Rio Tinto's Dual Listing Structure Remains Intact After Activist Challenge

Table of Contents

The Activist Challenge and its Objectives

The challenge to Rio Tinto's dual listing stemmed from concerns raised by [Insert Name(s) of Activist Investor(s) here], who argued that the dual listing created unnecessary complexities and negatively impacted shareholder value. Their primary argument centered on the perceived inefficiencies inherent in managing a share structure across two major stock exchanges.

The activist investor(s) presented several key arguments:

- Increased administrative costs: Maintaining separate listings on the LSE and ASX necessitates significant administrative overhead, potentially impacting profitability.

- Complexity for investors: Navigating dual listings can be challenging for investors, potentially hindering participation and limiting liquidity in one market or the other.

- Governance concerns: The dual structure might create complexities in corporate governance, potentially leading to inconsistencies in regulatory compliance and shareholder communication.

- Potential for diluted shareholder returns: The argument was made that a simplified, single listing structure could lead to enhanced shareholder returns.

Proposed changes suggested by the activist investor(s) included:

- A consolidation of the share structure into a single listing on either the LSE or ASX.

- Streamlined corporate governance procedures to address perceived inconsistencies.

- A reassessment of the company's capital allocation strategy to maximize shareholder returns.

Rio Tinto's Response and Defense of its Dual Listing

Rio Tinto responded to the activist challenge by firmly defending its dual listing structure, arguing that it provides significant strategic and financial benefits. The company highlighted the following points:

- Access to a wider investor base: Maintaining listings on both the LSE and ASX allows Rio Tinto to access a broader and more diverse pool of investors, enhancing liquidity and capital raising opportunities.

- Maintaining a strong presence in key markets: The dual listing solidifies Rio Tinto's presence in both crucial mining hubs: London and Australia, fostering strong relationships with investors and stakeholders in each region.

- Liquidity benefits for shareholders: The dual listing enhances liquidity for shareholders, providing more opportunities to buy and sell shares, and reducing price volatility.

- Strategic considerations: The company argued that the dual listing aligns with its long-term strategic objectives and its commitment to both the UK and Australian markets.

Key arguments used by Rio Tinto's management to defend their position included:

- The strategic importance of maintaining access to both the UK and Australian capital markets.

- The enhanced liquidity and investor reach provided by the dual listing.

- The minimal impact of the administrative costs compared to the overall benefits.

- The robustness of their existing corporate governance framework.

The Outcome: Maintaining the Status Quo

Ultimately, Rio Tinto successfully defended its dual listing structure. [Insert details about the shareholder vote, if applicable, and its results]. The decision reinforces the strategic importance the company places on maintaining a strong presence in both the UK and Australian markets. For shareholders, the outcome means the continuation of the existing investment landscape, with its benefits and potential drawbacks. For other dual-listed companies, it offers a case study in defending against activist pressures. The implications for the broader corporate governance landscape are complex, raising questions about the balance between shareholder activism and management’s strategic decisions. Will similar challenges arise in the future? This remains to be seen, but the successful defense sets a precedent.

Long-Term Implications of the Dual Listing

While the dual listing structure remains, Rio Tinto might make subtle adjustments to address some of the concerns raised by the activist investor(s). These could include:

- Enhanced transparency and communication with shareholders regarding the costs and benefits of the dual listing.

- Streamlining certain aspects of the administrative processes to improve efficiency.

- Continued engagement with investors to address any lingering concerns about corporate governance.

The long-term success of this structure will depend on Rio Tinto’s ability to maintain its strong performance and consistently demonstrate the strategic value of its dual listing. The impact on future investment decisions could depend on how effectively Rio Tinto communicates the value of this structure to investors.

Conclusion

This analysis reveals that Rio Tinto’s dual listing structure survived a significant activist challenge. The company successfully defended its position, emphasizing the strategic benefits and enhanced liquidity provided by maintaining listings on both the LSE and ASX. While activist investors raised valid concerns regarding administrative complexities and potential inefficiencies, Rio Tinto's arguments regarding broader investor access, strong market presence, and shareholder liquidity ultimately prevailed. The long-term success of this structure hinges on ongoing transparency and demonstrable value creation. Stay informed about the ongoing developments in Rio Tinto's corporate governance and learn more about the complexities of dual listings in the mining sector.

