Resistance Cleared: Ethereum Price Update And $2,000 Outlook

Table of Contents

Recent Ethereum Price Action and Key Levels

Ethereum's price has shown remarkable strength in recent weeks. After consolidating around the $1,600 - $1,800 range for several weeks, a decisive breakout propelled the ETH price above $1,900, clearing a significant resistance level. This surge in the Ethereum price suggests strong underlying bullish momentum.

- Specific Price Points and Dates: For example, on [Insert Date], ETH broke through the $1,850 resistance level with significant volume, confirming the breakout. Subsequent price action saw ETH briefly touch [Insert Price] before consolidating slightly.

- Volume Changes During Breakouts: The volume increase accompanying the breakout above $1,850 was a key indicator of strong buying pressure, suggesting sustained upward momentum in the Ethereum price.

- Correlation with Bitcoin's Price Movement: While Ethereum often shows correlation with Bitcoin's price, this recent move demonstrated a degree of independence, suggesting positive sentiment specific to Ethereum and its underlying fundamentals.

- Psychological Impact of Breaking Through Resistance: The psychological impact of clearing this resistance level is significant. Many investors view it as a confirmation of the bullish trend, potentially triggering further buying and pushing the Ethereum price higher.

Factors Influencing Ethereum's Price

Several key factors contribute to the current bullish sentiment surrounding Ethereum and its price appreciation.

Ethereum 2.0 and Network Upgrades

The ongoing rollout of Ethereum 2.0 is a major catalyst for ETH's price appreciation. These upgrades significantly improve the network's scalability, efficiency, and security.

- Effect on Transaction Fees (Gas Fees): Ethereum 2.0 aims to drastically reduce transaction fees (gas fees), making the network more accessible and affordable for a wider range of users and applications.

- Increased Network Efficiency and Speed: Sharding, a key component of Ethereum 2.0, will dramatically increase transaction throughput, leading to faster and more efficient processing.

- Positive Impact on Decentralization: The transition to a proof-of-stake consensus mechanism enhances Ethereum's decentralization, making it more robust and resistant to censorship.

Decentralized Finance (DeFi) Growth

The thriving DeFi ecosystem built on Ethereum is another significant factor driving ETH price increases. The total value locked (TVL) in DeFi protocols continues to grow, indicating strong user adoption and demand for ETH.

- Total Value Locked (TVL) in DeFi Protocols: The consistently high TVL demonstrates the popularity and trust in Ethereum-based DeFi platforms.

- Growth of Popular DeFi Applications: The continued innovation and growth of popular DeFi applications like [mention specific examples, e.g., Uniswap, Aave] further solidify Ethereum's position as the leading platform for decentralized finance.

- Impact of New DeFi Projects and Innovations: New DeFi projects and innovative applications continually emerge, adding to the ecosystem's vibrancy and driving demand for ETH.

Institutional Adoption and Investor Sentiment

Increasing institutional adoption and positive investor sentiment play a crucial role in fueling Ethereum price growth.

- Recent Significant Investments or Partnerships: [Cite examples of major institutional investments or partnerships]. These events signal a growing confidence in Ethereum's long-term prospects.

- Impact of Positive News and Media Coverage: Favorable media coverage and positive news stories surrounding Ethereum contribute to increased investor interest.

- Influence of Overall Market Trends and Risk Appetite: While correlated to the broader cryptocurrency market, Ethereum’s strong fundamentals often allow it to outperform during periods of increased risk appetite.

Macroeconomic Factors

Global macroeconomic factors also influence the cryptocurrency market and Ethereum's price.

- Inflation, Interest Rates, and Other Economic Indicators: Economic uncertainty can drive investors toward alternative assets, such as cryptocurrencies, potentially increasing demand for ETH.

- Impact of Geopolitical Events: Geopolitical events can create volatility in the market, affecting both traditional and crypto assets.

- Correlation between Traditional Markets and Crypto Markets: While not perfectly correlated, there is often some relationship between traditional market movements and the performance of cryptocurrencies like Ethereum.

Ethereum Price Prediction: The $2,000 Outlook

Based on the factors discussed above, reaching $2,000 for Ethereum is a plausible scenario, though not guaranteed.

- Short-Term Price Forecast (Next Few Months): Considering the current momentum and positive factors, a price range of $[Insert Price Range] within the next few months seems reasonable.

- Long-Term Price Forecast (Next Year): Looking further ahead, reaching $2,000 or even exceeding it within the next year remains a possibility, depending on continued network development, DeFi growth, and broader market conditions.

- Potential Hurdles and Challenges to Reaching $2,000: Potential hurdles include increased regulatory scrutiny, market corrections, and competition from other cryptocurrencies.

- Charts or Graphs to Visualize Potential Price Trajectories: [Insert relevant chart or graph showing potential price movements].

