Ripple-SEC Case Update: $50M Settlement And The Outlook For XRP Price

Table of Contents

Details of the $50M Settlement

What the Settlement Entails

The $50 million settlement between Ripple and the SEC represents a partial resolution to the lawsuit alleging that Ripple sold unregistered securities. The terms are complex, but essentially, Ripple neither admitted nor denied the SEC's allegations. This is a crucial point, as it avoids a full-blown admission of guilt, which could have had far more damaging consequences.

- No Admission of Guilt: The settlement explicitly states that Ripple did not admit to violating securities laws. This is a significant victory for Ripple, protecting their reputation and future prospects.

- Future Compliance Measures: Ripple has agreed to implement enhanced compliance measures to ensure future adherence to securities regulations. This shows a willingness to cooperate with regulators and could potentially influence future legal battles.

- Payment of $50 Million: The settlement involves a significant financial penalty. This payment is aimed at resolving the SEC's claims without a lengthy and costly court battle.

This nuanced settlement avoids a complete capitulation by Ripple, potentially setting a precedent for future cases involving cryptocurrency regulation. While Ripple faced accusations of selling unregistered securities, the settlement leaves some wiggle room for future interpretation of the Howey Test in the crypto market.

Ripple's Response and Future Actions

Ripple's official statement following the settlement emphasized their commitment to regulatory compliance and their belief that the outcome is positive for the cryptocurrency industry. They highlighted the lack of admission of guilt and their continued dedication to innovation in the fintech space.

- Key Quotes: Executives have emphasized their dedication to continued growth and the creation of a transparent regulatory environment. (Specific quotes can be included here pending release of official statements)

- Future Regulatory Compliance Strategies: Ripple plans to implement robust compliance protocols across their operations, investing in resources to navigate the evolving regulatory landscape. This proactive approach aims to prevent future conflicts and show the SEC their commitment to adherence.

Ripple's strategic response aims to reassure investors and the broader community that they are committed to operating within legal boundaries. The future will show how effectively these changes are implemented.

Impact on XRP Price and Market Sentiment

Immediate Price Reaction

The news of the settlement caused immediate volatility in the XRP market. While some anticipated a significant price surge, the reality was more complex.

- Price Changes: Initially, XRP experienced a notable price increase. However, this was followed by a period of consolidation and further fluctuations, reflecting the ongoing uncertainty surrounding the case’s implications. (Charts would be inserted here).

- Trading Volume Spikes: Trading volume increased dramatically following the announcement, indicating a surge in investor activity and speculation.

The immediate price reaction highlighted the intense market interest in the Ripple-SEC case and the lingering uncertainty surrounding XRP’s regulatory status.

Long-Term Price Outlook

Predicting the long-term impact on XRP's price is inherently speculative, yet several factors can influence the price trajectory.

- Price Predictions from Analysts: Various analysts offer differing predictions, ranging from optimistic forecasts based on increased regulatory clarity to more cautious assessments considering the ongoing challenges in the cryptocurrency landscape. (Specific price targets and analyst quotes would be included here).

- Potential Price Targets: Several key factors – wider exchange adoption, successful regulatory compliance, and sustained market demand - determine long-term price potential.

The long-term outlook hinges on how exchanges respond, investor confidence in the future of XRP, and general market conditions. Continued regulatory uncertainty could hinder significant growth.

Implications for the Broader Cryptocurrency Market

Regulatory Clarity and Future Lawsuits

The Ripple-SEC case sets a significant precedent for other cryptocurrency projects. The partial settlement offers some regulatory clarity, yet the lines remain blurred in many areas.

- Similar Cases: The case could influence pending lawsuits involving other cryptocurrencies, providing insights into potential outcomes and legal strategies.

- Potential Implications for Other Cryptocurrencies (e.g., ETH, Solana): While ETH and Solana aren't directly impacted, the precedent set could affect how regulators approach similar tokens in future.

The Ripple-SEC case doesn't provide definitive answers but shines a light on what may lie ahead for other crypto projects.

Investor Confidence and Market Stability

The outcome of the Ripple-SEC case has had a mixed impact on investor confidence. While some view the settlement as a positive development, others remain cautious.

- Investor Sentiment Data: Tracking investor sentiment indices post-settlement provides valuable insight into the overall market mood.

