Frazzled Investors: Coping With Market Instability And Huge Stock Swings

Table of Contents

Understanding Market Volatility and its Causes

Market volatility refers to the rate at which the price of a security or market index fluctuates. These fluctuations can range from small, daily variations to dramatic, large swings that can significantly impact investment portfolios. Several factors contribute to this instability:

-

Economic News: Announcements regarding inflation rates, unemployment figures, GDP growth, and other key economic indicators can trigger significant market reactions. Positive news generally leads to price increases, while negative news can cause sharp declines. Understanding economic cycles and their impact is crucial for navigating market volatility.

-

Geopolitical Events: International conflicts, political instability, and major global events (like pandemics) can create uncertainty and trigger significant stock market swings. These events often lead to increased risk aversion among investors, resulting in sell-offs and market corrections.

-

Interest Rate Changes: Central banks' decisions on interest rates have a profound impact on market sentiment and investment behavior. Interest rate hikes typically lead to decreased borrowing and spending, potentially slowing economic growth and impacting stock prices. Conversely, interest rate cuts can stimulate economic activity, but also potentially lead to inflation.

-

Inflation: High inflation erodes purchasing power and can lead to increased uncertainty, impacting investor confidence and causing market volatility. Investors often seek assets that provide a hedge against inflation during such periods.

-

Speculation and Market Psychology: Market sentiment, driven by speculation and herd behavior, significantly influences stock prices. Fear and greed can lead to irrational decision-making, causing market bubbles and crashes. Understanding market psychology is vital in mitigating emotional investment decisions.

Developing Effective Risk Management Strategies

Effective risk management is crucial for navigating market instability and protecting your investments during periods of significant stock swings. This involves understanding your risk tolerance and aligning your investment strategy accordingly.

-

Diversification: Diversification is a cornerstone of risk management. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and geographical regions reduces the impact of losses in any single asset. This diversification can help mitigate the negative effects of market downturns.

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy reduces the risk of investing a large sum at a market peak and benefits from lower average purchase prices over time. It’s particularly useful during volatile markets.

-

Stop-Loss Orders: A stop-loss order is an instruction to sell a security when it reaches a specified price, limiting potential losses. While not a foolproof strategy, it can provide a measure of protection against significant price declines.

-

Regular Portfolio Reviews and Adjustments: Regularly reviewing and adjusting your portfolio based on market conditions and your financial goals is vital. This allows you to rebalance your asset allocation, ensuring it aligns with your risk tolerance and investment objectives.

Managing Emotional Investing During Market Instability

Market swings can trigger powerful emotions, leading to impulsive decisions that often harm investment performance. Fear and greed are common culprits. Panic selling during market downturns is a classic example of emotional investing.

-

Long-Term Perspective: Maintaining a long-term perspective is crucial. Remember that market fluctuations are normal, and focusing on the long-term goals reduces the impact of short-term volatility.

-

Stress Management: Stress and anxiety related to investing can cloud judgment. Practices like meditation, mindfulness, and even seeking professional help can help manage these emotions and promote rational decision-making.

-

Avoid Impulsive Decisions: Avoid making impulsive investment decisions based on fear or greed. Instead, stick to your well-defined investment plan and strategy.

-

Disciplined Investment Plan: Having a detailed investment plan that aligns with your financial goals and risk tolerance provides a framework for making informed decisions, even during periods of market instability.

Seeking Professional Guidance for Investment Support

Seeking professional guidance from a qualified financial advisor can be invaluable, particularly during times of market instability.

-

Personalized Investment Strategy: A financial advisor can help you create a tailored investment strategy that aligns with your individual financial goals, risk tolerance, and time horizon.

-

Fee-Only vs. Commission-Based Advisors: Understand the difference between fee-only advisors (who charge a set fee for their services) and commission-based advisors (who earn commissions on the products they sell). Fee-only advisors generally offer more objective advice.

-

Due Diligence: Thoroughly research and vet any financial advisor before engaging their services. Check their qualifications, experience, and regulatory status.

-

Finding Qualified Professionals: Utilize resources such as the websites of professional financial planning organizations to find qualified financial professionals in your area.

