Reduced Cash Flow At Eni: Impact On Share Buyback And Cost-Cutting Measures

Table of Contents

Eni's Reduced Cash Flow: The Underlying Causes

Several factors have contributed to Eni's decline in cash flow. Understanding these root causes is crucial to assessing the company's future prospects. The recent volatility in the energy market has significantly impacted Eni's financial performance.

- Fluctuations in oil and gas prices: The global energy market is notoriously volatile. Price swings, influenced by geopolitical events and supply chain disruptions, directly affect Eni's revenue streams. A prolonged period of low oil and gas prices can severely impact cash flow generation.

- Increased operating expenses: Rising inflation and supply chain constraints have driven up Eni's operating expenses. The costs of labor, materials, and logistics have all increased significantly, putting pressure on profit margins and consequently, cash flow.

- Geopolitical factors impacting energy markets: Geopolitical instability in key energy-producing regions has created uncertainty and volatility in the market. Sanctions, conflicts, and political tensions can disrupt supply chains and lead to price fluctuations, negatively affecting Eni's cash flow.

- Investment in renewable energy projects: Eni, like many other energy companies, is investing heavily in renewable energy sources as part of the global energy transition. While these investments are crucial for long-term sustainability, they require significant upfront capital expenditure, which can temporarily strain cash flow.

- Impact of inflation and supply chain disruptions: The global inflationary environment and widespread supply chain disruptions have placed significant pressure on Eni’s operational efficiency and profitability. These pressures directly translate to a reduction in available cash.