- Emphasis on Uncertainty: It is crucial to reiterate that price predictions are inherently uncertain, and this analysis is not financial advice.

Conclusion

Ethereum's recent price surge, breaking through significant resistance levels, suggests a positive outlook for the asset. Factors such as Ethereum 2.0 upgrades, DeFi growth, institutional adoption, and overall market sentiment contribute to this bullish sentiment. While a $2,000 Ethereum price target is ambitious, careful consideration of the factors discussed makes this goal a plausible scenario in the future. However, it's crucial to remember that the cryptocurrency market is volatile, and any Ethereum price prediction carries inherent risk. Stay informed about the latest developments and continue monitoring the Ethereum price for valuable insights. Keep following our updates for more on the Ethereum price and further analyses of the $2,000 outlook.

Featured Posts

-

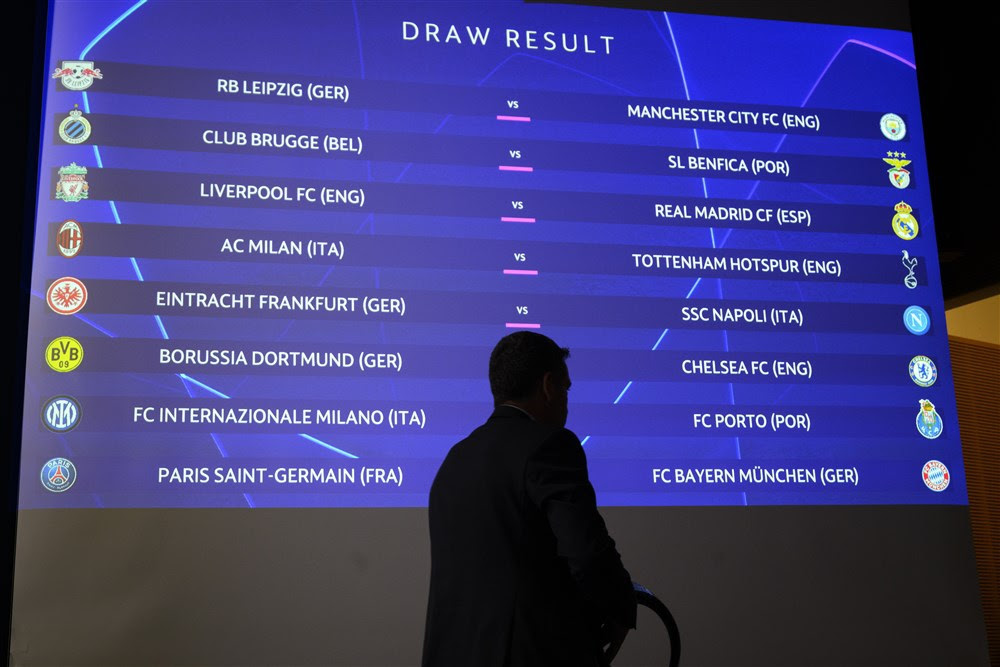

Seged Slavi Tri Umf Nad Pariz Sent Zhermen U Chetvrtfinalu Lige Shampiona

May 08, 2025

Seged Slavi Tri Umf Nad Pariz Sent Zhermen U Chetvrtfinalu Lige Shampiona

May 08, 2025 -

Friday April 18 2025 Daily Lotto Winning Numbers

May 08, 2025

Friday April 18 2025 Daily Lotto Winning Numbers

May 08, 2025 -

Bitcoins Rise Us China Trade Talks Fuel Crypto Investment

May 08, 2025

Bitcoins Rise Us China Trade Talks Fuel Crypto Investment

May 08, 2025 -

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025 -

Counting Crows Slip Into The Shadows A Deep Dive Into The Aurora Album

May 08, 2025

Counting Crows Slip Into The Shadows A Deep Dive Into The Aurora Album

May 08, 2025

Latest Posts

-

Pnjab Pwlys Myn Bry Tbdylyan 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025

Pnjab Pwlys Myn Bry Tbdylyan 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025 -

Lahwr Py Ays Ayl Mychz Ke Dwran Askwlwn Ke Awqat Kar Myn Tbdyly Ka Nwtyfkyshn

May 08, 2025

Lahwr Py Ays Ayl Mychz Ke Dwran Askwlwn Ke Awqat Kar Myn Tbdyly Ka Nwtyfkyshn

May 08, 2025 -

Lahwr Ky Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Ahm Qdm

May 08, 2025

Lahwr Ky Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Ahm Qdm

May 08, 2025 -

Trumps 100 Day Plan And Bitcoin A Price Prediction Analysis

May 08, 2025

Trumps 100 Day Plan And Bitcoin A Price Prediction Analysis

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn

May 08, 2025