Revised Trump Tax Bill Approved By The House

Table of Contents

Key Changes in the Revised Trump Tax Bill

The revised Trump tax bill includes several key amendments to the original proposal. These changes aim to address concerns raised by various groups and refine the original tax code revisions. Understanding these changes is crucial to assessing the bill's overall impact.

-

Individual Tax Brackets: The revised bill may include adjustments to individual tax brackets. For example, the standard deduction might be increased, potentially benefiting lower and middle-income taxpayers. Conversely, some higher tax brackets might see rate adjustments. (Specific numbers and percentages would need to be inserted here once the final bill is available).

-

Corporate Tax Rates and Deductions: Significant changes were made to corporate tax rates, aiming to boost business investment and economic growth. The revised bill might include adjustments to corporate tax rates (e.g., a reduction from the original proposal) and alterations to allowable deductions for businesses. Again, precise figures are needed pending the final version’s release.

-

Pass-Through Entities: The treatment of pass-through entities (like partnerships and LLCs) has undergone revisions. The bill aims to clarify and potentially modify the tax implications for these business structures, impacting owners' individual tax liabilities. Details on the specific changes to deductions and taxation for pass-through income are crucial for these business owners.

-

Child Tax Credit and Other Tax Credits: The revised bill might expand or alter the child tax credit, affecting families with children. Other tax credits, such as those for education or energy efficiency, may also experience changes. Understanding the specific modifications to these credits is critical for taxpayers who rely on them.

-

Addressing Earlier Concerns: The revised bill incorporates compromises made in response to criticisms leveled against the original version. These changes might include adjustments to specific deductions, tax rates, or provisions that disproportionately benefited certain groups or industries. Analyzing these compromises is essential to understand the overall direction of the tax reform.

Impact on Different Income Groups

The revised Trump Tax Bill's impact varies significantly across different income brackets. Careful analysis is needed to understand who benefits and who might bear a heavier tax burden.

-

Low-, Middle-, and High-Income Earners: The bill's effects on different income groups depend largely on the specific changes made to tax rates, deductions, and credits. For example, an increased standard deduction could benefit low- and middle-income earners, while changes to higher tax brackets could significantly impact high-income individuals. Detailed examples comparing tax liabilities under the old and new systems are essential for a thorough understanding.

-

Stimulating Economic Growth: The bill's success in achieving its stated goals hinges on its impact on economic growth. Whether the changes will truly stimulate the economy and reduce the tax burden for the middle class remains to be seen and depends greatly on the interplay of these various changes.

-

Unintended Consequences: Tax reform can sometimes have unforeseen consequences. Analyzing potential unintended consequences for specific income groups is critical. This might involve considering how the changes affect specific sectors, investment decisions, or overall economic behavior.

The Bill's Path Forward and Potential Senate Action

The fate of the revised Trump Tax Bill now rests with the Senate. Its journey through the Senate will determine whether it becomes law.

-

Legislative Process: The bill will now proceed to the Senate for debate, amendments, and a vote. The Senate may introduce its own modifications, potentially leading to further negotiations between the House and Senate.

-

Senate Approval: The likelihood of Senate approval depends on various factors, including political dynamics and party divisions. The Senate's composition and the prevailing political climate will significantly influence the bill’s fate.

-

Enactment Timeline: If the Senate approves the bill (or a modified version), it will be sent to the President for signature. The timeline for enactment will depend on the speed of the legislative process and any potential challenges or delays.

Potential Long-Term Economic Effects

The revised Trump Tax Bill’s long-term economic effects are subject to ongoing debate and analysis.

-

GDP Growth, Job Creation, and Inflation: Economists hold differing views on the long-term impacts on GDP growth, job creation, and inflation. The bill’s effect on these key economic indicators will depend on how businesses and individuals respond to the tax changes.

-

Expert Opinions and Forecasts: Many economic forecasts exist, and their accuracy will only become clear over time. Analyzing these various forecasts and expert opinions, considering their assumptions and methodologies, offers insights into the potential long-term economic implications.

Conclusion

The House's approval of the revised Trump tax bill represents a significant step in reshaping the US tax code. This article has highlighted the key changes, potential impacts on various income groups, and the bill's uncertain path ahead in the Senate. Understanding these complexities is crucial for both individuals and businesses. The specific details of the tax rate changes and other aspects will need to be carefully examined when the final bill is released.

Call to Action: Stay informed about the progress of this crucial legislation and its potential impact on your finances. Continue to follow updates on the Revised Trump Tax Bill and its implications for you. Learn more about how the revised Trump tax bill could affect your tax obligations and start planning for potential changes to your tax strategy.

