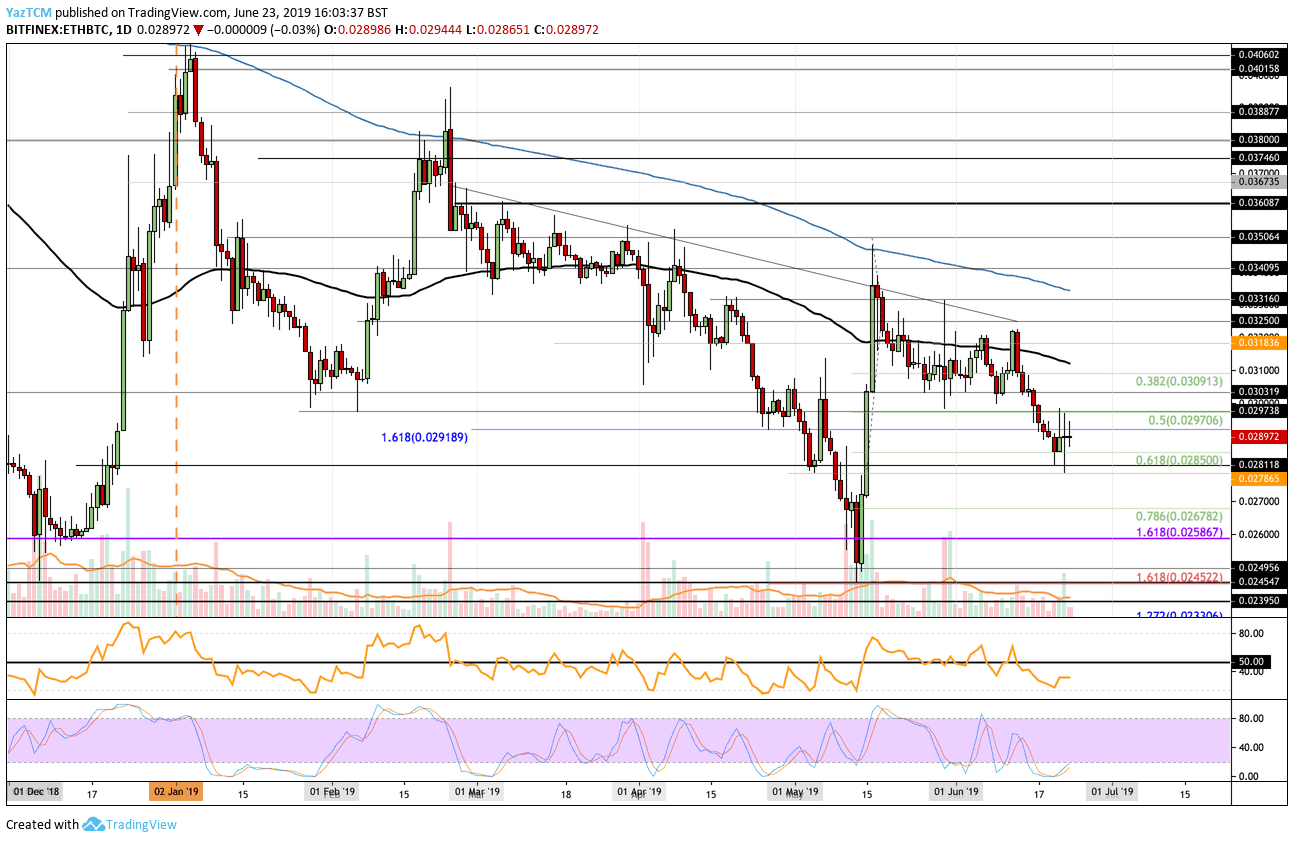

Recent price action shows a clear reversal of the previous bearish trend. We've seen a series of bullish candlestick patterns, indicating a shift in market sentiment. Support levels previously breached have now acted as strong foundations, while resistance levels are being consistently broken. Trading volume has also seen a significant increase, confirming the strength of the recent Bitcoin rebound. Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are showing signs of bullish momentum, further supporting the upward trend.

- Increased buying pressure from institutional investors: Large-scale institutional buying has been a major catalyst, injecting significant capital into the market.

- Reduction in selling pressure from previous market downturns: The panic selling witnessed during previous market corrections appears to have subsided, leading to a more balanced market.

Macroeconomic Influences on Bitcoin's Price:

The macroeconomic environment plays a significant role in Bitcoin's price fluctuations. While often touted as a hedge against inflation, Bitcoin's correlation with traditional markets is complex and not always straightforward. Recent interest rate hikes by central banks have impacted various asset classes, but the effect on Bitcoin has been less predictable than some analysts expected. Geopolitical events, particularly those impacting global stability and risk appetite, can also influence Bitcoin's price, creating both opportunities and challenges.