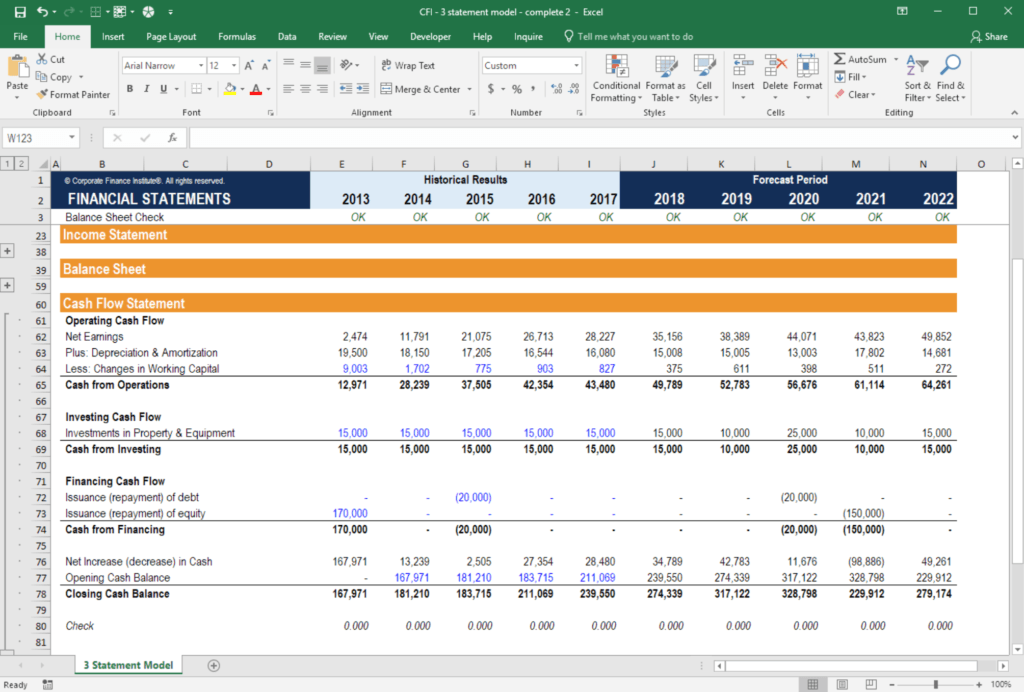

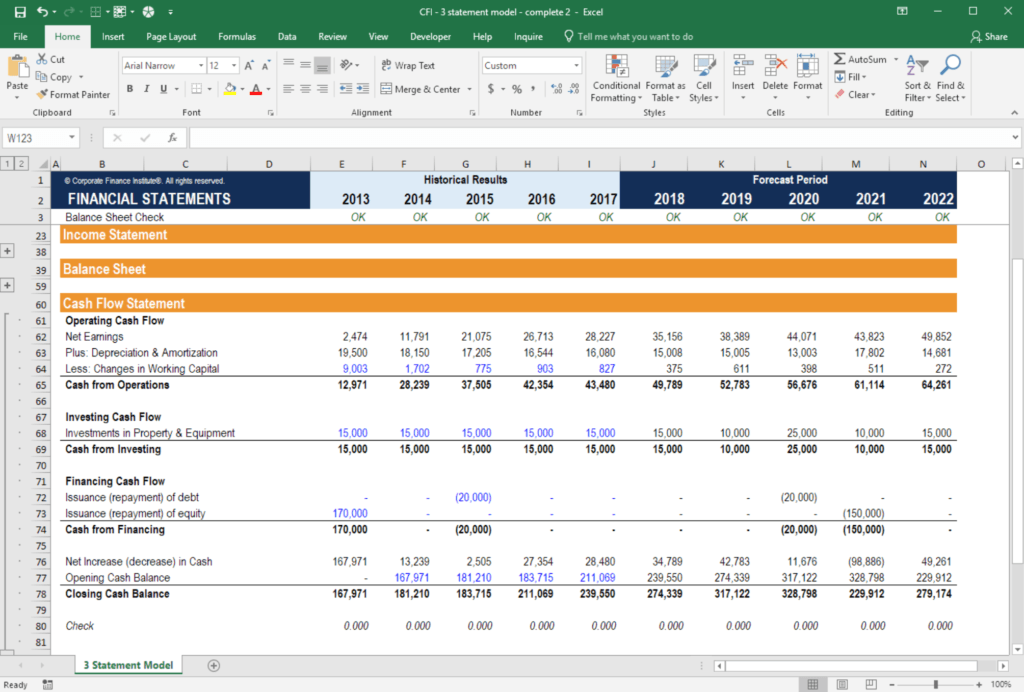

Analyzing Eni's financial statements reveals a clear correlation between these factors and the observed reduction in its cash flow. A comprehensive understanding of "Eni financial performance" requires considering these interconnected challenges within the broader context of "energy market volatility" and its impact on "cash flow reduction."

Impact on Eni's Share Buyback Program

The reduction in Eni's cash flow has had a direct and immediate impact on its previously announced share buyback program. The availability of funds for such initiatives is directly tied to the company's cash flow generation.

- Scale-back or suspension of the buyback program: To conserve cash and ensure financial stability, Eni may have to scale back or even suspend its share buyback program temporarily. This decision is a direct response to the reduced cash flow.

- Investor sentiment and stock price implications: The news of a potential reduction or suspension of the share buyback program can negatively impact investor sentiment. This can lead to a decrease in Eni's stock price, reflecting the market's perception of the company's financial health.

- Alternative capital allocation strategies: Faced with reduced cash flow, Eni might need to re-evaluate its capital allocation strategy. This could involve prioritizing investments in core businesses, debt reduction, or other strategic initiatives over share buybacks. Effective "capital allocation" is key to navigating this challenging period.

- Analysis of the impact on shareholder returns: A scaled-back or suspended share buyback program can affect shareholder returns, potentially leading to dissatisfaction among investors who were anticipating increased returns through the buyback program. Managing "investor relations" effectively during this period is crucial for Eni.

This situation underscores the complex interplay between "share buyback," "investor relations," "stock performance," and "capital allocation" strategies within the context of a changing energy landscape.

Eni's Cost-Cutting Measures in Response

To mitigate the impact of reduced cash flow, Eni has implemented various cost-cutting measures across its operations. These strategies aim to improve efficiency and preserve financial stability.

- Operational efficiency improvements: Eni is likely focusing on streamlining operations, improving productivity, and reducing waste across its value chain. This involves optimizing processes, adopting new technologies, and improving supply chain management.

- Reduction in workforce (if applicable): In some cases, companies facing cash flow challenges might resort to workforce reductions. This is a difficult but potentially necessary step to control labor costs. However, the specifics of Eni’s approach would need to be confirmed from official company communications.

- Deferred capital expenditure: Eni might delay or postpone some capital expenditure projects that are not deemed critical in the short term. This allows the company to conserve cash for more immediate needs.

- Restructuring of certain business units: Restructuring certain business units could involve streamlining operations, divesting non-core assets, or consolidating activities to improve efficiency and reduce costs.