Featured Posts

-

Understanding The Reasons Behind Male Eyelash Removal

May 03, 2025

Understanding The Reasons Behind Male Eyelash Removal

May 03, 2025 -

Influence Presumee De Macron Sur Le Choix Du Futur Pape A Rome

May 03, 2025

Influence Presumee De Macron Sur Le Choix Du Futur Pape A Rome

May 03, 2025 -

Market Reaction Canadian Dollars Surge After Trumps Carney Deal Mention

May 03, 2025

Market Reaction Canadian Dollars Surge After Trumps Carney Deal Mention

May 03, 2025 -

Why Are Mental Health Insurance Claims So Low Exploring Cost And Stigma Barriers

May 03, 2025

Why Are Mental Health Insurance Claims So Low Exploring Cost And Stigma Barriers

May 03, 2025 -

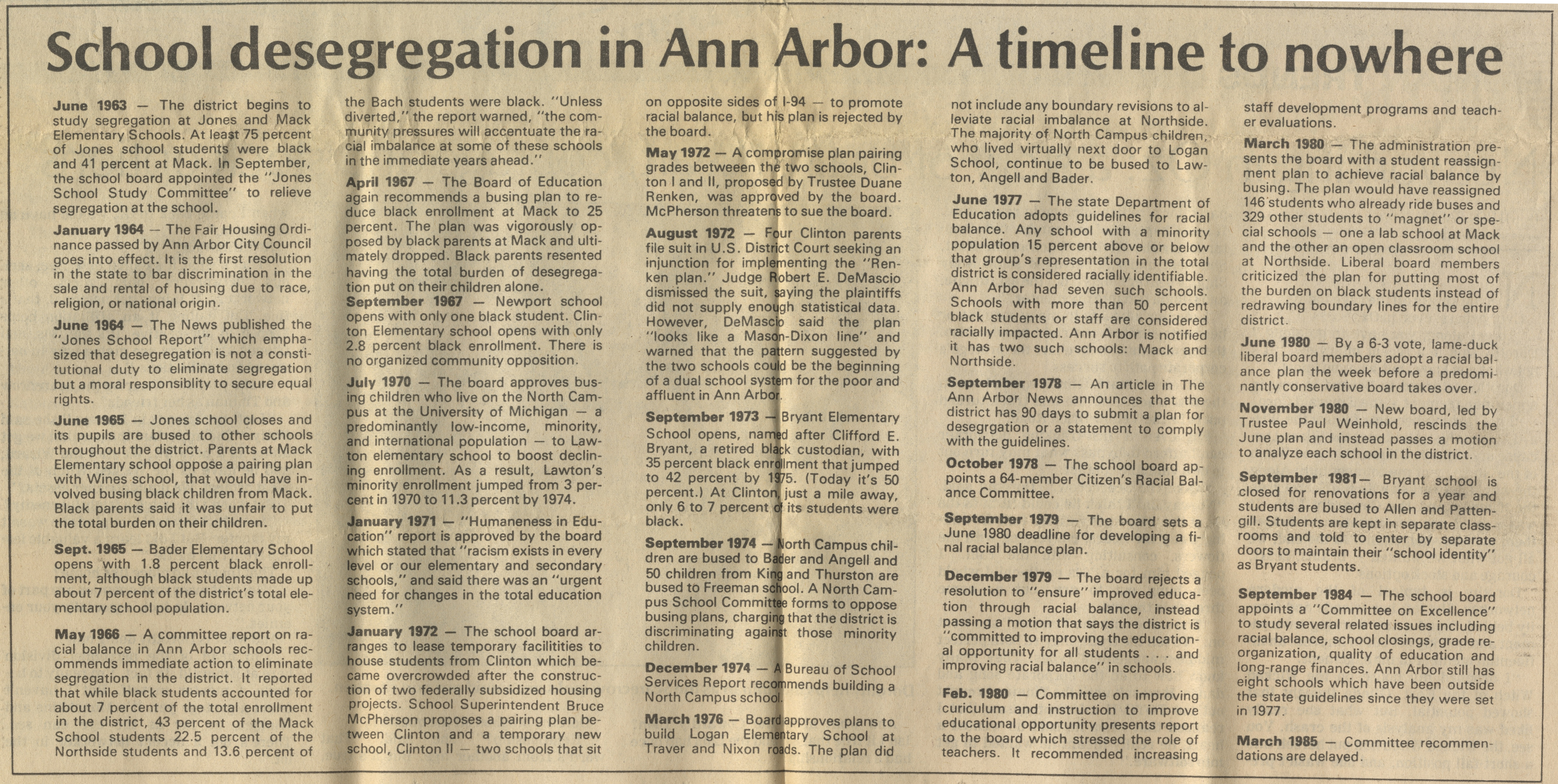

The End Of A School Desegregation Order And Its Potential Consequences

May 03, 2025

The End Of A School Desegregation Order And Its Potential Consequences

May 03, 2025

Latest Posts

-

Hong Kong Uses Us Dollar Reserves To Maintain Currency Peg

May 04, 2025

Hong Kong Uses Us Dollar Reserves To Maintain Currency Peg

May 04, 2025 -

Hong Kong Intervenes In Fx Market To Support Us Dollar Peg

May 04, 2025

Hong Kong Intervenes In Fx Market To Support Us Dollar Peg

May 04, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 04, 2025

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 04, 2025 -

Australian Election 2023 Voting Begins Labor Holds Lead

May 04, 2025

Australian Election 2023 Voting Begins Labor Holds Lead

May 04, 2025 -

Cassidy Hutchinsons Memoir A Deeper Look Into The January 6th Hearings

May 04, 2025

Cassidy Hutchinsons Memoir A Deeper Look Into The January 6th Hearings

May 04, 2025