US SEC Considers XRP A Commodity: Implications Of Ripple Settlement Talks

Table of Contents

The SEC's Shifting Stance on XRP Classification

The SEC's initial argument in its lawsuit against Ripple centered on the classification of XRP as a security, alleging that Ripple's sale of XRP constituted an unregistered securities offering. This classification relied heavily on the Howey Test, a legal framework used to determine whether an investment contract constitutes a security.

-

Initial SEC Argument: The SEC argued that XRP sales met the criteria of the Howey Test, emphasizing the expectation of profits derived from Ripple's efforts and the involvement of a common enterprise.

-

Potential Reasons for Reconsideration: Several factors might be contributing to the SEC's potential reconsideration. These include mounting legal challenges to their broad definition of "security" as applied to cryptocurrencies, the increasing acceptance of cryptocurrencies by mainstream financial institutions, and the potential complexities and challenges in pursuing a protracted legal battle.

-

Implications of Commodity vs. Security Classification: Classifying XRP as a commodity would have significant implications. It would likely result in less stringent regulatory oversight compared to being classified as a security, potentially easing trading restrictions and boosting investor confidence. Conversely, maintaining its classification as a security could lead to continued restrictions and regulatory hurdles.

-

Legal Precedent: The outcome of this case will set a crucial legal precedent for other cryptocurrencies facing similar regulatory challenges. A ruling in favor of XRP as a commodity could open the door for other digital assets to avoid being classified as securities.

-

The Howey Test: The Howey Test is a pivotal part of the SEC's argument. It considers whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC initially argued XRP met this criteria, but the possibility of a settlement suggests a reevaluation of this assessment.

Implications of Ripple Settlement Talks for XRP Investors

The Ripple settlement talks carry immense weight for XRP investors. The terms of any settlement will significantly impact XRP's price, investor confidence, and the overall regulatory landscape.

-

Impact on XRP's Price: A favorable settlement, recognizing XRP as a commodity, could trigger a substantial price surge. However, unfavorable terms could lead to further price decline.

-

Investor Confidence and Trading Volume: A clear and decisive outcome, regardless of whether it favors Ripple or the SEC, has the potential to boost investor confidence and trading volume by resolving the existing uncertainty. Prolonged uncertainty, conversely, could lead to continued volatility and suppressed trading activity.

-

Regulatory Clarity: A settlement could provide much-needed regulatory clarity, not just for XRP but potentially for other cryptocurrencies as well, influencing future regulatory approaches to digital assets.

-

Legal Ramifications: The settlement could have varying legal ramifications for both Ripple and XRP holders, potentially impacting future liability and the enforceability of existing contracts involving XRP.

Broader Impact on the Cryptocurrency Market

The Ripple case extends far beyond XRP itself, impacting the entire cryptocurrency market.

-

Ripple Effect on Other Cryptocurrencies: The SEC's approach to XRP classification and its potential shift in stance have created uncertainty for other projects facing similar regulatory scrutiny. The outcome of this case will serve as a benchmark influencing regulatory actions concerning other cryptocurrencies.

-

Market Volatility and Investor Sentiment: The ongoing uncertainty surrounding the case has contributed to increased market volatility and fluctuating investor sentiment. A clear resolution, regardless of the outcome, could help stabilize the market and potentially boost investor confidence in the long term.

-

Shaping the Future Regulatory Landscape: The outcome of this case will significantly influence the future regulatory landscape for digital assets. It may pave the way for more nuanced regulatory frameworks tailored to different types of cryptocurrencies.

-

Institutional Investment: The settlement's outcome will play a role in attracting or deterring institutional investment in the cryptocurrency market. A clearer regulatory environment generally fosters increased institutional participation.

The Role of Judge Analisa Torres's Ruling

Judge Analisa Torres's previous rulings have significantly shaped the trajectory of the Ripple case. Her interpretations of the Howey Test and her legal reasoning have been influential in the ongoing discussions.

-

Summary of Judge Torres's Rulings: Judge Torres's previous rulings have offered some clarity but not a definitive resolution, contributing to the ongoing uncertainty.

-

Shaping the Current Situation: Her judgments have influenced both Ripple's and the SEC's strategies, shaping the current negotiation environment.

-

Impact on Future Litigation: Her legal interpretations will undoubtedly have a bearing on future litigation involving cryptocurrencies, setting precedents that will be referred to and debated in subsequent cases.

-

Implications for SEC Authority: The outcome, shaped in part by Judge Torres's interpretations, will have implications for the SEC's authority and approach to regulating the cryptocurrency market.

Conclusion

The SEC's potential reclassification of XRP as a commodity and the ongoing Ripple settlement talks hold significant implications for XRP investors, the broader cryptocurrency market, and the future of digital asset regulation. The outcome will undoubtedly shape the regulatory landscape and influence investor confidence. The impact will be felt far beyond XRP, affecting other cryptocurrencies and potentially reshaping the entire digital asset ecosystem.

