Regulatory Changes Urged By Indian Insurers On Bond Forwards

Table of Contents

Current Regulatory Framework and its Shortcomings

India's existing regulatory framework for bond forwards presents several shortcomings that expose insurers to considerable risks. While the market offers potential for diversification and higher returns, the lack of robust regulations hinders its full potential. The current system struggles to adequately address crucial aspects of risk management and market transparency.

- Lack of Transparency in Pricing and Trading: Opacity in pricing mechanisms creates opportunities for manipulation and makes it difficult for insurers to accurately assess risk. This lack of transparency also limits price discovery and efficient market functioning.

- Inadequate Risk Management Frameworks: Current frameworks fail to provide sufficient guidance and oversight for insurers engaging in complex bond forward transactions. This lack of comprehensive risk management guidelines increases the likelihood of significant financial losses.

- Limited Regulatory Oversight of Off-Exchange Trading: A significant portion of bond forward trading occurs off-exchange, escaping the watchful eye of regulators. This lack of oversight increases the risk of fraudulent activities and market manipulation.

- Concerns about Market Manipulation: The absence of stringent regulations and transparent trading mechanisms makes the market vulnerable to manipulation, potentially impacting the financial health of insurers.

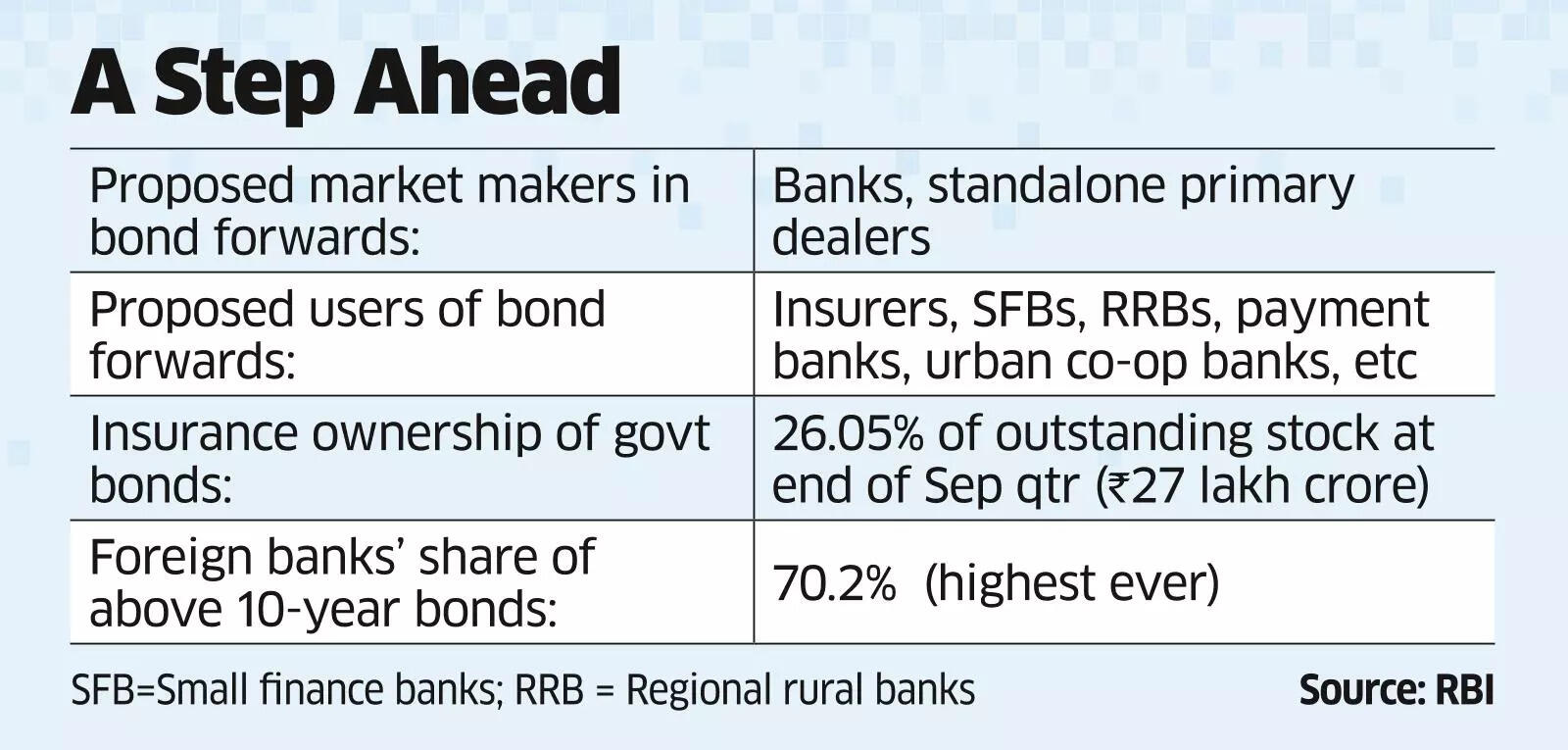

Proposed Regulatory Changes for Enhanced Risk Management

To mitigate these risks and foster a more stable and efficient market, Indian insurers are advocating for substantial regulatory changes. These changes focus on strengthening risk management, improving transparency, and enhancing investor protection.