Conclusion

Navigating market instability and huge stock swings requires a combination of understanding, planning, and emotional resilience. By implementing effective risk management strategies, managing emotional investing tendencies, and seeking professional guidance when needed, investors can better cope with volatility and protect their long-term financial goals. Remember that consistent financial planning and a long-term investment horizon are crucial for weathering market storms.

Don't let market instability leave you feeling like a frazzled investor. Take control of your financial future by implementing the strategies outlined in this article and seeking professional help if needed. Learn more about building a resilient investment strategy that can weather market fluctuations and achieve your financial aspirations.

Featured Posts

-

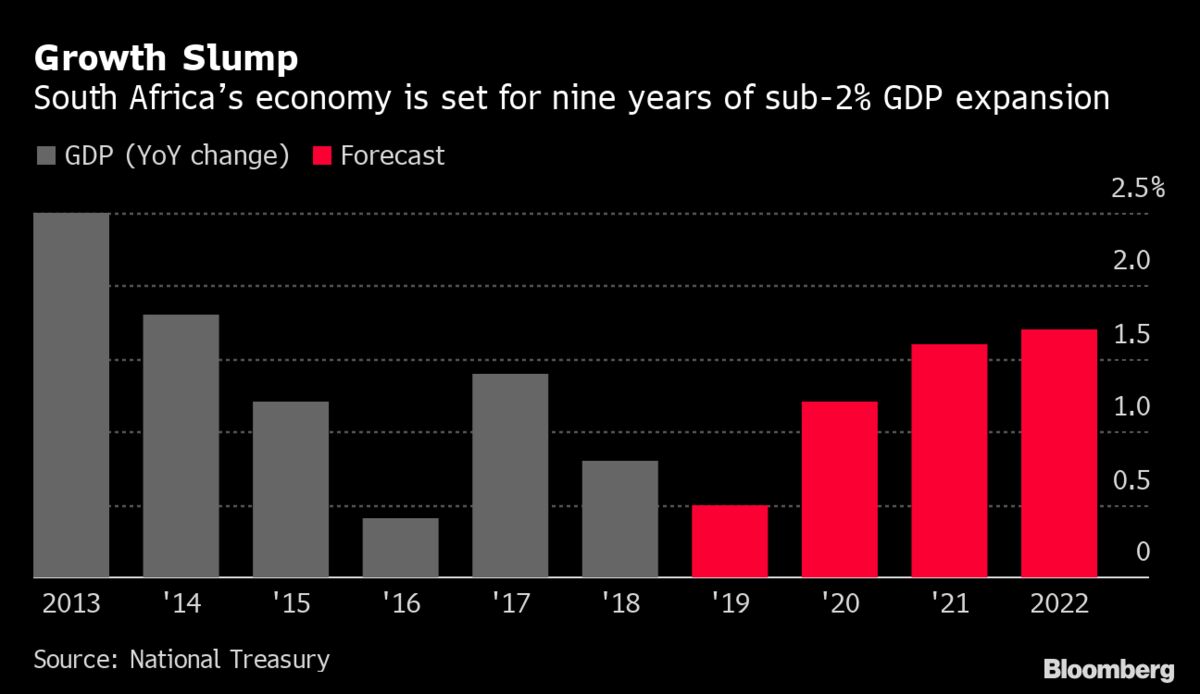

South Africas Coalition Faces Down Tax Increase

Apr 25, 2025

South Africas Coalition Faces Down Tax Increase

Apr 25, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 25, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 25, 2025 -