- Supply chain optimization strategies: Eni is likely exploring opportunities to optimize its supply chain, negotiating better terms with suppliers, and diversifying sourcing to mitigate disruptions and reduce costs.

The effectiveness of these "cost optimization" strategies will be crucial in determining Eni's ability to navigate the current financial challenges and maintain its "operational efficiency" in the long run. Managing "capital expenditure" effectively is also critical.

Long-Term Implications for Eni and the Energy Sector

The current situation at Eni highlights some broader trends affecting the energy sector. Understanding the "long-term strategy" of energy companies like Eni is vital in predicting future developments.

- Impact on future investments and growth: Reduced cash flow can impact Eni's ability to invest in future projects, potentially hindering its growth trajectory in both traditional and renewable energy sectors.

- Competitiveness in the evolving energy landscape: The ability to adapt to the energy transition and maintain competitiveness will be key. Eni's response to this challenge will shape its long-term position in the market.

- Sustainability and ESG (Environmental, Social, and Governance) considerations: The energy transition presents both challenges and opportunities. Eni's approach to sustainability and ESG performance will be closely scrutinized by investors and stakeholders.

- Potential changes in the company's strategy: Eni might need to adjust its overall strategy, prioritizing certain areas over others to ensure long-term survival and growth. This could involve portfolio adjustments, focusing on specific energy sources, or further exploration of renewable energy.

The success of Eni's long-term strategy will depend on how effectively it balances the need for short-term cost-cutting with investments in long-term growth and "competitive advantage" within the context of the ongoing "energy transition" and its commitment to strong "ESG performance."

Conclusion: Navigating Reduced Cash Flow at Eni: Looking Ahead

The reduced cash flow at Eni presents significant challenges, necessitating adjustments to its share buyback program and the implementation of cost-cutting measures. The underlying causes, ranging from market volatility to investments in renewable energy, require a multifaceted response. Eni's ability to successfully navigate this situation will depend on its strategic response and its ability to adapt to the evolving energy landscape. To understand the complete picture, it’s crucial to "monitor Eni's cash flow" and "analyze Eni's financial health" closely. The long-term implications for Eni and the wider energy sector are significant, highlighting the need to "understand the impact of reduced cash flow" on major energy companies. We encourage readers to continue following Eni’s progress and the broader implications of these financial challenges within the industry.

Featured Posts

-

The Harvard Case A Deeper Dive Into Trumps Scrutiny Of Foreign University Funding

Apr 25, 2025

The Harvard Case A Deeper Dive Into Trumps Scrutiny Of Foreign University Funding

Apr 25, 2025 -

Frazzled Investors Coping With Market Instability And Huge Stock Swings

Apr 25, 2025

Frazzled Investors Coping With Market Instability And Huge Stock Swings

Apr 25, 2025 -

Limited Time Catch Jack O Connell In This Breathtaking Amazon Prime Film

Apr 25, 2025

Limited Time Catch Jack O Connell In This Breathtaking Amazon Prime Film

Apr 25, 2025 -

House Of Hair Newton Aycliffe Celebrates Top Ten Echo Ranking

Apr 25, 2025

House Of Hair Newton Aycliffe Celebrates Top Ten Echo Ranking

Apr 25, 2025 -

Nhung Hinh Anh Voi An Tiec Buffet Duoc Trang Diem Cau Ky

Apr 25, 2025

Nhung Hinh Anh Voi An Tiec Buffet Duoc Trang Diem Cau Ky

Apr 25, 2025

Latest Posts

-

Arc Raiders Second Public Test What To Expect This Month

May 01, 2025

Arc Raiders Second Public Test What To Expect This Month

May 01, 2025 -

Actor Michael Sheens 100 000 Donation 900 Peoples Debt Cleared

May 01, 2025

Actor Michael Sheens 100 000 Donation 900 Peoples Debt Cleared

May 01, 2025 -

Arc Raiders Public Test 2 New Gameplay Details And Release Date

May 01, 2025

Arc Raiders Public Test 2 New Gameplay Details And Release Date

May 01, 2025 -

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025 -

Post Six Nations Review Frances Success And Lions Squad Formation

May 01, 2025

Post Six Nations Review Frances Success And Lions Squad Formation

May 01, 2025