Featured Posts

-

Vecher Pamyati Sergeya Yurskogo Teatr Mossoveta

May 24, 2025

Vecher Pamyati Sergeya Yurskogo Teatr Mossoveta

May 24, 2025 -

Sixty Minute Delays On M6 Southbound Due To Accident

May 24, 2025

Sixty Minute Delays On M6 Southbound Due To Accident

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025 -

Porsche Now Labubu

May 24, 2025

Porsche Now Labubu

May 24, 2025 -

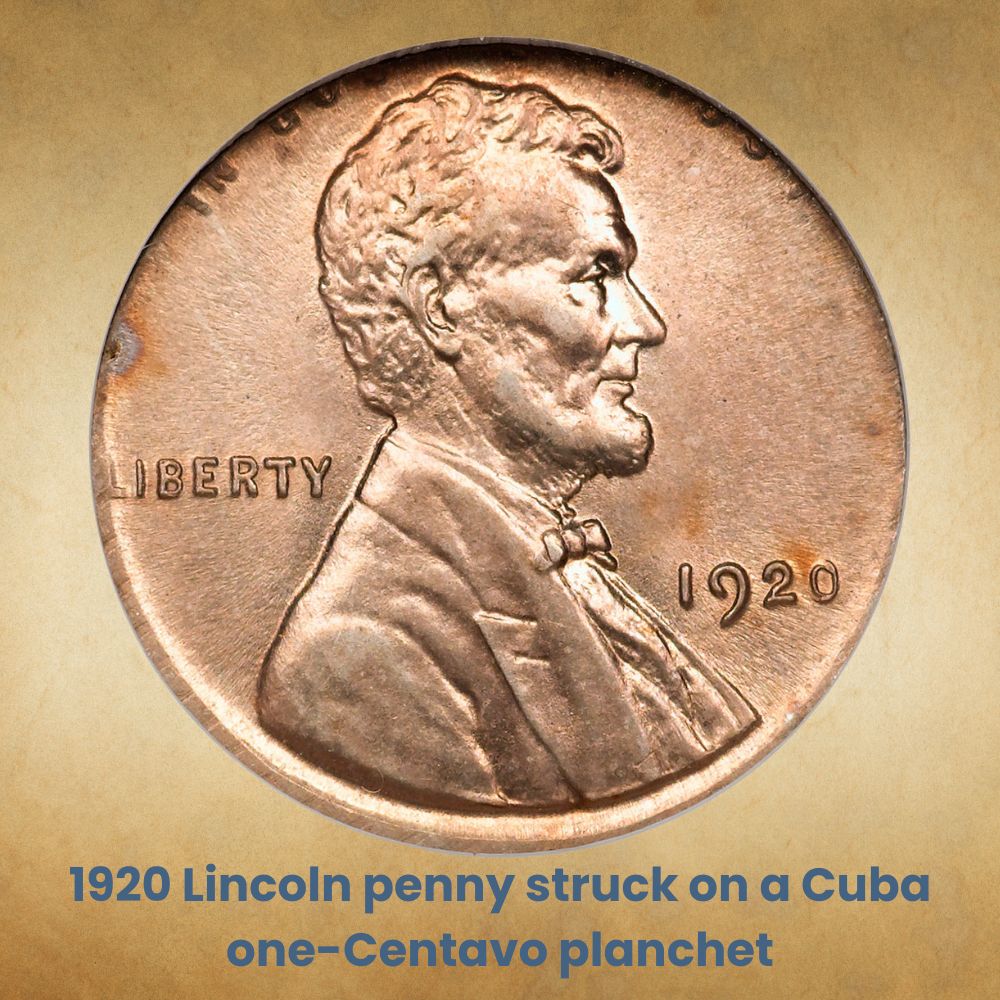

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025

Latest Posts

-

Dc Legends Of Tomorrow Everything You Need To Know

May 24, 2025

Dc Legends Of Tomorrow Everything You Need To Know

May 24, 2025 -

Neal Mc Donoughs Powerful Performance In The Last Rodeo

May 24, 2025

Neal Mc Donoughs Powerful Performance In The Last Rodeo

May 24, 2025 -

Conquering Dc Legends Of Tomorrow A Players Handbook

May 24, 2025

Conquering Dc Legends Of Tomorrow A Players Handbook

May 24, 2025 -

The Ultimate Dc Legends Of Tomorrow Walkthrough

May 24, 2025

The Ultimate Dc Legends Of Tomorrow Walkthrough

May 24, 2025 -

Dc Legends Of Tomorrow Team Building And Synergies Explained

May 24, 2025

Dc Legends Of Tomorrow Team Building And Synergies Explained

May 24, 2025