- Impact of regulatory changes globally: Varying regulatory approaches across different countries continue to shape market sentiment and investment decisions.

- Adoption by large financial institutions and corporations: Increased adoption by major financial players adds legitimacy and stability to the Bitcoin market.

Potential Drivers Behind the Bitcoin Rebound

Beyond the technical and macroeconomic factors, several key drivers are fueling the recent Bitcoin rebound.

Growing Institutional Adoption:

The increasing involvement of institutional investors is a critical factor. Large corporations and institutional funds are allocating a significant portion of their portfolios to Bitcoin, viewing it as a potential store of value and a diversification tool. This influx of institutional capital adds stability and credibility to the Bitcoin market.

- Grayscale Bitcoin Trust inflows: The consistent inflow of assets into Grayscale Bitcoin Trust demonstrates continued institutional interest.

- Increased offerings of Bitcoin-related financial products: The growing availability of Bitcoin-based financial products (ETFs, futures, etc.) makes it more accessible to institutional investors.

The Role of Network Development and Innovation:

Advancements in Bitcoin's underlying technology are also contributing to the positive sentiment. The development and adoption of Layer-2 solutions, like the Lightning Network, significantly improve scalability and transaction speeds. This enhanced infrastructure makes Bitcoin more attractive for everyday use, bolstering its long-term potential.

- The development and adoption of Layer-2 solutions: These solutions address scalability challenges, making Bitcoin transactions faster and cheaper.

- Growing interest in Bitcoin’s environmental impact solutions: Increased awareness of Bitcoin's energy consumption and the development of more sustainable mining practices have addressed concerns for many investors.

Assessing Risks and Potential Future Trends

While the recent Bitcoin rebound is encouraging, it’s crucial to acknowledge the inherent risks and uncertainties associated with the cryptocurrency market.

Volatility and Market Uncertainty:

Bitcoin's price remains highly volatile, and significant fluctuations are expected. This inherent risk requires a cautious approach to investing. Diversification and prudent risk management strategies are essential to mitigate potential losses.

- Potential regulatory crackdowns: Uncertain regulatory landscapes in various jurisdictions pose a significant risk to the market.

- The ongoing debate on Bitcoin’s long-term sustainability: Concerns about energy consumption and scalability remain subjects of ongoing debate.

Predicting Future Price Movements:

Predicting future Bitcoin price movements is inherently challenging. While fundamental and technical analysis can provide insights, they are not foolproof. Market sentiment, unexpected news events, and regulatory changes can all significantly impact price.

- Factors influencing potential future price appreciation or depreciation: These include macroeconomic conditions, regulatory developments, technological advancements, and overall market sentiment.

- Importance of staying informed about market trends and news: Staying updated on market developments is crucial for making informed decisions.

Conclusion

The recent Bitcoin rebound is a complex phenomenon driven by a confluence of technical, macroeconomic, and fundamental factors. While the positive price action is promising, investors should approach the market with a balanced perspective, recognizing the volatility and inherent risks. Understanding the drivers behind this Bitcoin rebound and staying informed about future trends is paramount for navigating this dynamic market. Continue to monitor Bitcoin price movements, market analysis, and news to make well-informed decisions about your Bitcoin investment strategy. Stay updated on the latest developments in the ever-evolving world of Bitcoin and cryptocurrency.

Featured Posts

-

Yevrokubki Detalniy Oglyad Matchiv Ps Zh Proti Aston Villi

May 08, 2025

Yevrokubki Detalniy Oglyad Matchiv Ps Zh Proti Aston Villi

May 08, 2025 -

First Trailer Released Mark Hamill Stars In Stephen Kings The Long Walk Adaptation

May 08, 2025

First Trailer Released Mark Hamill Stars In Stephen Kings The Long Walk Adaptation

May 08, 2025 -

New Ps 5 Pro Features What We Know So Far

May 08, 2025

New Ps 5 Pro Features What We Know So Far

May 08, 2025 -

Psg Derrota Al Lyon En Su Propio Estadio

May 08, 2025

Psg Derrota Al Lyon En Su Propio Estadio

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025

Latest Posts

-

Sufian Applauds Gcci President For Successful Expo 2025 Organization

May 08, 2025

Sufian Applauds Gcci President For Successful Expo 2025 Organization

May 08, 2025 -

Gcci Presidents Expo 2025 Efforts Earn Sufians Praise

May 08, 2025

Gcci Presidents Expo 2025 Efforts Earn Sufians Praise

May 08, 2025 -

Boston Celtics Nba Finals Merchandise Shop Official Gear At Fanatics

May 08, 2025

Boston Celtics Nba Finals Merchandise Shop Official Gear At Fanatics

May 08, 2025 -

Sufian Commends Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025

Sufian Commends Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025 -

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Nba Finals

May 08, 2025

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Nba Finals

May 08, 2025