Call to Action: Stay informed about the latest developments in the Ripple/SEC case. Understanding the evolving classification of XRP as a commodity and the implications of the settlement talks is crucial for navigating the complex world of cryptocurrency investment. Follow reputable sources for updates on the Ripple case and XRP's regulatory status. Keep your eye on developments regarding the SEC's stance on XRP and other cryptocurrencies, as this legal battle continues to define the future of digital asset regulation.

Featured Posts

-

Is Milwaukees Rental Market Too Exclusive A Competitive Analysis

May 02, 2025

Is Milwaukees Rental Market Too Exclusive A Competitive Analysis

May 02, 2025 -

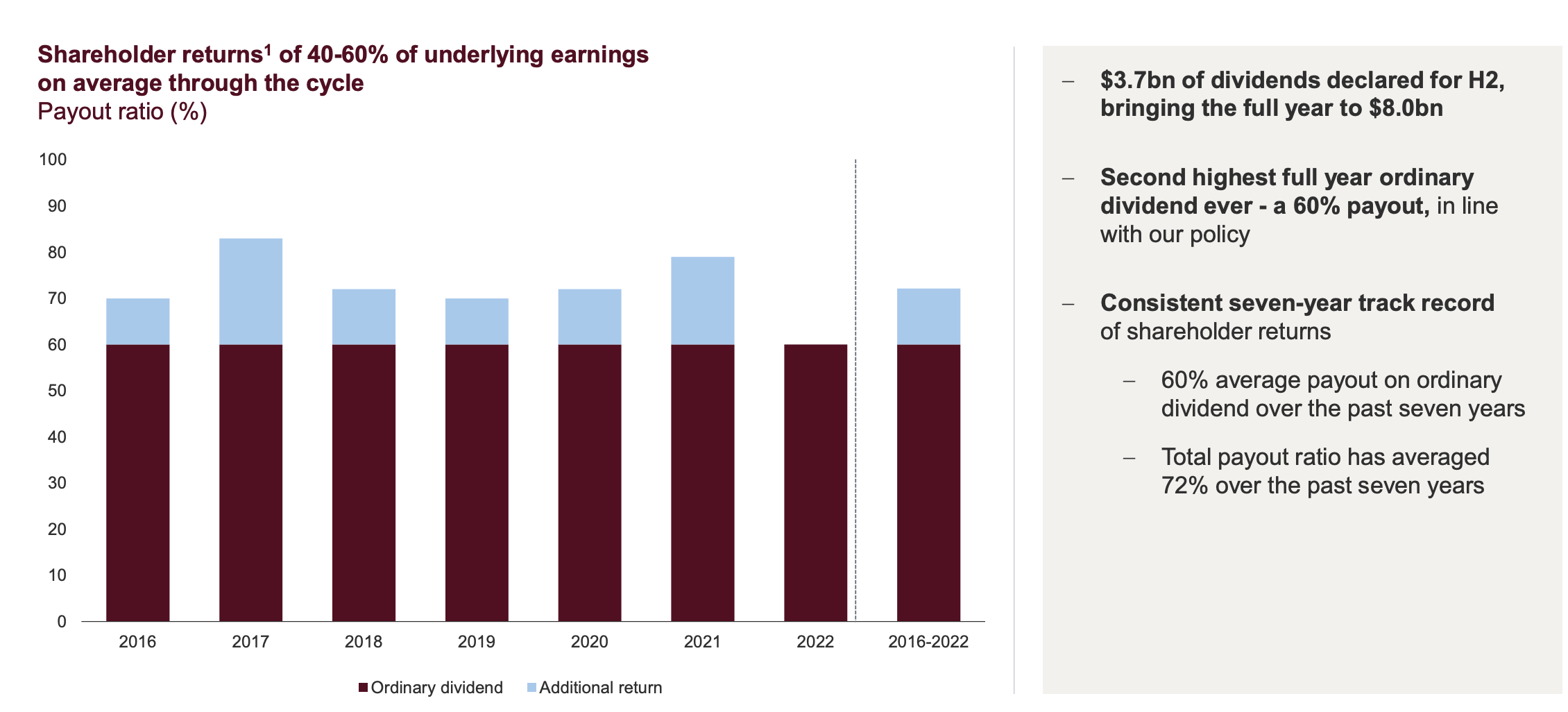

Rio Tinto Defends Dual Listing Against Activist Investor Pressure

May 02, 2025

Rio Tinto Defends Dual Listing Against Activist Investor Pressure

May 02, 2025 -

Loyle Carner Drops Emotive Double Single All I Need In My Mind

May 02, 2025

Loyle Carner Drops Emotive Double Single All I Need In My Mind

May 02, 2025 -

Experience The Beauty Of Little Tahiti In Italy

May 02, 2025

Experience The Beauty Of Little Tahiti In Italy

May 02, 2025 -

Legendary Dallas Star Dies At Age 100

May 02, 2025

Legendary Dallas Star Dies At Age 100

May 02, 2025

Latest Posts

-

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025 -

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025 -

Lee Anderson Welcomes Councillor Defection To Reform Party

May 03, 2025

Lee Anderson Welcomes Councillor Defection To Reform Party

May 03, 2025