Recent Changes Affecting Proxy Statements (Form DEF 14A)

Table of Contents

Increased Scrutiny of Executive Compensation Disclosure in Proxy Statements

The Securities and Exchange Commission (SEC) has intensified its focus on the transparency and accuracy of executive compensation disclosures within proxy statements. This heightened scrutiny aims to provide shareholders with a clearer and more comprehensive picture of how company executives are compensated.

Detailed Breakdown of Compensation Components

New regulations demand a more granular breakdown of executive compensation packages. This goes beyond simply stating total compensation. Now, companies must provide detailed information on:

- Base salary: Including any adjustments or increases.

- Bonuses: With clear explanations of the metrics used to determine bonus amounts.

- Stock options and awards: Including the grant date, exercise price, and vesting schedules.

- Other benefits: Such as retirement plans, perks, and other forms of compensation.

These enhanced requirements significantly impact shareholder analysis. Institutional investors and proxy advisory firms now have access to more data points to assess the fairness and competitiveness of executive compensation relative to company performance. This increased scrutiny puts pressure on companies to justify executive pay packages rigorously.

Say-on-Pay Provisions and Shareholder Engagement

Say-on-pay votes, allowing shareholders to express their opinion on executive compensation, have become more influential. Recent changes emphasize improved reporting of shareholder voting results, providing valuable insights into shareholder sentiment.

- Improved Reporting: Companies must clearly report the outcome of say-on-pay votes, including the percentage of votes for and against the compensation plan.

- Impact on Governance: Strong negative votes on say-on-pay can trigger corporate governance changes, potentially leading to adjustments in executive compensation structures.

- Managing Expectations: Companies must develop strategies to proactively engage with shareholders regarding compensation practices and address concerns to ensure alignment.

Enhanced Disclosure Requirements for Climate-Related Risks and Sustainability Initiatives

The increasing focus on environmental, social, and governance (ESG) factors has led to significant changes in proxy statement disclosures. Companies are now expected to provide more detailed information about their climate-related risks and sustainability initiatives.

Climate-Related Financial Disclosures

The SEC's focus on climate-related financial disclosures reflects the growing recognition of the financial implications of climate change. Companies need to disclose:

- Physical risks: Such as the impact of extreme weather events on operations and infrastructure.

- Transition risks: Such as the potential costs associated with transitioning to a low-carbon economy.

Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) provide guidance on effective climate-related disclosures, aligning reporting with investor expectations and supporting responsible ESG investing.

Integration of Sustainability Reporting into Proxy Statements

There's a growing trend of incorporating comprehensive ESG information into proxy statements. This includes:

- Best practices: Companies are increasingly adopting best practices for ESG reporting, using standardized frameworks to enhance comparability.

- Standardization challenges: Creating universally accepted standards for ESG reporting remains a challenge, leading to variations in disclosure practices.

- Investor demand: Investors are increasingly demanding ESG information to assess a company’s long-term sustainability and responsible business practices.

Changes to Proxy Access Rules and Shareholder Proposals

Recent amendments have significantly altered the rules governing shareholder proposals and proxy access. These changes aim to empower shareholders while maintaining corporate efficiency.

Updated Guidelines for Shareholder Proposals

The SEC has updated guidelines surrounding shareholder proposals, impacting submission deadlines and eligibility requirements:

- Changes to SEC Rules: These changes may include adjustments to the threshold for shareholder proposal inclusion, as well as clarifications on eligibility criteria.

- Impact on Activism: These updated rules influence the level of shareholder activism and the ability of shareholders to raise concerns on important corporate matters.

- Engaging with Proposals: Companies need strategies to engage effectively with shareholder proposals, understanding the implications and potentially addressing concerns proactively.

Modernized Proxy Access Rules

Amendments to proxy access rules provide shareholders with increased opportunities to nominate directors:

- Threshold Changes: The threshold of share ownership required to trigger proxy access may have been lowered, empowering more shareholders to nominate directors.

- Impact on Board Composition: This enhances board diversity and strengthens accountability by allowing a wider range of voices in board nominations.

- Managing Access Requests: Companies need to develop robust processes for managing proxy access requests, ensuring compliance with regulations.