- Increased Transparency and Standardized Reporting Requirements: Implementing standardized reporting requirements and enhancing data transparency would significantly improve market oversight and reduce the potential for manipulation. Real-time data dissemination and regular audits are crucial components of this proposal.

- Strengthened Regulatory Oversight of All Trading Activities: Extending regulatory oversight to all trading activities, both on and off-exchange, is essential to ensure a level playing field and prevent market abuse. This would require increased monitoring and enforcement capabilities.

- Implementation of Robust Risk Management Frameworks for Insurers: Implementing robust risk management frameworks tailored to the complexities of bond forwards is vital for protecting insurers from significant financial losses. This includes stress testing, scenario analysis, and appropriate capital allocation.

- Establishment of a Central Clearing Counterparty (CCP): Establishing a CCP would centralize clearing and settlement processes, significantly reducing counterparty risk and improving market stability. This would provide a crucial safety net for insurers.

- Enhanced Investor Protection Measures: Strengthening investor protection measures, including robust dispute resolution mechanisms, would boost investor confidence and attract greater participation in the market.

Impact on the Indian Insurance Sector and the Broader Economy

The implementation of these regulatory changes would have a positive ripple effect across the Indian insurance sector and the broader economy. A more regulated and transparent bond forward market will lead to increased stability and growth.

- Increased Investor Confidence and Participation: A more regulated market would attract greater participation from domestic and international investors, leading to increased liquidity and deeper markets.

- Improved Risk Management and Reduced Systemic Risk: Robust risk management frameworks and regulatory oversight would significantly reduce systemic risk within the financial system.

- Enhanced Stability in the Financial Markets: A stable bond forward market contributes to the overall stability of the financial system, reducing the risk of contagion effects during periods of stress.

- Greater Opportunities for Insurers to Diversify Investments: A regulated market allows insurers to diversify their investment portfolios more effectively, reducing their reliance on traditional asset classes.

- Potential for Increased Foreign Investment in the Indian Bond Market: A transparent and well-regulated market would attract significant foreign investment, boosting liquidity and supporting economic growth.

Challenges in Implementing Regulatory Changes

Despite the clear benefits, implementing these regulatory changes will not be without its challenges. Significant resistance from certain market participants accustomed to less stringent regulations is anticipated.

- Resistance from Market Participants: Some market participants might resist changes that could impact their existing business models or reduce opportunities for potentially exploitative practices.

- Balancing Regulation with Market Efficiency: The challenge lies in striking a balance between robust regulation and maintaining the efficiency and competitiveness of the bond forward market.

- Collaboration and Coordination: Effective implementation requires close collaboration between regulators, insurers, and other stakeholders to ensure a smooth transition and minimize disruption.

Conclusion: A Call for Action on Bond Forward Regulation in India

The arguments for regulatory changes in the Indian bond forward market are compelling. Addressing the identified shortcomings in the current framework is crucial not only for the stability of the Indian insurance sector but also for the broader economy. The benefits, including enhanced investor confidence, improved risk management, and increased foreign investment, far outweigh the challenges of implementation. The future of Indian Insurers' Investment Strategies hinges on timely and effective Regulatory Changes to the Bond Forwards market. We urge policymakers to consider and implement the proposed changes swiftly to create a more robust and transparent bond forward market in India. Share your thoughts and contribute to this crucial discussion!

Featured Posts

-

Analysis Indias Ascent In Global Power Rankings Second Only To

May 09, 2025

Analysis Indias Ascent In Global Power Rankings Second Only To

May 09, 2025 -

Us Deportations To El Salvador A Critique Of Jeanine Pirros Position

May 09, 2025

Us Deportations To El Salvador A Critique Of Jeanine Pirros Position

May 09, 2025 -

High Potentials Bold Season 1 Finale Why Abc Was Impressed

May 09, 2025

High Potentials Bold Season 1 Finale Why Abc Was Impressed

May 09, 2025 -

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 09, 2025

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 09, 2025 -

The Impact Of High Down Payments On Canadian Homeownership

May 09, 2025

The Impact Of High Down Payments On Canadian Homeownership

May 09, 2025