Ridley Scotts Apple Tv Series 5 Reasons The Reviews Generate Excitement

Apr 25, 2025

Ridley Scotts Apple Tv Series 5 Reasons The Reviews Generate Excitement

Apr 25, 2025 -

Renaults Us Sports Car Plans A Casualty Of Trumps Trade War

Apr 25, 2025

Renaults Us Sports Car Plans A Casualty Of Trumps Trade War

Apr 25, 2025 -

Governor Newsoms Sharp Words Addressing Toxicity Within The Democratic Party

Apr 25, 2025

Governor Newsoms Sharp Words Addressing Toxicity Within The Democratic Party

Apr 25, 2025

Latest Posts

-

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025 -

Russia Closes 62 Miles Of Black Sea Beaches Following Oil Spill

Apr 30, 2025

Russia Closes 62 Miles Of Black Sea Beaches Following Oil Spill

Apr 30, 2025 -

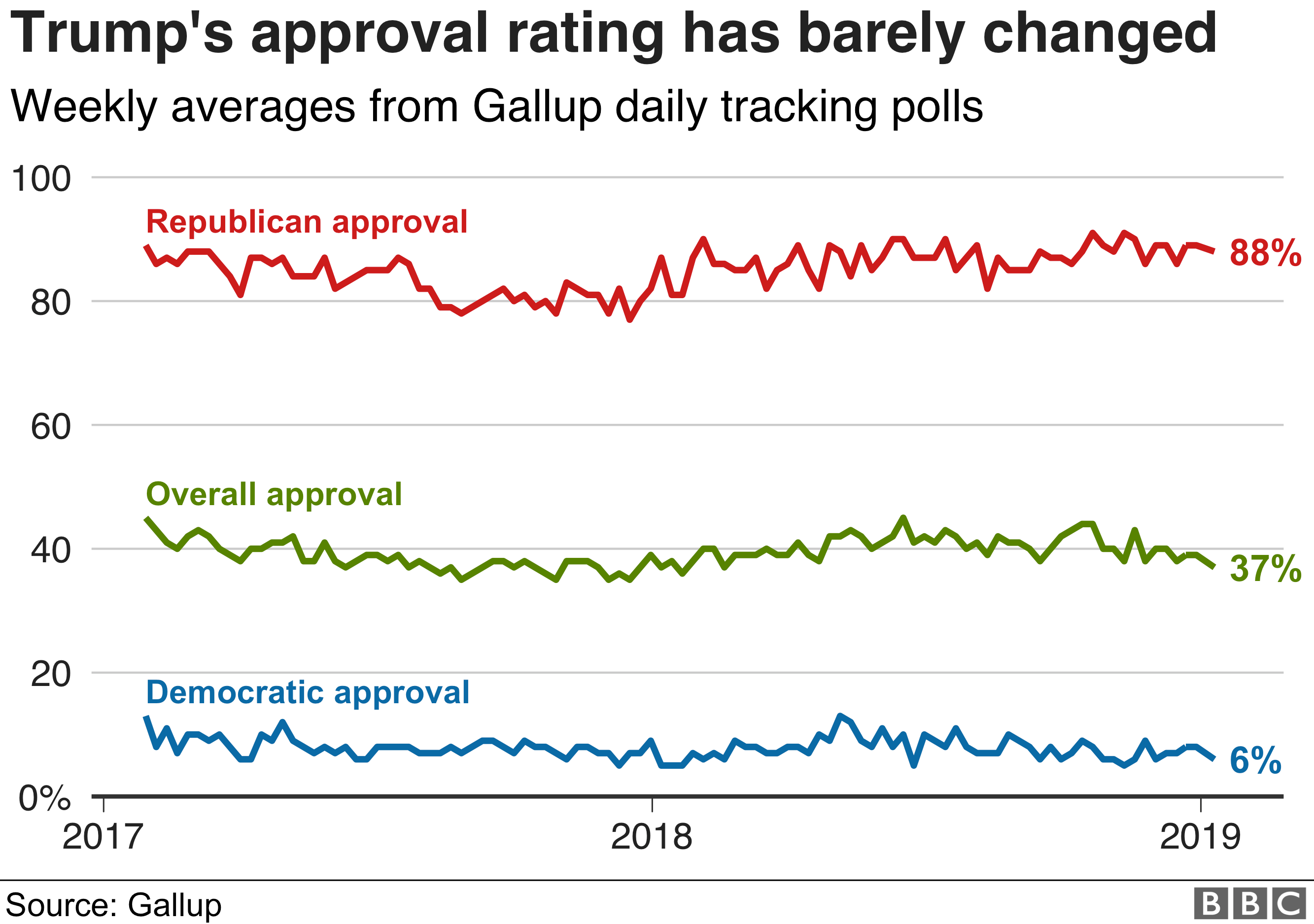

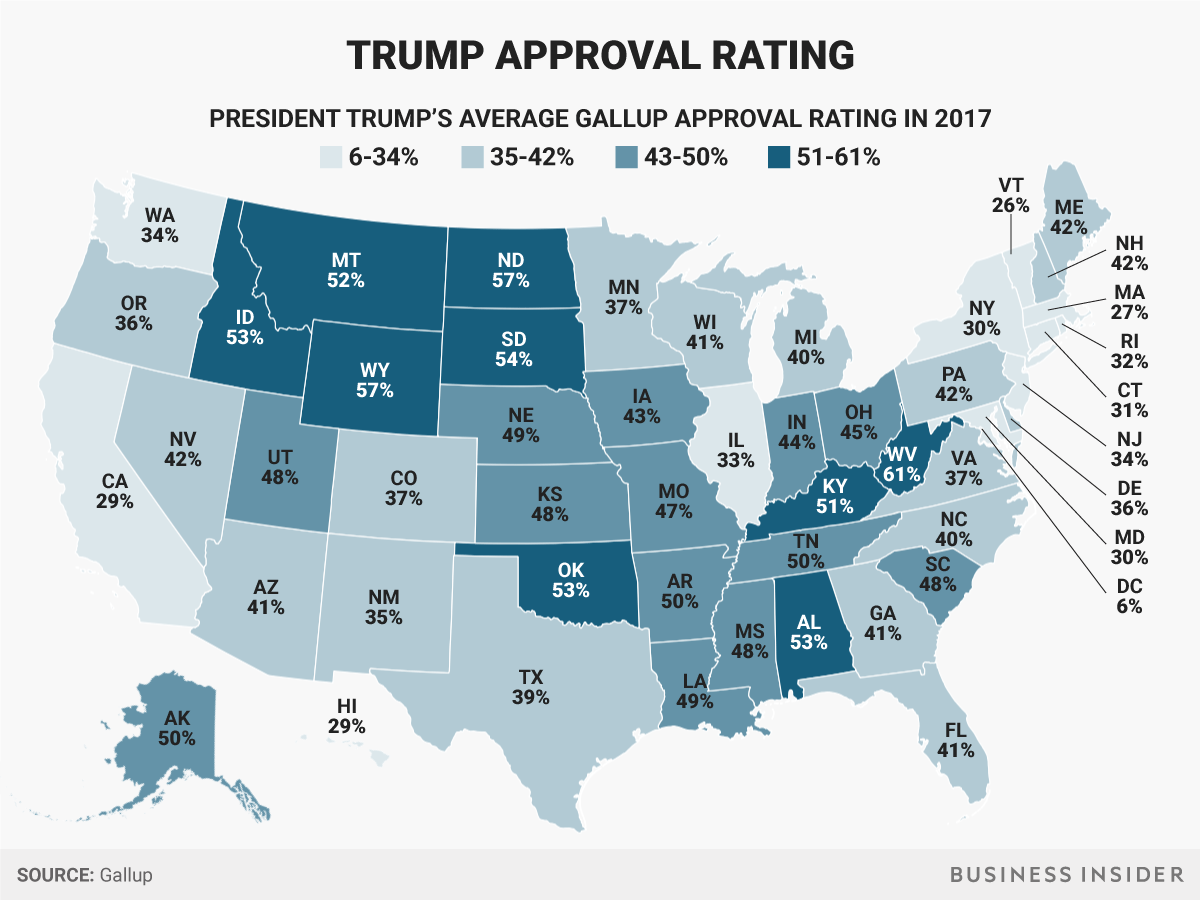

Trumps Presidency A 39 Approval Rating At The 100 Day Mark

Apr 30, 2025

Trumps Presidency A 39 Approval Rating At The 100 Day Mark

Apr 30, 2025 -

Low Approval For Trump 39 And The Challenges Of The First 100 Days

Apr 30, 2025

Low Approval For Trump 39 And The Challenges Of The First 100 Days

Apr 30, 2025 -

Increased Profits At China Life A Result Of Successful Investments

Apr 30, 2025

Increased Profits At China Life A Result Of Successful Investments

Apr 30, 2025