Technological Advancements and the Digitization of Proxy Voting

Technological advancements are transforming how proxy materials are delivered and how shareholders vote.

Increased Use of Electronic Delivery and Online Voting

The shift towards electronic delivery and online voting platforms offers several advantages:

- Benefits of Electronic Delivery: Reduced costs, faster dissemination of information, and increased accessibility for shareholders.

- Accessibility and Security Challenges: Companies need to ensure that electronic delivery and online voting systems are accessible to all shareholders and provide robust security to protect against fraud.

- Best Practices for Secure Voting: Implementing secure online voting systems requires careful consideration of data protection and authentication protocols.

Data Analytics and Insights from Proxy Voting Data

Proxy voting data offers valuable insights for companies:

- Understanding Preferences: Analyzing voting patterns helps companies understand shareholder preferences and improve investor relations.

- Data Breaches and Privacy: Companies must prioritize data security and comply with privacy regulations when handling sensitive shareholder data.

- Best Practices for Data Management: Robust data management protocols are crucial to ensure the confidentiality and integrity of proxy voting data.

Conclusion

Recent changes affecting proxy statements (Form DEF 14A) have broadened disclosure requirements, increased shareholder engagement, and leveraged technology to improve communication and voting processes. Understanding these changes is critical for both companies to maintain compliance and for investors to make informed decisions. Staying informed about updates to proxy statement requirements is crucial. Seek professional advice when navigating the complexities of Form DEF 14A and related proxy statement matters to ensure effective communication with shareholders and compliance with SEC regulations. The ongoing evolution of proxy statement regulations necessitates continuous learning and adaptation to maintain best practices.

Featured Posts

-

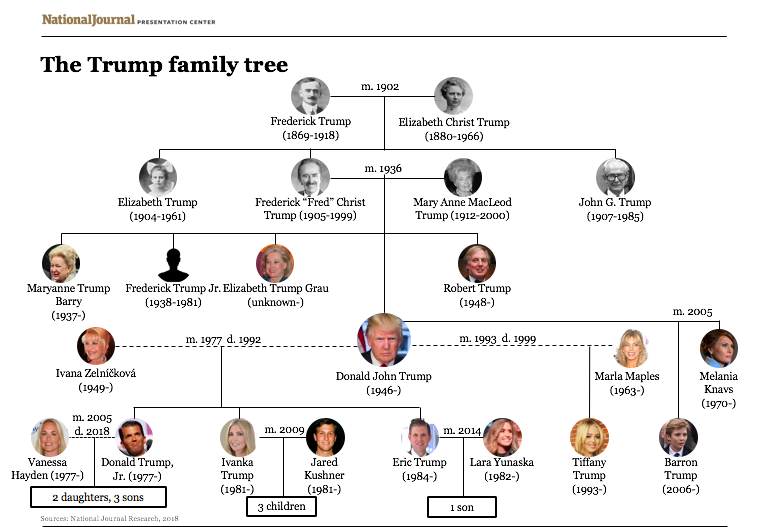

Trump Family Tree Exploring The Extensive Lineage Of The Former Us President

May 17, 2025

Trump Family Tree Exploring The Extensive Lineage Of The Former Us President

May 17, 2025 -

Novace Mensik Otkriva Dokovicevu Ulogu U Njegovom Uspehu

May 17, 2025

Novace Mensik Otkriva Dokovicevu Ulogu U Njegovom Uspehu

May 17, 2025 -

Rabota V Dubae Dlya Rossiyan Trudnosti I Vozmozhnosti V 2025

May 17, 2025

Rabota V Dubae Dlya Rossiyan Trudnosti I Vozmozhnosti V 2025

May 17, 2025 -

Principal Financial Group Pfg Stock 13 Analyst Ratings Analyzed

May 17, 2025

Principal Financial Group Pfg Stock 13 Analyst Ratings Analyzed

May 17, 2025 -

Live Knicks Vs Trail Blazers Score 77 77 March 13 2025 Updates

May 17, 2025

Live Knicks Vs Trail Blazers Score 77 77 March 13 2025 Updates

May 17, 2025