- Trading Volume Across Different Cryptocurrencies: Observing trading volumes across different cryptocurrencies reveals the ripple effects of the Ripple-SEC case on the broader market.

The impact on overall market stability is complex and still evolving. While some increased regulatory certainty is positive, the lingering uncertainties and open questions surrounding crypto regulation persist.

Conclusion

The Ripple-SEC settlement marks a significant milestone, providing some regulatory clarity but leaving many questions unanswered about the future of XRP and the broader cryptocurrency space. The $50 million agreement impacts not only Ripple's future but also shapes the legal landscape for other digital assets. While the immediate impact on XRP's price has been volatile, the long-term outlook remains dependent on various factors including regulatory developments and market sentiment. Stay informed on further developments in the Ripple-SEC case and continue monitoring the evolving regulatory landscape to make informed decisions regarding your XRP investments. Understanding the nuances of the Ripple-SEC case and its implications is crucial for navigating the complexities of the cryptocurrency market. Keep researching the latest developments surrounding the XRP price and the Ripple SEC lawsuit to stay ahead of the curve.

Featured Posts

-

Hemgjorda Kycklingnuggets Med Majsflingor And Asiatisk Kalsallad

May 01, 2025

Hemgjorda Kycklingnuggets Med Majsflingor And Asiatisk Kalsallad

May 01, 2025 -

Remembering Priscilla Pointer A Century Of Stage And Screen Excellence

May 01, 2025

Remembering Priscilla Pointer A Century Of Stage And Screen Excellence

May 01, 2025 -

Coronation Street Daisy Midgeleys Dramatic Exit Confirmed

May 01, 2025

Coronation Street Daisy Midgeleys Dramatic Exit Confirmed

May 01, 2025 -

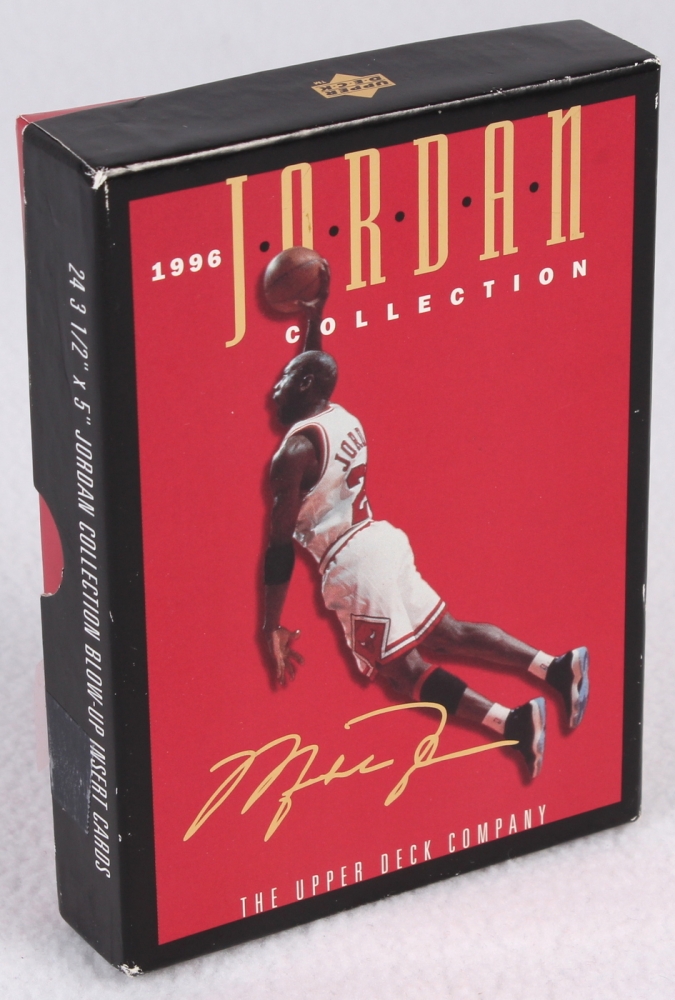

Unveiling Michael Jordan A Collection Of Fast Facts

May 01, 2025

Unveiling Michael Jordan A Collection Of Fast Facts

May 01, 2025 -

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Ghry Nzr

May 01, 2025

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Ghry Nzr

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025